Fortunately, Canadian investors are paying more attention to the high fees charged by asset managements, financial advisors, and mutual funds. Combining this with the increasing interest in ETFs, we are seeing an increased transfer of funds from traditional investments to robo-advisors which makes a healthy competition among the best robo-advisors in Canada.

To our advantage, robo-advisors technology is improving and many financial institutes offer investing in a robo-advisor managed portfolio within registered (TFSA, RESP, RRSP, LIRA, RRIF, LIF, RRIF), non-registered (Personal, Joint), or corporate accounts.

In this article, I am providing a complete list of current best robo-advisor providers in Canada including a comprehensive comparison. At the end, I will include my personal experience and why I recommend self-directed over robo-advisors investment.

Robo-advisors are usually an enhancement of discount brokerage with higher fees in return for a designed and ready to be deployed portfolio.

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive 2 free stocks to trade.

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

My goal is to help smart investors like you decide what works better for their needs. The most complicated and challenging part of this process is to decide if robo-advisor is the best choice and if so choosing the right robo-advisor provider.

Defining the Robo-Advisor Technology

Let’s make one point clear. There are absolutely no robots. Robo-advisor is as an automated process written by IT developers overseen by financial experts to follow a pre-defined investment’s algorithm to purchase from a variety of ETFs (Exchange-Traded Funds).

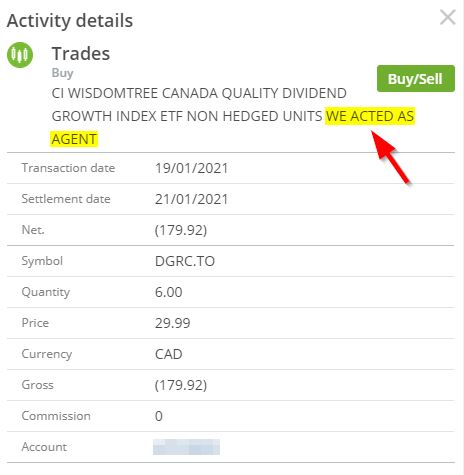

Basically, instead of a real human in form of a financial advisor to allocate the contributions, the software follows the algorithm and does the job on the investor’s behalf. As seen below, the robo-advisor software acts as an agent in buying and selling to automate the process of investing.

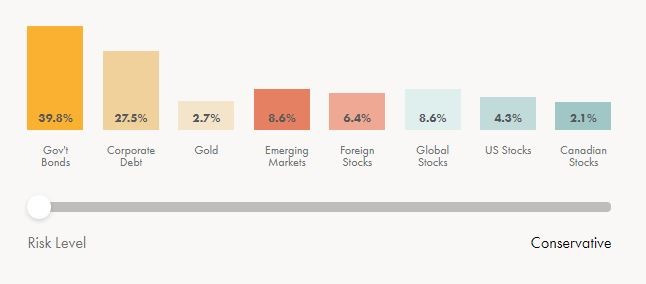

All robo-advisors offer different portfolios based on different risk tolerance levels which invest in different ETFs with the appropriate percentage reflecting the chosen risk. There are no stocks involved in any robo-advisor plan. They are solely ETFs which include many stocks.

This risk level is chose based on the answers the investor provides to a questionnaire. These are not complicated questions and are mainly based on the investment’s horizon and tolerance to volatility.

There are two fees when it comes to robo-advisors:

- Management Fee: The fee charged by the robo-advisor portfolio provider

- Fund’s Expense Ratio (MER): The fee charged by the invested ETF

Robo-Advisors Vs Human Financial Advisors Vs Mutual Funds

Robo-advisor methodology is usually based on passive investing in ETFs which is proven to outperform human advisors. The most obvious difference is the human aspect. You don’t have to consult a human when using a robo-advisor. This cuts the hassle of dealing with a financial advisor or planner in person or over a phone call or a Zoom meeting.

This can be seen as a disadvantage due to the lack of a personalized financial plan or a professional assisting in following your goals based on your need.

