Benefits of Investing in Global and Local REIT ETFs

Do you enjoy owning a slice of the best properties in Canada, Europe, Asia, or the US? I heard “YES”. How? By buying REIT stocks or one of the Best REIT ETFs in Canada. REIT ETFs are the awesome tools to simplify ownership and exposure to real estates in Canada and around the world.

Owning a Canadian listed REIT ETF provides the ability to part-own apartments, shopping malls, business parks, or any other type of property all over the world in a simple and diversified method. In addition, REIT stocks and ETFs come with some of the best monthly payments in form of distributions or dividends.

In this post, I am going to share the best REIT ETFs in Canada which are listed on TSX in our local CAD currency to avoid any complication or extra foreign exchange fees. REET is an option if you enjoy holding US listed equities.

Related: Every investor should consider investing in technology for a balanced income and growth portfolio. Find out about the 5 Best Technology ETFs in Canada

Best REIT ETFs in Canada

Below is the Best REIT ETFs chart as a reference. Every fund is explained briefly to give an understanding of its holdings. All below ETFs are in Canadian Dollar and listed on Toronto Stock Exchange (TSX).

| ETF | MER | Distribution | Yield (After MER) | Regions | 1 y Return | 3 y Return | 5 y Return |

| CGR | 0.72% | $0.1692 | 1.42% | Global | 21.16% | 5.34% | 6.23% |

| HGR | 1.36% | $0.0458 | 4.64% | Global | 11.98% | 4.69% | NA |

| PHR | 0.79% | $0.0720 | 2.83% | US & Canada | 29.54% | 11.15% | 7.91% |

| REIT | 0.51% | $0.0702 | 2.93% | Canada | 26.59% | 8.25% | NA |

| RIT | 0.97% | $0.0675 | 2.72% | Canada | 34.48% | 15.43% | 12.34% |

| VRE | 0.38% | $0.0943 | 2.51% | Canada | 28.98% | 8.22% | 8.98% |

| XRE | 0.61% | $0.0510 | 2.79% | Canada | 28.23% | 8.08% | 9.39% |

| ZRE | 0.61% | $0.0900 | 3.37% | Canada | 30.16% | 11.84% | 12.08% |

Related: Check out my list for Best & Most Tax Efficient US & International ETFs listed on TSX

