Hello Friends! Another year full of dreams has passed so quickly. A year full of achievements, memories, adventures, gains, learnings, and emotions.

Let’s start by main achievements before diving in the details of the 2021 year in review. I will also cover my investment, passive income, and liquid net worth charts for 2021 and the progress during the years.

- Started my blog in Feb 2021

- Started consolidating my GICs and savings accounts and investing in the market

- Visited 6 countries and 2 French Caribbean islands

- Started reinvesting in Cryptocurrencies

The Creation of Vibrant Dreamer Blog

It was Feb 2021 when I started feeling so depressed even though I had a 10 days trip in Ecuador just in January of the same year. However, when I left my home country Iraq, to my adopted country Canada, one of the most important factors for me was the freedom by having a powerful Canadian passport.

Covid crushed this dream even if was supposed to be a temporary impact. I started feeling depressed due to the unknown. I dislike uncertainty. I love planning and organizing. But, with Covid, any planning was a new Mission Impossible.

A little background is that I am addicted to traveling. It is like one of those bugs you can’t get rid of which forces you to do whatever it takes to make the travel plan rolling. In the past and during my free time, I was either traveling or planning for the next travel.

Considering Covid, I needed to find another hobby. There came the thought of focusing on my second favorite topic after traveling, Personal Finance. I always liked to share my knowledge with others. Sadly, as many of you might have experienced, it usually backfires especially when it comes with some passion!

People tend to feel sharing my financial accomplishments are kind of attacking or judging their financial decisions rather than thinking it is an inspiration that can be followed toward making their life happier.

Consequently, in Feb 2021, I created this blog to share my thoughts, financial reports, and travel diaries. To show to the world that it is possible to start from nothing and grow while having an average wage job.

However, I wanted to keep the site more generic. I didn’t want VIBRANTDREAMER.COM to be purely money focused as I knew I wanted to also share my passion about traveling. So I chose a name that is not money or travel specific. A generic name that represents my mission.

A Vibrant Dreamer who has dreams but always works very hard to achieve them, one step at a time.

I will share my blog stats next month to cover 12 months of blog activity. The creation of the blog led to other interesting developments which I am going to talk about next.

How Did my Blog Help Me Financially?

Well, the blog was a gate to other opportunities. It made me feel part of the great personal finance community with some of the most amazing and supportive individuals I have ever dealt with.

The blog connected me with bloggers who I always enjoyed learning from. Most of this happened through Twitter. I needed a method to tell the world about my site so I created my Twitter account as a platform to spread the word.

I also created a Facebook page to publish my articles. However, I am not active on that Facebook page but thanks to an amazing Plugin, I get all my posts published automatically to both Twitter and FB without any effort from my end.

You are wondering how all these helped me financially? Well, I started learning and focusing more on passive income. I never realized the power of dividends and was scared of investing heavily in the market mostly because of some bad trades I’ve done couple years ago costing me thousands.

Since those failures, I stayed away from the market rather than trying to fix the situation. The personal finance community brought back the confidence. Money Twitter regardless of its negativity, showed me the power of investments.

I also started learning more from those investors who were active in other areas including real estate or Options trading. In addition, I started to learn more about Cryptocurrencies which made me pull the trigger and start making relatively sizable profits along the way.

In addition, the blog and my financial reports, make me feel accountable. If I take a wrong action, I will have to report it to the world so I think twice before taking actions. The accountability helped becoming a more responsible investor.

Consolidating my GICs and Savings Accounts to Invest in the Market

Well, this wasn’t literally consolidating. It was more of getting rid of my GICs and Emergency or Savings accounts. I realized the power of good and long-term investments in value companies or ETFs.

After confirming to myself that investing in GICs isn’t the best approach even though I took advantage of some great interest rates including 3.75% annually before Covid hit, I started moving my GICs upon maturity to my investment accounts.

Sadly, I still have some GICs left but I will have some mature in April of this year which I will be moving to Wealthsimple Trade to invest in the market.

Wealthsimple Trade is Canada’s first $0 commission App.

