Why a Special Best Travel Credit Card

Traveling comes with unique expenses with its special features and coverages. Owning a good travel credit card can offset some costs and save hundreds of dollars in each trip. You might even end up traveling for free by using the points.

I am always on the look for cards offering benefits including full medical emergency and car rental coverage. A card with no foreign transaction fee is a key to not paying an extra $25 for every $1000 in foreign currency spending.

In addition, the earned points from your spending on your credit card can be used not only for purchasing flight tickets but also hotels, cruises, vacation packages, airport lounge, and many more.

By the end of this article, you’d know what credit cards I use personally and why I love and take my 2 free credit cards, Brim and Wealthsimple Prepaid Visa cards globally.

Find Out What Card Suits You by Answering Below Questions

- Do I need emergency out of province medical expenses insurance?

- Do I need car rental collision, damage, and loss (CDW – LDW) insurance?

- Do I need trip cancellation or delays coverage?

- Do I need loss or delayed baggage coverage?

- Do I need a 1 year extended warranty on my purchases?

- Do I need hotel theft coverage?

- Do I need electronics theft or damage coverage (mobile, tablet, camera, laptop)?

- Do I need a no foreign transaction fee card, or I am okay with 2.5% extra charges?

- Do I have a high yearly income and can apply for higher end credit cards?

- Do I want to pay for annual fees, or I prefer a free card?

- Do I like free money in form of bonus points?

I will compare the different cards in this article, answer above questions, and mention which one I personally own and use when traveling.

Criteria To Be Qualified As a Good Travel Credit Card

Of course, each credit card comes with its cons and pros but for me to consider applying for a travel credit card, it needs to have some special features. Below are the most important ones:

- Travel Medical Insurance

- Travel Insurance Coverage

- Trip cancellation and interruption

- Delated and lost baggage

- Flight delay coverage

- Car Rental Coverage

- Collision Damage Waiver (CDW)

- Loss Damage Insurance (LDW)

- No Foreign Transaction Fee

- Good Reward Program – Earn Cashback or Points

- Free or a Reasonable Annual Fee

Fortunately, there are many credit cards with most of above features. However, the focus should be on YOU and your personal requirements when traveling.

For instance, if you never rent a car abroad, you will not be worried about the car rental coverage. Or if you always prefer to pay cash (I discourage people from carrying cash around in foreign countries) then no need to worry about the foreign transaction fee.

When To Apply For a New Travel Credit Card

Always apply when there is a special offer. Those special offers are amazing and can offer a lot in points, waiving first year fees, and higher cash back rate (Up to 15% versus 2-3%).

