By now, you might have figured out that I have an addiction to finding ETFs and trying to have a balanced growth and dividend portfolio to boost my monthly income.

In this series of Best ETFs in Canada, I started to list the ETFs I hold with details including their holdings and MERs. I am providing answers to why I picked these unfamiliar low volume expensive ETFs over popular ETFs with high trading volume.

Initially, I wanted to make this in one post, but I realized how lengthy and complex it will get so I split it in multiple parts to cover my 17 ETFs forming my list of the Best ETFs in Canada. I understand holding 17 ETFs is very unusual and a big surprise! However, each ETF has its own purpose.

To be clear, I don’t like getting involved in USD-CAD currency exchange either by paying 1.5% to Wealthsimple (2.5% to Questrade) or using the complex Norbert Gambit method. Hence, I am sticking to ETFs listed in Canadian Dollar CAD on Toronto Stock Exchange (TSX).

As of today, my portfolio is about 35% ETFs. My goal is to have 15% Covered Call ETFs and 25% regular ETFs. These ETFs are mostly holding US and International exposure with the exception of XIC, VDY, and ZWC which are Canadian ETFs.

I personally use Wealthsimple Trade which is Canada’s first $0 commission.

Sign up using my referral code 8RR_5G to receive $10 to trade.

In this final Part III, I’ll cover my final 7 ETFs with Canadian, US, and International exposure.

In Part I of this series My Exotic Series of the Best ETFs in Canada – Part I, I covered technology ETFs including Blockchain. Currently, I don’t hold any Cryptocurrency ETF nor I plan to, but you can find a complete list under my Complete Cryptocurrency Purchase, Exchange, Wallet, and ETF Guide.

If you prefer a more advanced trading platform, I recommend using Questrade which offers amazing features including Options trading. You can get up to $250 or a free month in Questwealth, by using my Referral QPass 646713816388276.

Related: Best & Most Tax Efficient US & International ETFs Listed on TSX

Related: 5 Best Technology ETFs in Canada

If you’d like to know about my Health, Commodity, and Travel ETFs, I covered them in Part II of this series My Exotic Series of the Best ETFs in Canada – Part II. For now, let’s dive in and find out more the rest of my ETFs including some great dividend ETFs with attractive yields.

Brompton Global Dividend Growth ETF (BDIV)

BDIV offers monthly distributions and potential capital gains through an investment in an actively managed portfolio of large cap global dividend growth companies with a market capitalization of at least $10 billion selected by Brompton and complemented by a proprietary covered call program.

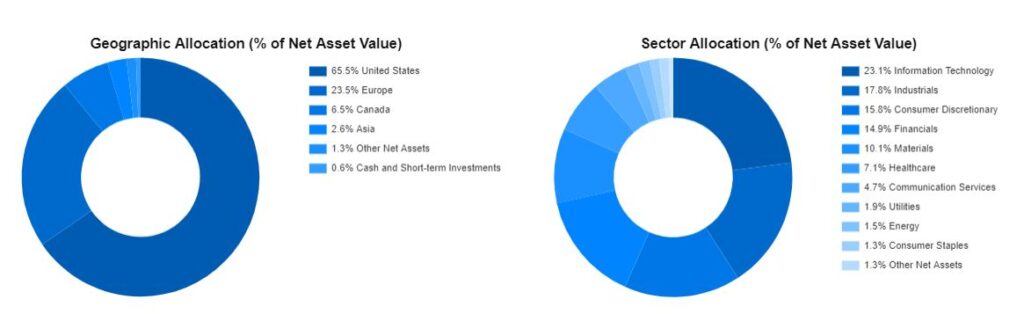

I chose this ETF because it offers an opportunity to diversify in sectors that are underrepresented in Canada like Tech, Healthcare, Consumer and Industrial. BDIV is mostly invested in the US market followed by Europe as shown below.

Of course there is a catch which is the high 1.15% ETF expense including both MER and TER. However, as I mentioned on previous parts, consider the whole picture. BDIV pays a monthly $0.10 per share which is equivalent to 5.58% annual yield based on its current cost. This means, the yield after deducting the high expense fees comes up to 4.43% annually.

