Wealth Increase and First Personal Financial Report

Honestly, writing about my finance is a bit scary and making me nervous in a good way. I have never disclosed this kind of information to anyone yet to the whole world. But I got inspired and thought it might be the best approach to get things done more appropriately. When someone is watching and expecting good results, we might do a better job (Or worse, depends on the personality).

Golden Wealth Keys: Will Power and Financial Management

I wanted to point out and make this clear that I am not writing to show off but instead to prove that IT IS POSSIBLE to save and live life if there is a WILL POWER along a PROPER FINANCIAL MANAGEMENT. It makes me sad seeing families with 2 incomes bringing over $150K a year struggle with life and live pay cheque to pay cheque. That is just not acceptable at all and

Personal Finance Background (Save and Invest)

Feel free to skip this part and go directly to the numbers if not interested in how it all began. I will not get offended 😊.

As you might have read in my About post, I ONLY had $1360 in Aug 2011. That was all my net worth prior to my first full time job (I had some unreliable project-based jobs). It is tough to have a newborn in a new country without a guaranteed income. Even though, I was promised an engineering job, the reality was different. Nobody wanted to hire an engineer without a North American degree or experience.

GOODBYE TO MY ENGINEERING FIELD & YEARS OF STUDY! HELLO, MY NEW TECH JOB!

Income Growth from Careers in Different Companies

My first job was a Level I Junior IT Technician dealing with customers fixing or escalating their technical issues. It taught me about the Canadian work culture and ethics on top of the technical knowledge.

However, I could not keep working for $16 / hour for more than a year. Therefore, I happily found a better paying job making $42K a year (Slightly higher but it was a progress). I changed multiple jobs till I got to my current position which is great. I work with a fantastic manager and a good team.

Hopefully, soon I can get a 6 figure pay cheque. I did not ask for a raise last year considering all the Covid crisis but hopefully soon.

Yearly Net Worth Growth Chart (Total Sum of Saving and Investing)

Here is the chart of my yearly net worth. The numbers are from the end of each year. By Dec 2020, my net worth increased to $314,223 CAD. I do realize there are many people with much more wealth especially considering the high value of Canadian properties, but the money I have is mostly invested generating a cash flow which gets reinvested.

Saving Accounts in GICs with a 3% Interest Rate

I have not been recording how much interest I made from investing basically because they were mostly in boring GICs (Guaranteed Investment Certificate). However, my average has been 3% taking advantage of the good interest rates prior to Covid.

I had or have accounts with Manulife, EQ, Zag, KFF, Meridian, Oaken, Peoples Trust, Simplii, and Tangerine. My worst current GIC rate is with Oaken 2.5% and the best is with Meridian 3.75%. They can be great source for those nearing their retirement and not wanting to risk relying on the market and its weird behavior.

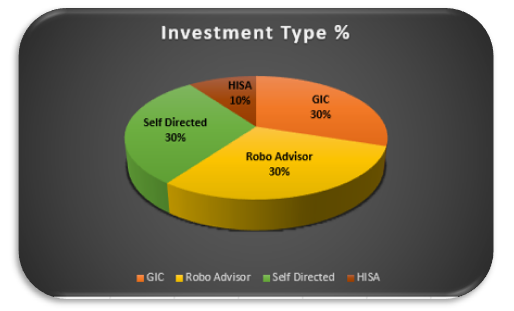

Currently, I only have GICs with Meridian and Oaken. The latest one will mature in Jan 2024. Below is my current investing situation. I am not renewing any GICs upon maturity but moving them to either Robo or Self investing.

A Fantastic 75% Net Worth Increase In 2 Years (2018-2020)

Mostly saving by not spending on items we do not need or could find a cheaper alternative. Honestly, we as a family have been doing an impressive job in saving considering the fact that we traveled a lot including multiple trips to Europe, the Caribbean, Central and South America in the past 5 years.

OUR NET WORTH GREW MORE THAN $73,000 or 30% IN 2020

Our Accounts – Registered (RRSP, TFSA, RESP) and HISA

We have the 3 registered accounts. I maximize my RRSP every year and Mrs. Dreamer and I maximize our TFSA accounts. I also put $5K in the kids RESP account yearly and take advantage of the federal and Quebec grants.

Non-registered HISA moves between whoever pays higher interest rate. It is with Tangerine till end of Feb 2021 taking advantage of the 2% bonus rate. Then, the funds will move to EQ for 1.5% until a better deal is found. This is mostly emergency fund which we do not lock inside a GIC or the market.

Mr. Dreamer’s Financial Goals in 2021

Increase the DIVIDEND payouts by adding positions in dividend paying stocks including banks and Telecom. I am not sure where Enbridge is heading and waiting to see what happens with its potential Line 5 closure in Michigan.

My past total investing income from interests and dividends are UNKNOWN which I am not proud of. However, after reading multiple amazing blogs by fellow Canadian investors, I decided to do my own blog and start documenting my financial progress. Please be patient as this will get better and better every month.

Our net worth is already up by more than $10K during the first 45 days of 2021!

Conclusion and Future Financial Plans

I am in the process of moving everything out of GICs and focusing on Robo and Self investing. I am aiming for a 4.5% annual payment in dividends from the self-directed investments which hopefully will be around $4500 – $5000 this year. If I add the dividends from the robo investing and the GIC interest payout, the total interest and dividends will reach $11,000 in 2021.

Thank you for reading and as always make me happy by leaving your comment below.

Be a Coin Master (Android – Apple) In an Always Winning Game, Saving & Investing!

Great stuff Vibrant

That’s a great increase in net worth over that time period. Unfortunate about your engineering degree though. I think its normal, have you thought of going to school here and topping up those skills?

Welcome to the financial blogging community too. It has helped us a lot since I started writing and sharing with people online. You learn more, and stay committed I find.

cheers!

Hey Rub,

Thanks for your comment. I am delighted.

When we landed, I went through the license registration process and my education was accepted. I registered with “Association of Professional Engineers of Nova Scotia” for the first year only. However, I couldn’t find a related job so didn’t see the point of renewing it.

I eventually enrolled in Masters and did 2 courses (out of 4) in Dalhousie but considering I was working full time, providing for the family, and my 2nd daughter’s birth, it became too complicated. I couldn’t deliver. I was even offered a $15000 scholarship to become full-time student which I declined. It is not something I regret but yes, I could have been on a better place financially if I were a P.Eng.

And thank you for your warm welcome! I agree, being part of a community helps a lot specially when discussing financial matters isn’t something, we can do easily with people we know (They take it the wrong way). I feel the online community is helping to be more organized and do better job at managing our finances.

Take care,

Mr. Dreamer