There are many wonderful online Canadian Financial Calculators and Income Tax calculators. I have spent some time trying to find out the best tools and calculators for personal financial benefit. In Part 1, I covered the Official Government of Canada’s Financial tools and calculators created by Financial Consumer Agency of Canada (FCAC).

KJE Computer Solutions Calculators (Canadian Financial Calculators)

One of the best Canadian Financial calculators are provided by KJE Computer Solutions. They have hundreds of calculators and a whole section dedicated to Canadians. Some of their special calculators include:

- Taxable versus Tax Advantaged Investments Calculator (Canadian): This calculator is designed to help compare a normal taxable investment, a tax deferred investment and tax-free investment.

- How Much is Enough to Fund My Retirement? Use this calculator to help you determine how long your investment savings might last. Enter your current savings plan in the contributions section of the calculator, and your withdrawal needs in the withdrawal section. This calculator will then plot your investment savings total year-by-year. You can then determine how much your investment savings could be worth, and how long it might last.

- Education Savings Plan Calculator: Saving for your children’s education requires a long-term plan. And, like saving for retirement, the earlier you start your plan the better. Use this calculator to help develop or fine tune your education savings plan.

To view all these amazing Calculators, head out to Free Canadian Financial Calculators

Total Income and Income Tax Calculator

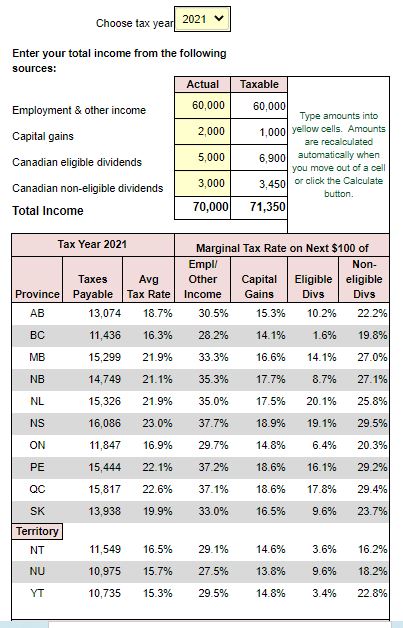

TaxTips has so many great calculators all focusing on Canadian Financial and Income Tax Calculations but their basic income tax calculator is as it sounds, basic. You enter Employment & other income, Capital Gaines, Canadian eligible dividends, and Canadian non-eligible dividends. Then it shows you the income tax for all provinces. It calculates Basic tax and any applicable surtaxes, Basic personal amount, Federal & YT enhanced basic personal amount, Dividend tax credits for Canadian eligible and non-eligible dividends, Federal tax abatement (QC only). However, it does not include CPP and EI premiums, ON health premium, BC MSP, QC health charges, income tax credits, Alternative minimum tax is not calculated.

You realize why I like Quebec from below screen shot? Guess who pays the highest Tax in Canada!

Income Tax and RRSP Savings Calculator

There are also the Detailed Canadian Income Tax & RRSP Savings Calculators and Quebec Income Tax and RRSP Savings Calculator. This as its name stands is very detailed. Looks similar to Income Tax Return Application Form and includes pretty much everything like Old Age Security (OAS), Canada Pension Plan (CPP), Capital Gains, Dividends, RRSP and RRIF Withdrawals, EI Benefits, Foreign dividends, Pension income, workers compensation benefit and more.

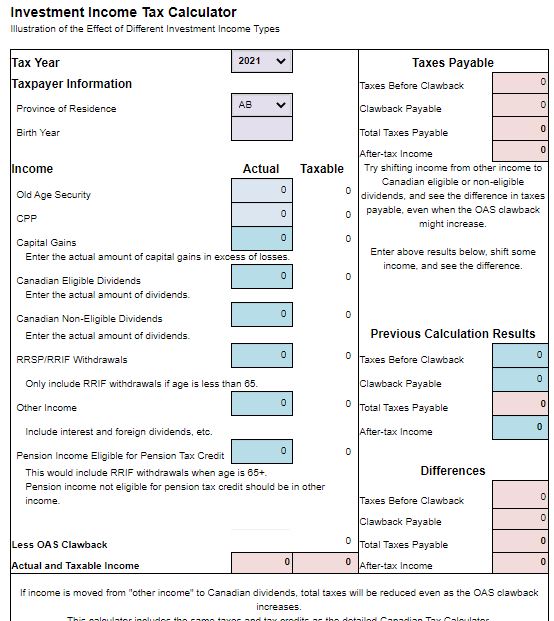

Investment Income Tax Calculator

There are other types of calculators like Investment Income Tax Calculator. There is a Canada and Quebec version. The purpose of these calculators is to show the big difference in taxes payable on different types of investment income. Even when the age credit and Old Age Security are clawed back, Canadian dividends and capital gains result in the least taxes payable when compared to other types of income such as foreign dividends and interest.

