Yes, the fascinating world of Cryptocurrencies! I went from an unbeliever to a full supporter! I didn’t know I have such an open-mind, but research and flexibility led to some fantastic moves.

In this post, I’ll be covering my Cryptocurrency portfolio and how I am making passive income from my cryptocurrencies by using high interest crypto savings accounts.

For those who would like to start buying Cryptocurrencies in Canada, I recommend using Newton Exchange which offers free e-Transfer and a withdrawal rebate of up to $5.

If you are a US or international reader, you can use Crypto.com or Gemini. Both are great and reliable exchanges.

Feel free to take a look at my guide on how to purchase Cryptocurrencies including a discussion about Bitcoin and Ethereum ETFs in Canada. I also post my monthly passive income which includes my Cryptocurrency earnings.

Isn’t Cryptocurrency Just a Scam?

Well, this is a twisted question to ask. How about “Isn’t the stock market just a scam?”. Of course the answer is a big NO! But again it depends on what stock (or crypto) you are looking at.

The technologies, blockchain and digital currency, are amazing which comes with many benefits including killing the middleman and distributing the profit directly to the participants. Then comes the voting system where token holders can vote for any change as small as changing the logo of a brand!

Beyond this, is the simplified lending process which comes with its own risks. It is the concept of Unbanking which I love! The true Unbanking comes through Decentralized Finance (DeFi) where the whole DEX (Decentralized Exchange) runs by its developers based on voting through its community.

There are currently 11,618 tokens listed on Coinranking and we all know most of what’s listed won’t make it. Basically, anyone can go ahead and create their own token. Some of the tokens are pure speculations while others are backed up by a real utility or service.

As an example, Filecoin (FIL) uses its own blockchain that runs a decentralized storage network which turns cloud storage into an algorithmic market to store data. Sounds too complicated but it is a beauty!

CRO is another token which is the native token of Crypto.org chain. This project aims to simplifies merchant’s ability to accept crypto as a form of payment. Crypto.com provides a huge set of products which I’ll cover in a separate post but for now consider CRO as the ticker (Stock) of Crypto.com company.

And there are many other amazing projects in this revolutionary industry which are offering some great services. However, the main issue is still the valuation of these coins. Some projects have clear earning report while others are a pure guessing game.

Where Does the High Cryptocurrency Interest Come From?

Glad you asked! The concept of high interest crypto savings accounts is backed up by multiple revenue channels including lending. The main difference between Crypto exchanges and tradition banks is the distribution of these earnings.

Most Crypto exchanges promise to only take 20% as a revenue and distribute the 80% to their community. In addition, there are other revenue streams to generate profit from. Here is a short list of few profit maker strategies:

- Spread on sell and buy

- Trading commissions

- Deposit and withdrawal fees

- Using DeFi to generate profit by Centralized Exchanges

Where Do I Make Money in My Cryptocurrency Portfolio?

I am keeping it simple (Kind of), but I use 4 different platforms (Exchanges) to generate income from my cryptocurrencies. Some of the methods are riskier than others but the riskier ones provide a higher yield.

In the stock market world, investors put money in penny stocks without even getting paid a fraction of a cent where their money can go down substantially. However, in Cryptocurrency world, you get rewarded for taking the risk. Yes, you might lose all your investments by making bad decisions or you might build a fortune eventually.

Pro Tip: There is no getting rich overnight! My approach includes managing my risks and diversifying my portfolios. If you know me, I am heavy in the stock market!

The 4 different services I use are CakeDeFi, Nexo, Crypto.com, and Celsius.

I am not going to explain any of these platforms in depth through this post. Nevertheless, I promise to cover them in future posts as I am getting more and more questions on how to start.

I am also thinking of creating a Crypto high interest table similar to Savings Rates Charts where I cover the highest interest rate of Traditional Canadian Financial Institutes for both Savings and TFSA accounts.

How Do I Make Money in My Cryptocurrency Portfolio?

My cryptocurrency portfolio is relatively small but growing! I make money through Liquidity Mining, Staking, and Lending. In the following sections, I will share my portfolio in each platform.

I’ll start by the ones I have the smallest dollar amount in which are CakeDeFi and Nexo before moving to Crypto.com and Celsius.