Canada’s Best Travel Credit Cards

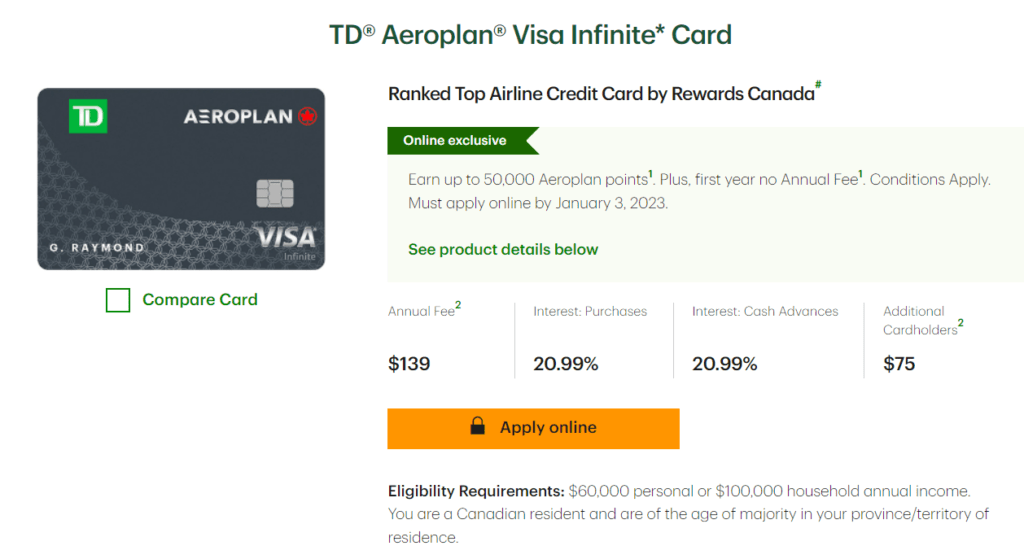

TD Aeroplan Visa Infinite Card

I used to own this card and took advantage of the special offer which added a nice 50,000 Aeroplan Points to my account plus a first year no annual fee.

How to earn the 50,000 Aeroplan Point bonuses?

- Get 10,000 after the first purchase

- Get $20,000 after spending $1,500 on the card within the first 90 days

- Get $20,000 anniversary bonus after spending $7,500 within 12 months

TD Aeroplan Visa Infinite Card Advantages

- Current Bonus (Until Jan 3, 2023): Earn 50,000 Aeroplan plus first year no annual fee

- Travel Medical Insurance: Up to $1 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip

- Trip Cancellation – Trip Interruption Insurance: For trip cancellation coverage of up to $1,500 per insured person, with a maximum of $5,000 for all insured persons, and for trip interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip

- Flight – Trip Delay Insurance: Up to $500 in coverage per insured person if your flight – trip is delayed for over 4 hours

- Delayed and Lost Baggage Insurance: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost

- Common Carrier Travel Accident Insurance: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example a bus, ferry, plane, train, or auto rental)

- Hotel – Motel Burglary Insurance: Up to $2,500 of coverage per occurrence for eligible personal items stolen from your hotel or motel room that belong to the Cardholder on the Account and eligible family members travelling with the Cardholder.

- Auto Rental Collision / Loss Damage Insurance: Coverage for up to 48 consecutive days

- NEXUS Rebate: Enroll for a NEXUS and once every 48 months get an application fee rebate (up to $100 CAD). Additional Cardholders can also take advantage of this NEXUS rebate

- Optional TD Auto Club Membership

- First checked bag free (up to 23kg/50lb) when your travel originates on an Air Canada

TD Aeroplan Visa Infinite Card Disadvantages

- $139 Annual Fee for main holder and $75 for additional cardholders after the first year

- Eligibility $60,000 personal or $100,000 household annual income

- 1.5 points per $1 on grocery, gas, and Air Canada purchases. 1 point per $1 on all other purchases

- 2.5% Foreign Exchange Fee

My Feedback: Apply for this card only if you care about the Aeroplan Points (I hope you do). Meet the bonus requirements, take them, and cancel the card before the annual fee kicks in. Also, apply for NEXUS during the first year to get the application cost covered.

