If you are planning to immigrate to Canada and settle down in this mysterious freezing cold place, your emotions can be a mix of thrill, joy, happiness, sadness, and horror. It is a totally strange but understandable feeling.

Are you doubting yourself and asking questions about how to survive in this new land while dealing with new people, culture, society, language, and weather?

It is definitely fun to be in a new continent thousands of miles away from homeland! However, every newcomer faces some challenges after arriving in this wonderful wonderland with its loveliest friendliest people.

In this blog post, I am going to list what we experienced and learned during our decade of Canadian life. You will learn about what to do and what to avoid. Avoiding the Top Mistakes by newcomers can help making your transition much easier and smoother. I will provide our personal experience with each recommendation.

Top Mistakes By Newcomers in Canada

Don’t Delay Opening Your First Canadian Bank Account

I usually recommend newcomers to open their first Canadian bank account as soon as possible. Almost all big Canadian banks have special accounts for newcomers. They realize that most people stick with the same account for their life so there is a stiff competition between banks to attract new account holders.

As a newcomer you can open an account with one of the big banks easily which I don’t recommend as it gets tricky after the first promotional offer year is over. Banks will start charging you fees.

You usually only need your landing paper and passport to open the account. The list of the best Canadian bank accounts for newcomers in Canada is as below:

- BMO NewStart Program

- Scotiabank StartRight Program

- RBC Newcomer Advantage

- CIBC Welcome to Canada Banking Package

- TD New to Canada Banking Package

What I recommend is to try becoming a little adventurous by opening an account with one of the digital banks below which offer great services without any fees. You can get anything done from your home via chat or phone customer support. Yes, in Canada we barely need to go to a branch nowadays.

Earn $50 by using my Tangerine Referral Orange Key. 43640010S1

Personal Experience: Based on the local immigration agency, I ended up opening a Scotiabank account. There was no fees during the first year.

However, I cancelled this account to avoid paying fees after the free promotional year was over. I instead opened a Tangerine account.

Don’t get cut with temporary promotions. They take advantage of you!

Don’t Show Up Without a Prior Appointment

In many countries around the world, an appointment is not really a thing. You just show up and go from there.

Often times, you can’t get things done easily so you keep trying over and over. This is because the culture of booking appointments and being organized might not be a culturally accepted practice in other countries.

In Canada, try to always call first or make an online appointment. This can be a bank, mechanic, doctor, teacher, accountant, lawyer, job agency, government agency, social worker, or any other service provider.

Personal Experience: When we landed in Halifax, we didn’t have a confirmed hotel booking. We never owned a credit card so couldn’t reserve anything online. I ended up looking up some places on real estate sites and chose one randomly .

We told the airport taxi driver to take us there. When we got to the place, nobody opened the door. There was a phone number which we tried unsuccessfully. We ended up going to a close by motel for a week before figuring our our next move.

Don’t Rely on Your Winter Boots or Jackets From Other Countries

First of all, if you had the option, try arriving in Canada between April and November when the weather is much nicer than the snowy freezing months of December to March. This will give you enough time to adjust to the new weather conditions in preparation for harsh winters.

However, if you land during the Canadian Winter, your jacket or winter boot that you brought from your homeland (unless you live in a cold country with sever winter months like Russia or Greenland) country won’t be useful here. It won’t protect you in the normal -20 C Canadian weather.

You can buy a good winter jacket from any retail store in Canada upon arrival. Just search online and you will find many options both to be purchased directly in stores or from an online retailer.

Personal Experience: Being from Iraq with a stop-over in Amman, Jordan before making our way to Canada, we didn’t have a chance to buy a real Winter jacket. We arrived in September and what we called winter jackets were barely enough for the Atlantic Canadian fall weather.

Do Avoid Big Cities, Downtown Cores or Expensive Neighborhoods

This is one of the biggest mistakes by newcomers where they focus on downtowns or most popular and expensive cities to start their life in Canada.

These new immigrants soon realize that life isn’t affordable in big cities like Montreal, Toronto, Ottawa, and Vancouver without a dual family income.

