With the intense increase of interest in Cryptocurrencies, investors have been looking for easier methods to understand and invest in this complicated technical asset. Fortunately, we are being given more and more options to make our cryptocurrency purchase easier.

My goal is to simplify the complicated process of buying and storing Cryptocurrencies focusing on Bitcoin and Ethereum. However, I will briefly cover the ways to purchase altcoin currencies like DOGE and SHIB.

In addition, as you might noticed my passion about ETFs from my previous posts like Best REIT or Best Technology ETFs in Canada, I will provide a complete ETF comparison table of the currently approved Cryptocurrency (Bitcoin and Ethereum) ETFs in Canada.

Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

Michael Saylor

Cryptocurrency index is very dynamic but based on the average index, currently 60% of the market is invested in either Bitcoin (40%) or Ethereum (20%). The other dominants are Tether (USDT), BNB, USDC, XRP, Solana, Cardano, Terra Luna, and Avalanche AVAX.

Related: Complete Crypto.com App Review & Cryptocurrency Beginners Guide

Please note that this is not an introductory to Cryptocurrency, Fiat Currency, or Blockchain. My assumption is that you already know about digital currencies and interested in owning them. As always, I encourage you to do your own due diligence and ask questions.

Cryptocurrency Purchase (How to Buy Crypto) Methods in Canada

- Cryptocurrency Exchanges (Custodial or Self-Custody Wallet)

- Cryptocurrency (Bitcoin or Ethereum) ETFs (Custodial Wallet)

- Cryptocurrency Account Wealthsimple Crypto (Custodial Wallet)

Each method has its own advantages and disadvantages. However, the main difference is how the real crypto currency is held and who has full control over the purchased coin.

In case of the non-custodial exchange, you have the private key and are the full owner who hold and own the crypto directly in your wallet. In theory, this means no regulations (banks or governments) can take away your coin.

On the other side, in a custodial exchange, ETF, or Wealthsimple Crypto, the real Crypto currency is held and owned by the Exchange, ETF Provider (Evolve, Purpose, CI Galaxy) or Wealthsimple.

They are the ones who have the private keys. This ultimately means, you might be out of your crypto in case of a security breach, bankruptcy, or government regulations confiscating crypto currencies.

Cryptocurrency Exchanges

The most direct method to own cryptocurrency is to buy directly through an exchange. The simplified steps are outlined below:

- Research and join a local or global Crypto Exchange

- Transfer funds using Interac, wire, pre-authorized bank, debit card, credit card, or external Wallet Transfers

- Use your fund and purchase the cryptocurrency

- If Custodial, leave your coin with the exchange and save some fees

- If Non-Custodial, get your own Wallet and transfer your coins to your wallet (Network Fees)

There are many cryptocurrency exchanges to choose from. However, as always, I like to keep it Canadian and encourage others to use and support a local Canadian exchange.

The other benefit is to fund the account with the local CAD currency directly from your Canadian bank account avoiding the foreign exchange hassle. Below is the chart for the most used Canadian Cryptocurrency Exchanges.

| Crypto Exchange | Available Cryptocurrencies | Trading Fees |

| Bitbuy | BTC, ETH, LTC, BCH, XRP, EOS, XLM, AAVE, LINK, DOGE, ADA, DOT, UNI, SUSHI, MATIC (Polygon), SOL | 0.20% |

| Coinberry | BTC, ETH, ADA, BAL, AAVE, AXS, BAT, BCH, COMP, CRV, DOGE, DOT, ENJ, FTM, GRT, KNC, LINK, LTC, LUNA, MANA, MATIC, MKR, SAND, SHIB, SNX, UNI, XLM, YFI, ZEC | 0-2.5% |

| CoinSmart | BTC, ETH, LTC, USDC, BCH, EOS, XLM, ADA, DOGE, DOT, SHIB, LINK, UNI, SOL, AVAX, MATIC | 0.20% |

| MyBTC | Bitcoin | 7.75% |

| NDAX | BTC, USDT, ETH, SHIB, XRP, LUNA, DOGE, ADA, USDC, XLM, SOL, FTM, VET, AVAX, FTM, DOT, MANA, ALGO, LTC, HBAR, GRT, GALA, SAND, CELO, EOS, LINK, NEAR, AAVE, AXS, COMP, UNI, TLM | 0.20% |