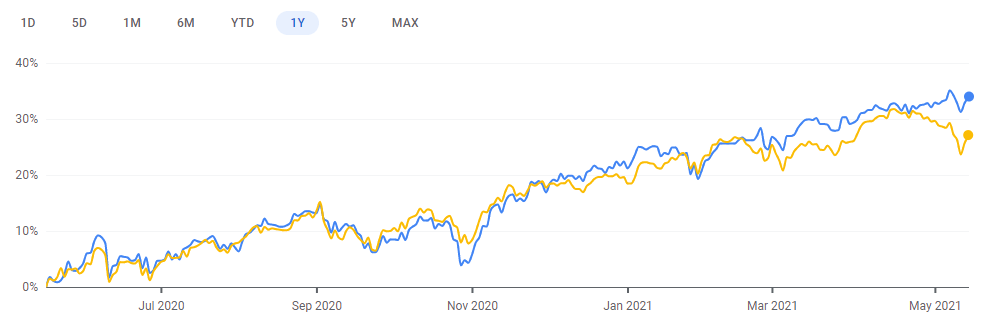

Considering the broad Global holdings of BDIV, I wasn’t sure how to compare its performance fairly. So, I am just showing below how close it moved with VXC (Vanguard FTSE Global All Cap ex Canada), XAW (iShares Core MSCI All Country World ex Canada), and XUU (iShares Core S&P US Total Market). However, VDY (Vanguard FTSE Canadian High Dividend Yield) is doing much better performance wise which is a reason I hold VDY as explained later on this post.

Basically, I am owning this ETF because it pays a great monthly yield plus a proven performance growth. I keep reviewing and comparing the performance annually to make sure I stay on top of it.

Harvest Brand Leaders Plus Income ETF (HBF)

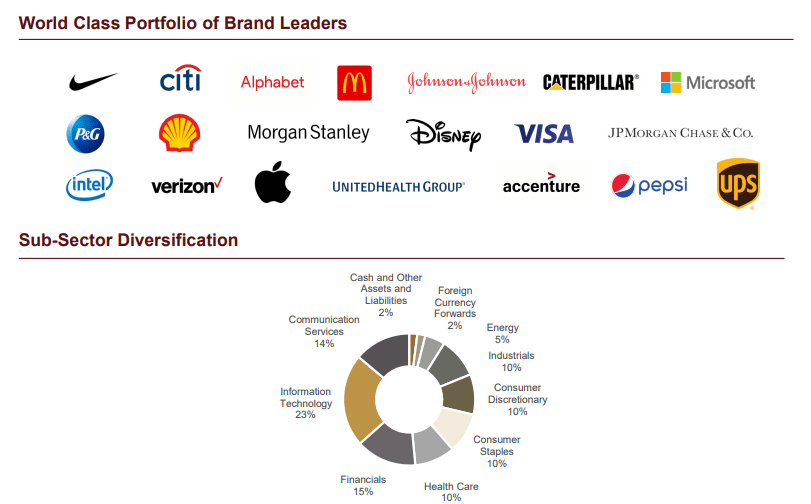

HBF is an equally weighted portfolio of 20 large companies selected from the world’s Top 100 Brands. The ETF is designed to provide a consistent monthly income stream with an opportunity for growth. In order to generate an enhanced monthly distribution yield, an active covered call strategy is engaged.

HBF currently pays $0.0542 per share monthly which is equal to 5.81% annual yield. However, as you expect, there is a high 1.19% ETF Expenses including both MER and TER. Deducting the expenses from annual yield means the pay is 4.62% which I consider a great dividend yield for holding great companies listed below.

HBF had a 34.01% growth versus 27.13% XUU (US Market) in the last 1 year. Based on this, I find holding HBF to have both growth and dividend income is a great choice. Also, it should be evaluated annually to confirm it is still on track for a good growth performance.

Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY)

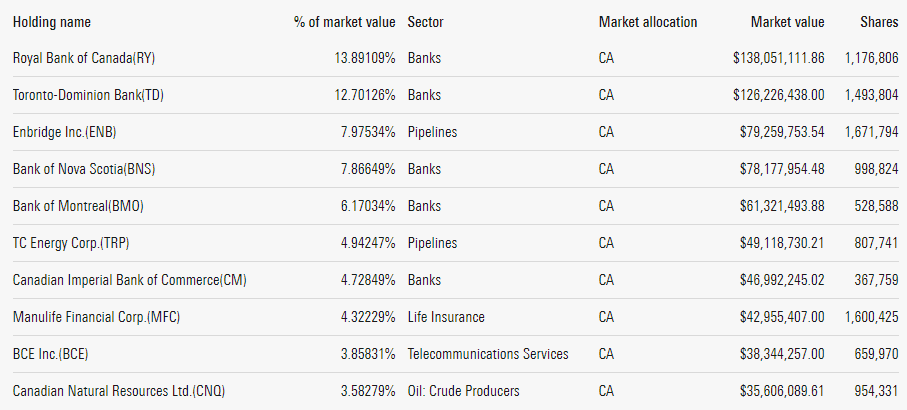

VDY seeks to track the FTSE Canada High Dividend Yield Index (or any successor thereto). It invests primarily in common stocks of Canadian companies that pay dividends. VDY distribution changes every month which makes it a little challenging to know the exact yield. However, the 12 month trailing yield as of 30 Apr 2021 is 4.07% annually.

VDY MER is 0.21% and currently holds 40 stocks with 60% Financial exposure followed by 23% in Energy. Telecommunication comes in 3rd with 8% holdings. As shown below, RY and TD count for 25% of VDY.

Currently, I don’t hold big banks directly (Except handful of TD Shares) in my portfolio which is a big concern for me personally. Therefor, I am covering my financial sector by holding VDY. But, my plan is to eventually add more Canadian banks directly and sell this ETF.

Vanguard FTSE Developed All Cap ex North America Index ETF (VIU)

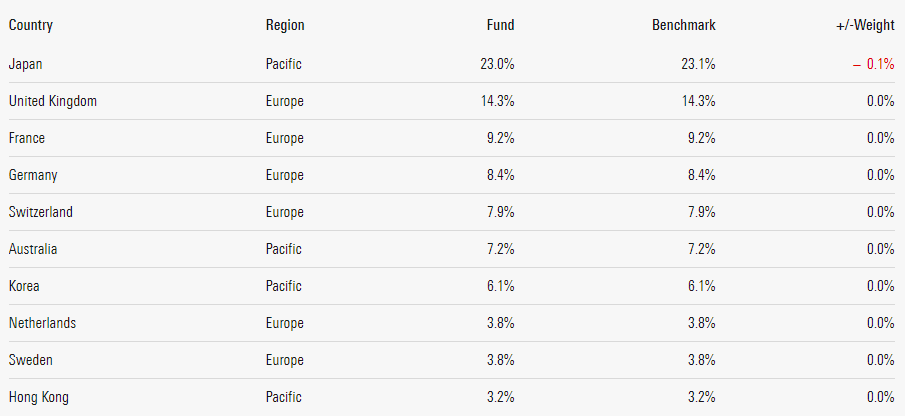

VIU tracks the developed market except US and Canada and pays a quarterly dividend which was $0.103621 per share or a 2.21% 12 month trailing yield. Its MER is 0.22%. VIU holds 3,839 stocks. 58.3% Europe, 41.1% Pacific, and 0.6% Middle East. Japan is the biggest holding with 23% followed by United Kingdom 14.3%.

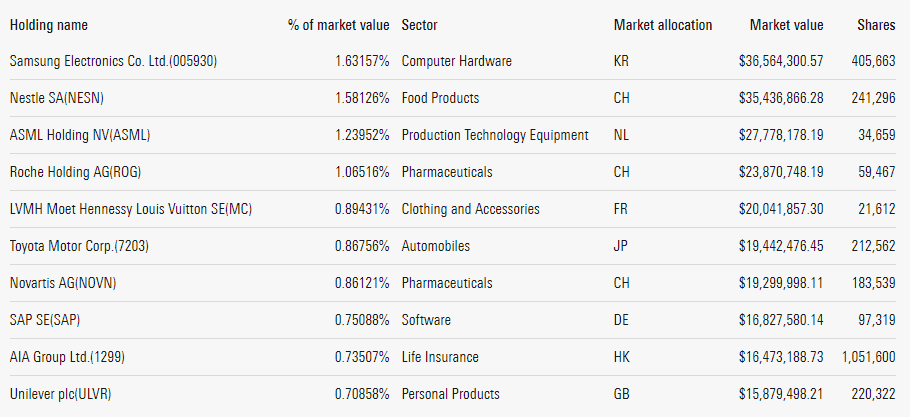

VIU has exposure to some of the best world companies including Samsung, Nestle, ASML, Toyota, SAP, Unilever, AstraZeneca, HSBC, Siemens, Sony, Allianz, and many more. Below are the top holdings.

