By now, you might have figured out that I have an addiction to finding ETFs and trying to have a balanced growth and dividend portfolio to boost my monthly income.

In this series of Best ETFs in Canada, I am going to list the ETFs I hold with details including their holdings and MERs. I’ll provide answers to why I picked these unfamiliar low volume expensive ETFs over popular ETFs with high trading volume.

Initially, I wanted to make this in one post, but I realized how lengthy and complex it will get so I split it in multiple parts to cover my 17 ETFs forming my list of the Best ETFs in Canada. I understand holding 17 ETFs is very unusual and a big surprise! However, each ETF has its own purpose.

To be clear, I don’t like getting involved in USD-CAD currency exchange either by paying 1.5% to Wealthsimple (2.5% to Questrade) or using the complex Norbert Gambit method. Hence, I am sticking to ETFs listed in Canadian Dollar CAD on Toronto Stock Exchange (TSX).

As of today, my portfolio is about 35% ETFs. My goal is to have 15% Covered Call ETFs and 25% regular ETFs. These ETFs are mostly holding US and International exposure with the exception of XIC, VDY, and ZWC which are Canadian ETFs.

I personally use Wealthsimple Trade which is Canada’s first $0 commission.

Sign up using my referral code 8RR_5G to receive $10 to trade.

In this Part II, I’ll cover 2 Health (HIG, PYSK), 2 Commodity (BASE, XBM), and 1 Travel (TRVL) ETFs.

In Part I of this series My Exotic Series of the Best ETFs in Canada – Part I, I covered technology ETFs including Blockchain. Currently, I don’t hold any Cryptocurrency ETF, but you can find a complete list under my Complete Cryptocurrency Purchase, Exchange, Wallet, and ETF Guide.

If you prefer a more advanced trading platform, I recommend using Questrade which offers amazing features including Options trading. You can get up to $250 or a free month in Questwealth, by using my Referral QPass 646713816388276.

Related: Best & Most Tax Efficient US & International ETFs Listed on TSX

Related: 5 Best Technology ETFs in Canada

In Part III, I will cover my choice of Mix Sector focusing on High Dividend ETFs. For now, let’s dive in and find out more about my Health, Commodity, and Travel ETFs.

Best Health ETFs in Canada

Healthcare is an under-represented sector in the Canadian equity market but it should be part of any diversified portfolio. I will be covering 2 Health ETFs in this section. I need to be clear as this might be confusing. In addition to the normal Health ETF, I am counting Psychedelics as a Health ETF. Eventually, the the final purpose of Psychedelics is to improve mental health by reducing anxiety and depression.

Brompton Global Healthcare Income & Growth ETF (HIG)

HIG provides monthly distributions and capital gains through investing in large-cap global Healthcare companies selected by Brompton, complemented by a proprietary covered call program. This is an actively managed ETF with the goal of optimizing distributable cash and total returns.

HIG comes in CAD Hedged (HIG) and USD (HIG.U) series. Its custodian is CIBC Mellon Trust Company with a total cost of HIG including MER (Management Expense Ratio) and TER (Trading Expense Ratio) of 1.09%. As always, don’t let the high MER makes you run away. There are other factors including distributions and performance to get the whole picture.

