Brim Financial offers one of the best free credit cards in Canada which is my go to for foreign day-to-day purchases to save on fees. Have you ever had a company paying you rewards on your birthday? Yes! Brim does every year!

What Is Brim Financial

Brim is a credit card issuer which is founded by Rasha Katabi in 2015 with its headquarter in Toronto, Canada and uses an innovative technology to connect consumers with merchants through rewards earned by using one of three Brim’s Credit Cards.

Join Brim Financial & get $10 by using my Brim Referral code 62333.

What Is Special About Brim Credit Cards

I initially considered Brim Mastercard when I was looking for a no foreign transaction (FX) credit card. Brim is a wonderful addition to my other travel credit cards. However, what makes Brim unique for me personally is its 0% foreign transaction fees in its free Brim Mastercard.

Other cool benefits are the Free Global Wi-Fi and a mobile app that provides access to Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and Fitbit Pay.

In addition, Brim offers Brim points back with a 1-2% Base rate reward. I think it is great to get 1% from spending in foreign currencies without paying 2.5% foreign transaction fees.

As Brim is partnered with merchants, you can get up to 40% in rewards by purchasing items through their partners using Brim’s eShop. The current highest rewards are Disney+ membership bonus (350 bonus points on top of the base rate) and NordVPN‘s 40% back in points.

Below is the detailed review of Brim Credit Cards. I will also discuss the features shortly.

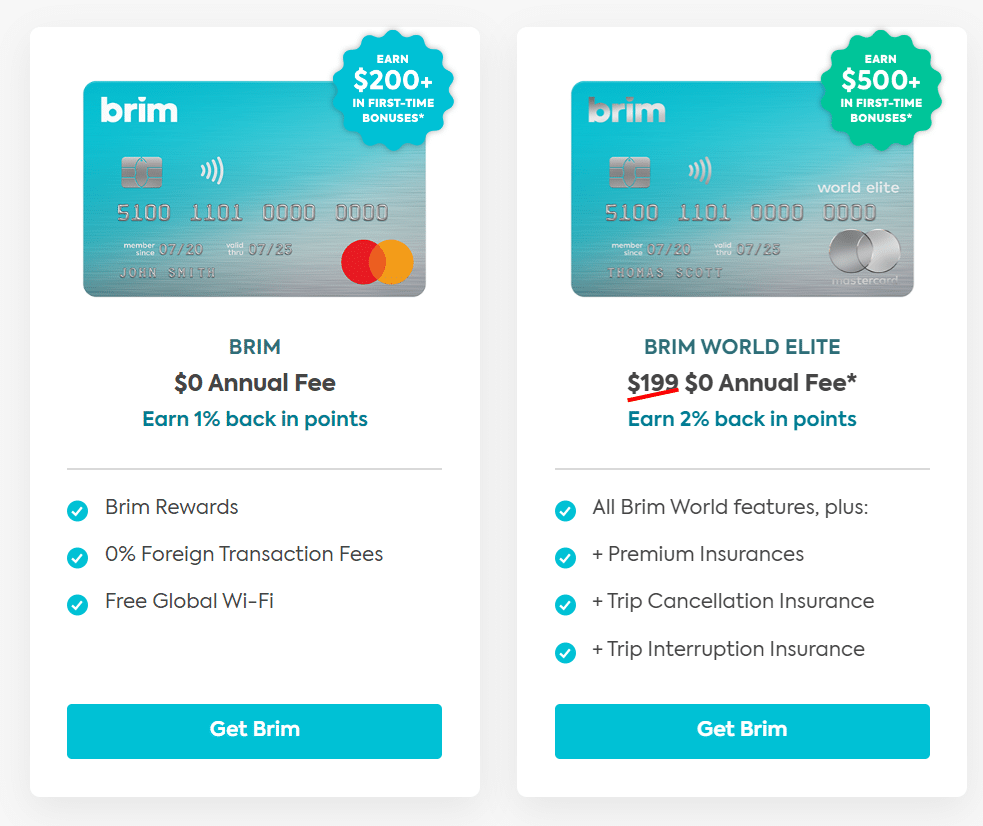

Brim Mastercard Features (Earn $200+ In First-Time Bonuses)

Brim has 3 different credit cards and Brim Mastercard is the only free Mastercard they offer. This is the card I own. Below are the free Brim Mastercard features.