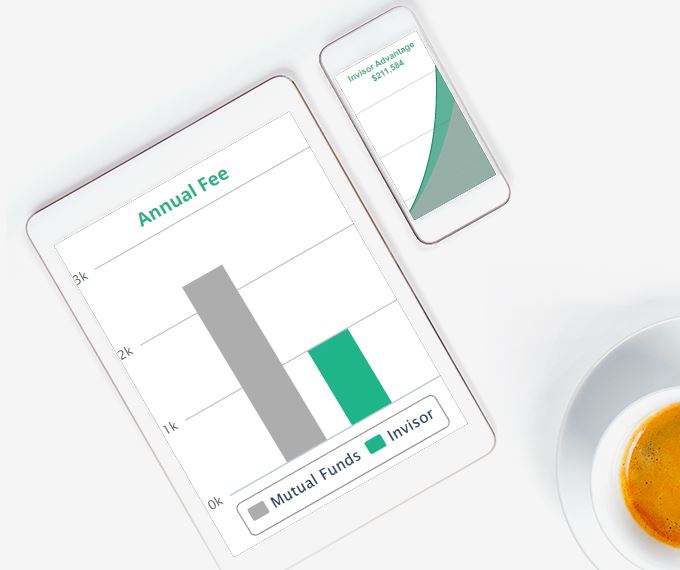

The second difference is the cost. Robo-advisors are much cheaper than using a financial advisor. Using robo-advisors will cut a high portion of the management fees.

Fees are also the main aspect differentiating robo-advisors from mutual funds. In robo-advisors which buy ETFs on the investor’s behalf, accumulated fees including both the management fees and the ETFs’ MER can average as low as 0.5%. On the other side, mutual funds charge an average 2% for the same kind of investment and exposure.

We should all agree on the fact that using a financial advisor or buying mutual funds isn’t in the investor’s best interest.

According to a 2020 report, over a 15-year period, nearly 90% of actively managed investment funds failed to beat the market.

Business Insider

However, we still have one more comparison to make. Robo-advisors versus self-directed or being one’s own advisor.

Robo-Advisors Vs. Self-Directed Benefits & Disadvantages

Robo-advisors simplify the complicated market investments process. Here are some benefits of using a robo-advisor solution:

- Robo-advisors stick to the plan and proceed without emotions

- Robo-advisors perform automatic rebalancing to keep a balanced portfolio

- Robo-advisors allow automatic investment of authorized contributions

- Robo-advisors are designed to be mostly tax-efficient

- Robo-advisors don’t charge trading commission or inactivity fees, Inactivity Fee

- Robo-advisors reinvest the received dividends

Like everything in life, robo-advisors aren’t all shiny and glorious. There are some disadvantages of using a robo-advisor which are listed below:

- Robo-advisors have a pre-defined list of ETFs which the investor can’t change

- Robo-advisors won’t allow choosing or putting more weight in one industry

- Robo-advisors rebalancing can cause loss of dividend contributions

- Robo-advisors include a small extra management fee

Related: Feel free to check my monthly updated account details under Personal Financial Reports.

Complete Comparison List of the Best Robo-Advisors in Canada

All below offer Non-Registered, RRSP, Spousal RRSP, RESP, and TFSA accounts. Hence, under “Offered Accounts” I will only put any extra type of offered account.

| Robo-Advisor | Fees | SRI | Minimum | Offered Accounts |

| BMO SmartFolio | 0.4% to 0.7% | No | $1000 | RRIF |

| CI Direct Investing | 0.35% to 0.6% | Yes | $1000 | LIF, LIRA, RRIF, Corporate |

| Invisor | 0.50% | No | None | LIRA, RRIF |

| Justwealth | $4.99 / Month 0.4% to 0.5% | No | $5,000 | LIF, LIRA, RRIF, Corporate |