| Newton | BTC, ETH, ADA, SOL, USDC, DOT, DOGE, APE, LUNA, SOL, UNI, HOT, SRM, LINK, XLM, MATIC, BCH, ALGO, LTC, DAI, AXS, XTZ, EOS, AAVE, FTM, UST, MKR, AMP, DASH, COMP, OMG, ZEC, SUSHI, MANA, ENJ, SNX, YFI, CRV, BAT, REN, ZRX, 1INCH, PAXG, KNC, BAL, UMA, SAND, SHIB, CHZ, GRT, CHR, HBAR, AVAX, LRC, ANKR, GALA, ALICE, ONE, ATOM, EGLD, DYDX, CELO, STORJ, SKL, CTSI, BAND, QNT, MASK, RNDR, ENS, QCAD, WBTC | None |

| Shakepay | Bitcoin, Ethereum | None |

Bitbuy Crypto Exchange

Bitbuy is the most established and popular cryptocurrency exchange in Canada. One unique feature of Bitbuy is its separated channel for basic traders (Express Trade) and experienced traders (Pro Trade). Bitbuy currently offers BTC, ETH, LTC, BCH, XRP, EOS, XLM, AAVE, LINK, DOGE, ADA, DOT, UNI, SUSHI, MATIC (Polygon), and SOL.

Bitbuy offers different rates. Express trade cost is 0.2% for buy and sell. Interact e-Transfer deposit or withdrawal cost 1.5%. Wire transfer deposit is 0.5% while its withdrawal is 1%. There is no fee for digital currency deposits.

Coinberry Crypto Exchange

Coinberry offers buying Bitcoin instantly in Canada. It is an insured, FINTRAC registered & PIPEDA compliant crypto trading platform. The platform offers BTC, ETH, ADA, BAL, AAVE, AXS, BAT, BCH, COMP, CRV, DOGE, DOT, ENJ, FTM, GRT, KNC, LINK, LTC, LUNA, MANA, MATIC, MKR, SAND, SHIB, SNX, UNI, XLM, YFI, and ZEC.

A unique feature of Coinberry is its Coinberry Pay which enables individuals and merchants to accept crypto as payment.

Coinberry doesn’t charge any fiat deposits or withdrawals fees. However, it charges 0% to 2.5% trading fees. In addition, it charges a dynamic withdrawal feels which is based on the network congestions and gas fees. There is also a minimum withdrawal amount.

CoinSmart Crypto Exchange

Promo: Join CoinSmart, Earn $15 after your first deposit

CoinSmart is another great Canadian crypto exchange offering trading BTC, ETH, LTC, USDC, BCH, EOS, XLM, ADA, DOGE, DOT, SHIBA, LINK, UNI, SOL, AVAX, and MATIC. It offers a proprietary system called SmartTrade for less experienced crypto users which offers an easier way to get and trade coins without complex transactions.

CoinSmart charges 0.20% for single trade and 0.30% for double trade. What they consider double trade is trading two cryptocurrencies other than Bitcoin (BTC) such as Litecoin (LTC) to Ripple (XRP). There are also other fees for funding and withdrawals.

In addition to charging fees on crypto withdrawals, CoinSmart also charges fees on fiat deposits and withdrawals which is very rare among Canadian cryptocurrency exchanges.

NDAX Crypto Exchange

NDAX features secure digital asset storage, multiple funding methods, and same-day deposit and withdrawal settlements, leaving you free to focus on trading, tracking, and managing your crypto portfolio.

It also offers one of the largest portfolio of coins in Canada including BTC, USDT, ETH, SHIB, XRP, LUNA, DOGE, ADA, USDC, XLM, SOL, FTM, VET, AVAX, FTM, DOT, MANA, ALGO, LTC, HBAR, GRT, GALA, SAND, CELO, EOS, LINK, NEAR, AAVE, AXS, COMP, UNI, TLM.

NADX is the one of the most advanced platforms among all Canadian crypto exchanges. It offers regular market orders, stop-limit orders, trailing orders, and other kind of orders like fill and kill orders. NDAX fiat and cryptocurrency deposits are free. However, it charges $4.99 for withdrawal fiat bank drafts or wire transfers.

It also has different fees for crypto withdrawals. However, in addition to ERC-20, NDAX supports Binance Smart Chain (BEP20) which reduces the withdrawal fees significantly.