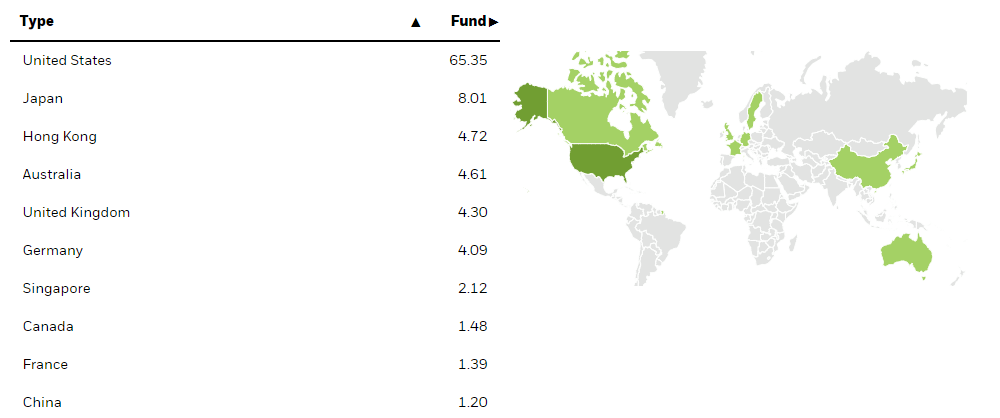

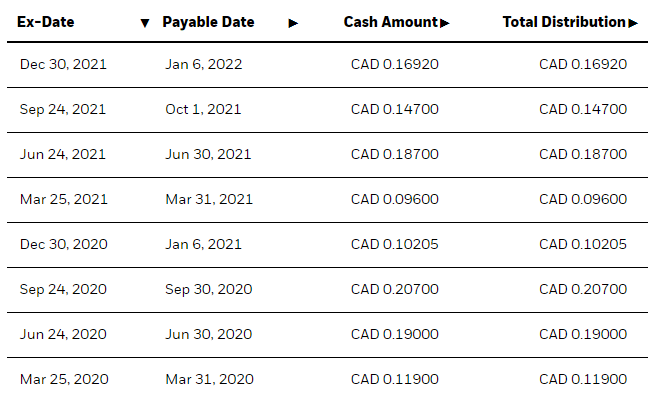

CGR is a global REIT ETF with a diversified portfolio around the world and an exposure to 75 publicly-traded global real estate companies. However, 60.70% of its exposure is in the US.

One disadvantage of CGR is that it pays unequal quarterly distributions with a current annual yield of 2.13%. Based on current numbers, the after MER annual pay yield is 1.42%.

HGR Harvest Global REIT Leaders Income ETF

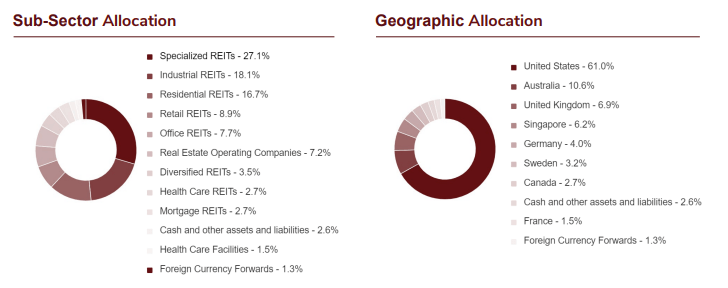

HGR is an actively managed portfolio of large-cap REIT companies in key developed markets, to provide access for Canadians to a variety of Global REITs. The ETF is designed to provide a consistent monthly income stream with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

HGR currently holds 26 companies. Biggest exposure is unexpectedly the US at 61.0%. It pays a very interesting $0.0458 per share distribution which makes its after MER annual yield 4.64%.

PHR Purpose Real Estate Income Fund

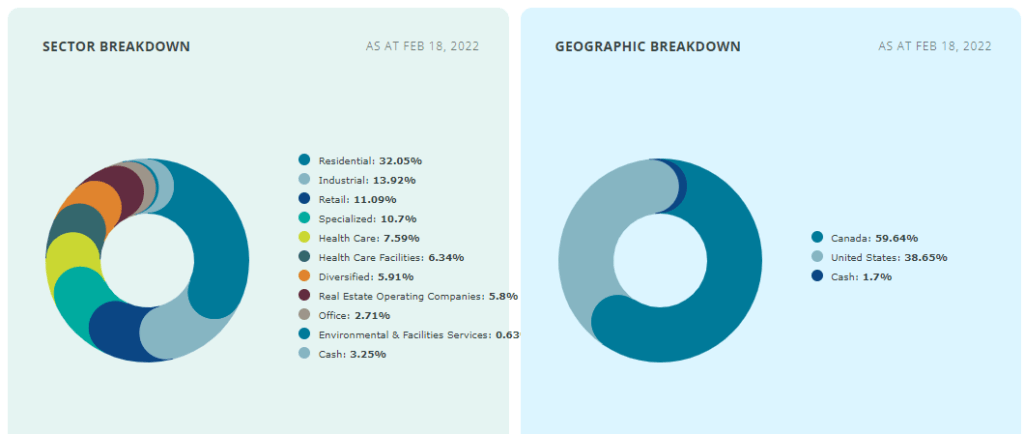

A diversifying source of income and growth linked to a broad portfolio of high-quality real estate assets. PHR ETF selects REITs with solid growth, strong balance sheets, low debt, and sustainable payout ratios. As of Feb 18, it holds 38.65% US and 59.64% Canada real estate equities.

This is a significant change in comparison with last year where US was about 60% of PHR REIT ETF.

After deducting the MER, PHR pays 2.83% income from a diversified US and Canada portfolio. There has been no distribution increase since my last year’s review.