| ModernAdvisor | Free to 0.50% | Yes | $1000 | LIRA, RRIF, Corporate |

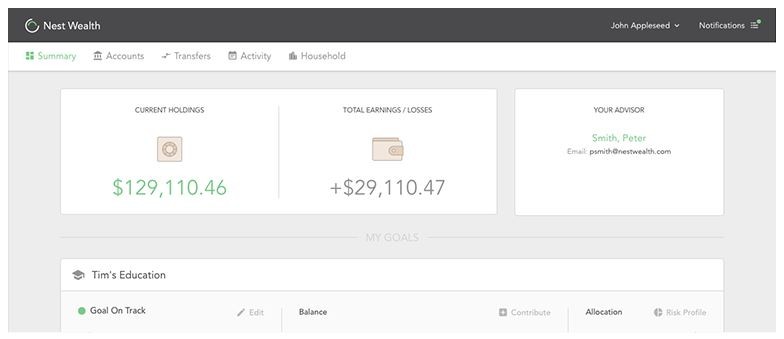

| Nest Wealth | $20 to $80 / Month | No | None | LIF, LIRA, RRIF, Corporate |

| Questwealth | 0.20% to 0.25% | Yes | $1000 | LIF, LIRA, RRIF |

| RBC InvestEase | 0.50% | Yes | $100 | No RESP |

| Wealthsimple | 0.40% to 0.50% | Yes | None | LIF, LIRA, RRIF, Corporate |

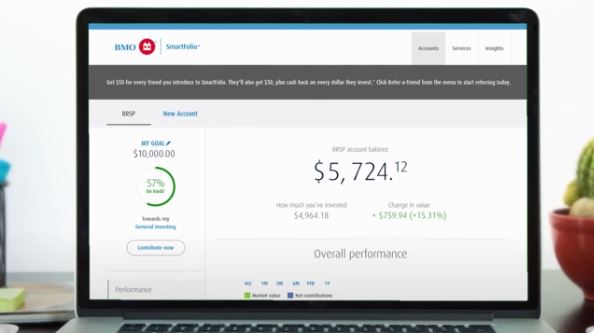

BMO SmartFolio Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: $1000

- Offered Accounts: Registered (TFSA, RRSP, RESP, RRIF), Non-Registered (Individual, Joint)

- Fees: 0.40% to 0.70% plus ETFs MER fees (0.20% to 0.35%)

- First $100,000: 0.70%

- Next $150,000: 0.60%

- Next $250,000: 0.50%

- Over $500,000: 0.40%

- Foreign Exchange Fee: 1.5%

- Portfolios: Capital Preservation, Income, Balanced, Long-term Growth, Equity Growth

- Protection: CIPF coverage up to $1M

- SRI (Socially Responsible Investing): No

- Signing up: BMO SmartFolio

CI Direct Investing (WealthBar) Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: $1000

- Offered Accounts: Offered Accounts: Registered (TFSA, RRSP, RESP, LIF, LIRA, RRIF, RDSP), Non-Registered (Individual, Joint), and Corporate

- Fees: 0.35% to 0.60% plus ETFs MER fees (0.16% to 0.26%)

- Under $150,000: 0.60%

- $150,000 to $500,000: 0.40%

- Over $500,000: 0.35%

- Foreign Exchange Fee: None

- Portfolios:

- ETF Portfolios: Aggressive, Growth, Balanced, Conservative, Safety

- Private Investment Portfolios: Aggressive Private, Balanced Private, Safety Private

- Protection: CIPF coverage up to $1M

- SRI (Socially Responsible Investing): Yes (Invesco Cleantech ETF PDZ)

- Signing up: CI Direct Investing site

Invisor Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: None

- Offered Accounts: Offered Accounts: Registered (TFSA, RRSP, RESP, LIRA, RRIF), Non-Registered (Individual, Joint)

- Fees: Flat 0.50% fee plus MER fees 0.20%

- Foreign Exchange Fee: None

- Portfolios: Portfolio Risk Scores 1 to 8

- Protection: CIPF coverage up to $1M

- SRI (Socially Responsible Investing): No

- Signing up: Invisor

Justwealth Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: $5000 – Except no minimum for RESP

- Offered Accounts: Registered (TFSA, RRSP, RESP, RRIF, LIF, LIRA), Non-Registered (Individual, Joint), and Corporate

- Fees: Minimum $2.99 – $4.99 & 0.40% to 0.50% plus ETFs MER fees 0.20%

- Under $12,000: $4.99 Monthly (Except RESP) – Minimum RESP is $2.99 Monthly

- First $500,000: 0.50%

- Over $500,000: 0.40%

- Foreign Exchange Fee: None

- Portfolios: More than 70 portfolios including more than 40 ETFs

- Unique Target Date RESP portfolio which changes the risk based on child’s age

- Protection: BBS Securities coverage up to $1M

- SRI (Socially Responsible Investing): Yes

- Signing up: Justwealth

ModernAdvisor Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: $1000

- Offered Accounts: Registered (TFSA, RRSP, RESP, RRIF, LIRA), Non-Registered (Individual, Joint), Corporate

- Fees: Free to 0.50% plus ETFs MER average 0.34%

- Under $10,000: Free

- $10,000 to $100,000: 0.50%

- $100,000 to $500,000: 0.40%

- Over $500,000: 0.35%

- Foreign Exchange Fee: None

- Portfolios: Core & SRI each with 10 Risk Levels based on ETFs – XIC, VUS, VEF, VEE, VSB, ZEF, VRE

