There are many wonderful online Canadian Financial Calculators including Income Tax calculators and Budget Planners. I have spent some time trying to find out the best tools and calculators for personal financial benefit. I occasionally created my own calculators using Microsoft Excel. Here I am sharing the best resources that could help me at some point in time.

Official Government of Canada’s Financial Tools and Calculators

I would like to start by the official resource to set the bar for other tools. Financial tools and calculators include some great tools by Financial Consumer Agency of Canada (FCAC) and provide help in choosing a bank account or credit card. It also includes budget and mortgage calculators. Here I am going to review its main sections.

Budget Planner

Budget planner is a perfect too to create a personalize budget that suits your needs by selecting the answers that best reflect your situation. You will receive personalized tips, suggestions and will be able to compare your budget with those of other Canadians like you. This is a how this tool works:

- Start by entering some personal information like family situation, age range, work status, home, and primary budget goal.

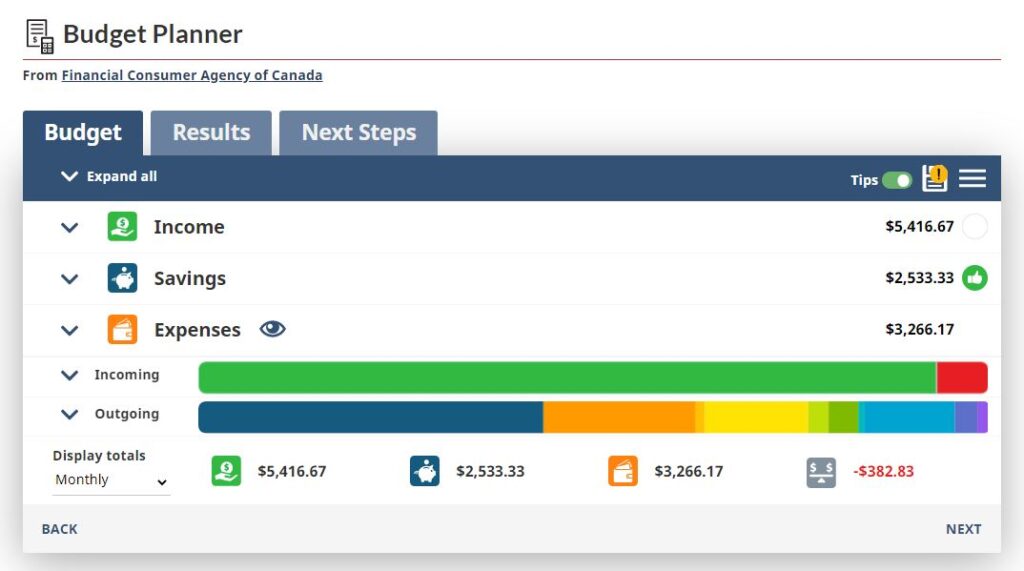

- Enter your income, savings, and expenses. It has a very detailed category list. In addition, it allows adding extra items if required. Everything is easily colored, and you can hover over every color to see the exact number and category.

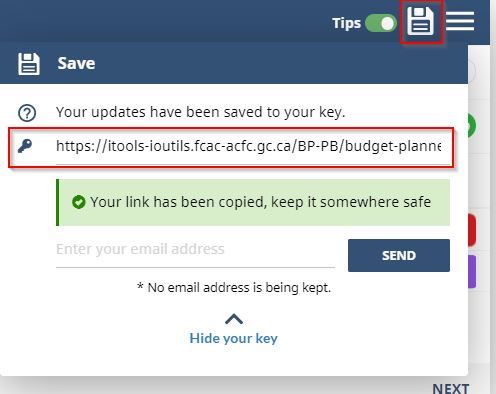

- Click Save which generates a special URL with a key specially made with this budget. You can always paste this URL in the browser and load your budget to view or modify. Also, Optionally you can enter your email and click Send to receive the URL in an email, so it never gets lost.