REIT Invesco S&P/TSX REIT Income Index ETF

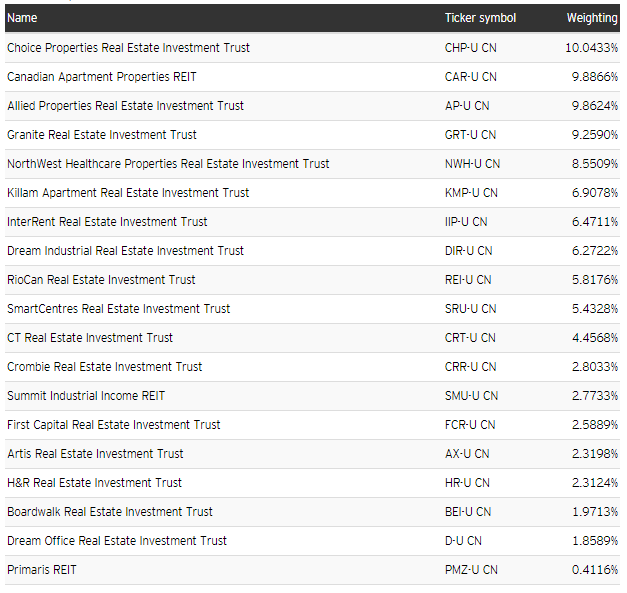

REIT ETF seeks to replicate the performance of the S&P/TSX Capped REIT Income Index, or any successor thereto. REIT’s holdings are more balanced than other ETFs with its highest 3 companies, Canadian Apartment Properties, Choice Properties, and Allied Properties with an almost equal 10% weight.

The after MER annual yield is 2.93% with its current monthly $0.0750 distribution payment per share.

RIT First Asset Canadian REIT Income Fund

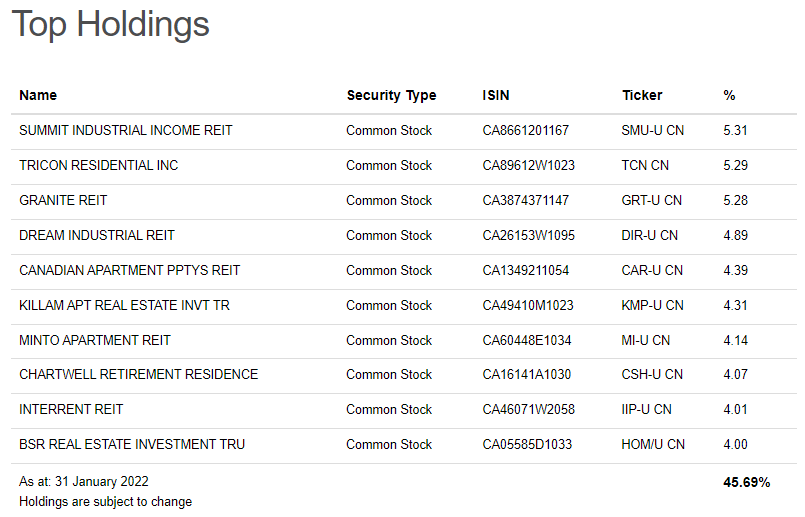

RIT ETF seeks long-term total returns consisting of regular income and long-term capital appreciation from an actively managed portfolio comprised primarily of securities of Canadian real estate investment trusts, real estate operating corporations and entities involved in real estate related services.

RIT currently holds 88.64% Canadian companies with a small 9.49% foreign exposure and an after MER annual distribution pay of 2.72%.