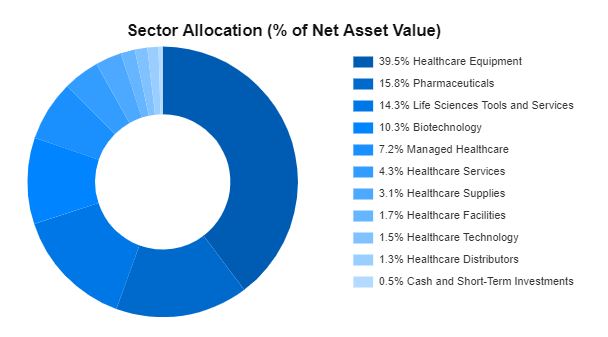

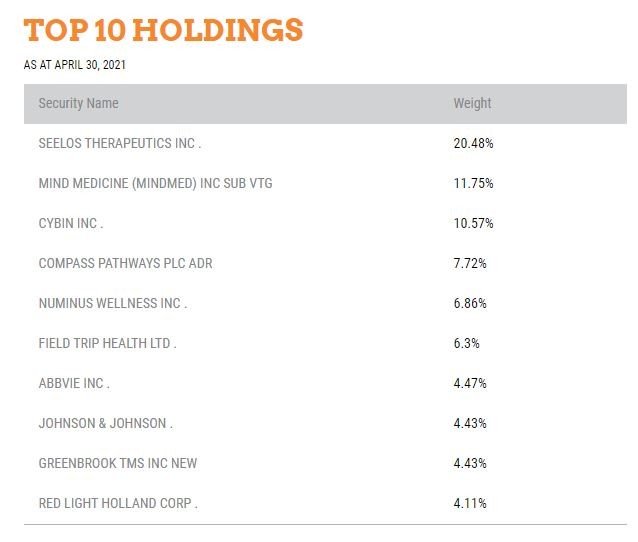

As shown above, HIG holds a diversified portfolio including different Health sectors with its majority holdings in US (87.1%) followed by European (11.9%) companies. In addition to the top 10 holdings below, HIG holds big names like UnitedHealth, Danaher, Amgen, Johnson & Johnson, and Boston Scientific Corp.

HIG pays a monthly $0.05 or 6.01% based on its current price. This means your profit from dividends deducting fees is 4.96%. Next factor is the performance. HIG had a 8.60% growth in the past 12 months without including the distributions.

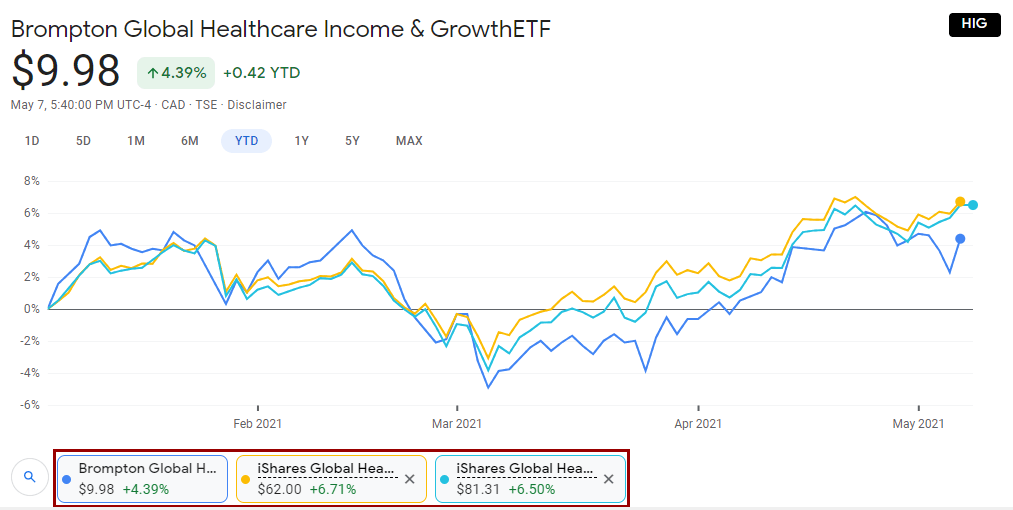

As always, I like to compare any ETF with a similar one to make an informative decisions. The only similar ETF in CAD I could find is XHC (iShares Global Healthcare Index ETF) which is CAD Hedged and holds IXJ. XHC has a Semi-Annual distribution with a 0.84% Yield and a 0.65% MER. Below is the YTD performance comparison of HIG vs XHC vs IXJ. As shown, they have been moving very closely. We should also consider HIG’s average 0.50% Bid-Ask spread which affects the short-term price.

I am holding and adding to my HIG for now. However, I will keep monitoring the performance and compare it with XHC as it is CAD Hedged. I don’t mind moving new funds to XHC if Brompton HIG starts falling behind in performance. Time will tell.

Horizon Psychedelics Stock ETF (PSYK)

I’d like to send a shout out to my friend Liquid Independence for introducing me to this ETF via his blog post. Let’s see if Liquid’s predictions come true and we will reach FIWOOT (Financial Independence Working On Own Terms) sooner than expected. Well, I am adding PSYK in very small amounts slowly and I will keep it under 1.5% of my total portfolio due to its speculation nature while being in the discovery stage as of today . Diversification is always a key.

PSYK which is traded on NEO Exchange (Accessible by all brokers including Questrade and Wealthsimple) provides exposure to a basket of North American publicly-listed life sciences companies having significant business activities or exposure to the psychedelics industry. What I like about PSYK is that it caps each company at 10% to reduce the risk when it rebalances quarterly.

