You might have noticed by now that I have an addiction to finding ETFs and trying to have a balanced growth and dividend portfolio to boost my monthly income.

In this series of Best ETFs in Canada, I am going to list the ETFs I hold with details including their holdings and MERs. I’ll provide answers to why I picked these unfamiliar low volume expensive ETFs over popular ETFs with high trading volume.

Initially, I wanted to make this in one post, but I realized how lengthy and complex it will get so will split it in multiple parts to cover my 17 ETFs forming my list of the Best ETFs in Canada. I understand holding 17 ETFs is very unusual and a big surprise! However, each ETF has its own purpose.

To be clear, I don’t like getting involved in USD-CAD currency exchange either by paying 1.5% to Wealthsimple (2.5% to Questrade) or using the complex Norbert Gambit method. Hence, I am sticking to ETFs listed in Canadian Dollar CAD on Toronto Stock Exchange (TSX).

As of today, my portfolio is about 35% ETFs. My goal is to have 15% Covered Call ETFs and 25% regular ETFs. These ETFs are mostly holding US and International exposure with the exception of XIC, VDY, and ZWC which are Canadian ETFs.

I personally use Wealthsimple Trade which is Canada’s first $0 commission.

Sign up using my referral code 8RR_5G to receive $10 to trade.

In Part I, I’ll cover 4 Technology (EDGE, TECH, TLF, HBLK) and 1 Mix (LEAD) ETFs including Innovative and disruptive sectors with Blockchain exposure. Currently, I don’t hold any Cryptocurrency ETF, but you can find a complete list under my Complete Cryptocurrency Purchase, Exchange, Wallet, and ETF Guide.

In future parts, I will cover my choice of Mix, Health, Commodities, and Travel Sector ETFs.

If you prefer a more advanced trading platform, I recommend using Questrade which offers amazing features including Options trading. You can get up to $250 or a free month in Questwealth, by using my Referral QPass 646713816388276.

In 5 Best Technology ETFs in Canada, I covered the best most traded and popular technology ETFs. However, I kept researching trying to find a balance between growth and dividends and I landed some really interesting ETFs. So I didn’t end up buying QQC.F as I planned initially to track NASDAQ .

Related: Best & Most Tax Efficient US & International ETFs Listed on TSX

I count the new disruptive technologies like Blockchain within the technology sector. It is technology after all leading to disruptive and innovative trends which fundamentally transforms our world. I will explain the importance of Blockchain when I get to HBLK. Shall we begin?

Evolve Innovation Index Fund (EDGE)

I feel emotionally connected to my first ETF on this list, EDGE, and for a good reason. This ETF is a package of a portfolio which provides equally weighted exposure to categories consisting of companies that are leading innovation across multiple sectors.

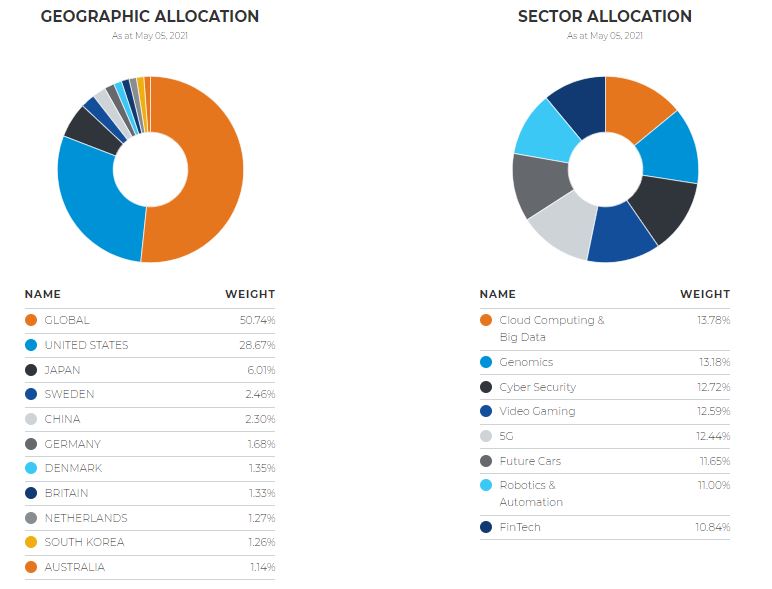

EDGE which comes in two series, Hedged to CAD (EDGE) and USD (EDGE.U) is an 8-in-1 Disruptive Innovation Fund providing investors with access to global companies that are involved in disruptive innovation themes across a broad range of industries, including Cyber Security, Cloud Computing, E-Gaming and E-Sports, Automobile Innovation, 5G, FinTech, Genomics, and Robotics & Automation.