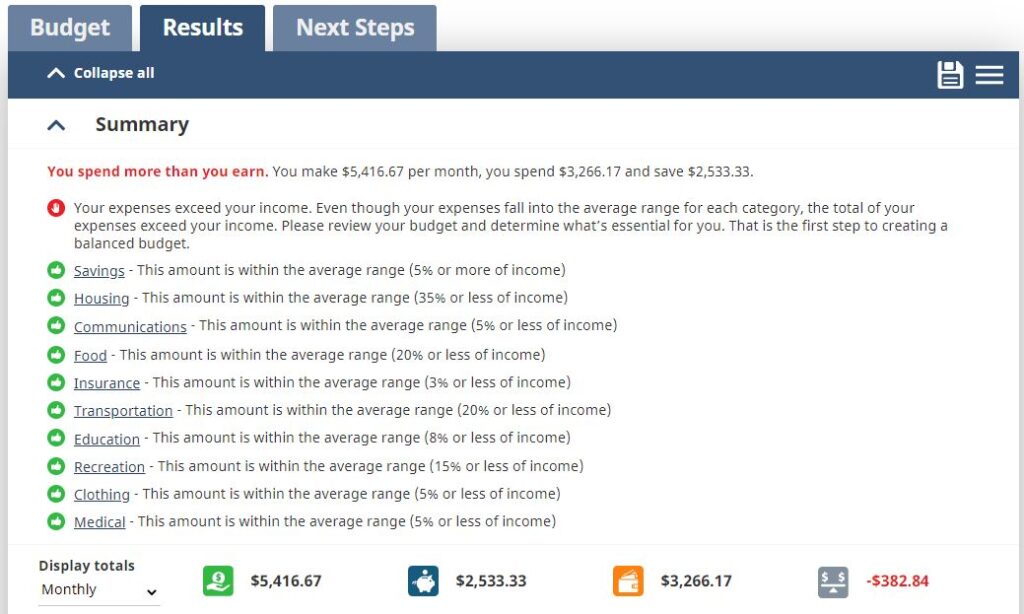

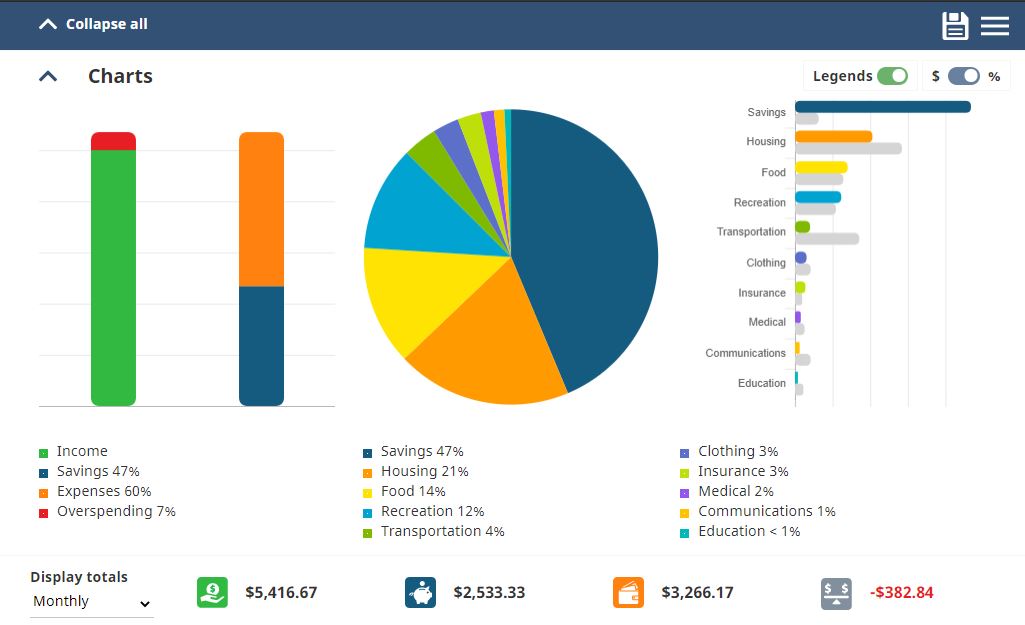

- Click Next to get your Results including a Summary with details of how you are doing comparing with the average range. Here you can also see Chats of what entered in Step 1 in either dollar $ or percentage % amount.

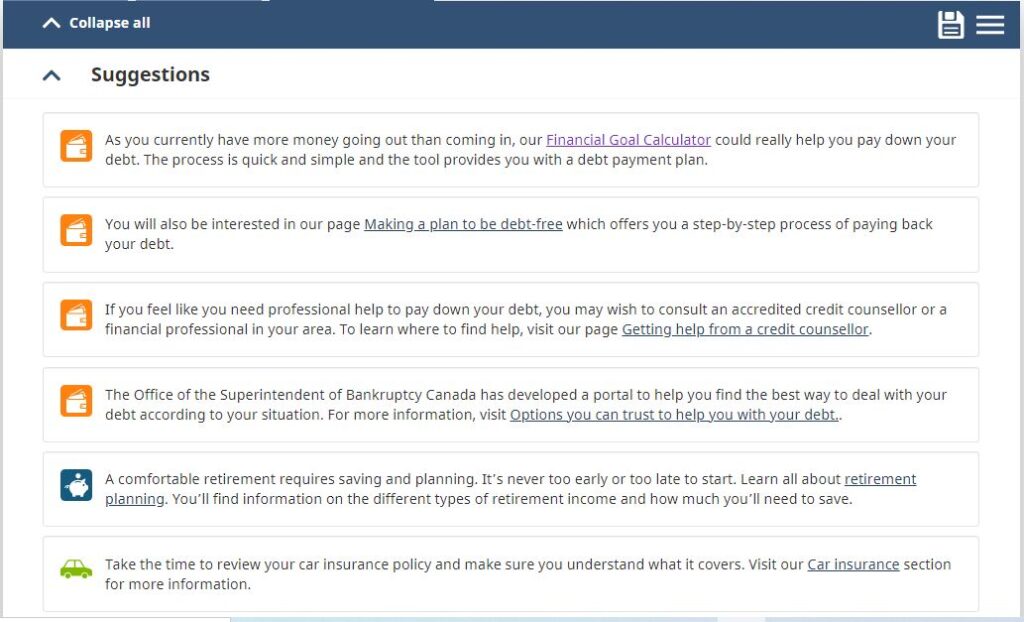

- Click Next to review the Suggestions. I find the suggestions to be useful and based on a good algorithm. In my example, even though, I didn’t record any debt, as my spending and saving showed more than income, the suggestion is offering checking Making a plan to be debt-free or Getting help from a credit counsellor.