- $0 annual fee

- 1% Brim Base reward (1 Brim point per $1) unlimited annually

- Brim Open rewards uncapped & unlimited

- 0% foreign transaction fees

- Installment plans for purchases above $500

- Free global Wi-Fi

- Free access to interactive budgeting & spending monitoring

- Real-time notification & wallet access through the app

- Receipt capture and maintenance

- Free additional members card

- Common carrier accident coverage up to $100k per insured ($300K per accident)

- Mobile device insurance up to $500 for loss, damage, or theft

- Event ticket insurance up to $1000

- Extended warranty which doubles the warranty up to 1 year capped at $25,000 per cardholder

- Purchase security insurance up to $1000 within 90 days of the purchase

The main reason I have this card is to get the 1% back and 0% foreign transaction fees when traveling internationally (Including the US) or even purchasing items from international resources including Amazon.com in US Dollar.

It is worth mentioning that this free card doesn’t provide any out of province emergency medical insurance which brings us to the next Brim Mastercard.

Brim World Elite Mastercard Features (Earn $500+ In First-Time Bonuses)

Brim World Elite Mastercard offers comprehensive travel insurance but still has its own limitations. For a card with such a high fee, I’d expect much more which is the reason I am not upgrading my Brim card.

- $199 annual fee (Waived first year for new Brim clients)

- 1.5% Brim Base rewards (2 Brim points per $1) up to 25K annually

- Brim Open rewards uncapped & unlimited

- 0% foreign transaction fees

- Installment plans for purchases above $500

- Free global Wi-Fi

- Free access to interactive budgeting & spending monitoring

- Real-time notification & wallet access through the app

- Receipt capture and maintenance

- $50 additional members card

- Complimentary airport lounge key access (Need to pay $32 USD per visit)

- Common carrier accident coverage up to $150k per insured ($500K per accident)

- Mobile device insurance up to $1000 for loss, damage, or theft

- Event ticket insurance up to $1000

- Extended warranty which doubles the warranty up to 1 year capped at $25,000 per cardholder

- Purchase security insurance up to $1000 within 90 days of the purchase

- Emergency medical insurance for 15 days up to $5M

- Flight delay insurance $500 daily up to $1000 per occurrence for all insured (+4 hours delay)

- Baggage delay insurance $1000 per insured per occurrence up to $2000 for all insured (+6 hours delay)

- Lost or stolen baggage $1000 per insured up to $2000 per account

- Hotel or Motel burglary insurance up to $1000 per occurrence

- Car rental collision or Loss damage insurance for 48 days up to $85K MSRP

- Car rental accidental death max $100K per insured or $300K per accident

- Car rental personal property insurance $1000 per insured up to $2000 per incident

- Trip cancellation insurance $2000 per insured up to $5000 per trip

- Trip interruption insurance $5000 per insured up to $25000 per trip

The biggest disadvantage of Brim World Elite Mastercard is its $199 fee which is the highest I have seen among similar cards.

In the next part, I am going to discuss the mentioned benefits providing their advantages, limitations, and my recommendations.

Brim Mastercard No Foreign Transaction Fees

I believe this is the main selling factor for Brim Financial which is included in all 3 Brim credit cards. I should also mention that the transactions are settled based on Mastercard’s exchange rate.

Most other credit cards (including for a fee cards) charge 2.5% foreign transaction fees. The only other free credit cards with no FX fees in Canada is Wealthsimple Prepaid Visa.

Brim Mastercard Base & Open Rewards

Brim has two kind of rewards, Base and Open rewards. Base rewards are 1% for free Brim Mastercard, 1.5% for Brim World Mastercard, and 2% for Brim World Elite Mastercard. The 1.5% and 2% rewards are capped at $25,000 spending annually which then fall back to 1%.

For Brim Base rewards, one great advantage is that there is no category and the rewards are applied on all transactions including grocery, gas, restaurants, car rentals, hotels, flight tickets, and more.

However, even after maxing the $25K, you can still earn rewards through Brim Open rewards which are uncapped, unlimited, and accessible through Brim Marketplace (eShop).

Brim currently offers double points on Amazon.ca (Up to $10,000 in annual spend). This means, you can get 2% cashback on your Amazon.ca purchases using the free Brim, 3% Brim World, or 4% using Brim World Elite Mastercard.