I highly recommend newcomers to try starting their life in places far from the main big cities until they adjust to their new life while gaining some Canadian working experience with a stable income.

Renting in smaller cities like Saskatchewan, Winnipeg, Halifax, Moncton, and Edmonton can save you a fortune when starting a new life in Canada.

Even in these smaller cities, don’t focus on downtowns or popular neighborhoods. They are expensive and won’t really suit your needs as a newcomer. Canada is one of the safest countries in the world so even a dangerous area in Canadian standards might be tens of times safer than a safe place in other countries.

Saving on paying high rents is a game changer and will shape your financial life in Canada eventually unless you can land a high paying career immediately.

Personal Experience: We chose Halifax as we were told it is a much affordable place to start our Canadian journey. I am glad we made this choice.

With almost no income, it would have been a nightmare paying rents in bigger cities like Toronto. Our rent was only $550 in Dartmouth, NS for a 1 bedroom apartment.

Do Find a Month to Month Rental & Read the Contract Carefully

Try a monthly contract if possible until you get to know the neighborhood and know where you are going to settle down. This can be close to your new workplace or university. If you can, I’d also suggest a cheap basement Airbnb or a hostel unless you have children.

In your first couple months or year of arrival, you are usually asked to provide a multi-months rent upfront. However, this might not be a legal practice in some provinces.

Try to know your rights and negotiate. If you don’t like the terms simply walk away and find alternatives. Don’t fall in love with a place or feel it might be the dream place. Don’t get intimidated by realtors or owners saying they have many others interested and the place won’t stay in the market long enough.

The best way to avoid paying multi months rents up front in cash is to have post-dated cheques. Most landlords accept this form of payment. You basically give them cheques dated for the future months which they can cash out later.

If your new landlord is grumpy and don’t accept post-dated cheques, you might need to find a co-signer who can be a family or friend. Most newcomers can find sweet hearted Canadians who are willing to sign your rental based on the assumption that you will be paying rent.

PLEASE BE KIND & PAY YOUR RENT or your co-signer will be in trouble and have to pay on your behalf.

Another very important point is to read the contract details very carefully. Spend some time reading and reviewing. Ask friends or social services for help if you have problems understanding any point.

Landlords can have some seriously questionable contracts such is requiring the tenant to paint the walls or wash the ceilings and windows before leaving. Be careful!

If you end up having issues with a landlord, all provinces have small courts dedicated for settling issues between landlords and tenants. Do attend these courts while being fully prepared and you shall win the case.

Personal Experience: Our first landlord was really a devastating person. She sued us for $1750 in damages for a $550 rental apartment per month. She claimed damages and brought invoices. All the invoices were by her husband’s company which they use to scam people together.

We didn’t damage anything but I was told she will take the $250 deposit anyway so I didn’t clean before leaving and was okay wit her taking that amount.

To my shock, she showed up at my workplace to serve me court papers. She got caught to be a liar in the court when denied any personal relationship with the contractor’s owner who was her husband so she lost the case.

I could have counter-sue her for damages but I decided to let go. It was a stressful one year.

Don’t Spend More Than What You Have or Earn (Stick to Your Budget & AVOID DEBT)

I totally get it. You are brand new here and need glorious new stuff. Don’t do it until you really have enough cash for at least your first year. Instead of buying new furniture, get used ones from Kijiji or Facebook Marketplace.

Credit cards are great tools to earn travel points or cash back ONLY if you fully pay them every month. They will become a burden and budget killer if you start accumulating debt and pay interest.

Make a plan and stick to spending what you have. Looking for some inspiration? Check out my About to know how we started our life in Canada. Other great resources are offered by the government of Canada. You can find the details in the Official Canadian Financial Calculators and Budget Planner Tools post.

Personal Experience: We had to cut on meat and fruits except apple and banana for months as we didn’t have enough income. My wife ate lots of apples during her first pregnancy.

We chose a cheap but safe apartment and purchased used items till we could stand up on our own feet.