VRE Vanguard FTSE Canadian Capped REIT Index ETF

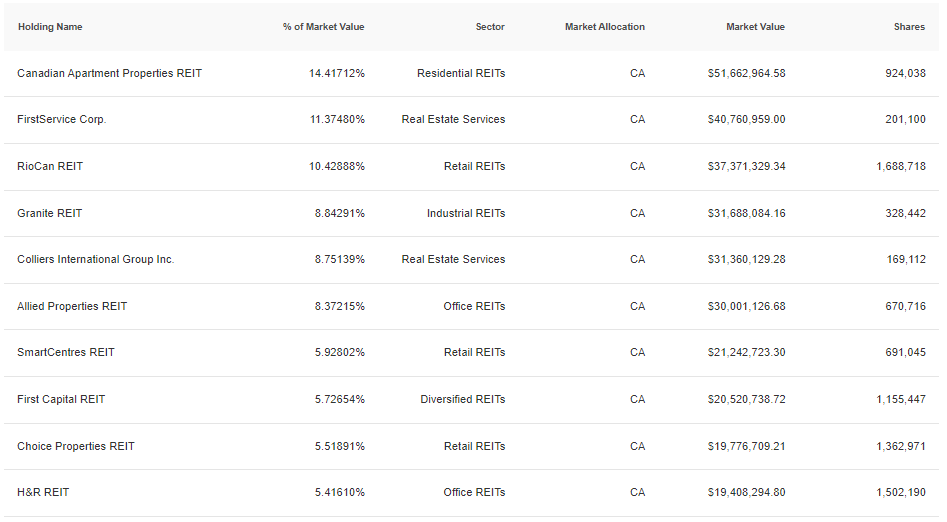

VRE ETF tracks the performance of a broad Canadian real estate equity. Currently, it holds 16 stocks and similar to XRE, its biggest exposure is Canadian Apartment Properties CAR.UN at 14.41% followed by FirstService Corp at 11.37%.

VRE pays a monthly $0.09434 per share in distributions. After MER annual yield pay is 2.51%.

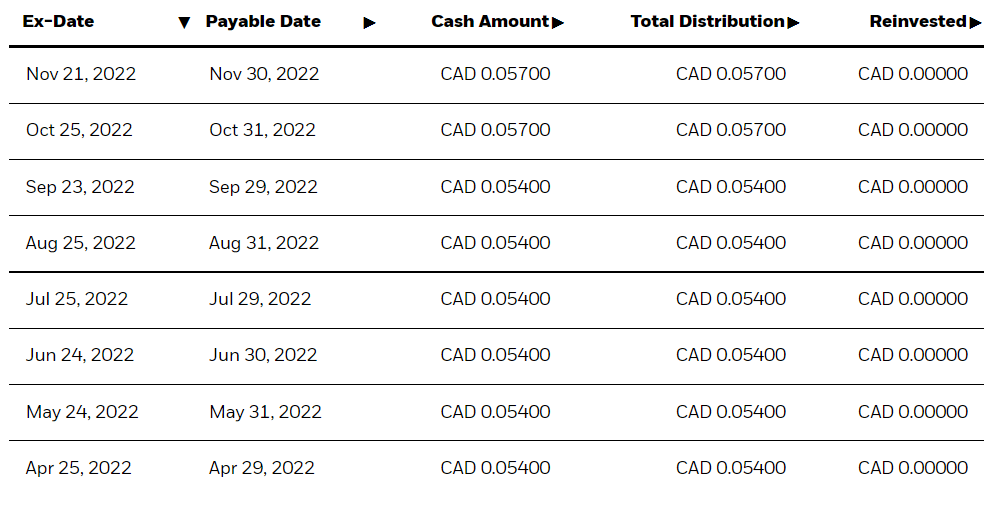

XRE provides long-term capital growth by replicating the performance of the S&P/TSX Capped REIT Index, net of expenses. XRE pays a monthly distribution of $0.057. After MER annual distribution yield is 2.79%.