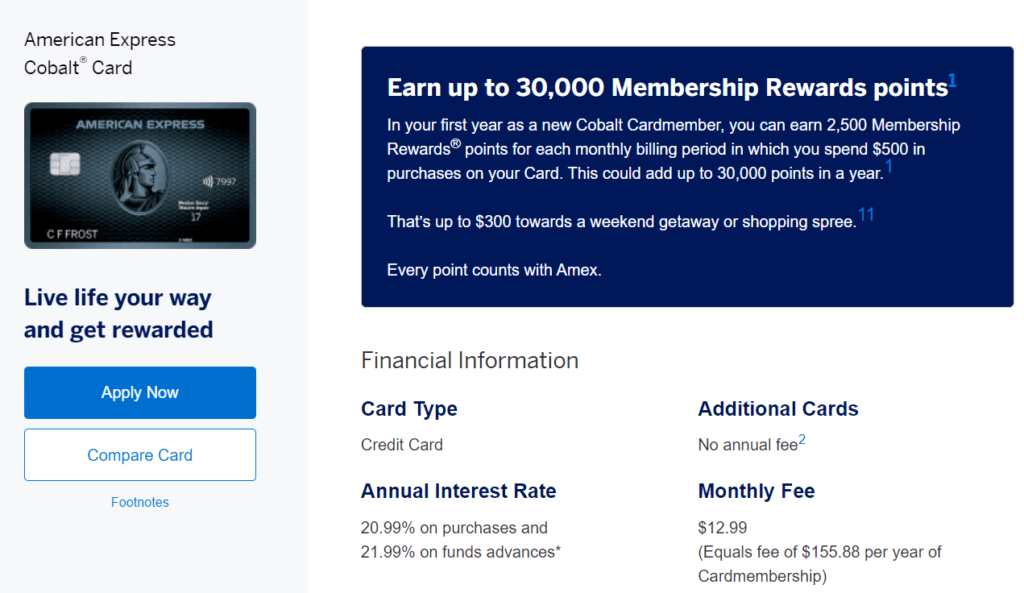

American Express Cobalt Card

I am not a big fan of American Express cards in Canada because many merchants do not accept Amex. In the past, I had to buy Walmart gift cards to meet the $3000 spending requirement in 3 months to take the bonus points.

American Express Cobalt Card Advantages

- Current Bonus: 2,500 points per month (Up to 30,000) for any month you charge minimum $500 on your American Express Cobalt card

- 5 points per $1 on grocery and dining. 2 points per $1 on travel, transit, and gas, 1 point on everything else. Points can be redeemed on travel, gift cards, fixed points travel program, concerts, events, and even Amazon.ca

- Emergency Medical Insurance: Up to a $5,000,000 if under 65 years old for the first 15 consecutive days of a covered trip

- Flight Delay Insurance: Up to $500 in coverage (aggregate maximum with Baggage Delay Insurance) for accommodations, restaurant expenses and sundry items purchased within 48 hours when delayed or denied boarding for 4 hours or more

- Baggage Delay Insurance: Up to $500 in coverage (aggregate maximum with Flight Delay Insurance), for essential clothing and sundry items purchased within four days of arrival at your destination when your checked-in baggage on your outbound trip is delayed for 6 or more hours

- Lost or Stolen Baggage Insurance: Coverage for loss or damage to your checked-in or carry-on baggage and personal effects while in transit for up to a maximum of $500 per trip

- Car Rental Theft & Damage Insurance: Coverage for theft, loss, and damage of your rental car with an MSRP of up to $85,000 for rentals of 48 days or less when.

- $250,000 Travel Accident Insurance: Up to $250,000 of Accidental Death and Dismemberment

- Purchase Protection Plan: Coverage for 90 days from the date of purchase in the event of accidental physical damage or theft for up to $1,000 per occurrence

- Buyer’s Assurance Protection Plan: Your coverage can automatically extend the manufacturer’s original warranty up to one additional year

- No Fees for secondary card holders

- No Minimum Income to be eligible for American Express Cobalt Card

American Express Cobalt Card Disadvantages

- $12.99 Monthly Fee. One of rare cards charging fees in a monthly basis for a total $155.88 annual fee

- 2.5% Foreign Exchange Fee

My Feedback: Apply for this card only if you can manage spending $500 every month for a year to take the 30,000 Bonus points. This can be equal to $300. Link your card with Amazon.ca and buy Amazon gift cards with the points.

Same as TD Aeroplan Visa Card, cancel after the first year as there are cheaper alternatives.