Don’t Get Cut By All the Shiny Mobile Plans & Devices

You probably already have a working cell phone. You can use your unlocked phone in Canada. Don’t get cut in an expensive 2 year mobile contract just because you want that new iPhone or Samsung Galaxy.

Phones are tools and all of them do the same tasks. You can call, text, run apps, watch videos, check emails, watch TikTok, and more. Don’t forget, all of them can take millions of pictures which we never go back to see in the future.

Take your time and do your research. Read How VoIP Phone Is Saving Us 1000s of Dollars. If you aren’t a fan of VoIP, you can still get affordable mobile plans by avoiding the big companies (Telus, Bell, and Rogers).

Usually smaller companies like Fido, Public Mobile, and Freedom provide higher plans with lower prices. If you are in Quebec, I highly recommend Fizz Mobile.

An interesting fact about Canada is that smaller companies which use the bigger ones’ infrastructure are usually much cheaper. This applies to banks, insurance companies, and mobile providers.

Tangerine is owned by Scotiabank and Simplii by CIBC but both offer no-fee banking services. Bell, Telus, and Rogers are the main mobile companies in Canada and own all the telecommunication infrastructure. Other players work as sub-contractors but provide cheaper mobile packages.

This also applies for home internet. Do your research and compare prices including installation fees and what it includes (Wireless modem and router, rebate on installation, first month free). Same rule applies for getting a home or auto insurance through a smaller broker rather than directly from the insurance provider.

YouSet Insurance is a great and affordable broker to start your home and auto insurance research with. They provide free online quotes as well.

Personal Experience: We never paid for TV Cable services. We usually had free offers for 6-12 months then we ended up cancelling before renewal. Also, since Netflix era, we stopped chasing this cable offers altogether.

For the mobile, we only use a pay as we go and data only plans. However, we never knew about the smaller internet providers and sadly kept paying the expensive cost of the main Atlantic Canada ISP, Eastlink, for years.

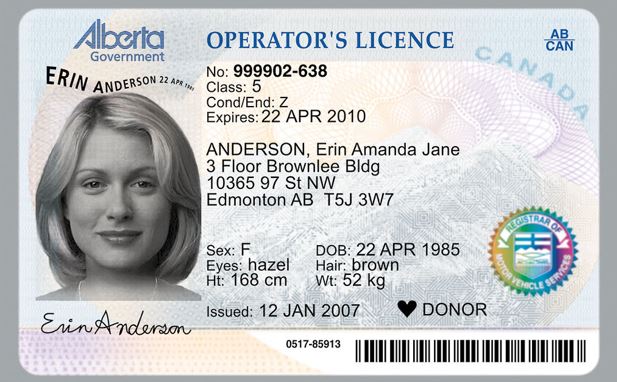

Don’t Delay Applying for SIN, Health Card, and Driver License

It is very important to visit Service Canada on your first weeks of arrival to get your SIN. Social Insurance Number (SIN) is the national Canadian identification number which is linked to all our financial life.

Banks will need your SIN to open a new account or credit card. Employers require your SIN to set up payrolls for tax purposes. Canada Revenue Agency (CRA) uses the SIN for all the services including tax deductions and benefit payments.

Newcomers who don’t have a permanent residency in Canada (Students, Workers) get a temporary SIN starting by the digit 9. This SIN will then be upgraded to a permanent one after obtaining the permanent residency status in Canada.

Next is to visit your local provincial service center and apply for a health card. Make sure to check the eligibility and requirements. Most provinces require a 3 months residency in the province before applying for the provincial health card.

Health card is the 2nd most important service anyone should have in Canada after SIN. It is used to enjoy the free Canadian health service. This includes visits to family doctors, walk-in clinics, and hospitals. Each provincial health provider has its own rules and regulations. Make yourself familiar with all the rules and health coverage.

Provincial health card do not include dental and drug coverage. Exception is QC where there is a drug coverage within the province health card paid for by taxpayers’ money.

After getting your SIN and health card, it is the driver license turn. If you know how to drive and already have a valid driver license, you might be able to exchange your home driver license with a Canadian license.