- Protection: CPIF coverage up to $1M

- SRI (Socially Responsible Investing): Yes

- Signing up: Modern Advisor

Nest Wealth Robo-Advisor

- Approach: A combination of ETF selections involving human advisors

- Minimum Balance: None

- Offered Accounts: Registered (TFSA, LIF, RRSP, RESP, RRIF, LIRA), Non-Registered (Individual, Joint), Group RRSP, and Corporate

- Fees: $20 to $80 Monthly plus ETFs MER 0.13% and Transaction Fees (Up to $100 Yearly)

- Under $75,000: $20 Monthly

- $75,000 to $150,000: $40 Monthly

- Over $150,000: $60 Monthly

- Foreign Exchange Fee: None

- Portfolios: Combination of 7 ETFs – VSB, ZAG, XRB, XIC, XSP, IEFA, VNQ

- Protection: CPIF coverage up to $1M

- SRI (Socially Responsible Investing): No

- Signing up: Nest Wealth

Questrade Questwealth Robo-Advisor

- Approach: An active approach management involving human advisors

- Minimum Balance: $1000

- Offered Accounts: Registered (RRSP, TFSA, RESP, LIRA, LIF, RRIF), Non-Registered (Individual, Joint)

- Fees: 0.20 to 0.25% plus ETFs MER average 0.19%

- Under $100,000: 0.25%

- Over $100,000: 0.20%

- Foreign Exchange Fee: None

- Portfolios: Conservative, Income, Balanced, Growth, Aggressive

- Protection: CPIF coverage up to $1M

- SRI (Socially Responsible Investing): Yes

- Signing up: Questwealth

RBC InvestEase Robo-Advisor

- Approach: A hybrid Passive-Active approach involving human advisors if necessary

- Minimum Balance: None

- Offered Accounts: Registered (RRSP, TFSA), Non-Registered (Individual)

- Fees: Flat 0.50% plus MER. Standard Portfolio 0.11% – 0.22%, SRI Portfolio 0.18% – 0.30%

- Foreign Exchange Fee: None

- Portfolios: Standard & Responsible each chosen from ETFs

- Protection: CPIF coverage up to $1M

- SRI (Socially Responsible Investing): Yes

- Signing up: RBC InvestEase

Wealthsimple Robo-Advisor

Detailed review of Wealthsimple Invest (Wealthsimple Robo Advisor) can be found here.

- Approach: A passive approach without involving human advisors

- Minimum Balance: None

- Offered Accounts: Registered (RRSP, TFSA, RESP, LIRA, LIF, RRIF), Non-Registered (Individual, Joint), Corporate

- Fees: 0.40 to 0.50% plus ETFs MER average 0.20%

- Under $100,000: 0.50%

- Over $100,000: 0.40%

- Foreign Exchange Fee: None

- Portfolios: Conservative, Balanced, Growth

- Protection: CPIF coverage up to $1M

- SRI (Socially Responsible Investing): Yes

- Signing up: Wealthsimple Robo

Announcing the Robo-Advisor Winner

Questwealth is the robo-advisor provider winner and my first choice. Its fees are almost half of all other providers including Wealthsimple. The setup is easy and straightforward with many options for funding an account such as Online banking, Interac online, Pre-authorized deposits, Transfer account, Cheque, Money order, Stock certificate, and Wire transfer.

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

I also like Questrade support where they offer instant live person chat, email, and phone support.

In addition, when it comes to reports, Questrade offers sophisticated reporting including Investment summary, Investment return, Account activity, Statements, Trade confirmations, and Tax slips. Questrade Portfolios details can be found on Questwealth ETF Portfolios.

One more advantage of Questwealth is My Family Program which allows you to connect accounts of family members, friends, relatives, and neighbors to lower the fees from 0.25% to 0.20%.

However, the disadvantage of Questwealth is that the funds are actively managed which means there is a human touch in replacing ETFs. Through my experience, this hasn’t been an issue and previous Questwealth performance proves the same.

Below are some highlighted points comparing the two most popular Canadian robo-advisors. Questrade vs. Wealthsimple. You will see why I chose Questwealth over Wealthsimple as the winner.

- Wealthsimple is purely algorithm (Passive) versus Questrade is a combination of algorithms and financial experts (Hybrid Active-Passive). I agree that human-touch might not be the best approach but Questwealth performance approves otherwise showing Questrade experts do a great job.

