In this complete Tangerine Credit Card review, I will be going in depth to show the advantages and disadvantages of getting any of Tangerine Mastercards.

I personally own Tangerine World Mastercard and I think Tangerine did a great job in their two credit cards. Hopefully, by the end of this Tangerine Mastercard review, you’d have a clear understanding of the benefits of these cards as well.

Currently, Tangerine offers two credit cards which are Tangerine Money-back and Tangerine World Mastercard.

Special Limited Bonus: Apply for a Tangerine Money-Back Credit Card or Tangerine World Mastercard by Jan 31 , 2023 and earn an extra 15% back (up to $150) when you spend up to $1,000 in everyday purchases within your first 2 months.

Tangerine Mastercards Comparison Chart

| Products | Tangerine Money-Back | Tangerine World Mastercard |

|---|---|---|

| Interest on Product | 19.95% | 19.95% |

| Balance Transfer Regular | 3.00% Minimum $5 | 3.00% Minimum $5 |

| Balance Transfer Promotion | 1.95% with 1% fee 6 months | 1.95% with 1% fee 6 months |

| Cash Advances In Canada | $3.5 | $3.5 |

| Cash Advance Outside Canada | $5.0 | $5.0 |

| Foreign Currency Exchange | 2.5% | 2.5% |

| Dishonored Payment Fee | $25 | $25 |

| Over Limit Fee | $25 | $25 |

| Required Personal Income | $12,000 | $60,000 |

| Required Credit | Good-Excellent | Good-Excellent |

| Special Offer (First 2 months) | 15% cashback up to $150 | 15% cashback up to $150 |

| Cashback Selected Categories | 2% on 2 (or 3) Categories | 2% on 2 (or 3) Categories |

| Cashback Other Categories | 0.5% Eligible Purchases | 0.5% Eligible Purchases |

| Cashback Limitation | No Limit | No Limit |

| Rush Card Fee | $25 | $25 |

| Zero Liability Coverage | Yes | Yes |

| Extended Purchase Warranty | Yes (Up to 1 year, $60K life) | Yes (Up to 1 year, $60K life) |

| Purchase Protection | Yes (Up to $60K life) | Yes (Up to $60K life) |

| Rental Car Coverage | No | Yes (Up to 31 days) |

| Mobile Device Insurance | No | Yes (Up to $1000) |

| Boingo WiFi Mastercard | No | Yes (1 million hot spots) |

| Airport Lounge Access | No | Yes ($32 USD per visit) |

Tangerine Money-Back Mastercard

This free credit card offers a nice 2% unlimited cashback in 2 selected categories. All other non-selected categories will receive 0.5% cashback.

Note: If you choose to receive the cashback in your Tangerine Savings Account, the 2% is extended to a 3rd category.

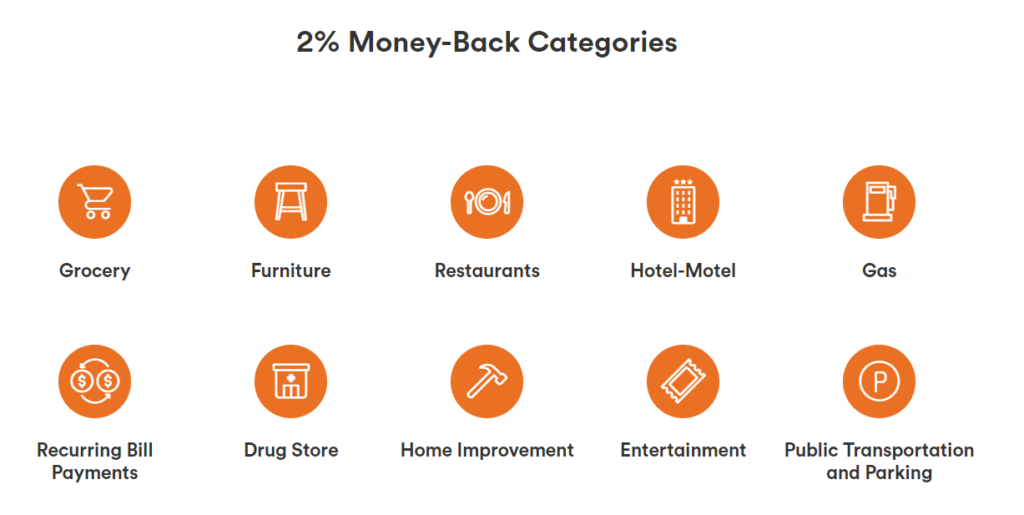

The categories are grocery, furniture, restaurants, hotels, gasoline, bills, drug store, home improvement, entertainment, and public transportation | parking. Tangerine Money-Back Mastercard has no annual fee with an annual 19.95% interest rate.