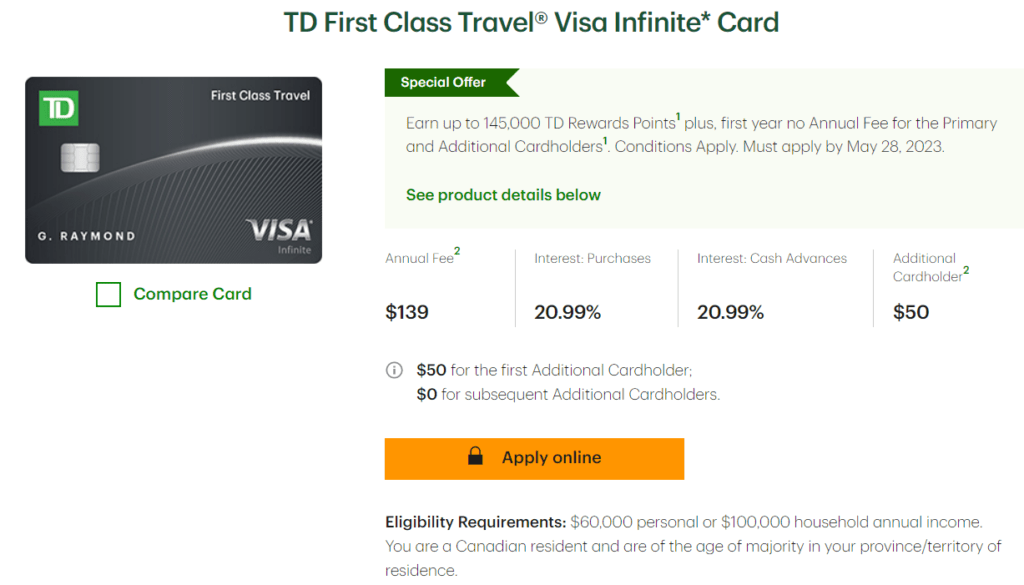

TD First Class Travel Visa Infinite Card

TD First Class Travel Visa Infinite Card Advantages

- Current Bonus: Up to 145,000 TD points (By May 28, 2023) and a first year no annual fee

- 2 TD points per $1 on all purchases. 8 points per $1 on travel through Expedia For TD. 6 points per $1 for groceries and restaurants. 4 points per $1 for recurring bills.

- Travel Medical Insurance: Up to $1 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip.

- Trip Cancellation – Trip Interruption Insurance: For trip cancellation coverage of up to $1,500 per insured person, with a maximum of $5,000 for all insured persons, and for trip interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Delayed and Lost Baggage Insurance: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example a bus, ferry, plane, train, or auto rental).

- Auto Rental Collision / Loss Damage Insurance: Coverage for up to 48 consecutive days.

- Optional TD Auto Club Membership

- An annual TD Travel Credit of $100 when you book at Expedia for TD

TD First Class Travel Visa Infinite Card Disadvantages

- $139 Annual Fee for main holder and $50 for additional cardholders after the first year

- Eligibility $60,000 personal or $100,000 household annual income

- 2.5% Foreign Exchange Fee

- The card requires $5,000 purchases within the first 180 days of opening to receive the extra 115,000 TD points

My Feedback: Considering 303 points will give you $1 off at Amazon, a value of 0.33 cents per point, I recommend taking advantage of their special bonus offer. 145,000 will be equal to $475 in free Amazon shopping.

The card can be cancelled afterwards as there are cheaper cards with same benefits.