I keep adding to my VIU slowly as I believe in the Developed countries growth. I also like the fact that I can invest in some of the world leaders through VIU. I did a detailed comparison between VIU versus XEF previously which you can read about here.

XIC owns the entire Canadian stock market with 229 stocks. Its MER is 0.06% and it pays quarterly dividend which was $0.20 per share which makes its 12 month trailing yield equal to 2.70%.

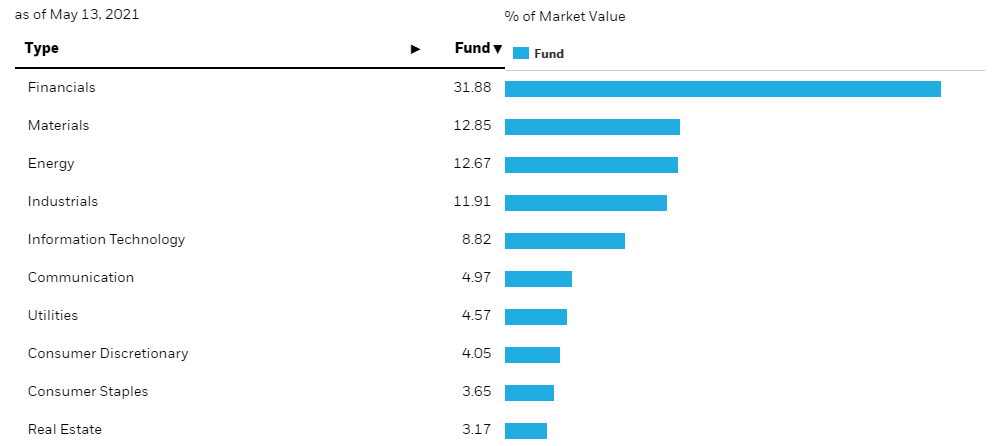

As shown below, XIC biggest 3 sectors are Financial 31.88%, Materials 12.85%, and Energy 12.67%.

I am adding to my XIC every time I have funds and Canadian market is down as I like to have exposure to all the Canadian market in addition to my exposure to the US and International Markets.

XUU owns the entire US market by holding ISHARES CORE S&P ETF (IVV), ISHARES CORE S&P TOTAL U.S. STOCK (ITOT), ISHARES CORE S&P MID-CAP ETF (IJH), and ISHARES CORE S&P SMALL-CAP ETF (IJR).