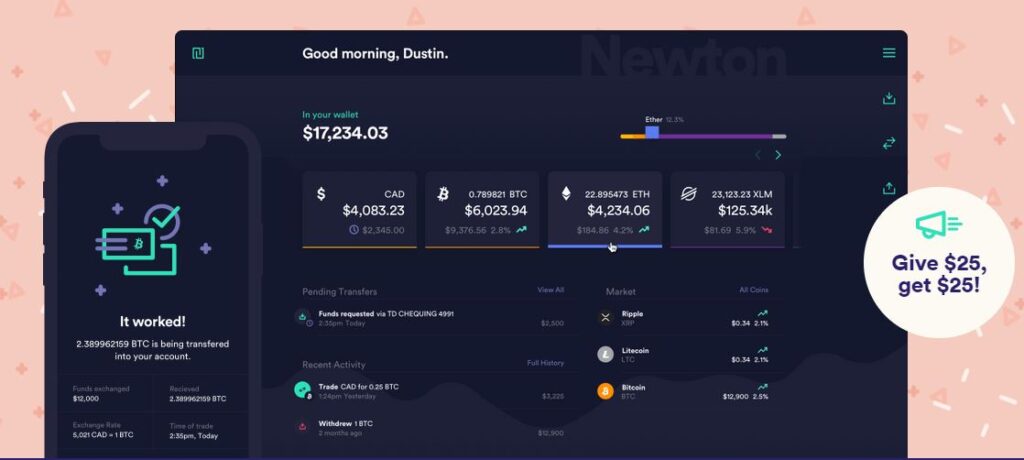

Newton Crypto Exchange

Promo: Join Newton, Earn $25 after your first $100 deposit

Newton is a the best Canadian no-fee crypto trading exchange. Newton stores all the customer data in Canada, PIPEDA compliant, and even offer exportable T5 statement for investment income.

You can buy and sell BTC, ETH, ADA, SOL, USDC, DOT, DOGE, APE, LUNA, SOL, UNI, HOT, SRM, LINK, XLM, MATIC, BCH, ALGO, LTC, DAI, AXS, XTZ, EOS, AAVE, FTM, UST, MKR, AMP, DASH, COMP, OMG, ZEC, SUSHI, MANA, ENJ, SNX, YFI, CRV, BAT, REN, ZRX, 1INCH, PAXG, KNC, BAL, UMA, SAND, SHIB, CHZ, GRT, CHR, HBAR, AVAX, LRC, ANKR, GALA, ALICE, ONE, ATOM, EGLD, DYDX, CELO, STORJ, SKL, CTSI, BAND, QNT, MASK, RNDR, ENS, WBTC, and QCAD instantly.

Use my Newton Referral so we both get $25 after your first $100 CAD investment.

With Newton, investors have the option to have their own wallet or use Newton’s custodian wallet. Newton buys from and sell to their users directly, allowing them to capture the bid-ask spread price difference.

In my experience, Newton is the best solution for Canadians. Newton has zero withdrawal or funding fees. Plus, they cover the first $5 in network fees for every trade which most of the time makes for free withdrawals.

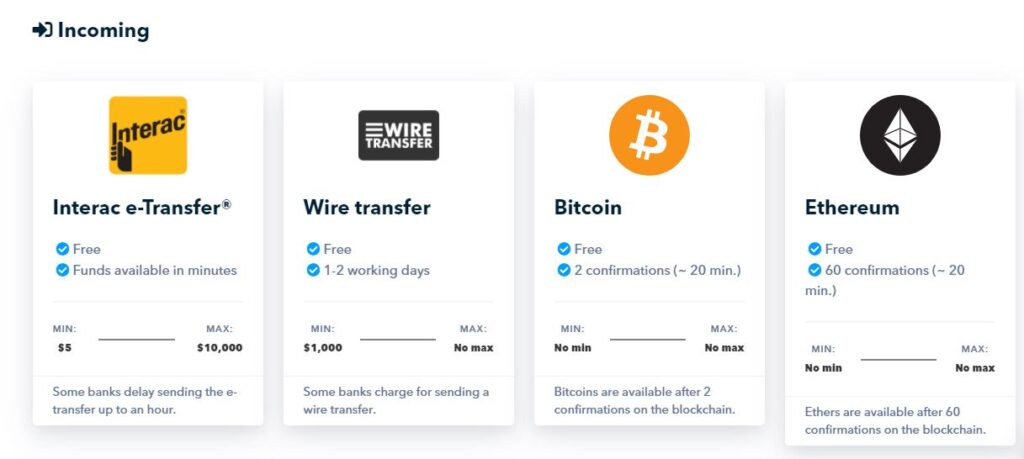

Canadians can fund with e-Transfers, wire transfers, pre-authorized debit, and crypto.