As expected, there is no distribution with PSYK as it is a pure growth stock. However, you still pay 0.85% management fees. It is too early to look at the world’s first Psychedelics ETF performance so we should just hold, add, and wait.

The top 3 are now weighting more than 10% which should be rebalanced by Horizon soon. The advantage of an ETF is that you don’t have to worry about missing out on a good company and its growth nor about rebalancing. It is all done for you. Of course, the alternative is to buy these companies individually and manage the sector on your own. I preferred to just buy the ETF.

Best Commodity ETFs in Canada

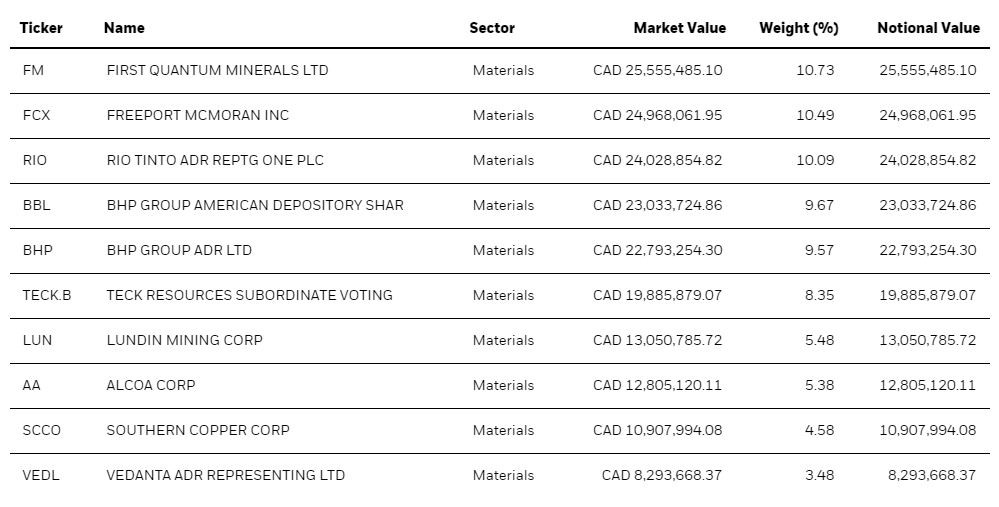

Evolve Global Materials & Mining Enhanced Yield Index ETF (BASE)

Looking for better yields in the materials and mining sector with less risk? The opportunity may be one (covered) call away applied on up to 33% of the portfolio. BASE replicates Solactive Materials & Mining Index (SOLMAMIH) and gets rebalanced quarterly. It has 2 series as usual. CAD Hedged (BASE) and Unhedged (BASE.B).

BASE comes with a $0.15 per share monthly distribution which makes it a nice 3.67% yield. However, as expected there is a 1.28% expense fees. BASE trading volume is low and traded only 150 days out of the past 240 which shouldn’t matter for a long-term investment.

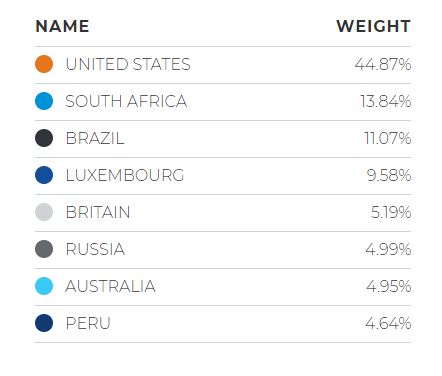

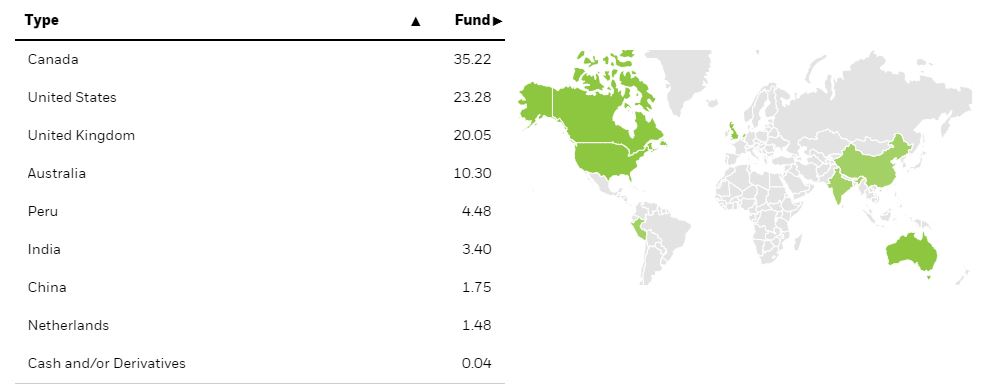

I am mainly holding BASE to get some income from investing in Materials. However, after comparing BASE performance with the next ETF, XBM, I decided to hold both so I won’t miss out on growth which has been increasing steadily in the last year. In addition, BASE doesn’t hold any Canadian or UK companies which is another disadvantage.

