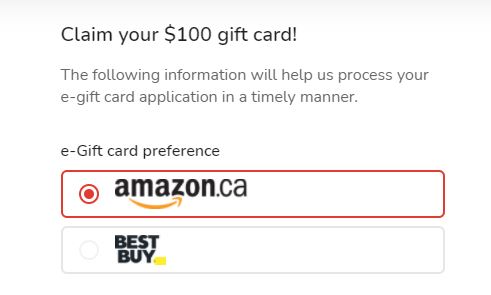

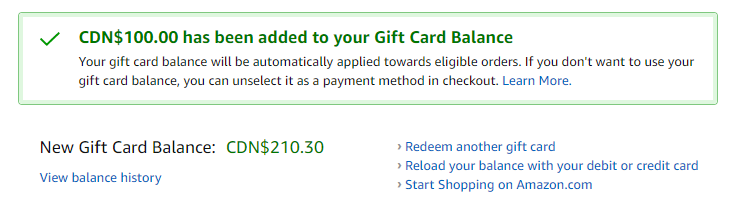

Update 1/1 – It took only 4 days (2 Business days) to receive my $100 Amazon.ca Gift Card offer.

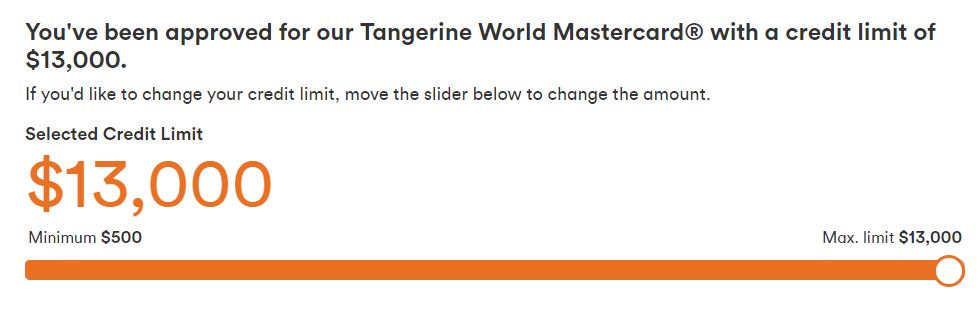

I got approved in 60 seconds. $13000 Credit Limit!

As you might have already figured out, I love applying for new Credit Cards to get some free money. Those special unique credit card offers including free Gift Cards are awesome.

I have never seen such an offer for Tangerine Credit Card anywhere so feeling lucky to have found this offer. I always apply for new Credit Cards for a good free money. Who doesn’t want a $100 without any hassle or commitment for a no-fee credit card?

- Read my Tangerine Bank Review for more info about Tangerine Bank and its services.

- You can also read True Best Travel Credit Cards in Canada 2021 and my choice of next credit cards for great bonuses.

This $100 free Gift Card offer can be activated only by applying via this site. These guys get some referral from Tangerine when you activate your card through their site (I don’t benefit from them).

Process to Get $100 Gift Card Special Tangerine Credit Card Offer

- Go to https://rates.ca/credit-cards/special-offers and click “Apply Now” and choose either Amazon.ca or BESTBUY e-Gift card.

2. Complete the form by entering your name, phone number, and email. Gladly there is no personal information to be given to them. I would have avoided it otherwise.

3. You will be directed to Tangerine’s official site. If you have a Tangerine account, sign in to your account and proceed with the card. If not, you will have to create an account first.