Earnings from Liquidity Mining & Staking in CakeDeFi

This is the riskiest investment among my cryptocurrency investments. I am using CakeDeFi which is a platform that allows its users to generate cash flow through pooled masternode staking and options lending based on DeFiChain blockchain.

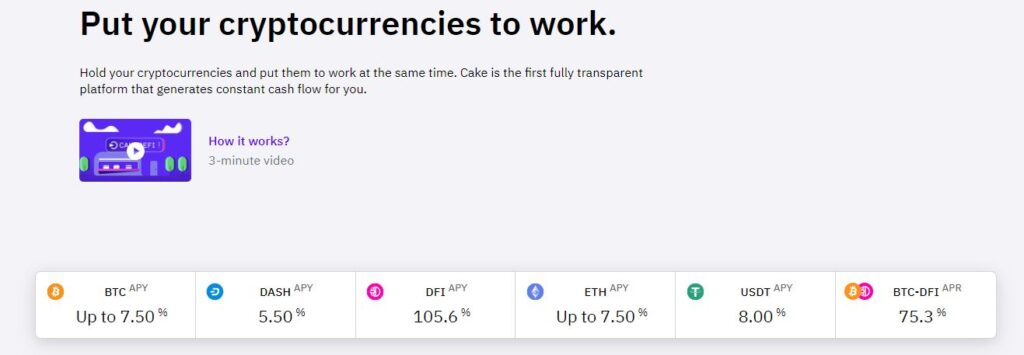

Here are the current APRs (Yield before compounding) which change constantly.

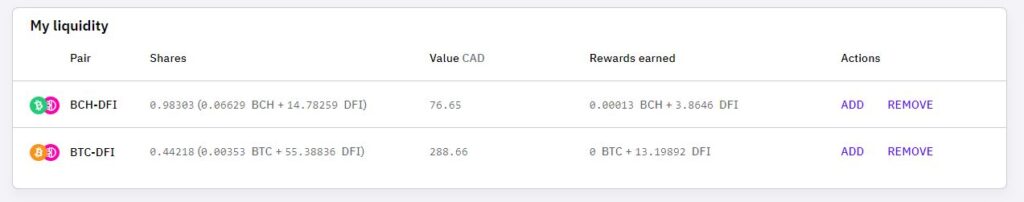

My current liquidity mining pairs are $BCH-$DFI and $BTC-$DFI. I really like that they pay me every 12 hours. Below is the screenshot of what I have and how much I received in rewards from liquidity mining in Cake during the past 3 months.

BTC reward doesn’t show because it is only 0.00000135 $BTC.

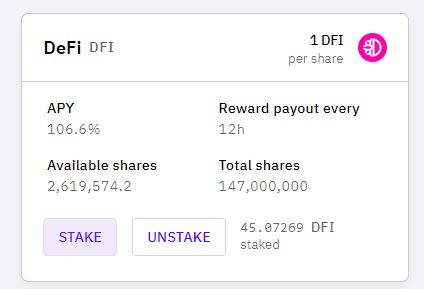

My second income in CakeDeFi comes from staking my 45.07269 $DFI tokens. In staking, I join masternode pools to earn high yield which is currently 106.6%.

You can start your Cake mission by investing $50 and getting a $30 bonus by using my CakeDeFi referral!

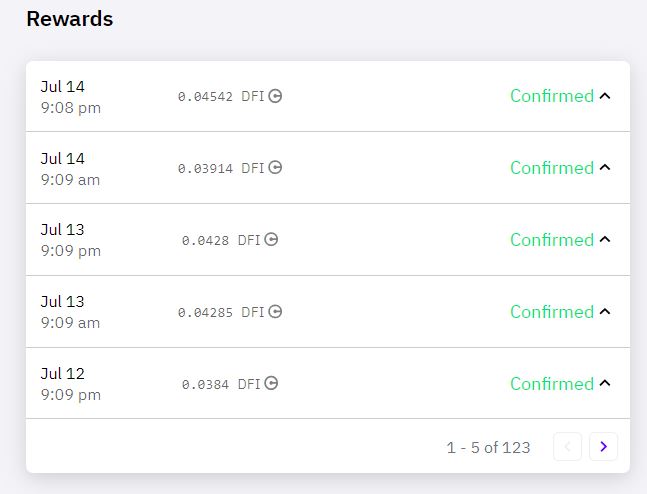

Below shows how rewards are paid out every 12 hours which I set to auto-stake.