- Wealthsimple charges 0.4-0.5% while Questrade charges 0.20-0.25%. This means an investor pays $400 on a $100K investments with Wealthsimple versus $250 with Questwealth. Counting in the ETFs MER fees, the cost will be average $600 Wealthsimple versus $400 Questwealth annually.

Which One Is Better, Robo-Advisor or Self-Directed

Deciding between a robo-advisor or self-directed investment depends on some factors:

- Do you have 2 hours a month to login to your portfolio and buy ETFs or Stocks directly?

- Do you have enough Excel or Math knowledge to rebalance your portfolio?

- Do you enjoy doing the work directly to put a sell or buy order in the market?

- Do you want to avoid paying extra management fees and score a higher dividend yield?

- Do you have enough discipline and financial knowledge to pick ETFs?

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive $10 to trade.

If you answered yes to most of these questions, give yourself some credit, you know more than you realize. If you know what Questrade does or can mimic their ETF Portfolios, and you know what an ETF is, you’re more financially literate than 90% of the population. Based on this assumption, avoid robo-advisors, and instead open a trading account to buy ETFs and Stocks directly.

However, if you get emotional and click the sell button easily or can’t manage rebalancing your portfolio properly, maybe it is best to go with Questwealth.

Leaving My Questwealth Robo-Advisor (Except RESP)

I have used both Questwealth and Wealthsimple. In July 2020, I transferred a matured GIC to RESP Wealthsimple. Wealthsimple offers 1 year free management fees for the first $10,000. The growth is similar to the market however there is barely any dividend payouts.

In addition, Wealthsimple doesn’t offer QESI which is Quebec Education Saving Intensive grant. Therefor, I initiated a transfer from Wealthsimple to Questwealth as I am planning to keep the kids’ RESP with Questwealth. RESP can’t grow too much as contribution is limited.

I am also moving other Questwealth accounts including TFSA and RRSP to Wealthsimple trading.

Related: Best REIT ETFs in Canada for Optimized Growth and Income

Related: 5 Best Technology ETFs in Canada

The reasons for moving out of robo-advisor to self-directed strategy is simple.

- I don’t have control over the purchases and can’t decide how much per sector or region

- I have the knowledge and time to do the work myself

- The dividend from robo-advisors portfolios is low. Questwealth income yield is currently 1.86%

- Eliminating management fees and using Wealthsimple free platform to trade stocks and ETFs

A Successful Self-Directed Approach & Recommendation

If you decided to go through the self-direct route, I recommend reading Canadian Coach Potato Model Portfolio. In addition, there are many great options like buying an All-in-One ETF.

Below is a table of such ETFs to start with:

| Name | Ticker | MER | Fixed Income % | Equity % |

| Vanguard Conservative Income ETF | VCIP | 0.25% | 80% | 20% |

| Vanguard Conservative ETF | VCNS | 0.25% | 60% | 40% |

| Vanguard Balanced ETF | VBAL | 0.25% | 60% | 40% |

| Vanguard Growth ETF | VGRO | 0.25% | 80% | 20% |

| Vanguard All-Equity ETF | VEQT | 0.25% | 100% | 0% |

| iShares Core Balanced ETF | XABL | 0.20% | 60% | 40% |

| iShares Core Growth ETF | XGRO | 0.20% | 80% | 20% |

| iShares All-Equity ETF | XEQT | 0.20% | 100% | 0% |

| BMO Conservative ETF | ZCON | 0.20% | 60% | 40% |

| BMO Balanced ETF | ZBAL | 0.20% | 60% | 40% |

| BMO Growth ETF | ZGRO | 0.20% | 80% | 20% |

| Horizons Balanced Tri ETF | HBAL | 0.16% | 70% | 30% |

| Horizons Conservative Tri ETF | HCON | 0.15% | 50% | 50% |

| Horizons Growth Tri ETF | HGRO | 0.16% | 100% | 0% |

Related: Best & Most Tax Efficient US & International ETFs Listed on TSX

As shown in above table, any investor can easily invest directly by purchasing one ETF without paying the extra robo-advisors management fees. These ETFs are also designed to rebalance which makes the job much easier. To avoid trading fees, I recommend using Wealthsimple which is Canada’s only free trading platform and offers sleek application and recently web.

Thank you for reading. Hope you enjoyed the comparison. Leave me your thoughts about using robo-advisors or your experience.