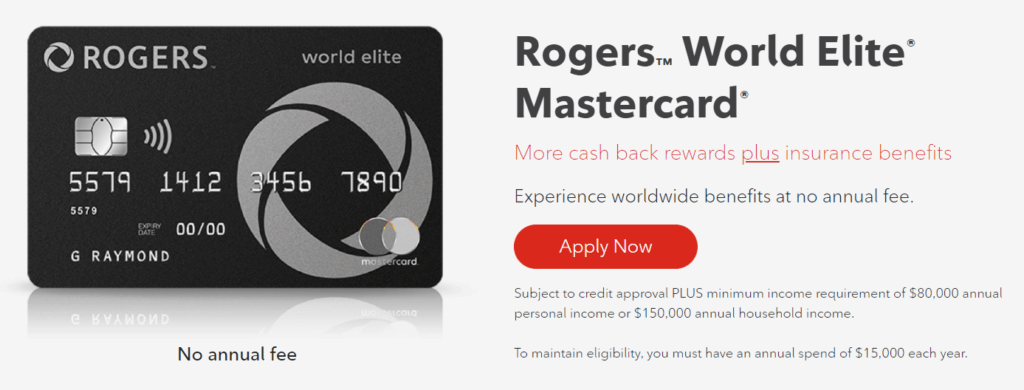

Rogers World Elite Mastercard

Rogers World Elite Mastercard Advantages

I currently hold this credit card as it does not cost me anything. It is still my card for purchases other than grocery, gas, and recurring bills as it offers a good 1.5% cash back on all purchases.

- Welcome Bonus: $25 in cash back rewards upon first card purchase within 3 months of receiving your card

- 1.5% cash back on all regular purchases – 3% cash back on USD purchases

- Emergency Medical Insurance: Up to a $1,000,000 if under 65 years old for the first 10 consecutive days of a covered trip (3 days if between 65 and 75 years old)

- Trip Cancellation: Up to $1,000 per insured person to an overall maximum of $5,000 per account, per trip

- Trip Interruption and Trip Delay: Trip expenses up to a maximum of $1,000 per insured person, to a maximum of $5,000 per account, per trip

- Car Rental Theft & Damage Insurance: Coverage for theft, loss, and damage of your rental car with an MSRP of up to $75,000 for rentals of 30 days or less when.

- Buyer’s Assurance Protection Plan: Your coverage can automatically extend the manufacturer’s original warranty up to one additional year

- No Annual Fees

- Free Boingo Wi-Fi for Mastercard Cardholders at over 1 million hotspots worldwide

Rogers World Elite Mastercard Advantages

- Eligibility $80,000 personal or $100,000 household annual income

- 2.5% Foreign Exchange Fee

My Feedback: Rogers World Elite Mastercard was a great card when they offered 4% cash back on all foreign transactions. However, it lost its advantages now. There are better cards with no 2.5% foreign exchange fee and easier eligibilities to consider.

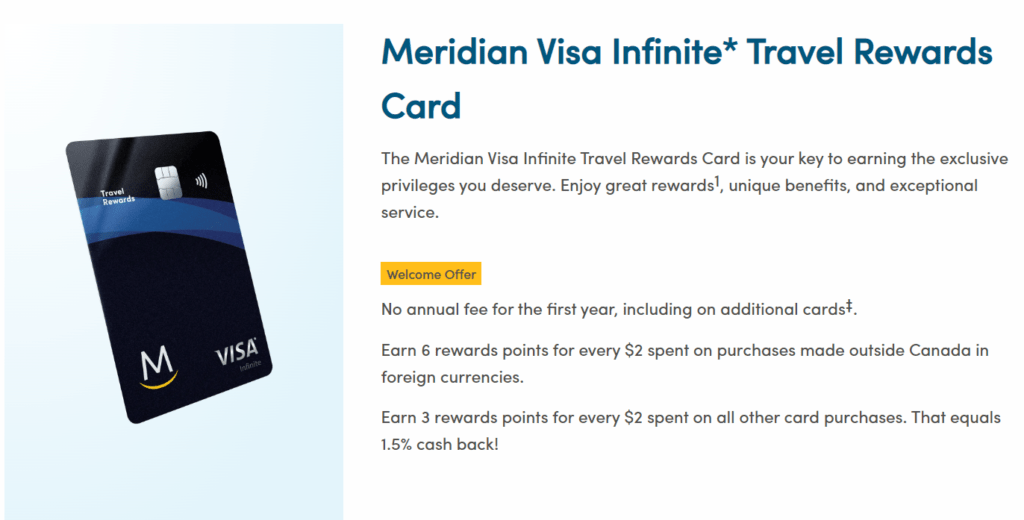

Meridian Visa Infinite Travel Rewards Card

This is a fantastic card if you are not a resident of Quebec.