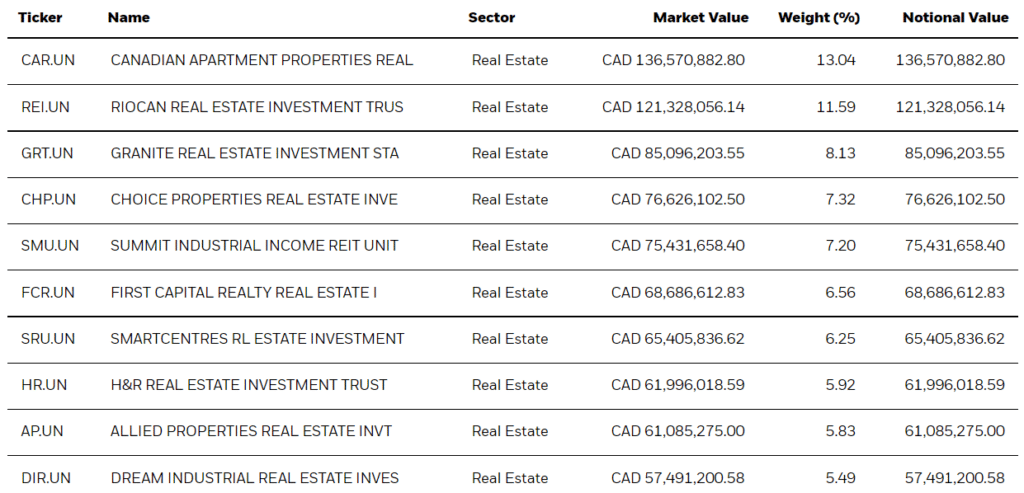

Currently, it holds 20 companies with its biggest exposure being Canadian Apartment Properties CAR.UN at 13.04%.

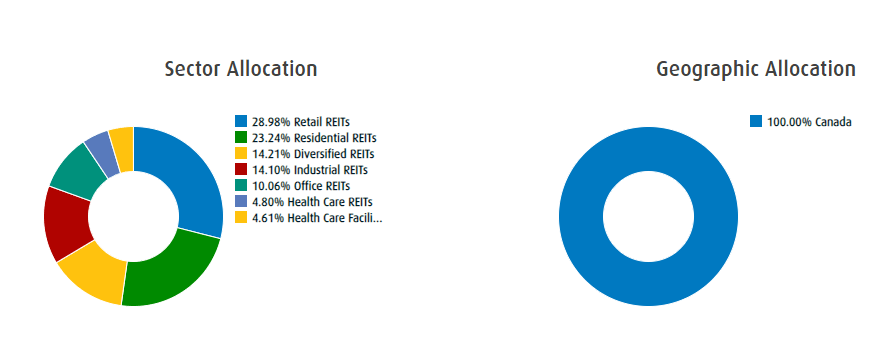

ZRE BMO Equal Weight REITs Index ETF

ZRE ETF invests in Canadian real estate investment trusts in the same proportion as they are reflected in the Index. ZRE currently holds 23 Canadian stocks and pays a monthly $0.09 per share distribution. Its annual yield payout after MER deduction is 3.37%.

The Best Canadian REIT ETF Winner – ZRE

| ETF | MER | Distribution | Yield (After MER) | Regions | 1 y Return | 3 y Return | 5 y Return |

| REIT | 0.51% | $0.0702 | 2.93% | Canada | 26.59% | 8.25% | NA |

| RIT | 0.97% | $0.0675 | 2.72% | Canada | 34.48% | 15.43% | 12.34% |

| VRE | 0.38% | $0.0943 | 2.51% | Canada | 28.98% | 8.22% | 8.98% |

| XRE | 0.61% | $0.0510 | 2.79% | Canada | 28.23% | 8.08% | 9.39% |

| ZRE | 0.61% | $0.0900 | 3.37% | Canada | 30.16% | 11.84% | 12.08% |

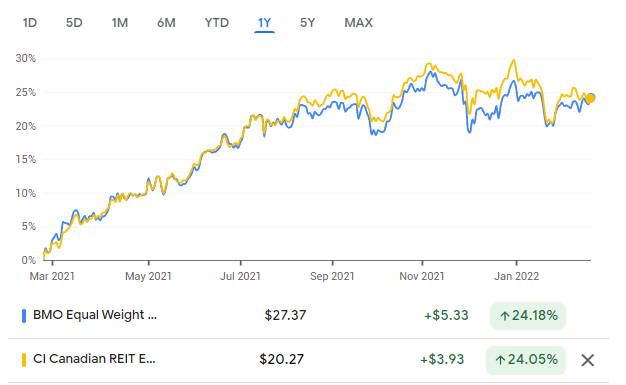

The competition is really strong. The numbers are really close and choosing the best REIT ETF is challenging. However, from the five listed Canadian REIT ETFs, I eliminate VRE and XRE due to their low annual yield but keeping RIT for now as its return is competitive.