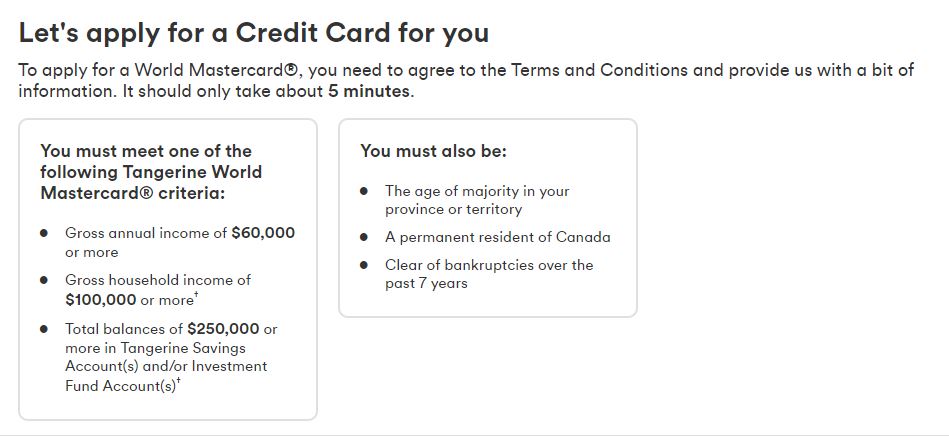

4. Complete the Application which really takes 5 minutes asking standard question about your income, employer, address, SIN, etc. All the information is already filled up if you have an account.

5. You will then wait couple seconds and hopefully see something like below. It is always exciting to see the auto approval so quickly. Kind of scary as well. Took 43 seconds for my $13000 limit. I could have lowered my credit limit but I am fine as I will cancel my MBNA card.

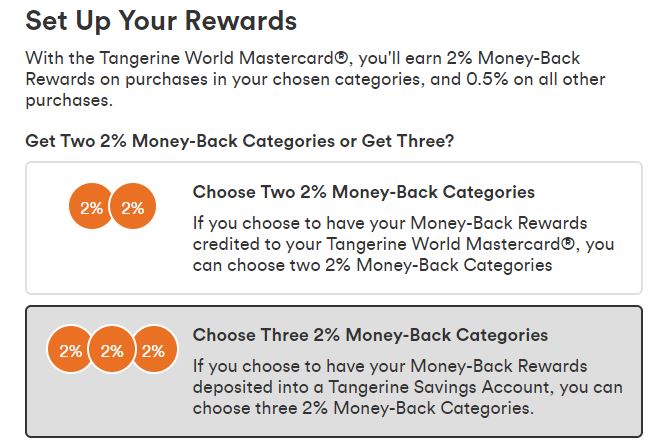

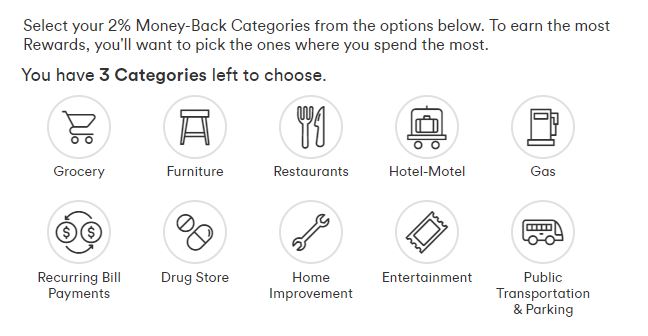

6. Part of the application after getting approved is to pick your preferred categories. Of course, deposit the cash back in your Tangerine account so you can pick 3 categories.