Financial Calculator

Financial Goal Calculator is designed to help you manage your debt and savings goals which includes 2 sections:

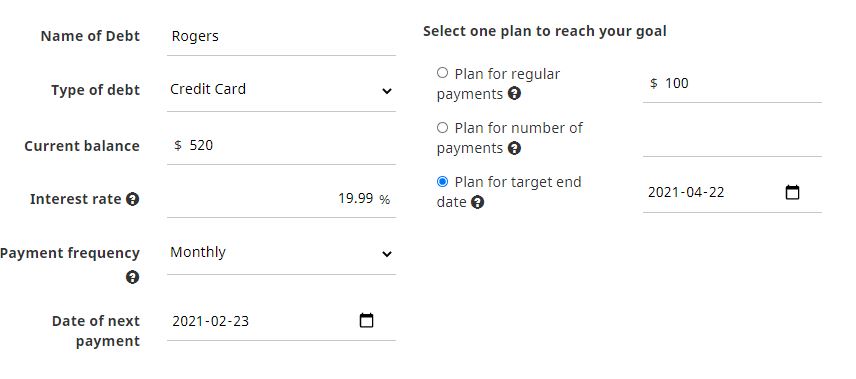

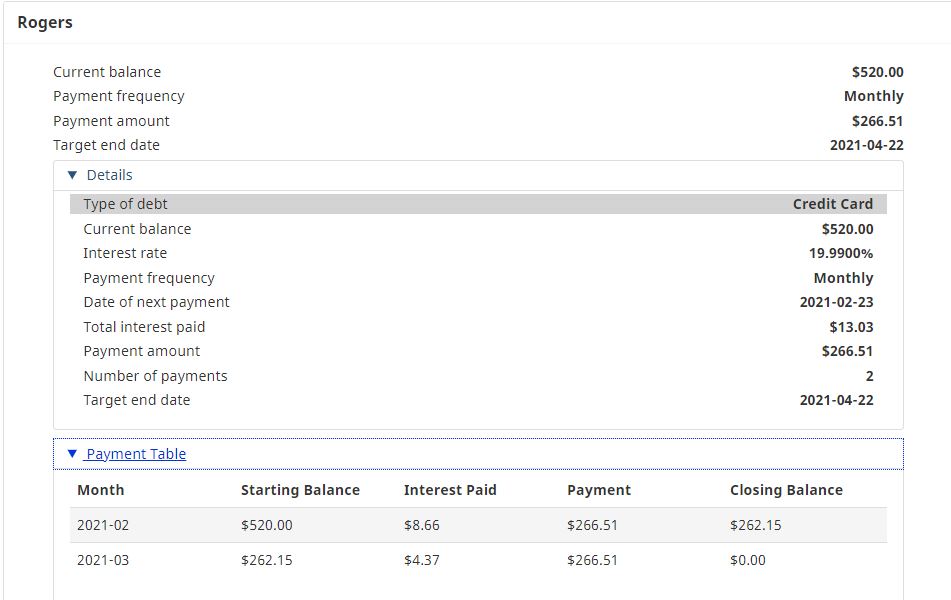

PLAN TO GET OUT OF DATE: Here you can enter the details for one of your debts. You may enter information on up to five debts. It will allow you to choose one of three payment options: Plan for regular payment where you enter dollar amount, Plan for number of payments, plan for target end date. Everyone’s situation is different, but I think the best option is to set a target date and stick with it. When done, click save and see your OVERALL DEBT PLAN DASHBOARD. You can also export it as PDF file.