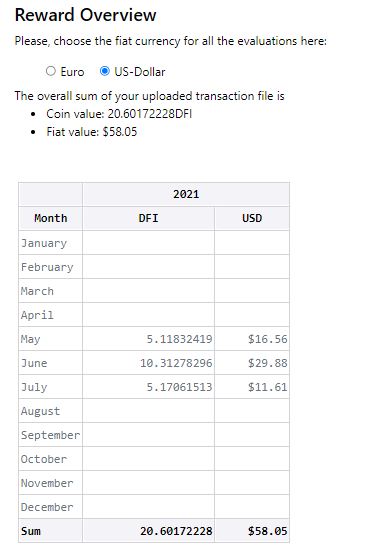

And here is the total reward I received since investing in CakeDeFi. $58.05 USD ($72 CAD) for $600 CAD investment in 3 months.

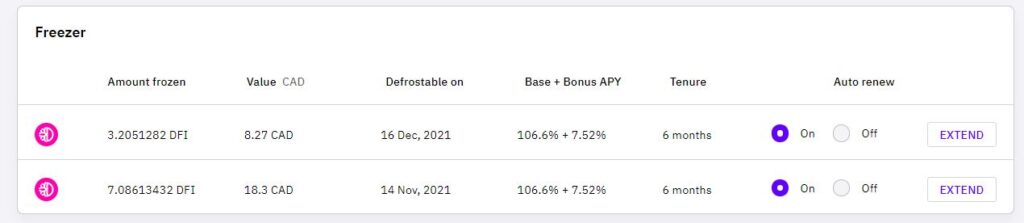

Another interesting option in CakeDeFi is the Freezer which is locking up $DFI for up to 10 years. Similar to GICs, the higher the length the bigger the rewards. I currently only have below DFIs frozen for 6 months with the auto-renew set to ON.

And this sums up my CakeDeFi wallet. Next is Nexo Exchange.