Brim rewards can be used to pay credit card balance at a base rate of 100 points for $1. Redeeming is as easy as clicking “Redeem” next to the transaction on the portal. For the App, just swipe left! How cool!

Sometimes, there are redemption multipliers with some merchants which offer $1.5, $2, $3, or even more for each 100 Brim points. Points can also be redeemed for a min $1 (100 points) and they will never expire.

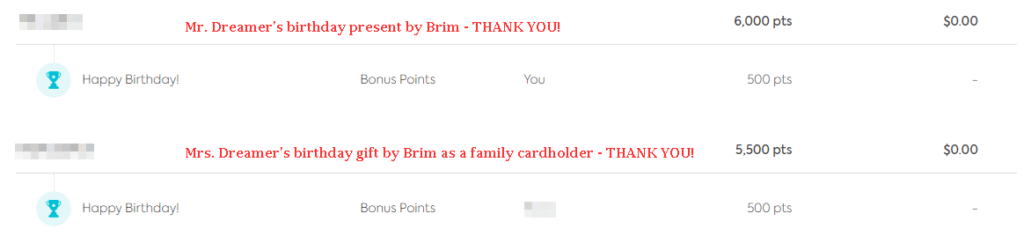

In addition, you get 500 Brim points on your and other members’ birthdays every year. You wonder why I like Brim Financial? Join now and you can get $10 plus giving me 20,000 Brim Points. Awesome, right?

Final note about rewards is that they don’t expire as long as the account is active. Of course, no Brim points if there is no Brim credit card account.

Brim Mastercard Free Global Wi-Fi

Brim offers free membership to Boingo which has over 1 million public hotspots worldwide including airplanes, trains, airports, restaurants, and hotels. This membership costs $14.99 USD / month if purchased directly but included with all Brim Credit cards including the free Brim Mastercard.

You will receive an activation code with your initial email to signup for Boingo and the rest is pretty straightforward process. The great feature here is that you can connect 4 devices simultaneously using the same credit card activation code.

It is worth noting that Boingo WiFi can also be used freely is some airlines as Boingo inflight.

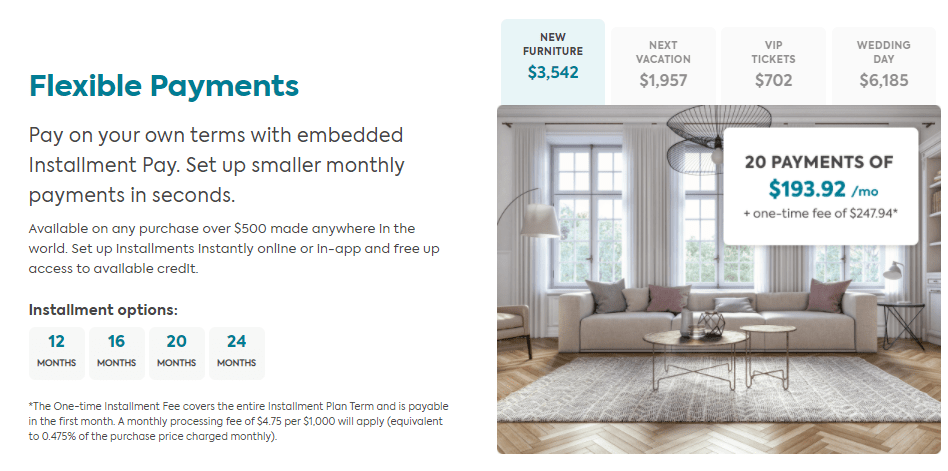

Brim Mastercard Installment Plans

I don’t really recommend using any installment plans as I believe in “Don’t buy if you can’t afford paying off instantly”. However, it is nice to see this unique feature for all Canadians except QC residents (QC Consumer Protection Act is really awesome as it protects against temptations).

This is available for any purchase above $500 with 4 options (12, 16, 20, or 24 months). Brim advertises it as a no interest installment plan but there are some fees included.

- One-time installment fee payable in the first month which is 7% of the overall purchase.

- Monthly processing fees equal to 0.475% of the overall purchase.

Let’s say you purchase an item for $2000 and finance it for 24 months. You will pay:

- $140 installment fee

- $2000 / 24 + ($2000 x 0.475%) = $83.33 in monthly installment plus $9.5 in processing fee

In total, for the no-interest plan, you pay back $2,367.92 which translates to 9.198% annual interest.