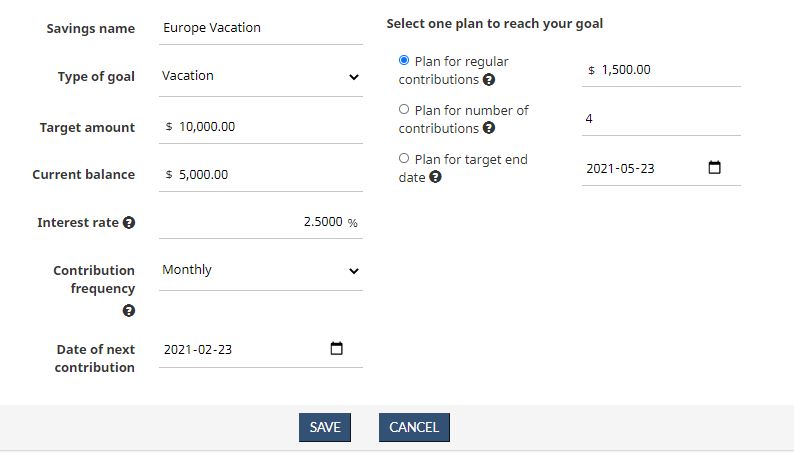

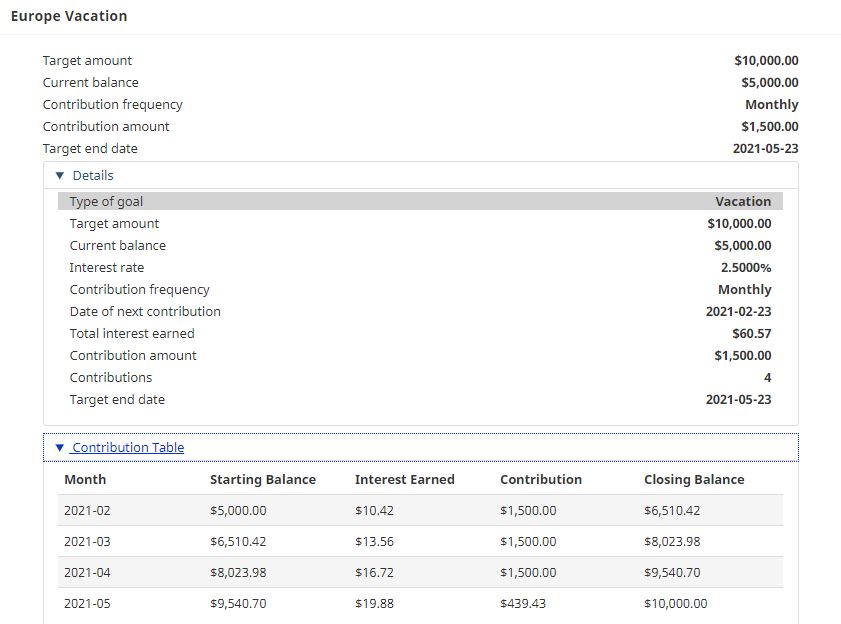

SET YOUR SAVING GOALS: This is like above, but it is a way to know when you can make enough saving for a specific goal. After entering the information including the total requirement, current saving, interest rate, and target date or regular contribution, click save to see your OVERALL SAVING PLAN DASHBOARD. You can also export it as PDF file.