Meridian Visa Infinite Travel Rewards Card Advantages

- Emergency Health Care Coverage: Coverage up to $5,000,000 per insured person for each trip is dependent on the insured’s age group up to age 75 and for up to 48 days.

- Trip cancellation & Interruption Insurance: Up to $2,000 coverage per person if the trip is cancelled prior to departure and unlimited coverage in the event of trip interruption after departure.

- Baggage Insurance: Coverage up to $1,000 per person against theft or damaged baggage and up to $500 against delayed baggage.

- Common Carrier Accident Protection: Up To $1,000,000 Accident Protection if you, your spouse, or children are the victim of accident death, dismemberment while using public transportation.

- Auto Rental Collision/Loss Insurance: Insurance covers you if your rental car is damaged or stolen for a period of up to 48 consecutive days when you charge the full cost of your car rental to your card.

- Intergenerational Insurance Coverage: Trip cancellation, lost baggage, emergency health care coverage and accident protection insurances extend to grandchildren travelling with grandparents.

- Mobile Device Insurance: Up to $1,000 in the event your cell phone, smartphone or tablet is lost, stolen, accidentally damaged or experiences hardware failure.

- Purchase Protection: Provides coverage for 90 days from the purchase date in the event of loss, theft, or damage when you to purchase eligible items. Maximum of $10,000 per item up to a maximum of $50,000 lifetime per account.

- Extended Warranty: Coverage automatically doubles the original manufacturer’s warranty for up to a maximum of one additional year. Maximum of $10,000 per item up to a maximum of $50,000 lifetime per account.

- Price Protection Service: New eligible purchases may be reimbursed within 60 days if a lower written advertised price is found for the difference up to $100 per item and $500 per account per year.

- Earn 1.5 points for every $1 of net purchases and 3 points for every $1 in foreign currencies

Meridian Visa Infinite Travel Rewards Card Advantages

- $99 Annual Fee (Rebate for first year) and $30 for supplementary card holders

- No VIP Perks like access to lounge

- 2.5% Foreign Transaction Fee which is returned with an additional 0.5% with the 3 points rewards for foreign transactions. However, will not be good if you must refund a foreign purchase as you will end up paying 5% in foreign exchange fee and no point

- QC Residents are not eligible

My Recommendation: I would have loved to apply for this card as it offers best insurance coverage with less fee than others. The 1.5% on every purchase is a great offer.

This card is similar to Rogers World Elite Mastercard but with a much better insurance coverage and extending the 3% reward on all foreign transactions and not just $USD.

The drawback is its $99 fee. I recommend this card unless you are looking for special perks like lounge access or free check-in baggage.

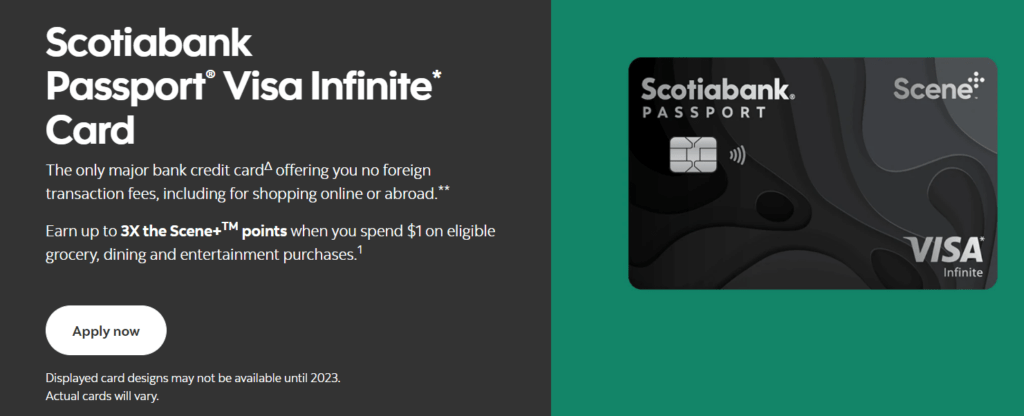

Scotiabank Passport Visa Infinite Card

Scotiabank Passport Visa Infinite Card Advantages

- Current Bonus: Earn up to 40,000 bonus Scene+ Rewards points in your first year