Shakepay Crypto Exchange

Promo: Join Shakepay, Earn $30 after your first $100 deposit

Shakepay isn’t really an exchange but more of an app which makes it the easiest option for Canadians to buy and sell bitcoin and Ethereum. There is no transactions or commission fees with Shakepay and like Newton they make money from the buy and sell spread.

Use my Shakepay referral to get $30 after your first $100 CAD, BTC or ETH deposit.

How to Buy Altcoins like Dogecoin (DOGE) and SHIBA INU (SHIB)

Occasionally, altcoins like Dogecoin (DOGE) and SHIBA become popular with a skyrocketing upside in their price value coming mostly from popular memes and trending mentions on social media.

From my experience, the easiest way to buy newly listed altcoins is through Crypto.com which I covered in my detailed Crypto.com review. However, almost all mentioned exchanges offer DOGE and SHIB. My preference is Newton Exchange due to its ease of use, transparency, and almost no fees structure.

Cryptocurrency Wallet

After creating your account in one of these exchanges and purchasing your cryptocurrency, it is time to decide where to store the beloved digital currency. There are multiple options:

- Keep them with the same exchange if they offer Custodial Wallet

- Transfer your Cryptocurrency to your own Hot Wallet

- Transfer your Cryptocurrency to your own Cold Wallet

To transfer coins from the exchange to your own wallet, you only need to know your coin address. However, transferring comes with a network fee which is sometimes very high. Below I will dive in explaining the two types of wallets (Hot Wallet and Cold Wallet) which can be used for storing your coins.

Hot Wallets (Software Wallets)

Hot (Software) Wallets come in either online or desktop forms. The benefit of using a hot wallet is that they can hold any cryptocurrency without additional cost making it a free wallet. Other benefits of Hot Wallets include the convenient, easy, and fast methods of sending and receiving payments.

Mainstream cryptocurrencies like Bitcoin or Ethereum have many different available digital wallets to choose where each offers its unique features and customizations. The most important consideration is security. They are vulnerable and can be hacked as the security keys to access the cryptos are stored in online servers. Some of the best Hot Wallers are listed below:

- Exodus is a free Mobile and Desktop wallet offering over than 100 cryptocurrencies.

- Mycelium is a free Mobile-Only wallet offering Bitcoin, Ether, ERC-20 tokens, and FIO tokens.

- Electrum is a free Mobile and Desktop wallet which only offers Bitcoin storage.

- Wasabi is a free Desktop-Only wallet limited to storing Bitcoin only.

- Blockstream Green is another Bitcoin Mobile and Desktop solution.

- Other Wallets: Aqua, ZenGo

Cold Wallets (Hardware Wallets)

Cold (Hardware) Wallets are a specialized devices designed to serve as a physical cryptocurrency storage. The main advantage of the cold wallet is that it is held physically by the owner similar to owning any physical asset. They are also compact, easy to carry around, backup, and store safely.

There are some disadvantages of holding cold wallets. The cost is one to consider. However, when holding a big value in Cryptocurrency, the cost of a cold storage can be negligible. The other consideration is that cold storages can mostly only hold the top cryptocurrencies like Bitcoin, Ethereum, Dash, and similar ones.

The main advantage of Cold Wallets is their security. In a cold wallet, you have full control, and everything is offline without internet connection so can’t be hacked. Of course if you lose it without a backup, it is gone. In addition, consider that cold wallets are impenetrable. The codes are nowhere other than your physical device. If it is damaged, stolen, or lost, it is the end of it. No way to take your crypto back.

Some of the well known and trusted cold wallet hardware devices are: Trezor T, Ledger Nano X, Trezor One, KeepKey, and CoolWallet S.

Keep in Exchanges or Transfer to Own Wallet (Self-Custody)

This is one of the most important decisions to make. Most exchanges offer regular offsite backup, encryption, layers of security, and fraud insurance. This means even in case of a cybersecurity hack, they will return your coins to you. However, it is very important to distinguish between a cyber attack loss and solvency (Bankruptcy).

Yes, Exchanges can be hacked or disappear specially the unregulated ones. The largest crypto hack happened between 2011 and 201. This Bitcoin hack resulted in the loss of 744,408 customer-owned and 100,000 Mt. Gox-owned bitcoins, along with $27 million cash from Mt. Gox.