To be eligible for Tangerine Money-Back credit card, the applicant needs a minimum $12,000 personal income.

What Are Tangerine Money-Back Mastercard Benefits

- Cashback: Earn 2% in 3 categories if you choose to drop the cashback in your Tangerine Savings Account. 0.5% on all other eligible purchases.

- Extended Warranty: Double the period of repair services to a maximum of one year

- Purchase Assurance: Cover loss, theft or damage on new items for 90 days

Tangerine World Mastercard

This credit card is another no fee card. Similar to Tangerine’s other card, it comes with 2% cashback on any selected 3 categories.

However, it comes with some features, like free Boingo Wi-Fi anywhere in the world, access to Mastercard airport lounges plus a travel reward program, and insurance (car rental and mobile device).

To be eligible for Tangerine’s World Mastercard, you need to have a personal income of $60,000, or household income of $100,000 or more or a total balance of $250,000 in Tangerine savings or investment accounts.

What Are Tangerine World Mastercard Benefits

- Cashback: Earn 2% in 3 categories if you choose to drop the cashback in your Tangerine Savings Account. 0.5% on all other eligible purchases.

- Boingo WiFi: Connect to the internet via over 1 million hotspots globally

- Mastercard DragonPass: Access to over 1,300 airport lounges for $32 USD per visit

- Rental Car Coverage: Damage and theft coverage for up to 31 consecutive rental days

- Mobile Device Insurance: Mobile or tablet damages, theft, failure coverage up to $1000

- Extended Warranty: Double the period of repair services to a maximum of one year

- Purchase Assurance: Cover loss, theft or damage on new items for 90 days

As mentioned earlier, I personally use Tangerine World Mastercard in my chosen three categories which are grocery, gasoline, and bills.

Apply for a Tangerine Money-Back Credit Card or Tangerine World Mastercard by January 31, 2023 and earn an extra 15% back on up to $1,000 in everyday purchases made within your first 2 months.

What Are Tangerine Credit Card Categories

Tangerine Mastercards categories are similar for both cards. The only difference is that money-back gets 2% on 2 categories while World Mastercard gets it on 3 chosen categories.

Here are Tangerine credit card categories to choose from:

- Grocery

- Furniture

- Restaurants

- Hotels, Motels, Hostels

- Gasoline

- Recurring Bills Payments

- Drug store

- Home improvement

- Entertainment

- Public transportation and Parking

Can I Change My Selected Category on Tangerine Mastercard

Yes, you can change your selected categories once a month from the online portal by following below steps:

- Login to your account and navigate to your credit card

- Click on Rewards and then click on Change Categories

- Select your new 2% cashback Categories

Does Tangerine Credit Card Offer Travel Insurance

The only travel related insurance by Tangerine World Mastercard is its rental car collision or loss damage insurance. This is also called CDW/LDW coverage.

This insurance covers a rental car for up to 31 consecutive days in damages or theft when the full cost of the rental is charged on the Tangerine World Mastercard.

Is Tangerine Credit Card Good For Students

Tangerine Money-back can be a good option for students making a minimum $12,000 annually with a good to excellent (above 600) credit score.

How To Access or Login In Tangerine Credit Card Online

This can be accessed via Tangerine website or mobile app.

Can Tangerine Credit Cards Be Added To Mobile Wallets

Yes, Tangerine Mastercards can be added to Apple Pay, Google Pay, or Samsung Pay wallets.

How To Apply For Tangerine Credit Cards

Simply click below and you will be invited to apply directly.

Does Tangerine Credit Cards Offer Promotions

Yes, there are usually some great promotions especially for new clients applying and getting approved for the cards. Current promotions are as below:

- Earn an extra 15% back on up to $1,000 of your everyday purchases made in the first 2 months with a Tangerine Money-Back or World Credit Card

- Balance Transfer Promotional Offer at 1.95% for 6 months (1% Balance Transfer Fee) Complete the Balance Transfer request within 30 days of account approval and activate your card within 45 days of the approval. Balance Transfers are treated as Cash Advances and do not have an interest-free grace period.

Tangerine Mastercard Review Conclusion

I personally use Tangerine World Mastercard for all my Walmart and Costco purchases. I also use it for gas and recurring bill purchases for the 2% cashback.

I think it is a great option for the selected categories to earn the highest earning point of 2% especially as both cards are free.

However, I don’t recommend the card as a main travel credit card due to its limited benefits, ATM fees, and FX fees. Instead, I highly recommend Brim Mastercard which is a great card for travel spending to save the extra 2.5% foreign currency exchange fee.

If you’d like to know more of Tangerine products, feel free to check my Complete Tangerine Bank Review.