XBM provides exposure to global securities of issuers involved in the production or extraction of base metals. XBM had a 122.40% total return in 1 year but we don’t know if this growth will continue and that’s why I am holding BASE to reduce the risk when demand slows down for commodities.

XBM pays quarterly fees which changes every quarter. The total payout yield for the last 12 months is 1.5%. Considering XBM’s MER is 0.60%, the dividends at least cover the cost of the ETF. However, the main reason to hold XBM is growth.

As seen, XBM covers what is missed on BASE by having the highest weight in Canadian companies. In addition, it gives us exposure to the UK companies. Here is the list of XBM top 10 holdings.

To have the full comparison picture for BASE vs XBM, we have to look at their performance. There has been a really weird run in the past year due to Covid complications so instead of checking the 1 year chart, I am comparing the YTD chart. BASE is fairly new so there is no 3-5 years performance which makes it another reason to make sure we reevaluate these ETFs at least once a year.

As illustrated above, XBM has been doing much better performance wise. This is not surprising considering the Canadian commodities performance. XBM had a 30.11% gain while BASE gained 21.85%. Even counting in the dividends, XBM is a big winner by far. However, to cover my concern of a retreat in Commodities and to reduce the risk, I’d keep both XBM and BASE.

Best Travel ETF in Canada

Well, the truth is, I love traveling and I am buying a Travel ETF because I am confident traveling will be back to normal soon. When that happens, we will experience a huge growth in travel stocks due to a sudden demand. Basically, I think the technology growth we have been seeing will replicate itself on the travel industry. People are already booking cruises so it is just a matter of time.

Harvest Travel & Leisure Index ETF (TRVL)

Believe it or not, this is the only Travel and Leisure ETF in the Canadian market. There is another ETF U.S. Global Jets ETF (JETS) on NYSE Exchange. However, JETS isn’t as diverse or fun as TRVL as it only holds airlines including Air Canada (3.87%) with a 0.60% fee.

Back to my most favorite ETF, TRVL. This is the closest I am getting to traveling nowadays. Hopefully TRVL grows and covers the expenses of some of my future travels. TRVL replicates Solactive Travel & Leisure Index TR. It currently invest in the top 30 dominant, large capitalization Travel & Leisure companies listed in North America and comes in two series CAD Unhedged (TRVL) and USD (TRVL.U).

As shown above, TRVL holds Hotels and Resorts, Leisure Facilities, Casinos, Cruise Lines, on top of Airlines with its biggest holding in Booking 10.4% followed by 8.1% Marriott International. The ETF is really new but it should be a great long-term investment. TRVL management fee is 0.40%.

Final Thoughts & Recommendations about my Best ETFs in Canada

I generally believe ETFs should make an average investor’s life easier but as you see on this series, they aren’t making mine any easier but happier and wealthier for a good reason. I like the growth as much as I want to keep the dividend yield. Indeed, the high MERs are painful but everything comes with a price. You can certainly do your own covered calls trading to save the fees but that will not be everyone’s job.

I need to make one point very clear. These ETFs come with limited trading volume and a big bid-ask spread. It shouldn’t matter for long-term investors, but I always use a Limit Order and don’t stress about having it filled on the day. This is just to try avoiding being taken advantage of by the high asks.

As buying ETFs is really easy through either Questrade or Wealthsimple, I don’t see why I’d limit myself trying to pick an ETF over the other one. I spent time evaluating these ETFs and comparing them with traditional ETFs and concluded that these ETFs considering their potential growth and distributions are worth the high MER even though I hope there were more competitions brining the MER lower. When I have doubts like in the case of Commodities, I hold both of them.

I will need to reevaluate some of these ETFs in a yearly basis and compare their performance with similar ETFs to make sure I am staying on the track. I hope we will have more Travel ETFs in Canada to increase the competition and provide investors more choices.

In Part III, I will discuss my Mix ETFs including Dividend ETFs. Thanks for Reading & See you soon!