As mentioned previously, I am in the cleaning up process. Feel free to read more about my journey from the beginning and how we started from zero just years ago by reading my post here.

You can also find my first ever income report here Jan-Feb 2021 Net Worth and Income Update.

I also started a new eBay business and I sold my first ever item on eBay. Sorry not as fancy as the hype of Non-Fungible Tokens (NFTs) but if all goes well I am looking at a $3.5 profit. Yup! That’s all my first profit unless something goes wrong and I end up in a -$13.5 loss. We shall see.

Current Non-Chequing Accounts

I am slowly moving funds from GIC and Robo accounts to Trade accounts to have more control. My goal is to only leave Mrs. Dreamer’s TFSA and Girl A & B’s RESP in Questrade Robo account (Questwealth).

GIC accounts are all over the place but I have good interest rates in 2.75% – 3.75% range. However, I am not renewing any GICs anymore and moving them to trade accounts in WealthSimple upon maturity. Hopefully WealthSimple will offer trading LIRA account by the time my LIRA GIC matures in April 2023.

I love WealthSimple Trade. It is really simple and no commission. I feel it is much better to save the trading money in my pocket rather than giving it out by using our trading platforms. However, I do my research and check technical via Questrade. The combination has been working great.

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive $10 to trade.

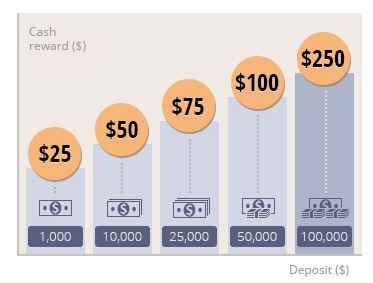

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

Questwealth Managed Account Bonus

Self-Trading Account Bonus

Major changes to our accounts:

- RESP WealthSimple Trade account is now moved to Questrade Robo.

- I have a TFSA in Oaken maturing this week which will be moved to WealthSimple TFSA Trade.

- I contributed a total of $13500 to my WealthSimple RRSP trade account.

| Bank | Type | Account | Value | Owner |

| Questrade | Robo | TFSA | $75,759.55 | Mrs. Dreamer |

| Questrade | Robo | RESP | $41,820.75 | Girl A & B |

| Questrade | Robo | RRSP | $32,163.27 | Mr. Dreamer |

| Questrade | Robo | TFSA | $7,294.06 | Mr. Dreamer |

| EQ Bank | HISA | HISA | $49,471.94 | Mr. Dreamer |

| Meridian | GIC | RRSP | $14,601.82 | Mr. Dreamer |

| Meridian | GIC | TFSA | $6,459.08 | Mr. Dreamer |

| Oaken | GIC | LIRA | $21,647.32 | Mr. Dreamer |

| Oaken | GIC | RRSP | $21,367.94 | Mr. Dreamer |

| Oaken | GIC | TFSA | $56,707.24 | Mr. Dreamer |

| WealthSimple | Trade | RRSP | $13,783.88 | Mr. Dreamer |

| WealthSimple | Trade | Personal | $3117.74 | Mr. Dreamer |

Current Net Worth & 4.96% MoM Net Worth Increase

Our Net Worth grew to $344,261.09 by April 1st, 2021. This is a $16,272.15 in 1 months. I am happy with this 4.96% net worth increase during March 2021. Part of it came from the income tax return (The magic of RRSP). The rest got generated from monthly full-time pay cheques savings, market increase, dividends and savings accounts returns.

Looking at the chart, I love how we were blessed to have a 34% Year over Year (YoY) increase of $87,675.

March Total Income (Dividends & Savings Accounts)

Since January 2021, I started calculating our income from dividends and savings accounts. You can also find my first ever income report here Jan-Feb 2021 Net Worth and Income Update.

I will not report detailed stock or ETF income till it becomes more meaningful which will be Q3 2021.

I just do not want to do a sudden move of all the funds due to the market craziness. I do believe in Time in Market rather than timing the market to some extent. Here are the numbers for 2021 for a total $1,926.96

| Month | Dividends | Savings Accounts | Total |

| Jan 2021 | $571.03 | $206.14 | $777.17 |

| Feb 2021 | $40.28 | $295.02 | $335.30 |

| Mar 2021 | $305.00 | $510.29 | $815.29 |

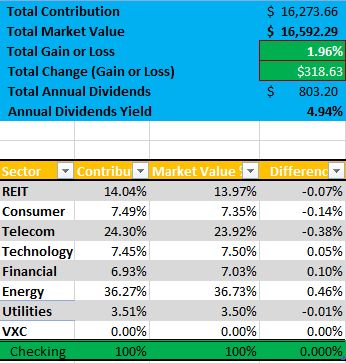

And to give a bit of more details. Here is my current Personal and RRSP Trading accounts status. There was a 1.96% total growth while expecting a 4.94% Annual Dividends Yield.

This month, I also started counting my income from credit card churning, credit card cash backs, and survey points. The accumulative total as of now is $902.25.

Thank you for reading and let me know if you have any questions or feedbacks.

Wow, that’s an excellent net worth increase in one month! Excellent work.

And I agree—larger tax refunds due to RRSP contributions is magical, ha ha. Even better are the big tax refunds we get from writing off our leveraged investing interest. It’s crazy!

Thank you, Chrissy. You are right. However, this is like taking someone’s money then in a year return a portion of it without interest. It is unfair.

Sadly, it is not easy to reduce the Tax at source due to RRSP contribution. CRA and Revenue Quebec require a yearly proof of upcoming contributions sent to them 2-3 months before the end of each year. Too much work. So we keep giving free-interest loans to the government.

Ah, yes. You are right it’s not actually a great thing to get a big tax refund. I am very lazy about it and have never asked for less tax to be withheld at source. It’s funny that I don’t, given what an optimizer I am!

It’s easier here in BC, but it’s enough of a hassle that I just never get to it. (I also have to get my husband to do it, since it’s his paycheque. So it’s just another added step that deters me!)

Maybe we should try a movement and gather signatures to have these changed. Honestly, it should be much easier for tax-payers specially those with proven track of contribution to RRSP to reduce their taxes at source.

CRA won’t lose any money. At the end of the day, if a person didn’t contribute to RRSP, they will end up paying their fair share of taxes.

Have you heard of the Grumpy Accountant? He wrote a book and is trying to start a movement around tax simplification in Canada. You might want to reach out to him, if only to commiserate!

Yes. I signed and shared his petition last night but I only told him to add one step to his movements. Make CRA accept emails as a form of communication! Come on we are in 2021 where people use Crypto and CRA still wants people to use snail mail or fax. Funny they don’t trust email for security reasons but okay with people sending digital faxes. How ironic.

Great details! Thanks for sharing the breakdown.

Thank you. Not as exciting as yours 🙂

Great job!

Thank you!

Impressive net worth increase, Mr. Dreamer! I agree on keeping more of the investment fees in your pocket. I have been focusing more on that this year. I am using Wealth Simple for my CAD stocks, and I pay for my USD commissions with credit card points. Your overall net worth is impressive. Nice work!

Hello Graham and Thanks for your comment.

It is nice you pay for USD Commissions with your Credit Card points. The good thing about Wealthsimple is that they charge 1.5% versus Questrade’s 2.5% for foreign transactions but yes Norbert’s Gambit is another more complicated but cheaper option.