My Mission and Plans

As you might read on my first financial report, my mission is to move all my fund to self managed trading platform. Hence, I am in the hunt for the most tax efficient US & international ETFs.

In order to have a balanced portfolio with exposure to all global market, I am planning to have 50% in high yield Canadian dividend stocks and 50% in low-middle yield growth stocks. Of course, the dividend stocks will grow but slower than growth stocks (Apple, Facebook, Tesla, Google, Netflix, Amazon, Microsoft, Disney, and others).

The 50% Canadian Stocks will be distributed among Real Estate, Financial, Communication, and Utility stocks. The other half was giving me headache. I only want to hold ETFs in our CAD currency to avoid any foreign exchange fees and conversion complication. I don’t like the CAD – USD conversion game!

To find the ETFs for my 50% US and International coverage, I did some extensive research which eventually landed me in some interesting ETFs. I will only cover the ETFs which made the final cut to avoid confusion and complexity.

Feel free to read my review of the 5 best Technology ETFs to buy in Canada.

Related: Are you looking for a lazy diversified 3 fund portfolio with US Stocks, US Bonds, and International Stocks in $USD? If so, check out the post A 3 Fund Portfolio: The Simple Way To Invest by my friend Steve Cummings.

The BIGGEST Headache: Foreign Dividend Withholding Tax Rules

There are some great resources explaining the withhold tax rules. One great source is Canadian Portfolio Manager Blog.

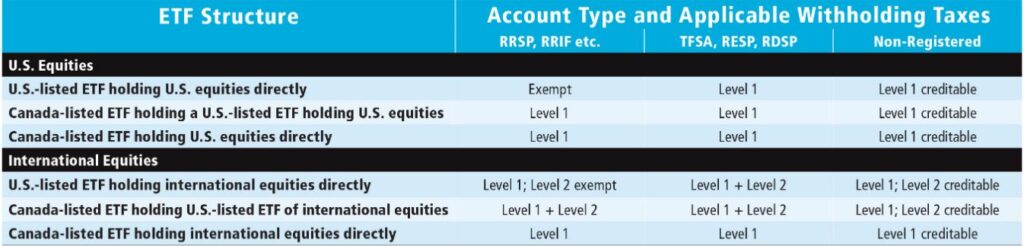

Structure – Canadian ETF investors can gain exposure to U.S., international, and emerging markets stocks in three ways:

Structure I – A US listed ETF that holds the foreign stocks

Structure II –A Canadian listed ETF that holds a US listed ETF that holds the foreign stocks

Structure III –A Canadian listed ETF that holds the foreign stocks directly

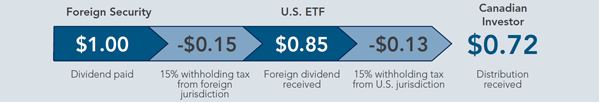

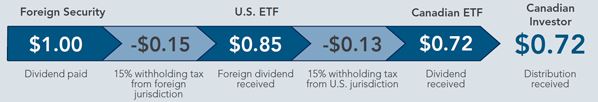

Withholding Tax Levels – In all three cases, investors are potentially subject to two layers of withholding tax levels:

- Level I withholding taxes are those levied by the countries where the stocks are domiciled, whether in the US or overseas.

- Level II withholding taxes are incurred when international or emerging markets stocks are held indirectly via a Canadian listed ETF that holds a US listed ETF. Specifically, there’s an additional 15% US tax on the foreign dividends, before the US listed ETF pays the net dividends to Canada.

Account Types – Different account types in which you’re holding the ETF (such as an RRSP, RRIF, TFSA, RESP, RDSP, or a taxable or non-registered account) are vulnerable to foreign withholding taxes in different ways.

- When US listed ETFs are held directly in an RRSP, RRIF, or LIRA investors are exempt from withholding tax from the US (but not from overseas countries).

- This exemption does not apply to TFSAs, RESPs, or RDSPs.

- If you hold foreign equity ETFs in a personal taxable account, you will receive an annual T3 or T5 slip indicating the amount of foreign tax paid. This amount can generally be recovered by claiming the foreign tax credit on your return. But what if your international or emerging markets equity ETF is subject to both Level I and Level II withholding taxes in a taxable account? Here, only the second layer of US withholding tax is generally recoverable.