Currently, EDGE has 43 holdings including 4 ETFs which tracks Solactive Global Innovation Index with a 0.40% Management Fee. EDGE is a very well diversified ETF holding multiple technologies as shown. I like its exposure to all the reliable growth companies with a minimum $100M market capitalization.

These are companies like Google, Oracle, SAP, Microsoft, Salesforce, Amazon, Shopify, Intuit, Zoom, ServiceNow, Fortinet, Nintendo, EA, Roblox, Nvidia, Tesla, BioNTech, Visa, Vodafone, T-Mobile, Verizon, Samsung, Mastercard, Qualcomm, AMD, PayPal, Sony, and Intel.

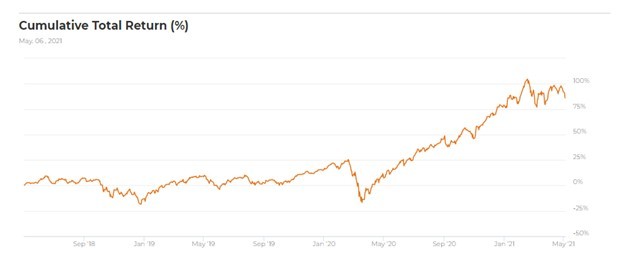

There is currently a $0.0050 distribution every quarter which is equal to 0.05% dividend yield. Below is its total cumulative return since inception showing it has a 68.09% 1 year return. I should also mention that EDGE had 15% more growth than NASDAQ QQQ.

Evolve FANGMA Index ETF (TECH)

Simple! Gain exposure to the 6 tech giants for $10? Evolve is really doing a great job answering to investors needs. Many investors like me can’t buy Amazon shares directly anymore but would like to have a bigger percentage exposure. TECH which started trading on May 6th, 2021 solves this challenge.

TECH gives exposure to six tech giants in one ETF by replicating Solactive FANGMA Equal Weight Index Canadian Dollar Hedged. These six big tech companies have transformed our world significantly. TECH comes with a 0.40% management fee which is honestly high, but it is the easiest way to get high exposure to the giant tech companies which are Facebook, Amazon, Netflix, Google, Microsoft, and Apple.

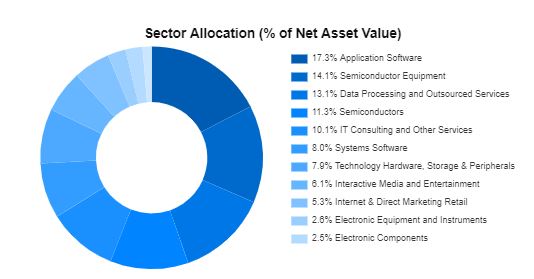

Brompton Tech Leaders Income ETF (TLF)

This was a game changer in my tech ETF explore which consists of global technology companies. I am really impressed by TLF performance regardless of its high 1.05% Expense Fee. Don’t let the MER deter you because there is a fantastic $0.06667 quarterly distribution per share. This translates to a 4.03% dividend yield or 2.98% after deducting the costs.

Challenge: Bring me a tech ETF with similar performance paying a similar high yield.

Similar to other ETFs, TLF comes in CAD Hedged (TLF) and USD (TLF.U) series.

How can they give such a good dividend from Tech companies which barely pay any dividend? By optimizing the magic of covered call Options. Of course, you can do your own research and get involved in call options to save the high MER, but I personally don’t have the patient to do it directly.

What is the catch? I don’t see any as of now! I initially thought I am going to give up some amazing gains because of the covered calls but apparently it has been performing great which proves Brompton PMs are doing a wonderful job actively managing this ETF by following a propriety procedure. One note is to re-evaluate these ETFs on a yearly basis to make sure their performance, cost, and dividend yield are still matching your goals.

Below is a solid proof showing how TLF is moving and almost tracking NASDAQ QQQ and its CAD equivalent QQC.F. Count in the monthly income, and you see how TLF is the winner.

You might ask, why I am buying TECH ETF? Simple reasons.

- I can’t guarantee how well Brompton covered calls will perform in the future.

- TLF holds 14.1% Semiconductors which is going through shortages driving their stocks higher.

- TLF doesn’t hold Facebook and Netflix.

In addition to the top 10 holdings listed below, TLF holds Mastercard, Cadence Design Systems, Apple, Salesforce, Cognizant, Logitech, Adobe, Keysight, Amphenol, ServiceNow, and Visa for a total of 21 holdings plus a 1.3% cash and short term investments.