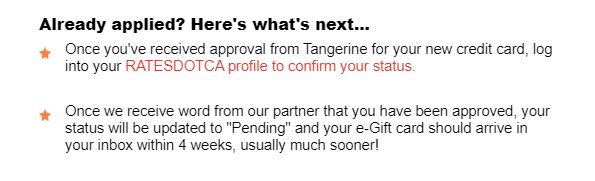

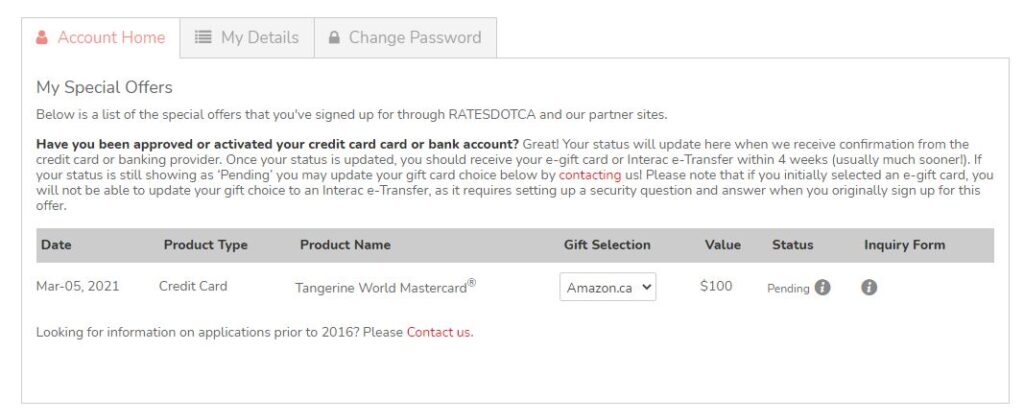

7. You should have already received an email from RATESDOTCA.

8. (Optional) Click on the link via the email and create your RATES.CA account. Login to track your claim status progress. I love this option!

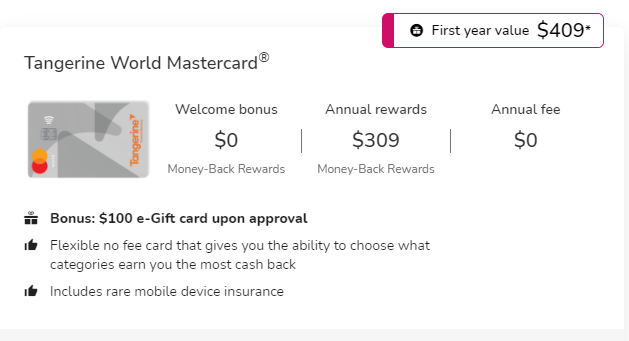

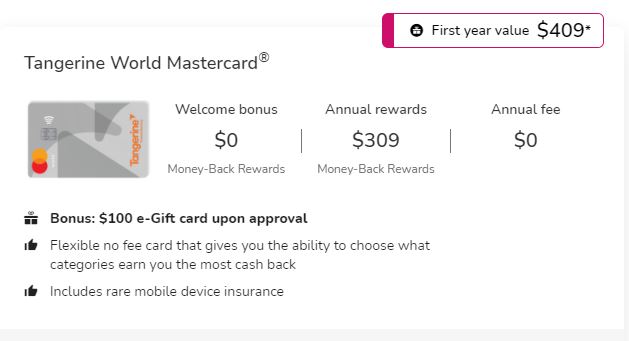

Tangerine World Mastercard Credit Card

Top 5 perks

- Mobile Device Insurance – $1,000

- Purchase Protection – 90 Days

- Rental Car Theft and Damage

- Extended Warranty – 1 year

- Mastercard Airport Experience membership provided by LoungeKey

- Boingo Wi-Fi for Mastercard

Money-Back Rewards

- 2% Money-Back on purchases in up to three categories of your choice

- 0.5% Money-Back on all other purchases

Interest rates

Promotional Rates

- 1.95% Balance Transfer promo for 6 months

- 1% fee on amount transferred

Standard Annual Interest Rates

- 19.95% on Purchases

- 19.95% on Cash Advance

- 19.95% on Balance Transfer

Criteria

- Personal Income: $60,000

- Household Income: $100,000

- Credit Score: Good (660+)