- Since no tax slips are issued for dividends received in a registered account, any foreign withholding taxes incurred in an RRSP, RRIF, TFSA, RESP, or RDSP are not recoverable.

I am not going to discuss the US listed ETFs as I don’t want to get into the complications of holding foreign entity plus exchanging CAD – USD which adds up to the cost of purchasing these ETFs.

Rule 1: For now, I will stick to buying Canadian listed ETFs.

Based on my Rule 1, for me, the best option is holding any US or International in my personal taxable account (After maximizing RRSP, TFSA, RESP with Canadian dividend stocks). This will give me the benefit of recovering the 15% of any US or International Withholding Tax.

Some countries like Brazil or India charge 25% withholding tax which means 10% of the international dividend is unrecoverable and therefore lost.

Rule 2: Avoid double taxation, consider a Canadian listed ETF which holds International Stocks directly. Double Tax: STOP! Avoid Canadian listed ETF holding a US ETF holding International Stocks.

If I am not holding these ETFs in personal taxable accounts, next option would be TFSA accounts. This is because, at least, there won’t be Canadian Income Tax on them and I am just losing the foreign withholding tax. Holding in RRSP will be a loss. First same TFSA or Taxable account withdrawal rules apply and second, the dividends are taxable as counted Canadian Income when withdrawn.

Let’s take an example to simplify all the madness. Jennifer is investing $20K in Canadian listed ETFs holding US or International stocks or ETFs directly. We assume Jennifer’s tax margin is 35% now and when she retires (Withdraws RRSP). As shown below, Jennifer is best set to invest the ETF in Non-Registered Taxable account. Same as what Mr. Dreamer decided to do.

If Jennifer buys a Canadian listed ETF holding US ETF which holds the international stocks, she is looking at a non-recoverable 15-25% extra withholding tax. However, in our example below, she can claim back the 15% tax (Foreign Tax Credit) if in a Non-Registered Taxable income.

| Account | RRSP, LIRA, RRIF | TFSA | Non-Registered Taxable |

| Investment amount | $20,000 | $20,000 | $20,000 |

| Annual dividend @ 2% | $400 | $400 | $400 |

| Non-resident withholding tax (15%) | -$60 | -$60 | -$60 |

| Canadian tax | $0 | $0 | -$140 |

| Foreign tax credit | $0 | $0 | $60 |

| Withdrawal amount | $240 | $240 | $260 |

| Tax on withdrawal | -$84 | $0 | $0 |

| After-tax dividend | $156 | $240 | $260 |

Of course, as mentioned earlier, the situation differs if the income tax margin is different or if there is no enough money to maximize RRSP or TFSA first. For those cases, the investor should put the money in RRSP first to reduce the tax cut in source (No income tax cut on RRSP so there goes a 35% advantage).

I appreciate below chart by First Asset as a reference for the Foreign Withholding Tax.

Now that we understand how the tax system works and where to hold what. We can dive in the favorite part which is what EFTs are to hold and why. However, before that, I’d like to give reference to some of the great Canadian bloggers and their preferred ETF with a link to the source.

Selected ETFs by Canadian Financial Bloggers

- Another Loonie lists his list of best Dividend ETFs for 2021 but I am not sure what he holds.

- Bob from Tawcan shows why he chose XAW in his detailed post.

- Finance Journey doesn’t report owning a growth US ETF or International ETF but instead focuses on Dividend paying US and International ETFs.

- Gen X from My Road to Wealth and Freedom owns TD e-Series Mutual Funds.

- Gen Y from Gen Y Money holds many ETFs. I can’t really get the list anywhere but from her Jan and Feb dividend income post seems she holds VEE and VXC.

- German from Dividend Income Stocks don’t seem to hold any non-Canadian ETF or stock. His portfolio is listed here.

- Jordan from Money Master shows he owns 5199 XAW share.

- Liquid from Freedom 35 holds some interesting ETFs. ZHY, ZCM, and XPF to name some.

- Mike from The Dividend Guy Blog portfolio doesn’t seem to be holding any ETF.