Harvest Blockchain Technologies ETF (HBLK)

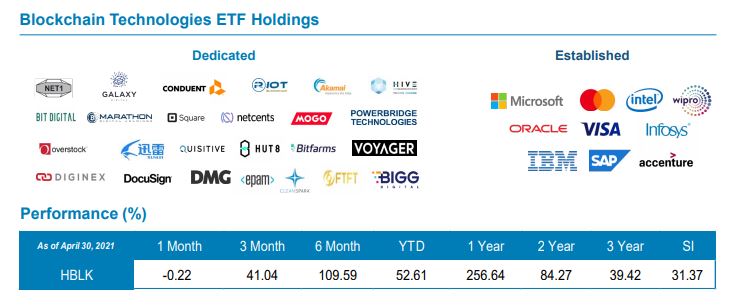

This is another one of my most favorite ETFs which is one of Canada’s top performing ETFs. HBLK invests in large-cap established and stand alone blockchain companies. It has a total 35 holdings which 25 are dedicated Blockchain companies. HBLK comes with a very high 2.26% expense fee and a 0.65% dividend.

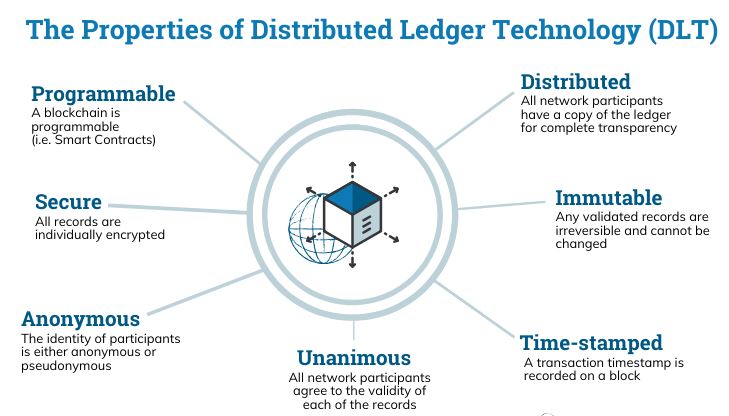

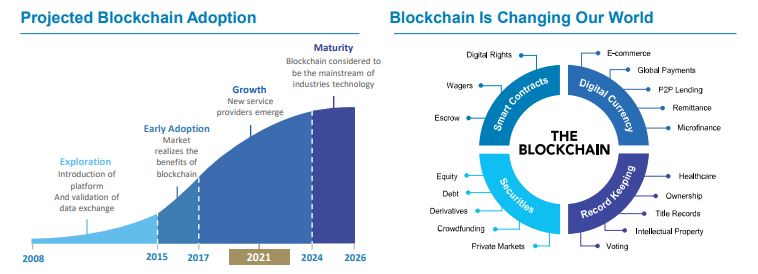

What is Blockchain? Blockchain technology is the future which is considered the newest evolution after the Internet & Cloud innovations. It is the core of cryptocurrencies which solves the trust issue by ensuring no Crypto founder can give themselves random number of cryptos or taking other people’s tokens without a proper transaction.

Blockchain is a type of decentralized database system called Distribution Ledger Technology (DLT) which records digital ledger of transactions. These records get duplicated and distributed across the entire blockchain network in a unique method to make it almost impossible to change, hack, or cheat any transaction.

Blockchain’s immutable cryptographic signature or hash is the perfect way to protect and prove the system’s integrity because to corrupt a blockchain system, hackers would need to change every block in the chain, across all of the distributed versions of the chain which is theoretically impossible.

Let me simplify as I know this is a very complicated concept. In normal databases such as Oracle or SQL, there is always a database admin with enough privilege to modify entries which can lead to misuse of the system. Blockchain is a totally different system as nobody is in charge. The whole blockchain runs by its users which means cryptocurrencies like Bitcoin or Ethereum can’t be faked, hacked, or double spent.

There are tens of potential application uses of Blockchain including Banking, Cybersecurity, Supply Chain Management, Healthcare, and even Government. Blockchain can be efficiently used in Smart Contracts and Identity Management systems.

Back to our ETF. HBLK holdings are shown below which are divided between Established Large Cap (43.7%) and Dedicated Blockchain (55.7%) companies. HBLK had a 256.64% growth in the last year which based on Blockchain adoption projections might continue until 2024.