If the Exchange offers insurance for cyber and solvency loss, it is safe to use their custodian wallet. However, if they don’t offer any bankruptcy insurance, you should transfer your coins to your own wallet to have full control and avoid any loss in case of the exchange or their custodian wallet bankruptcy. Of course this is not a concern for the bigger exchanges like Binance and Coinbase.

On the other hand, going with self-custody means you are responsible to backup and safeguard your private key. I totally discourage usage of hosted or custodial wallets unless it is provided by one of the biggest and most reliable exchanges which are legally a registered financial institute and offer full insurance in case of cyber attack or bankruptcy.

Cryptocurrency Account – Wealthsimple Crypto

Wealthsimple Crypto is one of the most convenient methods for Canadians to trade Bitcoin, Ethereum, Dogecoin, and many more. It is also the first regulated crypto platform in Canada.

There is no deposit or withdraw fees. Wealthsimple custodian is Gemini Trust. However, Wealthsimple charges 1.5-2% operation fee per transaction.

Wealthsimple added many altcoins to be purchased directly. Currently, Canadians can buy ZRX, 1INCH, AAVE, APE, AMP, AVAX, AXS, BAL, BAT, BTC, BCH, ADA, CELO, LINK, CHZ, COMP, ATOM, CRV, DAI, MANA, DOGE, ENJ, ETH, FTM, FIL, GALA, GRT, KNC, LTC, LRC, MKR, DOT, MATIC, REN, SAND, SHIB, SOL, XLM, SUSHI, SNX, LUNA, XTZ, UMA, UNI, USDC, QNT, ANKR, DYDX and YFI.

Like owning an ETF which is explained below, you don’t really own the Crypto as you, the investor, don’t have the private key. Wealthsimple Crypto added deposit and withdrawal for some of its offered cryptocurrencies including BTC, ETH, BCH, DOGE, MANA, USDC, and others.

The only major disadvantage with Wealthsimple Crypto is the 1.5-2% operation fee as there is no other fees charged.

If you read until here, Congratulations! You are now all set to start trading and investing in cryptocurrencies directly. However, if you got dizzy and feel overwhelmed, don’t give up. There is now a much easier way to invest in Cryptocurrencies by using ETFs which are traded normally on Toronto Stock Market (TSX).

I recommend opening a brokerage account with Questwealth or Wealthsimple for trading ETFs. Wealthsimple offers a totally free commission buying and selling while Questrade offers only free ETF purchase.

Cryptocurrency ETFs in Canada (Bitcoin ETFs & Ethereum ETFs)

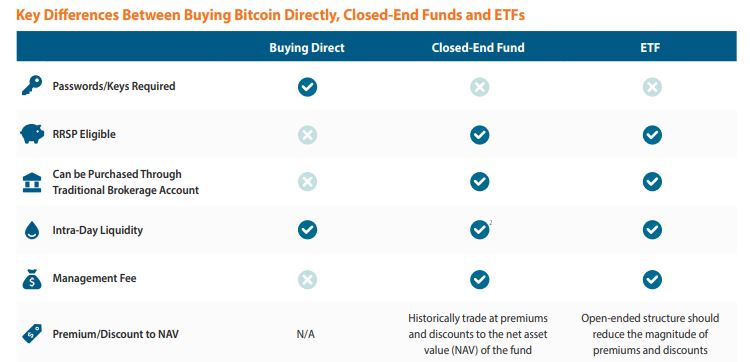

Currently, approved Cryptocurrency ETFs are only covering Bitcoin and Ethereum. They are different than traditional ETFs were there is exposure to many underlying equities. In Crypto ETFs, they only hold one asset, either Bitcoin or Ether which provide investors with a convenient and simplified way to get exposure to bitcoin and Ethereum.

Owning a crypto ETF reduces the headache as the investor won’t have to deal with exchange or wallet. It is also possible to own these ETFs in registered accounts including RRSP, RRIF, RDSP, DPSP, RESP and TFSA.

Get two free stocks when opening a Wealthsimple trade account using my referral.

You can potentially grow your money tax free by trading these ETFs like any other ETF inside a TFSA account. All these ETFs have the same features of buying real Bitcoin or Ethereum and holding them through their Custodians in secure offline cold storages. Here is the process:

- Investor purchases ETF units on TSX the same way they buy any other stock or ETF

- ETF provider use the proceeds to purchase Bitcoin or Ether from institutional-grade liquidity providers

- The Bitcoin or Ether is then settled and stored in a secure, offline wallet (Cold Wallet)

- The investor now own units of the ETF, which owns physically settled Bitcoin or Ether

Purchasing bitcoin or Ether directly means maintaining cold storage or digital wallets, keeping track of passwords, and figuring out how to report proceeds for tax purposes. There is the risk of losing your investment completely if you forget a password, or potentially complicated tax filing requirements.