- Rob from Passive Canadian Income holds 150 XAW in his portfolio.

- Robb from boomer & echo only holds one ETF, VEQT. He is the proud owner of the 4 minute portfolio.

XAW (iShares Core MSCI All Country World ex Canada Index ETF) and VXC (Vanguard FTSE Global All Cap ex Canada Index ETF) seem to be the most popular ones among the community. So, I am going to compare holding these ETFs versus holding Mr. Dreamer’s ETF which I am calling MRD.

Comparing XAW vs VXC

| Ticker | US Holdings | Developed Holdings | Emerging Holdings | Fees | 12m Trailing Yield | 1Y Return | 3Y Return | 5Y Return |

| XAW | 58.8% | 28.1% | 13.1% | 0.22% | 1.47% | 22.71% | 30.85% | 79.83% |

| VXC | 58.1% | 30.1% | 11.8% | 0.27% | 1.43% | 25.11% | 33.01% | 82.33% |

As shown, VXC has been performing better than XAW which seems to be due to its 1 year return. However, it is offering less contribution and higher fees. Comparisons like PWL Capital for withholding tax aren’t valid anymore (unless they update it) because XAW updated their underlying ETFs and now uses VIU which is Canadian listed and invests directly in Developed market.

This means, we can assume XAW and VXC both have a same withholding TAX of 0.36% on registered accounts.

| Ticker | Fees | Tax on Taxable Accounts | Total Cost Taxable Accounts | Tax on Registered Accounts | Total Cost Taxable on Registered Accounts |

| XAW | 0.22% | 0.36% | 0.58% | 0.04% | 0.26% |

| VXC | 0.27% | 0.36% | 0.63% | 0.04% | 0.31% |

As concluded, XAW used to be the winner. However, it is losing the battle to VXC considering its performance.

Now, let’s take a look at other ETFs which might be a good replacements for multiple reasons including:

- Holding US and International Stocks directly to avoid the double withholding tax

- More control over the dividends payments, MER, and percentage of exposure

Three Type of Required ETFs

I need three ETFs to have a good Globe exposure. All the ETFs need to be listed on TSX in CAD and ideally have direct exposure to their underlying equities.

ETF Type I – All US Market ETF (XUU vs VFV)

There are 2 final candidates. XUU (iShares Core S&P U.S. Total Market Index ETF) and VFV (S&P 500 Index ETF). Both hold US stocks directly so the 15% US withholding Tax applies which can be claimed on Taxable non-registered accounts. Below is the table comparing these two great ETFs.

Also, both have a Quarterly Distribution which I much prefer than Semi-Annual payments of XAW.

| Ticker | Holding | Fees | 12m Trailing Yield | 1Y Return | 3Y Return | 5Y Return |

| XUU | Entire US Stock Market | 0.07% | 1.26% | 25.97% | 46.21% | 101.49% |

| VFV | US S&P 500 Index | 0.09% | 1.31% | 24.95% | 46.05% | 101.05% |

XUU versus VFV – As shown above, the return is almost identical. Same as the contribution yield and fees when considered together. The only major difference is their exposure. XUU has access to all US Stock versus S&P 500. Hence, I choose XUU due to its broader exposure.

ETF Type II – Developed Market Except NA ETF (XEF vs VIU)

The final candidates are VIU (Vanguard FTSE Developed All Cap ex North America Index ETF) and XEF (iShares Core MSCI EAFE IMI Index ETF). Both hold international stocks directly which means only 1 tax layer (NO extra US withholding tax layer for going through a US ETF).

Some Important Notes:

- XEF holds 1.16% IEFA (iShares Core MSCI EAFE ETF) which means double tax for 1.16% of the total dividends.

- VIU holds 6.1% in South Korea. XEF doesn’t hold any South Korea.

| Ticker | Holding | Fees | 12m Trailing Yield | 1Y Return | 3Y Return | 5Y Return |

| XEF | 2665 Stocks | 0.22% | 1.88% | 16.53% | 13.24% | 50.23% |

| VIU | 3734 Stocks | 0.22% | 1.96% | 18.78% | 15.09% | 53.84% |

XEF versus VIU – As shown above, the return is almost identical with VIU giving a slightly higher return. XEF has a higher Contribution yield but their fees are both 0.22%. The only major difference is their exposure with XEF missing South Korea exposure. These are companies like Samsung which is the highest holding in VIU. To summarize my reasoning:

- VIU has a slightly better Return

- VIU holds 1000+ stocks directly

- VIU has exposure to South Korea with its highest single holding of Samsung

- VIU has a higher distribution yield

Hence, I choose VIU.