- Travel Medical Insurance: Up to $1 million of coverage for the first 25 days. If you or your spouse is aged 65 or older, you are covered for the first 10 days of your trip

- Trip Cancellation – Trip Interruption Insurance: For trip cancellation coverage of up to $2,500 per insured person, with a maximum of $10,000 for all insured persons

- Flight – Trip Delay Insurance: Up to $500 in coverage per insured person if your flight – trip is delayed for over 4 hours

- Delayed and Lost Baggage Insurance: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 4 hours from the time of arrival or lost

- Common Carrier Travel Accident Insurance: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example a bus, ferry, plane, train, or auto rental) per person up to $1M per occurrence

- Hotel – Motel Burglary Insurance: Up to $1,000 of coverage per occurrence for eligible personal items stolen from your hotel or motel room that belong to the Cardholder on the Account and eligible family members travelling with the Cardholder only in the US or Canada

- Auto Rental Collision / Loss Damage Insurance: Coverage for up to 48 consecutive days rental

- Purchase Security & Extended Warranty Protection: Coverage extends for the first 90 days from the date of purchase against theft, loss, or damage up to Maximum lifetime liability of $60,000

- Price Protection Service: When you use your Scotiabank Passport Visa Infinite Card to buy an eligible new item in Canada that is offered for sale in Canada at a lower price within 60 days of your purchase, the Price Protection Service can pay you the price difference up to $100 per item and $500 per calendar year

Scotiabank Passport Visa Infinite Card Disadvantages

- $150 Annual Fee for main holder and $50 for first additional cardholders

- Eligibility $60,000 personal or $100,000 household annual income

- 2 Scene+ Rewards per $1 on grocery, dining, entertainment, transit. 1 Scene+ Rewards per $1 for all other purchases

My Feedback: Scotiabank Passport Visa Infinite Card is a wonderful card for traveling considering its great insurance coverage and no foreign transaction fee.

However, the rewards are not appealing. Counting its $150 per year, I do not recommend getting this card unless you can take advantage of the amazing annual 6 complimentary Airport Lounge access.

Other Cards Worth Mentioning

TD Platinum Travel Visa Card: There is currently a special offer to earn 50,000 TD Points and no first year annual fee. However, this card is not worth the $89 fee at all as it does not have Emergency Travel Medical insurance. I will consider this card only to take advantage of their current sign-up bonus.

Home Trust Preferred Visa: This is not really a travel credit card. However, it has a fantastic advantage of not charging the 2.5% foreign transaction fee. It also offers 1% cash back on all Canadian transactions. It only has car rental collision and loss damage insurance and unavailable for QC residents.

Brim Mastercard: This is my backup card when traveling internationally for any foreign purchases. The card has no FX fees and offers 1% cashback on all purchases plus its fantastic free global WiFi coverage. Join Brim and earn 10,000 points which is $10.

Alternatively, take advantage of the no first annual fees for Brim World Elite Mastercard which offers trip cancellation and interruption insurance.

HSBC World Elite Mastercard: This is another wonderful card with a great bonus offer currently. Bonus is 80,000 points if outside QC and 110,000 if in QC plus first year’s $149 fee waived for non-Quebec residents.

The great advantage of this card is its no foreign transaction fees and 3% travel rewards on all travel expenses plus 1.5% on all other eligible expenses. The rewards can be redeemed for gift cards as well. I also like the $100 annual travel enhancement credit which can be used to pay for lounge, seat, or checked baggage fees.