I also eliminate REIT due to its lower performance and not very competitive yield. REIT’s 1 or 3 year return isn’t impressive compared with others.

We have 2 final REIT ETFs to choose from. ZRE vs RIT. As you can see, ZRE has a higher yield but very similar performance to RIT. This was the opposite of what we saw in last year’s review where RIT totally lost the battle to ZRE.

However, in my opinion, ZRE is still a better choice due to its higher and consistent yield along its trading volume. Hence, I recommend buying ZRE for your REIT portfolio.

The Best International REIT ETF Winner – HGR

| ETF | MER | Distribution | Yield (After MER) | Regions | 1 y Return | 3 y Return | 5 y Return |

| CGR | 0.72% | $0.1692 | 1.42% | Global | 21.16% | 5.34% | 6.23% |

| HGR | 1.36% | $0.0458 | 4.64% | Global | 11.98% | 4.69% | NA |

| PHR | 0.79% | $0.0720 | 2.83% | US & Canada | 29.54% | 11.15% | 7.91% |

It is a bit challenging to find international REIT ETFs listed on TSX. However, the above gives enough exposure and diversity. From the 3 ETFs, I won’t consider PHR because it includes 60% Canadian market stocks which we are already covering with ZRE.

HGR is an actively managed ETF which utilizes covered call options strategy. Covered call is used as a tool to generate income. Harvest writes covered call options to a maximum of 33% on any position. This strategy generates high yield and allows participation in the long-term growth.

Theoretically using this strategy will cut the growth return by 33%. This explains why HGR had an average 10.18% lower yearly return comparing to CGR. This should be enough to say the Covered call strategy used in HGR ETF isn’t a winner by any measures.

Even tough, CGR has a much lower distribution yield, I declare it as the winner among the two based on below simplified comparisons including after MERs Yield plus Annual Return.

Based on the Total Yearly Average numbers, CGR is surprisingly the winner if we only consider the last 1 year performance. However, as with every long-term investment, we should consider the long-term impact and performance.

- HGR Yield + Annual Return (3 Years) = 9.33%

- CGR Yield + Annual Return (3 Years) = 6.76%

- HGR Yield + Annual Return (1 Year) = 16.62%

- CGR Yield + Annual Return (1 Year) = 22.58%

Final Thoughts on the Best REIT ETF and Recommendations

Buying ZRE and HGR offers a great global REIT exposure with high returns. Hopefully, REIT market around the world keeps recovering slowly leading to even higher returns.

I personally own Canadian REIT stocks directly as I like the control and higher distributions without paying MER. Personally, I am not investing in international REIT ETFs. One word of caution is that both HGR and CGR have low liquidity (lower trading volume) which leads to a gap between their Market and NAV value.

How do I buy REIT ETFs? I love Wealthsimple Trade. It is really simple and no commission. I feel it is much better to save the trading money in my pocket rather than giving it out by using our trading platforms. However, I do my research and check technical via Questrade. The combination has been working great.

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive $10 to trade.

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

ZRE vs XRE ETFs? Both offer the similar 0.61% MER. However, ZRE has been paying higher distributions and returning a slightly higher performance growth. Among the two, ZRE is a clear winner.

XRE vs. VRE ETFs? VRE has a much lower MER than XRE. However, its yield after deducting the MER is lower than XRE too. Performance wise, they are almost identical. Overall, XRE is a better choice due to its higher yield after subtracting the MER.

ZRE vs. XRE vs. VRE ETFs? ZRE comes out as the winner REIT ETF among the three ETFs as explained in details previously.

It is your turn! Do you own any REIT ETFs? What is your favorite?

Great analysis my friend ! 👌😀📈💲 I agree with you and that’s why, I choose $ZRE as well for REITs. Even if the MER is expensive, I don’t need to manage individual stocks into that field and I have diversification too. I’m still growing my position and now will receive monthly around 61$ ✓

I have ZRE ETF and I am very satisfied with it. It’s well diversify, only bad point the MER of 0,61%. Other than that, great REITs ETF ✓