Mortgage Calculator

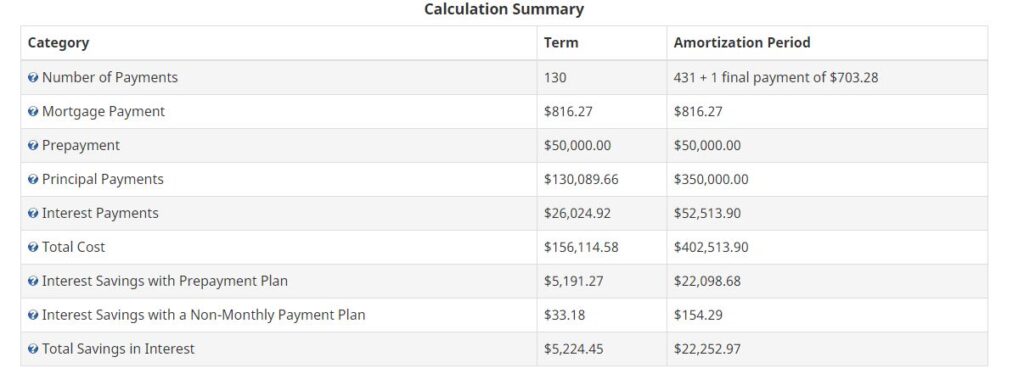

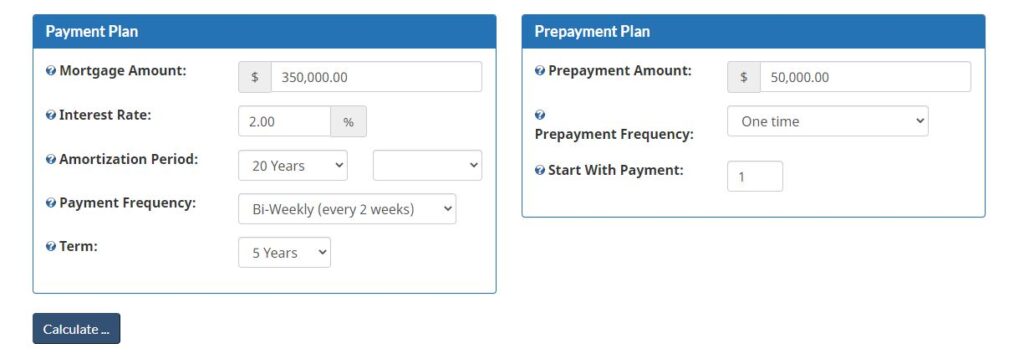

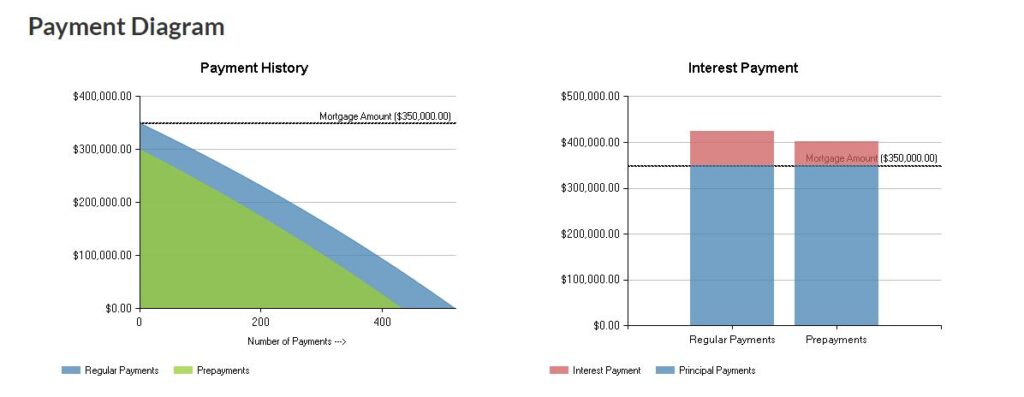

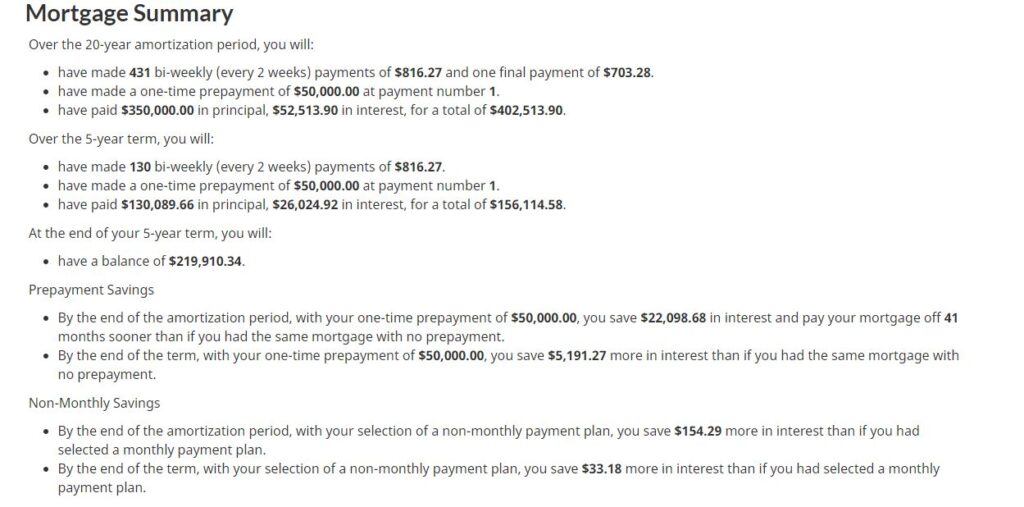

Mortgage Calculator determines your mortgage payment and provides you with a mortgage payment schedule. The calculator also shows how much money and how many years you can save by making prepayments. The calculator comes with its rules and limitations including the maximum amortization period for mortgages with less than a 20% down payment is 25 years. It is so conveniently providing you with a Calculation Summary, Mortgage Summary, and Payment Diagram.