Evolve Future Leadership Fund (LEAD)

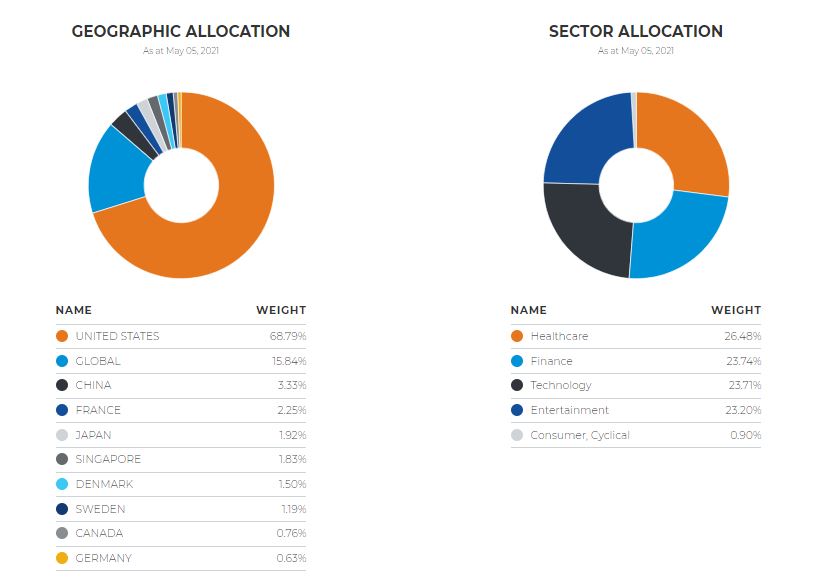

Next on my list is another product by Evolve team, LEAD. Lead gives exposure to four categories. Finance, Healthcare, Technology, and Media & Entertainment. LEAD is an actively managed ETF which utilizes covered call strategy up to 33% of the portfolio.

The benefit of these covered calls is the extra generated income and the risk reduction. However, it also means there is a chance of missing out on 33% of the underlying stocks growth when the calls are exercised.

LEAD comes in three series. Hedged CAD (LEAD), Unhedged (LEAD.B), and USD (LEAD.U) with a high 0.75% Management Fee but similar to LTF, don’t let the high fees disappoint you as there is a nice $0.1050 monthly distributions which is a very nice 5.67% dividend yield.

Considering the MER will hover over 1%, the after expenses income should still be over 4.50% annually.

I am honestly undecided about LEAD’s future as it has a very similar holdings to EDGE but adds the benefits of having a stream of income with the expense of missing out on growth. On top of this, it holds financial leaders like Nasdaq Inc, Goldman Sachs, and Morgan Stanley. It also gives me exposure to Health leaders such as UnitedHealth, Danaher, Pfizer, AstraZeneca, Novartis, AbbVie, and Johnson & Johnson to name a few.

So, I will have to evaluate it like other ETFs in an annual basis to decide keeping or not based on the three factors of Performance, MER, and Dividend Yield.

Final Thoughts & Recommendations about my Best ETFs in Canada

I generally believe ETFs should make an average investor’s life easier but as you see on this series, they aren’t making mine any easier but happier and wealthier for a good reason. I like the growth as much as I want to keep the dividend yield. Indeed, the high MERs are painful but everything comes with a price. You can certainly do your own covered calls trading to save the fees but that will not be everyone’s job.

I need to make one point very clear. These ETFs come with limited trading volume and a big bid-ask spread. It shouldn’t matter for long-term investors, but I always use a Limit Order and don’t stress about having it filled on the day. This is just to try avoiding being taken advantage of by the high asks.

As buying ETFs is really easy through either Questrade or Wealthsimple, I don’t see why I’d limit myself trying to pick an ETF over the other one. I spent time evaluating these ETFs and comparing them with traditional ETFs and concluded that these ETFs considering their potential growth and distributions are worth the high MER. I still believe a simple exposure to NASDAQ QQQ ETF can suit many investors.

In Part II, I will discuss my Health, Commodities, and Travel ETFs. Thanks for Reading & See you soon!

These are interesting picks. QQQ is popular with many people, but more specialized ETFs have the chance to produce more amazing returns. 🙂

I know a covered call strategy can earn really high returns. But I’ve also heard it doesn’t perform as well as simply buying and holding the stock. I don’t know which is more correct, lol. I look forward to the rest of your series.

Hey Liquid. Yes, I agree. QQQ is pretty much everyone’s pick but I like to diversify more and also earn some dividends from holding Tech. That’s why I am having couple tech ETFs. Days like today where NASDAQ went down 2.5% makes me feel better about holding TLF as I know I am receiving cash regardless.

Covered call strategy is great but I don’t feel it is sustainable strategy for me. It needs research and staying on top of the market kind of thing. I have a full-time job and can’t really focus on doing it. Plus it makes me stressful. So, I rather hold ETFs doing it and I pay them like a lazy guy paying someone doing their grass / snow (Couldn’t think of a better comparison).