How do I Choose My Best Travel Credit Card In Canada

I do not mind applying for 2-3 new cards every year. As you might already know, I love free money. My criteria for applying for a new card comes with special sign-up bonus, benefits, and coverage.

Of course, having a card with no foreign transaction will make traveling much affordable. However, as I already have Brim Card which offers no foreign transaction fee plus 1% points, this is not a priority in a new card anymore.

Redemption policy for the card is important too. Some cards have flexibility on where to redeem the card while others force you to be using their own platform which limit your options significantly. I prefer the cards that provide flexibility for redeeming points.

Conclusions and My Recommendations

Choosing a credit card that suits own benefits is critical and confusing. However, it pays off to do your own research and pick what works the best for your needs.

We are living in a complicated world and need to take advantage of any offers we can find to make our life easier while leaving more money in our pockets.

Nowadays I travel with multiple travel credit cards including Brim Financial and Wealthsimple Prepaid Visa. Read more about Wealthsimple Visa here. This card offers No foreign exchange fees, and No ATM withdrawal fees which makes it a great card for traveling.

In addition to Brim which offers 1% cashback with no FX fees and Wealthsimple, I always have a credit card with full insurance which I use to purchase my travel bookings with to reduce the headache if something goes wrong.

Final note regarding Brim Financial, even though it is a free card, it offers Free Global Wi-Fi, a limited $100,000 / insured Common Carrier Accident Insurance, $500 for loss or damage to Mobile Device, $1000 Event Ticket protection, Double Extended Warranty for up to 1 year and $25,000, and Purchase Security Insurance.

If you need a Brim Referral Code to get $10 and then refer your own friends to get $2o, please consider using mine. Thank you! 62333

Brim Referral Link: https://link.vibrantdreamer.com/Brim

My Next Steps

I am in the hunt for 1 new travel credit cards to take advantage of bonuses and cancel my current Scotiabank Passport Visa Infinite card before the first year fee kicks in.

Thank you for reading. What is your Travel Credit Card? Are you planning to apply for more cards for bonuses or cancel old cards?

My go to travel card is the RBC avion card. I like the flexibility of being able to use it on any airline, which is a drawback of aeroplan.

I can’t wait for the day that regular non essential travel becomes normal again:)

Hello Maria,

I honestly never checked out RBC Avion Credit Card. I think I will. I totally agree about the Flexibility specially as Air Canada doesn’t always have the best prices. However, I like that they have many partners.

My main card was Rogers World Elite MC cause of the cash back on foreign transaction. However, that card is obsolete now as they made the cash back only on USD.

For now, I am only focusing on Credit Card Crunching. When hopefully travel is back to normal, I will first check what card includes Covid coverage and go from there. I am eyeing Scotiabank Passport Visa card. It looks really good with their 6 complimentary lounge and no FX. Not paying Foreign Transaction is a deal maker / breaker for me. Imagine renting a car in Spain for $500 EUR. Do you want to pay an extra 2.5% if booking it in local currency? Same goes for all local payments from transportations to restaurants to activities.

Let’s hope 2021 behaves!

Take care,

Mr. Dreamer

Great writeup, lots of good travel card offers coming out recently, I wish I could take advantage of more of them. You did a good job summarizing!

I had the RBC Avion Maria mentioned but actually cashed in my points for WestJet dollars.

I agree. Wish I could get more and more without hitting my credit score hard! My score is down about 20 points so I am going to give it some more time while trying to figure out how to spend on these cards to get the points. A true challenge during Covid.

I should look into RBC Avion. Never had any RBC Credit Card before.

I like the TD Visas, they are great.

The TD First Class Visa is better than expected, we were able to book it “Book Any Way Travel” for things like local attractions. I like the flexiblity.

I agree but sadly, TD rejected my application (I don’t blame them, Haha) so I have to wait couple months or even till next year before re-applying. How did you find the points versus dollar value for local attractions? Basically, how many points did you need to apply for let’s say $10 attraction?