Mortgage Qualifier Tool

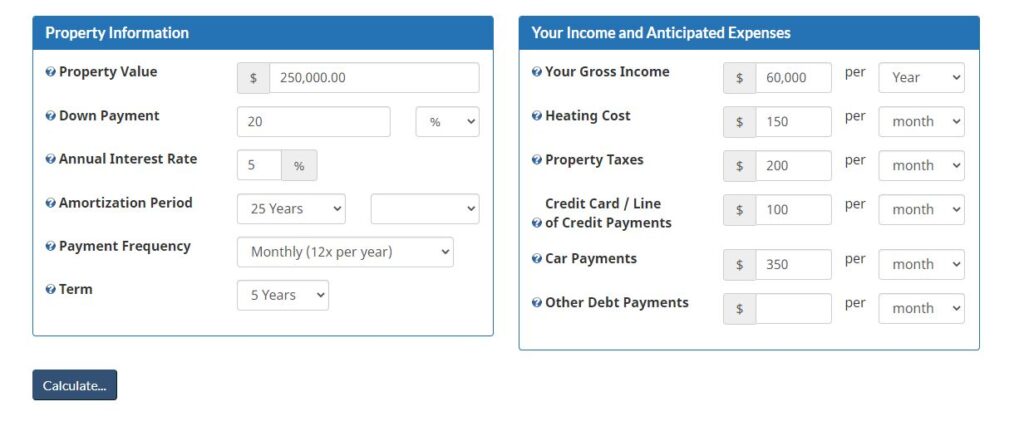

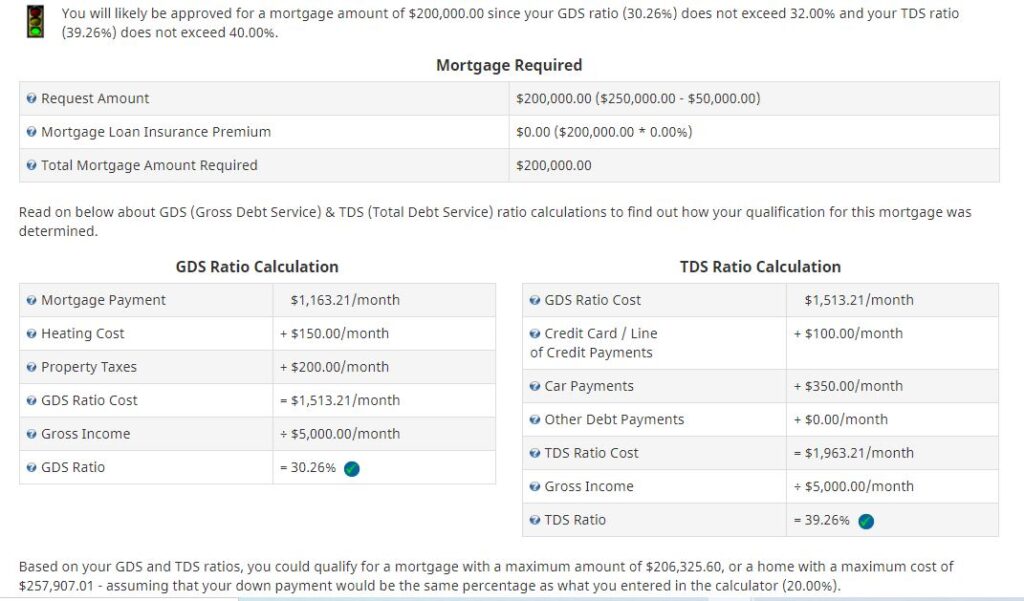

Mortgage Qualifier Tool determine whether you can qualify for a home mortgage based on income and expenses. To qualify for a mortgage loan at a bank, you will need to pass a “stress test”. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your mortgage contract. Also depends on your need of a mortgage loan insurance, the bank must use a higher interest rate.

FCAC uses a Gross Debt Service (GDS) ratio of 32% and a Total Debt Service (TDS) ratio of 40% in this tool as a guideline.

Account Comparison Tool

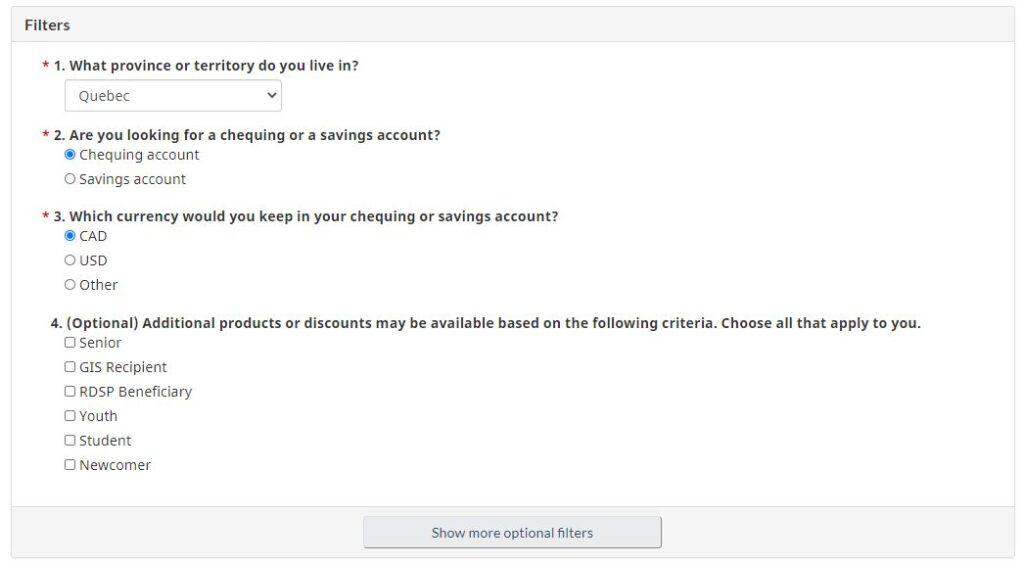

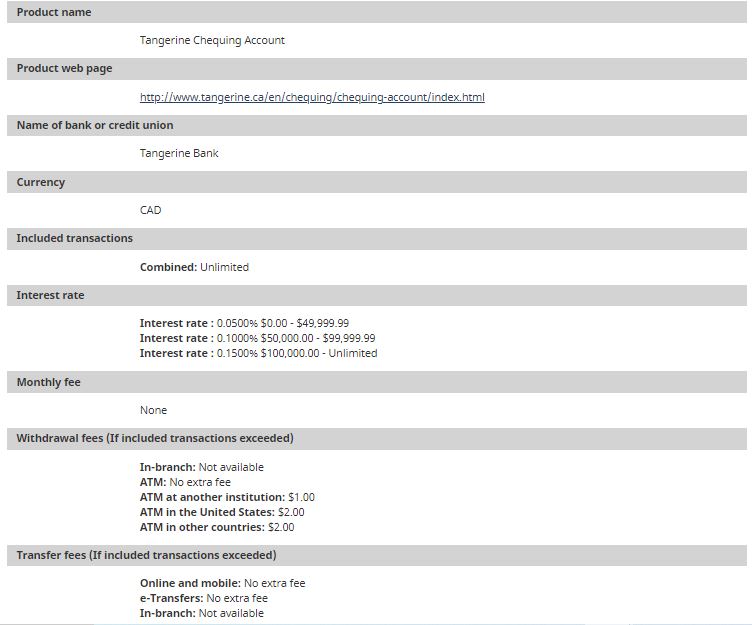

Account Comparison Tool Compare features for different chequing and savings accounts, including interest rates, monthly fees, and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results.