Whatever you have to pay monthly, shows up in the statement and needs to be settled following the minimum payment rules of each billing cycle or they will start accumulating the higher interest rate.

It’s worth noting that you can call Brim Financial and pay back your loan earlier than your term. This means, pay back as soon as you can to avoid extra fees.

Brim Mastercard Security

I am quite impressed with Brim Mastercard security honestly. You have multiple options to secure yourself including locking your card, locking online purchases, or locking foreign purchases.

In addition, Brim sends real-time notifications for purchases which is a very standard feature nowadays.

Brim Mastercard Insurance

Each Mastercard has its own insurance which I mentioned in the details of each credit card above. However, I won’t use any of the paid Brim credit cards personally especially not Brim World Elite Mastercard which costs $199 annually.

I especially don’t like that you only get 15 days of emergency travel insurance with World Elite and even less (8 days) with Brim World Mastercard. On the other hand, the rental car coverage is amazing and covers up to 48 days of rental in Brim World and World Elite Mastercard credit cards.

However, to be fair, you still get great great insurance and coverage even with the free Brim Mastercard which is impressive for a free card. Brim Mastercard offers Common carrier accident coverage, Mobile device insurance, Event ticket insurance, Extended warranty, and Purchase security insurance.

Brim Mastercard Airport Lounge Access

The free Brim Mastercard doesn’t come with Lounge access membership. However, the paid Brim cards have a complimentary lounge access. This feature isn’t really useful as you still have to pay $32 USD per visit per person.

This is another reason I don’t see the value in paying for Brim World and World Elite Mastercard credit cards. Other cheaper cards like HSBC World Elite Mastercard ($149) and Scotiabank Passport Visa Infinite ($139) credit cards include 4 and 6 Lounge accesses annually.

There is also Crypto.com Visa cards’ Royal Indigo and Jade Green which are free and offer unlimited lounge access annually. You need to deposit and lock $5,000 CAD worth of their token ($CRO) for 6 months but can withdraw your money afterwards and keep the lounge access.

Brim Mastercard Extra Benefits

All Brim cards come with free access to their interactive budgeting and spending monitoring tools which are available on both the portal and the app.

You can also set monthly spending limits in chosen categories. Noticing anything exciting below? Yup! No spending as I only use this card for foreign transactions.

Another great feature is the referral program. You get 20,000 ($20) Brim points anytime you refer someone to signup for a Brim Mastercard account. Did you click my link yet?

My Recommendations for Brim Mastercard Credit Cards

As you might have noticed, I don’t recommend using the World Elite Mastercard credit cards. However, I am totally recommending getting the free Brim Mastercard which gives nice coverage, no foreign transaction fees, 1% base return for all categories with no cap.

Another disadvantage of Brim’s World Elite card is the cap on 1.5 – 2% Base return which is $25,000 on spending annually. Add the no free lounge access and you will totally go against paying for the cards.

For travelers like myself, I also recommend getting the free Wealthsimple Visa Card which offers free worldwide ATM withdrawal and no FX fees.

A newer option is the Crypto.com Prepaid Visa Card which offers different tiers. Crypto is losing ground but I still love my card as it gives me free unlimited lounge access globally.

Final Brim Financial Review Thoughts

I personally combine multiple cards when traveling. I use Crypto.com for accessing lounges freely, Wealthsimple Prepaid Visa for international ATM withdrawals, and Brim to pay for international purchases and get 1% back in Brim points.

Join Brim Financial & get $10 by using my Brim Referral code 62333.

Finally, if you want a wonderful premium travel credit card, I highly recommend Scotiabank Passport Visa Infinite credit card with its awesome benefits and features including 6 free lounge access annually.

Switched to free Brim card after Home Trust Visa cancelled 1% cash back on foreign purchases a couple years back. (Also HT Visa customer service was difficult to access.) Been very happy with the BRIM Responsive customer service and no problems to date, knock wood.

Thanks, Lee for your feedback. Glad to hear it has been a good card for you. I also used it last month in the UK and Ireland with no issues.

It seems like the free card isn’t available now. I tried to apply and it leads me to sign up for the world elite card

Hello there. Thanks for your feedback. The free card is available but their sign up is strange. You just have to continue after the first page (click Sign Up) to choose the free card.

If you have doubt, feel free to call them 1-866-305-2746 and confirm.

I am inquiring for my credit card I have applied but it has been over a week and I have not heard anything.