On the other hand ETF Advantages include:

- Eligible for Registered accounts including RESP, RRIF, RRSP & TFSA

- Can be purchased or sold using a traditional investment brokerage account

- No need to maintain digital wallet or cold storage

- No need to manage passwords and private keys

However, Cryptocurrency ETFs come with some serious disadvantages including MER fees up up to 1.5%. In addition, regardless of what the ETF provider says, you don’t really own the coin itself as you don’t have the private key to access it and can’t exchange your ETF with a real Bitcoin or Ethereum. In addition, investors lose the decentralized untraceable feature which means any government regulations will be enforced.

Here is the list of currently available Bitcoin ETFs in Canada. They all have almost the same features except HBIT which follows bitcoin future. The main difference is management and MER fees.

Canadian Bitcoin ETFs Comparison List

| Bitcoin ETF | Purpose Bitcoin ETF | CI Galaxy Bitcoin ETF | Evolve Bitcoin ETF | Horizon BetaPro Bitcoin ETF | 3iQ CoinShares Bitcoin ETF | |

| Manager | Purpose Investments | CI Investments Inc & Galaxy Digital | Evolve Funds Group | Horizon ETFs Management | 3iQ CoinShares | |

| Management Fee | 1.00% | 0.40% | 0.75% | 1.00% | 1.00% | |

| Bitcoin Price Index | Tradeblock XBX | Bloomberg Galaxy Bitcoin | CME CF Bitcoin Reference Rate | Horizons Bitcoin Front Month Rolling Future | MVIS CryptoCompare Bitcoin Benchmark Rate | |

| Custody | Cidel | Cidel | Cidel | CIBC Mellon | Cidel | |

| Sub-Custodian | Gemini | Gemini | Gemini | Gemini | Gemini | |

| Auditor | ERNST & YOUNG | ERNST & YOUNG | ERNST & YOUNG | KPMG | Raymond Chabot Grant Thornton | |

| Tickers | BTCC, BTCC.B, BTCC.U | BTCX.B, BTCX.U | EBIT, EBIT.U | HBIT, HBIT.U | BTCQ, BTCQ.U |

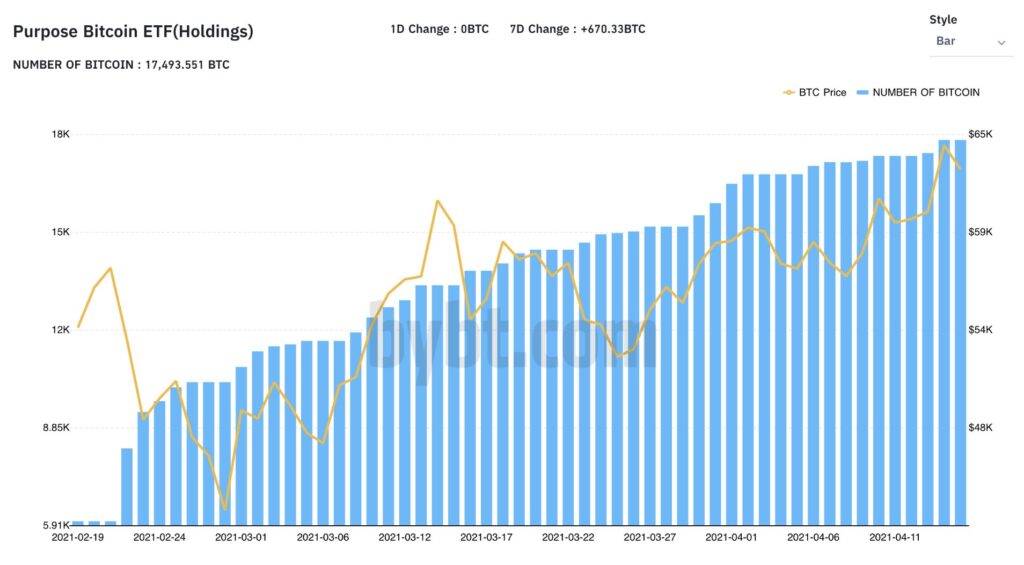

Purpose Bitcoin ETF (BTCC, BTCC.B, & BTCC.U) – Management Fee 1%

Purpose Bitcoin ETF was the world’s first Bitcoin ETF. As of April 23rd, 2021, the fund holds 18600.0928 BTC and comes in three series. CAD Hedged BTCC, CAD Unhedged BTCC.B, and USD BTCC.U.