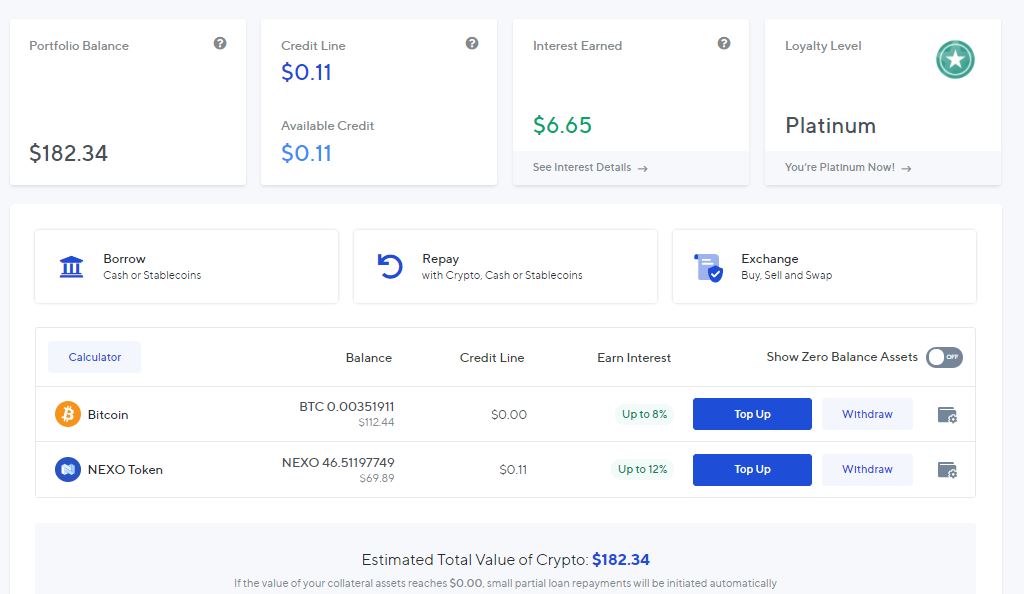

Nexo Exchange High Interest Crypto Savings Account

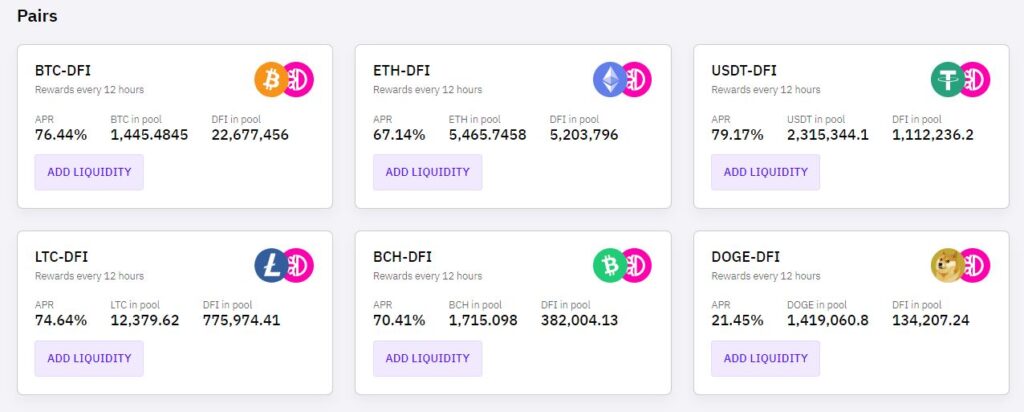

Nexo is a Cryptocurrency Exchange which provides earning interest on many cryptocurrencies including stablecoins. Nexo also offers up to 12% earning on USD, EUR, and GBP currencies.

Are you still holding your Cash US Dollar in a bank paying you 0.05%? It is time to do a change in strategy.

Join Nexo Exchange using my referral and top up $100, to get a $10 bonus.

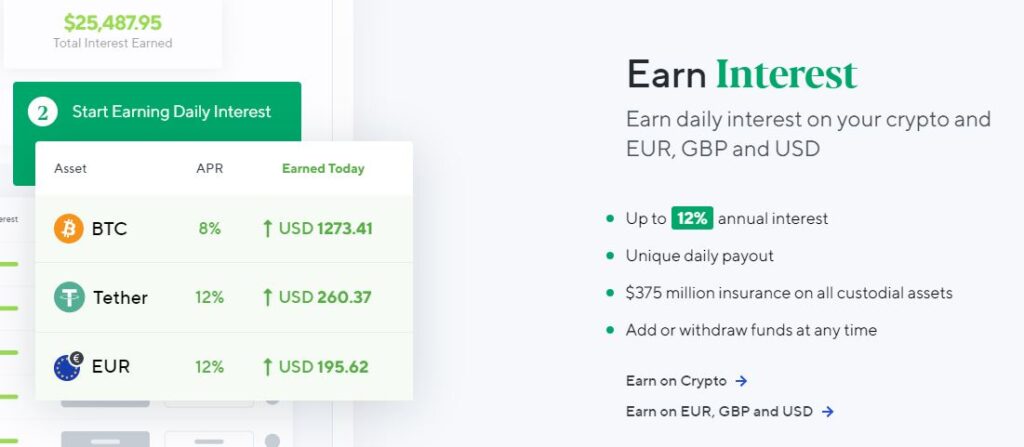

I don’t have much left in Nexo as I wanted to take advantage of promotions offered by Celsius. Therefore, I moved most of my assets from Nexo to Celsius temporarily awaiting the unlocking of the promos.

For now, I only have small amounts of $NEXO and $BTC in Nexo. I locked my $NEXO for 12 months to earn 12%. I also renew my monthly $BTC term to earn 8% interest rate.

As shown below, I earned $6.65 USD ($8.39 CAD) from Nexo Exchange.

Frankly, I am not planning to earn in any Altcoins (Alternative Coins) except $CRO and $DFI anymore. But I won’t sell my $NEXO for now as I don’t need the fund and I hate taking the loss.

Lending, Staking, & Supercharger in Crypto.com

Crypto.com is on a mission to accelerate the world’s transition to cryptocurrency. This platform offers so much that I keep discovering new products. Currently, I earn through three channels.