What is really great about these calculators are the comparing of scenarios side by side, open the calculator by clicking the link above (the calculator will open in a new tab), then come back to this page, right click on the above link, and select “Open in a new window”. You now have 2 instances of the calculator open so that you can compare the results.

TFSA vs RRSP Calculator

One of the most beloved Canadian Calculators is is TFSA vs RRSP Calculator. This is very helpful for those trying to figure out if they should contribute to RRSP or TFSA.

The calculator uses two scenarios – deposits going to RRSPs, and deposits going to TFSAs. You input how much you would deposit into an RRSP, and the calculator determines the after-tax amount of that deposit, which is used as your TFSA deposit. You also input when you would like to convert to a RRIF, and if you would like to start withdrawing from your RRSP before it is converted to a RRIF. Once these withdrawals are started, the TFSA scenario uses the RRSP/RRIF withdrawal, less tax on that withdrawal, as the TFSA withdrawal.

The balances of pre-existing RRSPs/RRIFs or TFSAs are not entered into this calculator. Instead, the calculator requires you to input your estimated annual income, including withdrawals from already existing RRSPs or RRIFs, at the time that you start your withdrawals. This would not include the income from the RRSPs or TFSAs created by the contributions that you are making from this point on.

RRSP RRIF Calculator

You can use their RRSP/RRIF calculator to determine the estimated annual minimum withdrawals from any RRSPs or RRIFs that you already have. The calculator will show any claw back of Old Age Security (OAS), as well as any Guaranteed Income Supplement (GIS) to which you may be entitled.

The result of the calculations is that the net disposable income (cash in your pocket after tax) is exactly the same in both the RRSP and TFSA scenarios, until the balance of either one is reduced to zero, unless GIS supplements are received.

Loan and Mortgage Calculator

See how much interest you can save by paying down your debt more quickly! Input up to 3 different payment options for your loan/mortgage, to see a side-by-side comparison. See how much sooner your debt will be repaid if you increase your regular payment.

Borrow for RRSPs Calculator

Should you borrow to contribute to RRSPs? If you aren’t sure, use this Borrow for RRSP Calculator.

RRSP vs Mortgage Calculator

Are you trying to decide whether to increase your monthly mortgage payment, or contribute the extra monthly amount to an RRSP? Let our RRSP vs mortgage calculator help you make the decision. Although we use the term “mortgage”, the calculator also works for regular loans.

Net Worth Calculator

It can be very helpful to monitor your financial progress by periodically making a summary of your net worth. To calculate your net worth, you add up the value of your major assets and any investments, and deduct any debts.

Investment Income Tax Calculator

See the big difference in income taxes payable with different types of investment income. See how total taxes can be reduced even as the OAS clawback is increased. This was mentioned in details above.

Rule of 72 Calculator

The Rule of 72 provides a very simple way to estimate how long it will take your investment to double. Simply divide 72 by the compound annual rate of return on the investment. The result is the number of years it will take to double your investment.

For example, if the rate is 12%, divide 72 by 12. The investment will double in approximately 6 years. At a 9% rate of return, it would take 8 years. At 0.5%, the approximate rate paid by most high-interest savings accounts in 2017, it would take 144 years! However, inflation is much higher than that, so you’d actually be losing money, because double the money would buy about 1/4 to 1/2 of the goods!

Borrow to Invest Calculator

This calculator helps you to see the advantages of borrowing to invest in stocks and exchange traded funds (ETFs). You can input different interest rates, rates of return and other data to compare scenarios. You will be provided with details of net after tax income for two different cases – borrowing to invest, or doing nothing.

Investment Return Calculator

What returns are you getting on your investments? For individual investment, or an investment account. The calculator provides both total % return and annualized % return (internal rate of return).

Present Value and Future Value Calculator

What do you need to invest today to achieve the desired amount in the future? This calculator will determine:

| Present value – how much you need to invest today to achieve a desired amount in the future, based on the nominal annual interest rate and compounding Future value – how much an amount invested today will provide you at a future date, based on the nominal annual interest rate and compounding Interest rate – what interest rate is required to provide a desired amount in the future, based on an amount invested today Time period – years and months required to achieve the desired amount, based on the amount invested and the expected interest rate |

CPP (Canada Pension Plan) Payment Calculation

How about the very complicated CPP (Canada Pension Plan) contribution calculation? Unfortunately, there is no calculator to calculate the very complicated only can be done by Supercomputers CPP. However, you can find the solution to this mystery by visiting CPP (Canada Pension Plan) Retirement Calculation

As always, thank you for stopping by. Please leave me your questions or comments below. Thanks!