- Canadian Resident

- Provincial Age of Majority

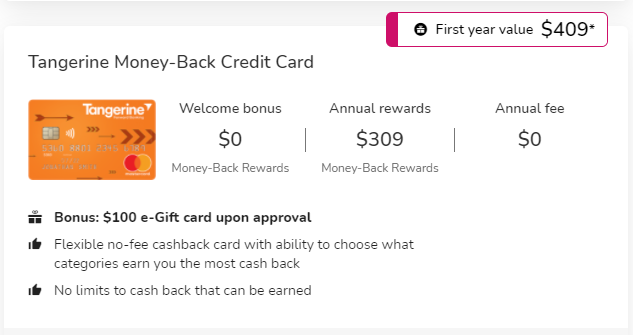

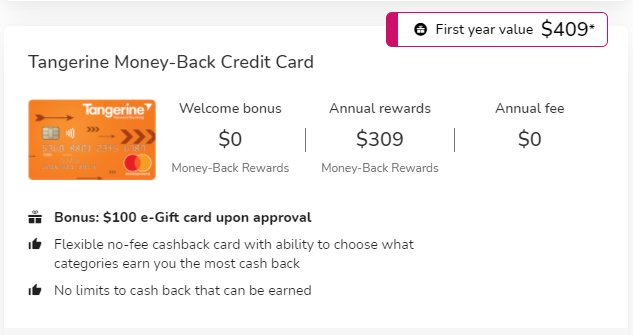

Tangerine Money-Back Credit Card

Top 5 perks

- Purchase Protection – 90 days

- Extended Warranty – 1 year

- Zero Liability Fraud Protection

Money-Back Rewards

- 2% Money-Back on purchases in up to three categories of your choice

- 0.5% Money-Back on all other purchases

Interest rates

Promotional Rates

- 1.95% Balance Transfer promo for 6 months

- 1% fee on amount transferred

Standard Annual Interest

- 19.95% on Purchases

- 19.95% on Cash Advance

- 19.95% on Balance Transfer

Criteria

- Personal Income: $12,000

- Credit Score: Good (660+)

- Canadian Resident

- Provincial Age of Majority

Time to cancel my BORING MBNA card! It has been a fun 8 years. I got that card when there was a special 5% cash back for 6 months. I don’t use it in most of my purchases anymore as I have Canadian Tire World Elite Mastercard offering 3% on Groceries (Walmart and Costco not included).

Enjoy your new card and let me know if you already have any Tangerine Credit Card.

After applying the new $100, my Amazon Gift Card Balance reaches $210.30. I think I should report this as income for my March report.

Thanks for sharing this, Mr. Dreamer. I will think about applying for one of these cards. I tried about a year ago and was REJECTED! I don’t know why. I’ve never been rejected for a card before. Maybe I’ll have better luck this time. 🤞

Hello Chrissy!

I am sorry but don’t let one rejection discourage you. Maybe you could have called the bank and check the reason with them.

They each look at different criteria but the main ones are income and credit score. Have you checked your credit score recently? I posted in another blog how TD rejected my application while Tangerine, BMO, and CIBC all approved me at the same time. Funny part is that my score on Equifax went up by 8 points.

I love the free money from these promotions. I found 2 others with gift cards on top of the bank’s bonus which I will apply for in 2 months. Just need to find a way to spend $3000 in 3 months on the new BMO card to get the bonus points. I probably end up buying Grocery Store’s Gift Cards as usual and enjoy the look of the store ladies when asking them to “Please put $1000 in this card”.

Bets of luck,

Mr. Dreamer

Thanks for the great tips. I didn’t realize that the banks will actually tell you why you were rejected. I’ll have to give them a call next time.

For some reason, during the pandemic, I’ve had NO motivation to do any card churning. I’m not sure why as I’m leaving money on the table!

Maybe it’s because I normally churn for travel points and things are still so uncertain. I will wait for the motivation to strike again, then I’ll get back to it!

I totally understand. I was still in the traveling Vibe and travelled once during the New Year break you can read about it on here.

However, since the latest rules, I can’t justify traveling considering the extra necessary costs (PCR test twice, Insurance covering Covid, and the Hotel Quarantine).

Seems like it is going to be the year we do the Cross Country Road trip (I wished we could return through the US but it is what it is).