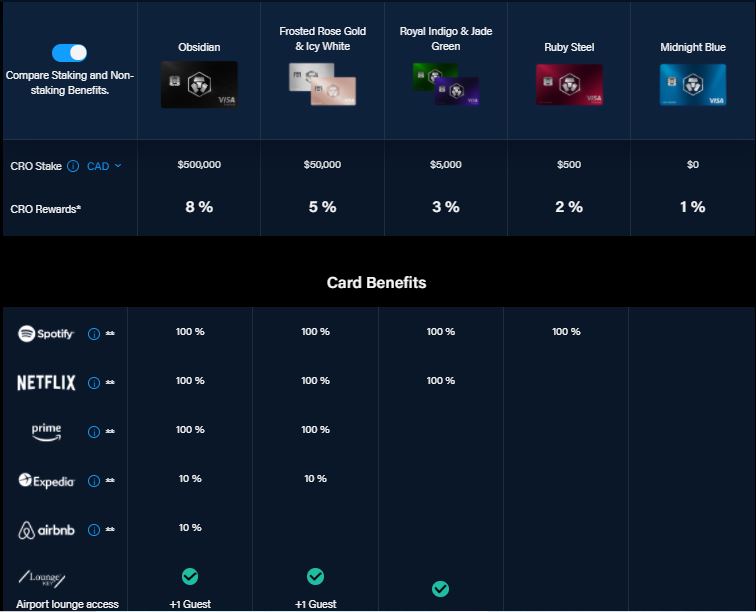

First channel is staking for the free Crypto.com credit card. There are currently 5 cards where each tier has its own features and benefits. However, the real fun begins with Royal Indigo or Jade Green credit cards.

With this tier, the $CRO cashback will be 3% on almost every purchase and the interest rate on earning will increase by 2% to 12% on 3-months terms. In addition, you get 10% for your staked $CRO.

Other benefits are rebated Netflix and Spotify memberships. However, the most amazing benefit especially for travelers like myself, is the free unlimited lounge access which I can’t wait to use!

I am in process of accumulating $5000 CAD ($4000 USD) in $CRO to upgrade my current credit card, Ruby Steel. I am aiming to reach the goal by end of August or even earlier.

The two highest tiers have some wild features including earning extra 2% (on top of the already applied 2%) bringing the total interest on Stablecoins to 14% annually. You also get a Private Jet Partnership which I have no idea what it means!

The interest on flexible $CRO wallet is low. Hence, I am utilizing the supercharger until I own $5000 in $CRO to stake for the upgraded credit card which will be locked for 6 months earning 10% interest.

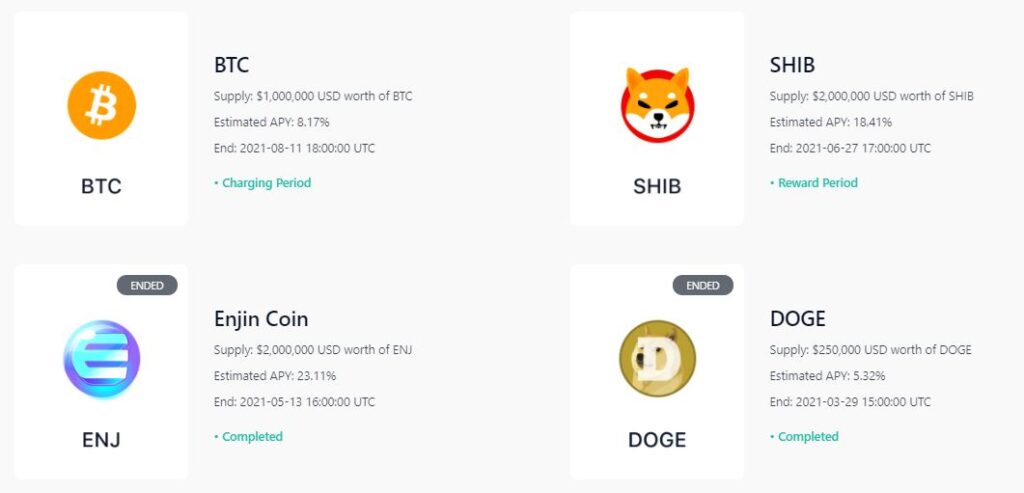

Supercharger looked like a mystery at the beginning, but it is really fun. Basically, you deposit money for 45 days where it can be withdrawn at any time without any consequences. After the 45 days, you get paid daily during the following 45 days based on the allocated time and amount in the event.

The current event is paying 8.17% interest in $BTC. I keep adding $CRO to supercharger till I reach my goal of holding enough $CROs.