I was surprised by this tool. It is convenient yet overlooked. For below filter I got 50 results including Tangerine, Alterna, Desjardins, Laurentian Bank of Canada, Manulife Bank, and many more. You can click “View Details” on each result to get more details. It can also be exported to PDF or Emailed to Friends.

Credit Card Comparison Tool

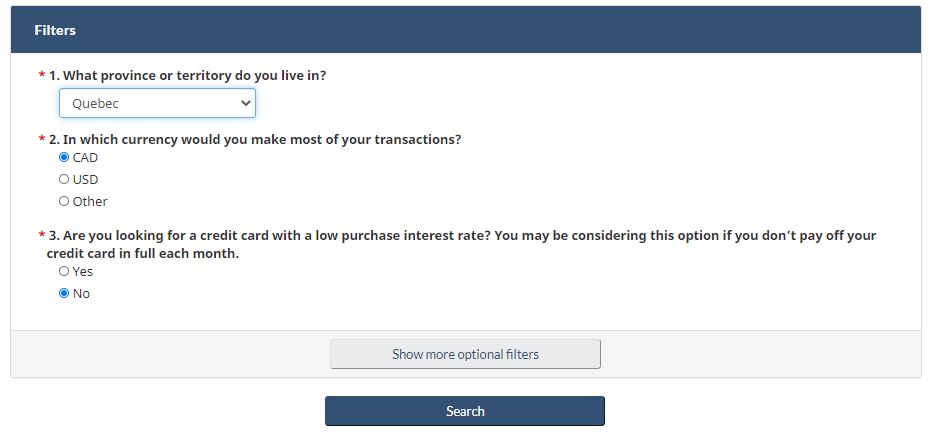

Credit Card Comparison Tool Compare features for different credit cards, including interest rates, annual fees, and rewards. Find the credit card that best suits your needs. Narrow your search, view credit card options, and compare your results.

When I ran the below search, I got 75 matching results. That is 75 Credit Cards which starts by lowest Interest Rate. Desjardins Flexi Visa with 10.9% interest rate all the way to a card called VISA EXPLORE by Laurentian Bank of Canada with a $110.00 annual fee and a 19.99% interest fee.

I do not think I like these Credit Card Comparison Tool. There are much better and easier on the eyes sites to help choosing a Credit Card. ACFC could have done a much better job making this tool prettier and easier on the eyes.

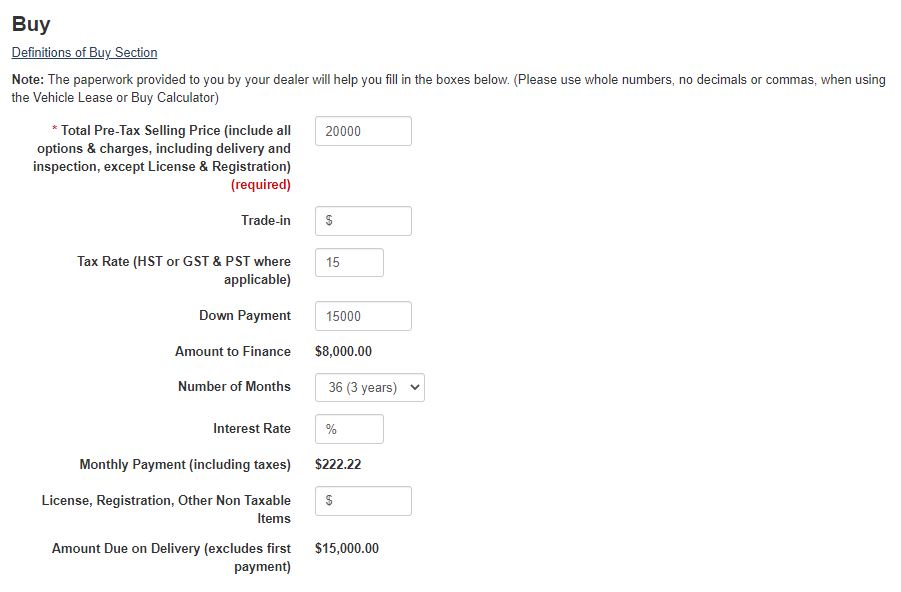

Vehicle Lease or Buy Calculator

Vehicle Lease or Buy Calculator which compares the costs to finance, lease or lease-buyout a vehicle over time. It is a simple calculator and not as fancy as it sounds. For instance, before opening, I expected a tool with a database of car values and value depreciation overtime, but I think I was asking too much.