Please sign-up using my referral code 8RR_5G to receive two free stocks.

Get up to $250 or a free month in Questwealth by using my QPass 646713816388276

I also eliminated cash in emergency and high interest savings accounts which I will talk about in depth in another post. However, if I were to keep money in a savings account, I’d go with EQ Bank which currently offers 1.65% interest rate.

Some Amazing Adventures in 2021

If you have been following my journey, you know that we had a great year traveling around. I posted some of the travel reports including below trips:

Ecuador Survival: This was my first trip during Covid. I was supposed to go to Belize and Nicaragua in April and we as a family had Argentina booked for June 2020 but they were all cancelled. By end of December 2020, I had to find a destination and travel. Ecuador was the winner.

Traveling to Iraq in Aug: We haven’t been to Iraq for many years and our daughters never met their grandparents, uncles, aunts, cousins, and the rest of the family. With Covid offering remote work, it was a great opportunity to take advantage of some cheap flights with Qatar Airways and travel to Iraq.

Self-drive Tour of Turkey in Sept: While in Iraq, we decided to take a break and go to Turkey. It was an amazing trip and Turkey is now my most favorite country in the world.

We are even considering a retirement plan there due to its location, amazing nature, culture, international hub, and food. You can read about the Turkey journey here.

Side trip to Greece: Well, me being me, I couldn’t avoid the temptation of seeing another country so booked flights and we flew to Greece. Rented a care in Greece and drove around for a week.

Guadeloupe: Another Christmas break and I decided to fly again! This time it was solo as flying in December is expensive plus kids will have to quarantine 2 weeks upon return to Canada. I set to Guadeloupe for couple days before taking the ferry to other Caribbean islands.

I haven’t wrote the rest of the reports, but after Guadeloupe, I visited Dominica, St. Lucia, and Martinique.

Don’t say it but yes it was a crazy adventure especially during Covid. I had to do 5 Covid tests in total. Best part of passive income is that it pays for travels.

In total, I spent around $20K on traveling in 2021 but I will never try to save this money solely for the purpose of having more investments.

The money which doesn’t provide happiness or opportunities to do what we love is useless to me.

Investing in Cryptocurrencies including CeFi & DeFi

I started my Cryptocurrency journey just before the big May crash! Yes, it was funny to experience the shock of Crypto so quickly but it wasn’t unexpected.

However, as I am a firm believer in Dollar-Cost Averaging, I didn’t just bought thousands in Crypto right away. I started slow and recovered by far since then. I also made couple thousands dollars extra from my investments.

The best part of Crypto investments is the passive income that comes from Stablecoins in platforms like Crypto.com.

Join Crypto.com and earn $25 in $CRO when you deposit $100. Free e-Transfer in and out.

I have a diversified Crypto portfolio including Stablecoins, Bitcoin, Ether, CRO, and even a Metaverse Crypto Index called MVI which I love.

All my Cryptos generate passive income in form of earning by loaning, liquidity mining, or staking. In 2021, I earned $3,027.28 in passive income from my Crypto investments.