To make it more fun, I participated in the previous Supercharger event during its 2 days and earned 64,000 $SHIB coin. I am keeping my $SHIB for maybe if ever (almost impossible) this coin wanted to behave like $DOGE.

Here are some of previous supercharger events. I had no idea what Enjin coin is and wrongfully assumed it is another useless coin similar to SHIB. However, thanks to my amazing Crypto researcher friend who corrected my mistake, I now realize that Enjin Coin is one of the most exciting projects in DeFi.

And there I reach the most important method of earning in Crypto.com which is the interest from lending.

I am only planning to buy $TCAD (Backed by Canadian Dollar) and $USDC (Backed by US Dollar) in Crypto.com App.

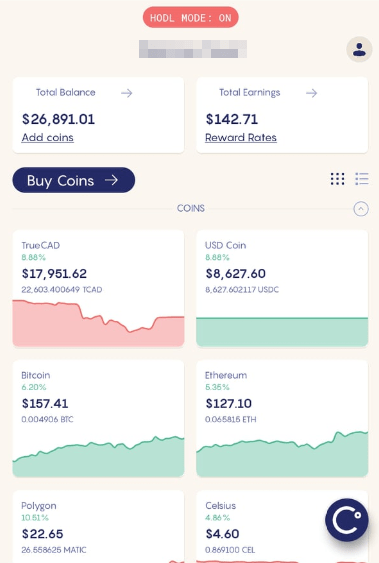

For now, I have $1000 in $TCAD which generates $1.92 every 7 days. Below is my Crypto.com Wallet.

Supercharger balance is $1684.88 $CRO. My strategy is similar to investing in the stock market. Dollar-Cost Averaging.

- Interac e-Transfer $100 CAD from Tangerine to Crypto.com App

- Purchase $USDC instantly and transfer to Crypto.com Exchange for free

- Put limit orders to swap $USDC with Crypto.com’s native token $CRO

- Transfer $CRO to the App and deposit in the Supercharger event

- When enough $CRO, stake for the higher tier credit card

Use my Crypto.com referral to earn $25 in $CRO.

I know these looks lots of work, but it all takes couple clicks. Everything except the e-Transfer which can take up to 30 minutes is almost instant.

My Celsius wallet is shown below. As you see, I am heavy in Stablecoins $USDC and $TCAD. I like stability so I am treating this as a very high interest crypto savings account.

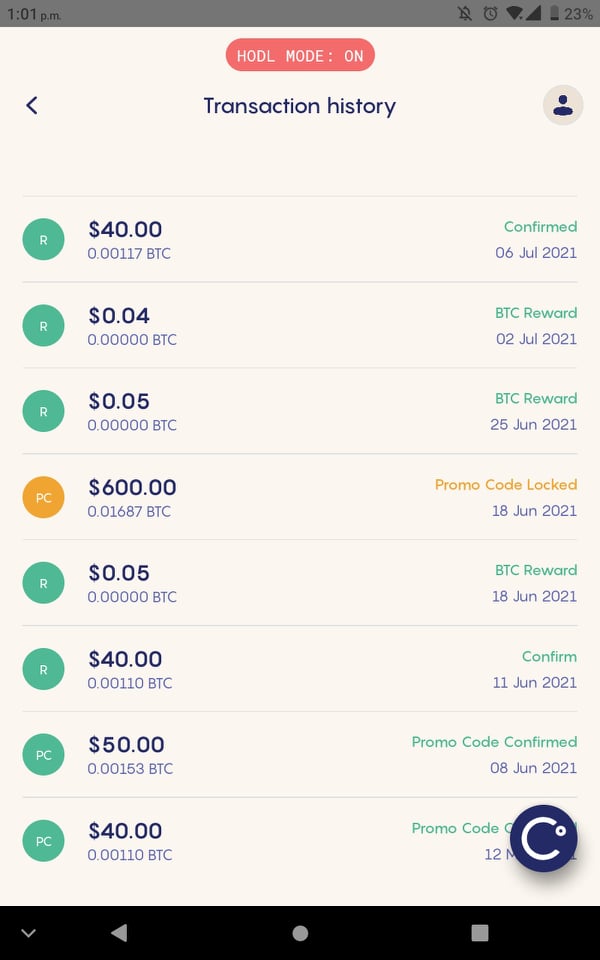

I bought almost all my $TCAD and $USDC less than 3 weeks ago and as you seen, I have already earned $142.71 USD ($180 CAD) which is paid every Monday morning.