Purpose Bitcoin ETF management fee is 1% but MER (Management Expense Ratio) can be up to 1.5%.

CI Galaxy Bitcoin ETF (BTCX.B & BTCX.U) – Management Fee 0.40%

CI Galaxy Bitcoin ETF invests in bitcoin and CI Bitcoin Fund provides exposure to bitcoin by buying units of CI Galaxy Bitcoin ETF. This ETF comes in two series. CAD Unhedged BTCX.B and USD BTCX.U which carry a 0.40% fee with an MER capped at 0.95%.

Evolve Bitcoin ETF (EBIT & EBIT.U) – Management Fee 0.75%

EBIT offers investors exposure to bitcoin by investing directly in bitcoin, with EBIT’s holdings of bitcoin priced based on the CME CF Bitcoin Reference Rate, a once-a-day benchmark index price for bitcoin denominated in US dollars.

Evolve Bitcoin ETF comes in two series. CAD Unhedged EBIT and USD EBIT.U. Cidel Trust Company and Gemini Trust Company are respectively the ETF’s Custodian and Sub-Custodian. The ETF’s bitcoin is held in cold storage by sub-custodian Gemini Trust Company. Gemini uses segregated cold storage bitcoin addresses which are directly verifiable via the Bitcoin blockchain.

EBIT and EBIT.U have a 0.75% plus tax management fee.

Horizon BETAPRO Bitcoin ETF (HBIT & HBIT.U) – Management Fee 0.40%

Horizon BetaPro Bitcoin ETF is interesting as it doesn’t directly invest in bitcoin. Instead, it provides exposure to the performance of bitcoin futures. current Underlying Index is HBIT is the Horizons Bitcoin Front Month Rolling Futures Index. This ETF comes in two series. CAD Unhedged HBIT and USD HBIT.U which carry a 0.40% fee with an MER capped at 0.95%.

BTCQ tracks MVIS CryptoCompare Bitcoin Benchmark Rate Index (BBR) which comes in two series. CAD Unhedged BTCQ and USD BTCQ.U. Cidel Trust Company and Gemini Trust Company are respectively the ETF’s Custodian and Sub-Custodian.

The 3iQ CoinShares Bitcoin ETF’s management fee is 1.00% with a 1.25% cap on its MER.

BetaPro Inverse Bitcoin ETF (BITI) – Management Fee 1.45%

BITI is designed to provide one-times (100%) the inverse (opposite) of the daily performance of Bitcoin Futures. The current Underlying Index of BITI is the Horizons Bitcoin Front Month Rolling Futures Index (Excess Return). BITI management fee is 1.45% plus applicable tax.

Considering the speculative nature of Bitcoin and the volatility of its market, an investment in any of these ETFs is not intended as a complete investment program and is appropriate only for investors who have the capacity to absorb a loss of some or all of their investment.

Now, I am going to discuss Ethereum ETFs in Canada. Similar to Bitcoin ETFs, Ethereum ETFs hold real Ethereum coin on an offline cold storage wallet.

Canadian Ether ETFs Comparison List

| Ethereum ETF | Purpose Ether ETF | CI Galaxy Ethereum ETF | Evolve Ether ETF | 3iQ CoinShares Ether ETF | |

| Manager | Purpose Investments | CI Investments Inc & Galaxy Digital | Evolve Funds Group | 3iQ Digital | |

| Management Fee | 1.00% | 0.40% | 0.75% | 1.00% | |

| Ether Price Index | Tradeblock XBX | Bloomberg Galaxy Ethereum | CME CF Ether-Dollar Reference Rate | MVIS CryptoCompare Ethereum (EBR) | |

| Custody | Cidel Trust | Cidel Trust | Cidel Trust | Cidel Trust | |

| Sub-Custodian | Gemini Trust | Gemini Trust | Gemini Trust | Gemini Trust | |

| Auditor | ERNST & YOUNG | ERNST & YOUNG | ERNST & YOUNG | Raymond Chabot Grant Thornton | |

| Tickers | ETHH, ETHH.B, ETHH.U | ETHX.B, ETHX.U | ETHR, ETHR.U | ETHQ, ETHQ.U |

Purpose Ether ETF (ETHH, ETHH.B, & ETHH.U) – Management Fee 1%

Purpose Ether ETF is the world’s fist physically settled Ether ETF. As of April 23rd, 2021, the fund holds 13343.6225 ETH and comes in three series. CAD Hedged ETHH, CAD Unhedged ETHH.B, and USD ETHH.U.