One final note, I also found TPE (TD International Equity Index ETF) which is very similar to XEF however it holds through the German Solactive GBS index which means an extra 15% tax. TPE’s MER is 0.24% so higher than both VIU and XEF. Its 1 year return is 15.76% which is the 3% less than VIU.

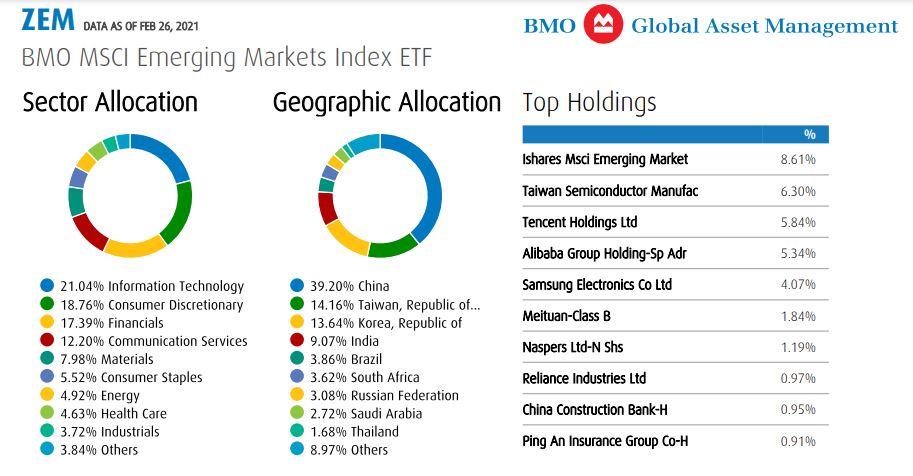

ETF Type III – Emerging Market ETF (VEE vs XEC vs ZEM)

This is a tricky one. Remember all the double tax-layer discussion above where we concluded best is to hold an ETF with direct exposure to the international stocks to avoid the US 15% Withhold Tax? The only option for Emerging Market listed on TSX is ZEM (BMO MSCI Emerging Markets Index ETF).

ZEM covers 26 Emerging Market Countries with 891 holdings. However, its biggest holding is EEM (iShares MSCI Emerging Markets ETF) with a 10.02% weight. The only other ETF it holds is KWT (iShares MSCI Kuwait ETF) which is fine as it is direct exposure to Kuwait’s market (And not via the US like EEM). ZEM also holds 3.89% Samsung Stocks.

This means, 10.02% of ZEM’s dividends will go through the double tax tunnel but still much better than other options, VEE (Vanguard FTSE Emerging Markets All Cap Index ETF) and XEC which don’t hold any stock directly and get double taxed regardless where only one layer can be deducted as foreign tax.

XEC only holds on ETF IEMG, which in return holds 3019 stocks. Noticed how double tax works?

| Ticker | Holding | Fees | 12m Trailing Yield | 1Y Return | 3Y Return | 5Y Return |

| VEE | 5019 Emerging Stocks | 0.24% | 1.54% – Quarterly | 25.59% | 18.13% | 78.86% |

| XEC | 3019 Emerging Stocks | 0.27% | 1.56% – Semi | 27.40% | 17.68% | 81.08% |

| ZEM | 891 Emerging Stocks | 0.27% | 2.04% – Annual | 28.31% | 18.85% | 89.94% |

VEE versus XEC versus ZEM: As shown above, ZEM is winning the return battle. It also has the highest distribution yield. The 0.03% higher fee yield is negligible when counting the first 2 factors plus no double taxation for 90% of its holdings. Hence, I pick BMO’s ZEM as the winner for Emerging Market ETFs listed on Canadian Exchange.