I should mention all my $BTC in Celsius Exchange came from bonuses. So far, I have earned $170 worth of $BTC which is down to $157.41. I have earned many bonuses in Celsius mainly from deposits. I have to wait till September 19th to get the $600 or 0.01687 $BTC unlocked.

Final Thoughts About Earning on Cryptocurrencies

Hopefully I didn’t confuse you with my Cryptocurrency portfolios. I might have raised more questions than answers regarding high interest crypto accounts.

I tried to answer the “How to earn on Cryptocurrency” question through my own experience. I promise there will be dedicated posts explaining everything I know about some of these exchanges especially Crypto.com and Celsius 😊

My approach to use these exchanges comes after extensive research including watching many interviews with their CEOs and checking each exchange’s Twitter and Reddit account for reviews and the community engagement. I also check if they were ever hacked and how they protect their assets.

I personally don’t believe in royalty so I will use the exchange which is more trustworthy and giving me more returns on my investments. If Celsius pays less than Crypto.com or Nexo, I will move my fund there which is what I will be doing in September.

Feel free to leave your questions or comments below. Alternatively, you can message me directly via Email, Twitter, or Facebook.

Cryptocurrency Referral Codes

You can find all my links including referrals here. The referrals used in this page are below:

- Newton Referral: Earn $25

- Nexo Referral: Get $10 in $BTC

- CakeDeFi Referral: Earn $30

- Crypto.com Referral: Get $25 in $CRO

- Gemini Referral: Earn $10

There are other services I use that you can find under my referral page.

Reading this post affirms why I don’t invest in crypto it still just seems so complicated. Glad you’re making it work for your portfolio and I don’t think you’re alone in reaping the benefits. For now I will still with something I understand – real estate.

Hello Maria & Thanks for your thoughtful comment. Real estate is awesome.

But, Crypto is not as complicated as getting a mortgage, filling many applications, going through the bidding war process to purchase a property including paying for agents, lawyers, inspectors, contractors, and finally getting it hopefully rented out every month to a good tenant who won’t give you a headache.

Here is the simplified process to buy Cryptocurrency (And I am not suggesting you do it but just saying it is really much simpler than buying any type of physical asset):

1. Open a Newton Exchange account (Canadian Company). https://web.newton.co/r/GEGRQU

2. Buy your desired Cryptocurrency or Stabelcoin

3. Open a Celsius account. https://celsiusnetwork.app.link/134004dae3

4. Transfer your assets from Newton to Celsius and start earning

You can do all the above in an hour if the KYC (Know Your Customer) process goes through smoothly.

Great article, thanks for sharing the wisdom and the knowledge. It’s important to remember that Celsius is a hot wallet, you don’t own the keys, and there’s no insurance from any side of it, so there is SOME risk.

Hello & Thanks for stopping by! Very true. However, as I mentioned in my in-depth Celsius review here “Celsius uses MPC (Multiparty Computation) through Fireblocks as its custodian which is SOC 2 Type II certified. Fireblocks insurance policy covers both stored and in-transit digital assets”

Wow, I didn’t understand any of it at all, but it sounds like you’re doing well. I couldn’t imagine doing what seems to be a lot of learning, a lot of work, a lot of accounts, lots of transactions, some risk for a few hundred dollars. Or maybe I have that all wrong!!

I communicate with someone who claims to be making enormous $$$ with USDT, ETH.

Maybe I’ll DM you on twitter.

Cheers

Hello Deane & Thanks for stopping by.

It was a period of excitement to know more about all these places so I can try personally and write reviews about them. I ended up opening up a dozen new accounts.

However, the yield is still great. I have a very small amount in Crypto (mostly USDC and ETH) nowadays but it generates almost half of the passive income.

It is a lot of risk indeed and all these places can go down at anytime. Many of the “reliable” ones like Celsius, Hodlnaut, or even publicly traded ones like Voyager went under during this bear market and they took people’s money with them (Gladly, I didn’t have any money in any of them or took it out on-time).

You can try for fun and experience but I feel you are doing great already and no need for this extra headache.