Canadian Retirement Income Calculator

Canadian Retirement Income Calculator will provide you with retirement income information. This includes the Old Age Security (OAS) pension and Canada Pension Plan (CPP) retirement benefits. To estimate your retirement incomes from various sources, you will need to work through a series of modules. You will then need to compare them to your goal income. It also allows you to see the impact of the changes you make in how you save.

This online service includes information on the Post Retirement Benefit (PRB). It will help you better understand how contributions to this new benefit will further contribute to your financial security after you retire.

This is the most complicated and advanced calculator of all the ones mentioned so far. It takes about 30 minutes to use the calculator considering you already have your CPP Statement of Contributions or QPP Statement of Participation, Employer pension if applicable, RRSP statements, and statement of any other savings that will provide ongoing monthly retirement income (annuities, foreign pensions; survivor pensions, etc.)

I am not going into the details of this calculator as it deserves its own section.

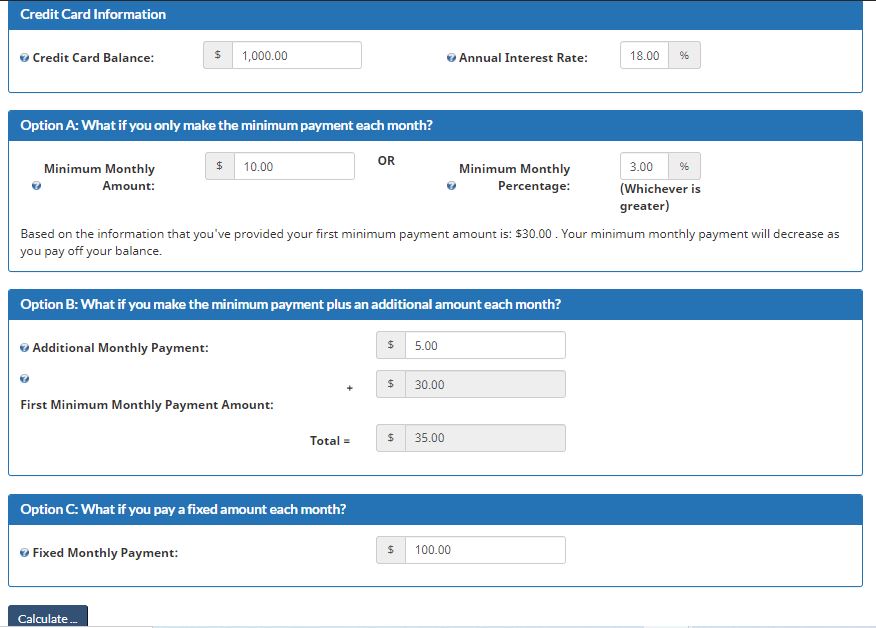

Credit Card Payment Calculator

Credit Card Payment Calculator It is always best to pay off your credit card balance in full by the due date indicated on your statement. If you cannot, you can still reduce the amount of interest you will have to pay. The credit card payment calculator compares 3 different payment options to pay off your credit card balance. The credit card calculator assumes that you are not using your credit card while you are paying off the balance.

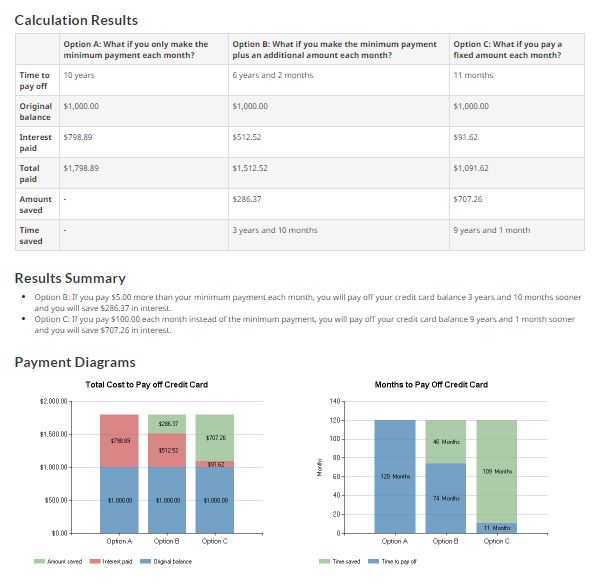

Option A: What if you only make the minimum payment each month?

Option B: What if you make the minimum payment plus an additional amount each month?

Option C: What if you pay a fixed amount each month?

It then offers a Calculation Results, Result Summary, Payment Diagrams, and Other Saving Strategies. For example, it says instead of paying $100.00 every month, if you pay $50.00 every 2 weeks you will save an additional $7.19 for a total savings of $714.46 and 9 years and 1 month compared to just making the minimum payment. You can also get a Summary report for each of the Options.

In addition to all the mentioned sections, if you feel adventurous, why not evaluating your money management skills and knowledge by taking an 8 minutes Financial literacy self-assessment quiz?

Lastly, the final part is Canadian Financial Literacy Database to find resources, events, tools and information on budgeting, money management, insurance, saving, investing, and taxes from various Canadian organizations.

I didn’t plan this post to be so long but I wanted it to be comprehensive. Thank you for reading and don’t forget to stay in touch by leaving your comment.