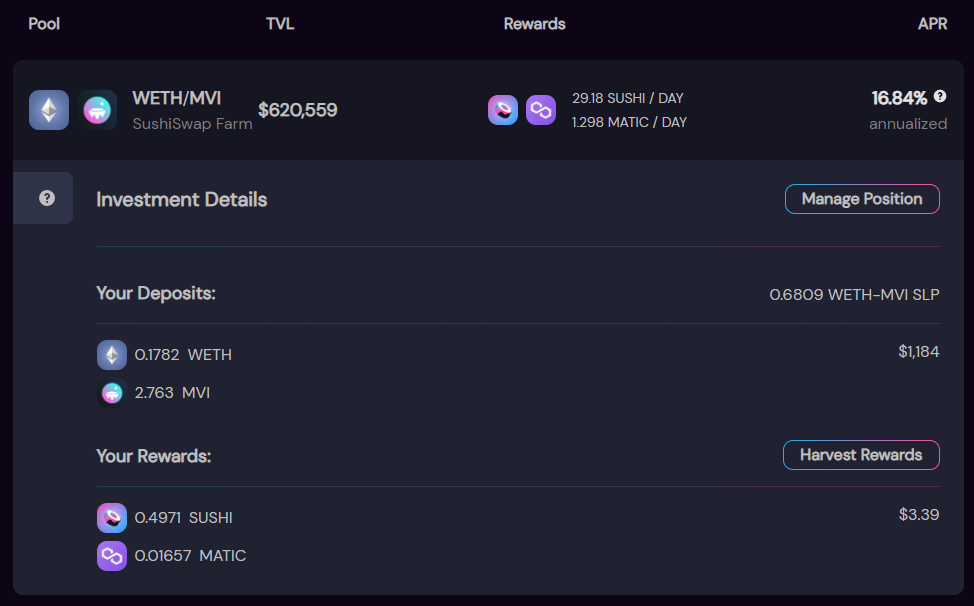

Other than Centralized Finances, I use DeFi platforms like Sushi and Balancer Fi. I am enjoying the very high yield on these platforms. Here is one example but note that the rate fluctuates. However, I haven’t seen it below 12.5% but as high as 65%.

Investment Progress During 2021

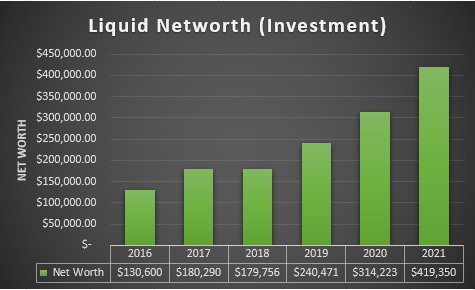

Honestly, I exceeded my own expectations in 2021. I never imagined my liquid invested net worth goes beyond the $400K threshold in 2021. But, I crossed that in November thanks to Crypto, Market, and Hustle income.

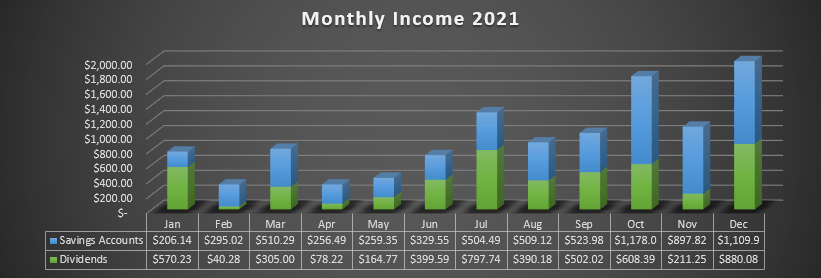

Basically, my investments increased more than my annual 9-5 income before taxes and other deductions. Here is my 2021 monthly passive income progress. I made $11,527 in total passive income in 2021.

This translates to an average $960.5 monthly which is $40 short of my goal. However, if I include the hustle income, the number jumps to $18,120 or $1510 monthly which is much more than anticipated.

My passive income came from eBay or Kijiji reselling or referrals to different platforms like Brim, Celsius, Crypto.com, Leo, Gemini, Newton, and others. You can find all my recommendations here.

And here is a chart of annual invested net worth in the past couple years. I am hoping the progress continues and I can break another record by having $500K invested by the end of 2021 generating $25K in passive income.

2021 Year in Review & Passive Income Conclusion

Honestly, it was a fantastic year despite the Covid craziness. Best part of 2021 was seeing family which included lots of hugs and tears without any distancing or masks. It sounds crazy but it is magical.

I learned a lot about passive income and growing my money from different channels not just relying on a full time job. Crypto had its nice impact as well.

I don’t expect 2022 to be as great as 2021 for market investments but who knows considering the amazing run of Canadian banks and utilities. For me, I have a plan which includes investing in a way that I can generate passive income constantly. Dividends, distributions, and Crypto income are going to be my focus for 2022.

I also have another project going on which I hope grows and brings me more passive income eventually.

Thank you so much for reading. I hope you had a great 2021 and an amazing 2022 ahead.