However, the driver license of most countries can’t be easily exchanged in Canada. In this case, you will need to go through some driving lessons. Sometimes, you can bypass the driving lessons by taking a driving exam in your province. If you are used to drive in your home country, driving in Canada should be easy (except in Winter).

Make yourself familiar with the Canadian rules which are the standard driving rules all over the world including traffic lights, stop sings, yield signs, taking over rules, speed limit.

Most places accept both provincial health card and driver license as a valid form of identification saving you from carrying your passport everywhere you go.

Personal Experience: There is not much to say here except I never knew how to drive and didn’t have a driver license. I made it a priority and got my first ever driver license on our 2nd year of being in Canada.

Do Get At Least One Canadian Credit Card to Build Your Canadian Credit History

This might sound contradicting to my other piece of advice on avoiding debt. However, credit card is a two edged knife. If used properly, it can provide you with valuable benefits including roadside assistance, travel and emergency insurance, discount on gas, cashback and points.

As an example, I carry a free Tangerine Money-Back Mastercard which offers 2% cashback on grocery, gas, and recurring bill payments. This means I get $20 free money on every $1000 I spend as long as the statement is paid in full every month to avoid interests.

A Canadian credit card is very important to build a Canadian credit history. Financial institutes and banks rely on this credit history to decide giving you a mortgage for purchasing a home, car loan, personal line of credit, or even approving a more lucrative credit card.

Therefore, it is important to start your Canadian credit history as soon as possible. I can’t stress this enough! Spend as much as you can pay back and AVOID DEBT at all costs.

Credit cards usually charges 19.99-29.99% in interests. This means they charge you $19.99-$29.99 for every $100 you borrow from them! It is disaster.

Personal Experience: My first credit card was from Scotiabank. But, as I didn’t have a credit history, they locked $500 from my savings account and gave me a $500 credit limit. Even after a year, they refused to increase or unlock the hold.

I ended up cancelling the card and getting a new credit card from RBC. Ironically, RBC gave me a $9000 credit limit. The point is to never give up. Keep trying with different providers until you get what you deserve.

Do Use Classification Ad sites like Kijiji, eBay, and Facebook Marketplace With Cautions

Yes, almost everyone I know uses Kijiji or Facebook Marketplace to purchase items. I personally bought furniture, kitchen appliances, kids’ toys and clothes from these resources. I even sold my car on Facebook marketplace!

However, don’t assume every seller is honest. Some sellers intention is to get rid of what they have in any expense. Others are in the business of buying and reselling for a profit and do what it takes to make some profit including scamming others.

Do your due diligence and meet the sellers in person. Don’t be shy to take someone with you if you are buying an expensive item. Check the items in person before transferring money.

Personal Experience: I only had 1 bad experience with Kijiji and that was my first ever interaction with the site or online buying in general. In our first month of arrival in Canada, we found a great looking couch and sofa set for $80. I contacted the seller who agreed on delivering for an additional $20. I thought it was a great deal.

Unfortunately, they delivered them during rain in an open truck. The furniture got really wet and smelly. They also weren’t as nice looking or clean as the Ad said. On top, they had a broken leg with tears here and there.

I didn’t notice this until later. But, this wasn’t the main issue. The issue was that after I paid and received the furniture, I noticed there is one missing leg. I messaged them to get the missing leg.

However, we really didn’t like this couch and sofa and decided to try selling or swapping it on Kijiji. We listed it for $100 to cover our expenses. The original seller saw our Ad and made a deal out of it thinking we are trying to make a profit.

She refused to bring the missing leg and threatened me by calling the police. As a newcomer to Canada, we weren’t in any position to deal with the police. She took advantage of us, but we learned a valuable lesson.

The moral point is to say no if you don’t like something in person. Plus, don’t get intimated by some random threats if you haven’t done anything wrong. This is the case for anything we buy nowadays including new items on Amazon. Free returns if not as described.