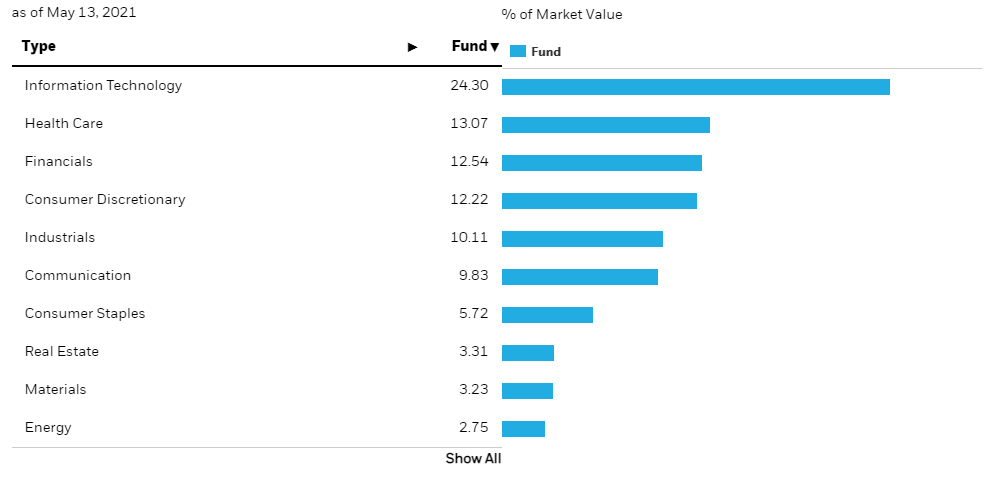

XUU has a very low 0.07% MER with a 12 month trailing yield of 1.25% which is paid Quarterly. Below is the current sector exposure which shows how Information Technology and Health are heavy on the US Market with a 37% weight.

I did a comparison of XUU vs VFV on my “Best & Most Tax Efficient US & International ETFs Listed on TSX” post which you can read here.

As I pointed out previously, I don’t like getting involved in USD-CAD exchange especially as USD keeps losing value. Instead, I buy the whole US market by adding XUU to my portfolio every time the US market is suffering.

BMO Canadian High Dividend Covered Call ETF (ZWC)

ZWC provides exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors. The Fund utilizes a rules based methodology that considers dividend growth rate, yield, and payout ratio.

The ETF also dynamically writes covered call options. The call options are written out of the money and selected based on analyzing the option’s available premium. The option premium provides limited downside protection. ZWC has a high 0.72% MER but a nice $0.11 monthly distributions which is equal to 7.31% annual dividend yield.

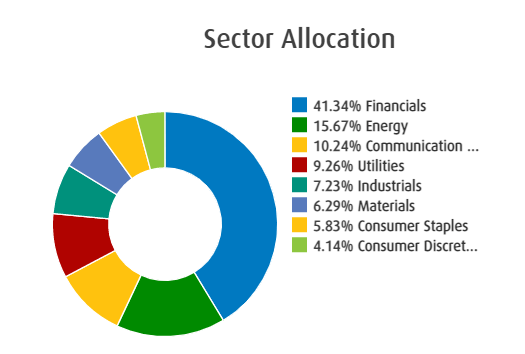

ZWC includes 81 Canadian holdings with the highest exposure to Canadian Financial sector followed by Energy and then Communication.

When it comes to performance, ZWC is lagging a lot comparing with VDY and XIC. ZWC had a 24.72% annual growth versus 40.89% in VDY and 30.03% for XIC. I am planning to have equal weight of ZWC and XIC in my portfolio. This will increase my annual income on top of reducing risk. However, it also means I am going to miss on some growth because of the Covered Call Options.

Final Thoughts & Recommendations about my Best ETFs in Canada

I pretty much enjoy increasing my shares on all these ETFs and generally believe ETFs should make an investor’s life easier. However, as shown on this series, they aren’t making mine any easier but happier and wealthier for a good reason. I like the growth as much as I want to keep the high dividend yield.

Indeed, the high MERs are painful but everything comes with a price. You can certainly do your own covered calls trading to save the fees but that will not be everyone’s job.

I need to make one point very clear. Many of these ETFs come with limited trading volume and a big bid-ask spread. It shouldn’t matter for long-term investors, but I always use a Limit Order and don’t stress about having it filled on the day. This is just to try avoiding being taken advantage of by the high asks.

As buying ETFs is really easy through either Questrade or Wealthsimple, I don’t see why I’d limit myself trying to pick an ETF over the other one. I spent time evaluating these ETFs and comparing them with traditional ETFs. I concluded that these ETFs considering their potential growth and distributions are worth the high MER even though I hope there were more competitions brining the MER lower. When I have doubts like in the case of Commodities, I hold both of them.

I will need to reevaluate some of these ETFs in a yearly basis and compare their performance with similar ETFs to make sure I am staying on the track as Covered Calls might leave some gain so diversification is a key to success.

Thank you so much for hanging around and I hope you enjoyed knowing more about my list of exotic best ETFs in Canada. Let me know your thoughts or if you buy any unusual ETF.

I like the way you explain your research findings – clear and thorough. Great job, thank you.

Thank you so much for your kind feedback. Appreciate it. Hopefully it helps others.

Excellent and unbiased comments and logical explanation helps when the financial jargon is in street language. Great work which I appreciate.