Full Comparison Between Holding XAW, VXC, and 3 ETFs (MRD ETF)

To make a comparable comparison I am going to assume my holdings be equivalent to XAW’s. I will also recalculate XAW’s TAX based on the information from Canadian Portfolio Manager tax calculation. Please note, the calculation for VXC is outdated as of today because VXC replaced VGK and VPL with VIU.

You can also reference to this article where the writer shows how close VIU and XEF are in Tax calculations. Please note below are based on holding in a Registered Accounts without any refunds.

| Ticker | Market | Fees | Weight | Tax | Weighted Tax | Weighted Fees | Total Cost |

| XUU | US | 0.07% | 58% | 0.27% | 0.157% | 0.041% | 0.197% |

| VIU | Developed | 0.22% | 28% | 0.34% | 0.095% | 0.062% | 0.157% |

| ZEM | Emerging | 0.27% | 14% | 0.28% | 0.039% | 0.038% | 0.077% |

| IVV | US | 0.22% | 58% | 0.27% | 0.157% | 0.128% | 0.284% |

| XEF | Developed | 0.22% | 28% | 0.34% | 0.095% | 0.062% | 0.157% |

| IEMG | Emerging | 0.22% | 14% | 0.60% | 0.084% | 0.031% | 0.115% |

MRD Total Cost = 0.197% + 0.157% + 0.077% = 0.431%

XAW Total Cost = 0.284% + 0.157% + 0.115% = 0.556%

As discussed earlier, I will assume VXC’s withholding Tax is same as XAW which is:

0.157% + 0.095% + 0.084% = 0.336%

VXC Total Cost = 0.336% + 0.22% = 0.606%

This means MRD is 0.125% and 0.175% cheaper than XAW and VXC respectively. However, to complete the comparison, I will also compare the Yield and Performance as shown below.

| Ticker | 1Y Return | 3Y Return | 5Y Return | Weight | 1Y Weighted | 3Y Weighted | 5Y Weighted |

| XUU | 25.97% | 46.21% | 101.49% | 58% | 15.06% | 26.802% | 58.864% |

| VIU | 18.78% | 15.09% | 53.84% | 28% | 5.26% | 4.225% | 15.075% |

| ZEM | 28.31% | 18.85% | 89.94% | 14% | 3.96% | 2.639% | 12.592% |

| XAW | 22.71% | 30.85% | 79.83% | 100% | 22.71% | 30.850% | 79.830% |

| VXC | 25.11% | 33.01% | 82.33% | 100% | 25.11% | 33.01% | 82.33% |

And the final Performance calculation is as below showing how MRD’s ETF outperforms XAW. However, MRD lost the performance battle to VXC in 1 year return.

| Ticker | 1Y Return | 3Y Return | 5Y Return |

| MRD | 24.28% | 33.67% | 86.53% |

| XAW | 22.71% | 30.85% | 79.83% |

| VXC | 25.11% | 33.01% | 82.33% |

The final property to compare is the distribution yield.

| Ticker | 12m Trailing Yield | Weight | Weighted Yield |

| XUU | 1.26% | 58% | 0.731% |

| VIU | 1.96% | 28% | 0.549% |

| ZEM | 2.04% | 14% | 0.286% |

| XAW | 1.47% | 100% | 1.470% |

| VXC | 1.43% | 100% | 1.43% |

MRD Yield Calculation: 0.731% + 0.549% + 0.286% = 1.565%

Well, it seems MRD’s yield is 0.095% higher than XAW and 0.135% than VXC.

Advantages of MRD’s 3 ETF Solution Versus XAW

- MRD will pay 0.125% less in annual fees. This is a $125 saving for a $100K investment annually.

- MRD will receive 0.095% more in distributions. This is $95 increase comparing with XAW on $100K.

- MRD’s 2 funds pay quarterly distributions which increase the income significantly if an investor like Mr. Dreamer buys weekly or monthly. XAW pays semi-annual dividend only which means funds have to wait for up to 6 months to receive an income.

- By having US holding separated from international’s, we have full control on the tax complication.

- MRD is outperforming XAW by 1.5% annually.

Advantages of MRD’s 3 ETF Solution Versus VXC

- MRD will pay 0.175% less in annual fees. This is a $175 saving for a $100K investment annually.