Purpose Bitcoin ETF management fee is 1% but MER (Management Expense Ratio) can be up to 1.5%.

CI Galaxy Ethereum ETF (ETHX.B & ETHX.U) – Management Fee 0.40%

CI Galaxy Ethereum investment objective is to provide holders of units exposure to Ether through an institutional-quality fund platform based on Bloomberg Galaxy Ethereum Index. This ETF comes in two series. CAD Unhedged ETHX.B and USD ETHX.U which carry a 0.40% fee with an MER capped at 0.95%.

Evolve Ethereum ETF (ETHR & ETHR.U) – Management Fee 0.75%

ETHR offers investors exposure to Ether by investing directly in Ethereum, with ETHR’s holdings of Ether priced based on the CME CF Ether-Dollar Reference Rate (“ETHUSD_RR”).

Evolve Ether ETF comes in two series. CAD Unhedged ETHR and USD ETHR.U. Cidel Trust Company and Gemini Trust Company are respectively the ETF’s Custodian and Sub-Custodian.

ETHR & ETHR.U carry a 0.75% plus tax management fee.

ETHQ tracks MVIS CryptoCompare Ethereum Benchmark Rate Index (EBR) which comes in two series. CAD Unhedged ETHQ and USD ETHQ.U. Cidel Trust Company and Gemini Trust Company are respectively the ETF’s Custodian and Sub-Custodian.

The 3iQ CoinShares Ether ETF’s management fee is 1.00% with a 1.25% cap on its MER.

These four ETFs (ETHH, ETHX, ETHR, and ETHQ) are the currently approved Ether ETFs in Canada.

Final Considerations & Recommendations

We covered a lot in this post. Honestly, my recommendation is to do your own research and don’t let the hype gets the best of you leading to big losses of your hard earned money.

However, Crypto is here to stay and it will grow daily. If you’d like to start, don’t invest more than 15% of your savings due to the high risk.

Depends on what you decide to purchase, open an exchange account or buy an ETF. Either way, Count in all the fees including the transfer in, transfer out, transaction, commission, and MER fees. Between the mentioned options, I don’t recommend using Wealthsimple Crypto due to its high fees.

If you plan to only buy Bitcoin or Ethereum, keep it simple and open a Shakepay account which offers free deposits and withdrawals. However, if you don’t feel opening a new account, use Wealthsimple trade, and purchase ETFs like Evolve EBIT for Bitcoin or ETHR for Ethereum because of their lowest offering MER fees.

When it comes to Exchanges, my favorite is Newton exchange which can save you a lot of fees.

- Join CoinSmart, Earn $15 after your first deposit

- Join Newton, Earn $25 after your first $100 deposit

- Join Shakepay, Earn $30 after your first $100 deposit

- All my other recommendations

Are you a Crypto investor or trader? What is your favorite exchange or ETF?

Thank you so much for this detailed article. I don’t know much about bitcoin and other cryptos currencies but with your complete guide, it helps if one day, I wanna get invested with this! Keep up the good work man ! 👍😃

Hi Fred! Thanks for stopping by and nice words! Yes, this is one of those things. The more you know the more you realize you don’t know! It can get complicated and confusing but luckily with the ETFs things are getting easier. I think we should all allocate a small portion of our portfolio to this new technology. I myself am buying Blockchain ETF HBLK and adding Ethereum slowly. I am not sure about Bitcoin itself. Everyone says it is the new Gold!

There’s so much that I didn’t know I didn’t know. Wow, I can’t believe how much there is to learn about crypto currencies, beyond the basics of how it all works!

For now, I have no plans to invest in crypto, but I am much more educated about how to do so, thanks to this post. You made me a little bit smarter today. 🙂

Thanks for stopping by, Chrissy! Crypto is indeed a whole new world and a non-stop learning curve until it matures and find some common ground. There are literally thousands of Tokens (Cryptocurrencies) and tens if not hundreds popping up weekly. Of course they won’t all make it to the final cut.

Learning is a blessing and I learn from your creative content as well.

Wow! This is an awesome article with tons of helpful information for Canadian investors. Kudos to you man for making this article!