Do Make Connections, Update Your Resume & LinkedIn Profile, Apply for 100s of Jobs

Finding a job in this competitive Canadian job market isn’t always easy. There are hundreds of thousands of newcomers coming to Canada yearly. In addition, count in all the university and college graduates yearly.

Companies can usually find highly skilled employees and pay them less competitive wages. I have had friends who were graduated with a Masters in Engineering degree but getting jobs paying them less than $25 an hour.

Having connections in Canada can help finding a job easier or faster. You will need a reference when applying for a job so try getting to know a circle of people within your profession to make this transition smoother.

There are many great resources in Canada to find your first or upcoming jobs. Below are some of the best job search engines and resource in Canada to begin with:

- Job Bank directory by Government of Canada

- LinkedIn Job Search

- Indeed Job Search Canada

- Workopolis Let’s go to Work

- Monster Career Search Directory

In addition, every province has its unique career services and resources which are a Google search away. The best recommendation I can give is to never feel disappointed. The job market is competitive and it is really tough to get your hand on your first job unless you graduate from a highly skilled program in Canada.

It doesn’t make a difference if you are a doctor, dentist, or an engineer in another country. You still need to get certified by taking course or exams to start your career in Canada. Expect to apply for hundreds of jobs to only get handful of phone calls leading to 2-3 interviews and hopefully one job offer.

The best way to make yourself attractive is to have an updated resume that demonstrates how you will be a great fit in a particular job. You might need to tweak your resume multiple times depending on the job you are applying for. Be patient, persistent, and strong. You can do this.

Personal Experience: My first job was difficult. It involved traveling to other cities while I didn’t have a car so I had to arrange a ride or take buses. Things got better after I found my first full-time job. Your best friends are Indeed and LinkedIn. I found all my jobs through LinkedIn.

Indeed is an okay source to find a job but don’t rely on getting it while applying through Indeed. Make an effort. Find the company’s web site and apply directly or send a personal email to the HR and introduce yourself.

Do Apply for all Eligible Social and Financial Benefits Immediately

Based on your situation, you can be eligible for some great social services and benefits in Canada. It might take months to start receiving these benefits so apply as soon as you can. Some of these benefits are listed below:

- Employment insurance benefits and leave

- Family and caregiving benefits

- Child benefits

- Public pensions

- Student aid and education planning

- Housing benefits

Government of Canada has a really amazing tool to help finding benefits which is called Benefits finder. I recommend using this tool to find all the benefits you might be eligible for.

Personal Experience: Even though we applied for child benefits as soon as our daughter was born, it took months, tens of phone calls, and many applications to get it processed.

They just didn’t believe we had a daughter I guess! Gladly, nowadays, no application is required. It is all automatic via CRA.

Don’t Let the Charming Salespeople Sell You Stuff or Services

This is one of the very important things to always consider. Yes, most people are honest, but they work for a commission, and they need to bring clients or sell products to make money. Don’t feel overwhelmed or intimidated by these sales techniques.

If someone is trying to sell you something really hard, that thing is probably not too good. This usually means they don’t have enough clients joining via referrals or recommendations, so they need to hire people to get more clients.

You might find people offering services from the time you land at the airport. This can be phone plans, credit cards, or anything in between. You can also have people knocking at your door trying to sell you products like cable TV or internet.

Personal Experience: I did a big mistake when listened to my colleague and accepted some sales people to come to my home and sell me their RESP (Registered Education Saving Plans).

This was with a group benefit company called Knowledge First Financial (KFF). Avoid them and similar ones at all costs. Simply, they are legal thieves taking about 30% of your contribution as fees. Gladly I didn’t contribute much but still they took $1750 out of my $6000 contribution. Be warned!

Conclusions & Recommendations

To be successful in your mission, do your research prior to any decision. There are many great online resources to help your settlement in Canada. Use all the available resources and ask questions.

Feel free to call government agencies and inquiry about what you have in mind. Call and make appointments with both public and private agencies. Be mindful to yourself and your budget and be patient.

It takes a lot of effort to be successful in a new country but believe in yourself and you shall succeed.

Thank you for reading and good luck in your new home, Canada!