- MRD will receive 0.135% more in distributions. This is $135 increase comparing with XAW on $100K.

- By having US holding separated from international’s, we have full control on the tax complication.

Conclusion & Final Verdict

MRD (XUU – VIU – ZEM) is doing much better than XAW in all aspects (Distributions, Performance, Fees). However, it is very close to VXC with a total saving of $310 / $100K annually. The main difference will be the performance. Over the 5 years MRD is winning. However, it narrowed down in the span of 3 years and seems VXC’s performance is better in the last year.

I love WealthSimple Trade. It is really simple and no commission. I feel it is much better to save the trading money in my pocket rather than giving it out by using our trading platforms. However, I do my research and check technical via Questrade. The combination has been working great.

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive $10 to trade.

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

For peace of mind, the $310 annually is negligible. It will come to personal choice of managing 3 versus 1 fund. I go with the 1 fund solution and declare VXC as the winner. How about you?

As always, I’d like to hear your plans and ideas. Please leave me your comments below specially if you see I missed a point or made a calculation mistake. THANK YOU!

That’s very well details + deep analysis ! Good job ! I like that, I see that you are passionate with finance ! For myself, outside 🇨🇦 🇺🇸 stocks/ETFs into my portfolio, I decided to go both ways with VXC (TFSA) + XAW (RRSP/taxable) for international 🌍 diversification, so far so good, can’t complain! I think, it’s the best of both World ! Both are very well rated on Morningstar !

Hello Dividends & FNB and Thank you for stopping by! Yes, Covid made me realize I can do something other than traveling!

That is a very interesting idea to hold both. I never thought about that honestly. However, there is one more factor to consider when purchasing. There are days US, Developed, Developing perform differently. Considering that, I personally started buying XUU (US), VIU (Developed), ZEM (Developing) separately. Basically, I buy small amounts of each whenever they are down. For example, VIU was down today a bit so I bought some.

I transferred $14K to Wealthsimple this week and have to find deals to buy.

Mr. Dreamer,

Thank you for the in depth analysis of ETF. I am an individual stock picker myself and don’t own any ETFs. I am always for saving money and not paying extra fees hence I can see ETF’s as a good addition to my stock portfolio. I love the idea as well of global exposure without the need to convert CDN to USD.

Hello Rommel,

Indeed, there is no right or wrong answer here. Whatever works as long as it follows your strategy.

Kind Regards.

This is exactly what I was looking for and couldn’t quite find the answer anywhere else – not with all direct comparisons and examples covering all angles. Thank you ever so much! You’re a superstar!

I already went through a bit of trouble of using Questrade to buy IVV/QQQ in USD – first time paid a good 2%+ in internal conversion, but later used Norbert’s Gambit. But this is a lot of headache especially having different things in different places and not able to get a good picture of my overall distribution etc. You dismiss this kind of thought process very early in the post and I am totally going to MRD going forward. If you had written about any comparisons to holding US ETFs, that would be a great read if you could point me to it please. I am wondering if I should close those positions and move to local etf’s or let them be.

Hello Eversmann,

Thank you so much for your detailed reply and very kind words. Very much appreciate it.

The main reason I am avoiding the thoughts of buying any stock or ETF in $USD is to avoid the currency conversion headache. The simpler the better, right? Yes, Norbert’s Gambit can be fun but then I don’t want to keep doing this every 2 weeks.

I should mention that I also stopped adding to ZEM. I just don’t feel we need that much of an exposure honestly considering many of our Canadian companies invest and have business in South America, Asia, and even Africa. However, I keep adding to XUU and VIU regularly.

As you mentioned QQQ, take a look at http://vibrantdreamer.com/5-best-technology-etfs-in-canada-2022/ when you have some time. I compare the tech ETFs and conclude that QQC-F is the best option IMHO after the analysis. However, it is very much identical to XQQ in terms of performance but with lower MER and volume.

Let me know if I can be of any help.

Talk soon!

What about ZEA vs VIU?

In that example of Jennifer, how is the Withdrawal Amount $240, $240 & $260? Shouldn’t it have been $340, $340 & $260?