Do you fancy credit cards’ points and would like to optimize your BMO Rewards Points value? In this article, I am going to walk you through a complete review of BMO Rewards Points while comparing all the methods in order to answer the question: How do I spend my BMO points?

Is BMO Rewards Points Program Worth Considering

Maximizing the return on our credit card rewards is a fantastic way to recover a small portion of our spending. BMO Rewards is one of the most appealing and flexible programs in the Canadian credit card market.

In addition, BMO is a popular bank which means many Canadians with a BMO bank account have a BMO credit card. However, needless to say, taking advantage of all the promotional bonuses that come with getting a new BMO rewards credit card is the fastest method to collect BMO Rewards point.

After a year of owning my first ever BMO credit card, BMO eclipse Visa Infinite, I accumulated enough points from bonuses and minimum spending requirements to redeem my points for a reasonable amount. This is similar to any investment return where I invested my time to apply and optimize the return.

As pointed on my article here, I like to apply for different credit cards to earn bonuses and points that I can redeem for rewards. On top of this, as I don’t like paying for credit cards yet want to have a card with a great insurance coverage including travel and rental car coverage, I always get a new card annually to take advantage of the waived first year fee.

Related: Best Travel Credit Cards in Canada

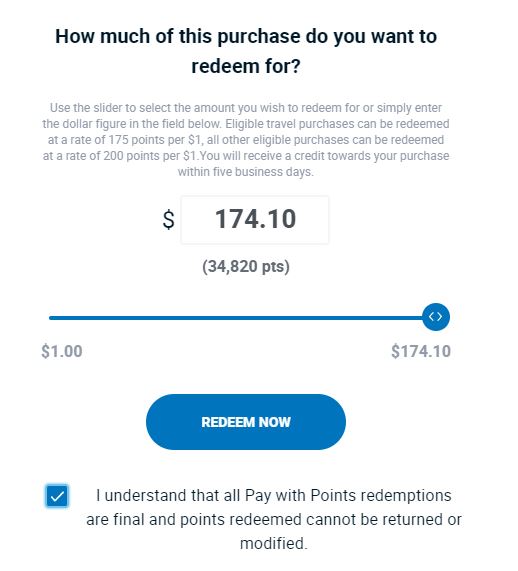

Last year, I applied for BMO Credit Card and earned 34,821 BMO Rewards since then. It is now time to redeem my BMO Rewards points to cash or equivalent. Honestly, I prefer cashback versus points programs. But, BMO Rewards program is one of the best in Canada due to its flexibility so no complaints.

In the following sections, I am going to cover BMO Rewards Points value and which category to use in order to maximize the dollar value of your BMO Points.

What Is the BMO Rewards Points Value

Lots of people ask questions like, how much is 40000 BMO Points worth? To answer this and similar questions including “how do I spend my BMO Points?”, we need to understand the different ways and the value of redeeming BMO Rewards points to cash value.

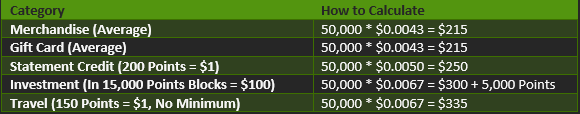

Here is a chart showing the average dollar value of 100 BMO points in different categories.

As shown in the table, the BMO Rewards points to cash value can be in average anywhere between $0.43 to $0.67 per 100 BMO Points.

How to Maximize BMO Rewards Points Redemption

The best methods to optimize BMO Points is to use them in either travel or investment category. Next best option is to apply the points for a statement credit. And finally, the worst or least favorable method is to redeem BMO Rewards for gift cards or merchants.

How to Calculate the BMO Rewards Points Value in Cash

Let’s say you need 15,000 BMO Points to redeem for $100 of investment. To calculate the value of 100 BMO Rewards Points to cash the math will be as simple as below:

$100 * 100 / 15,000 BMO Points = $0.67 (1 BMO Point = $0.0067)

Another example is that you need 11,750 BMO Points to buy a $50 Costco gift card. Below is the related calculation:

$50 * 100 / 11,750 BMO Points = $0.43 (1 BMO Point = $0.0043)

The 100 in the middle is to do the calculations for 100 BMO points to make the number more human readable. You can easily do the same calculation for 1 BMO by removing the 100.

How to Redeem BMO Rewards Points for Gift Cards

There are 80 products under gift cards section of BMO Rewards. This section is divided into 3 subcategories which are Digital Gift Cards, Physical Gift Cards, and Prepaid Cards.

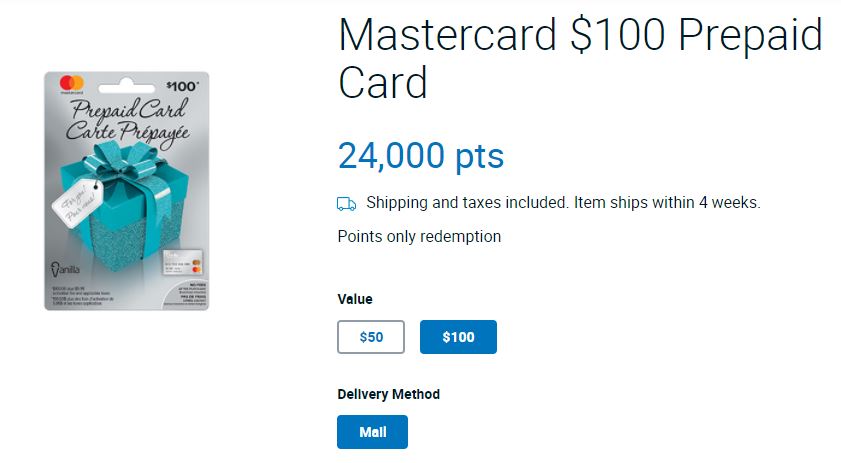

Currently there is only 1 card under the prepaid cards category which is a Prepaid Mastercard. You need 13,000 BMO Points for $50 or 24,000 Points for $100 Prepaid Mastercard. Both these redemptions are higher than the average redemption value for gift cards.

In the gift card section, the cheapest card is a $20 Nintendo gift card for 5,000 BMO Reward Points which is equal to $0.40 per 100 BMO Points.

BMO offers a wide range of gift cards. The list contains Costco, Wayfair, The KEG Steakhouse, Cineplex, American Eagle, Shell, Indigo, SAQ, Bed Bath & Beyond, Irving Oil, Petro Canada, Best Buy, Canadian Tire, Sobeys, Gap, The Ultimate Dining Card, Starbucks, Staples, American Eagle, Uber, Xbox, and many more.

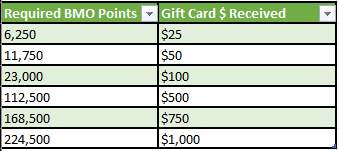

Most cards can be redeemed based on the following table:

As shown above, the redemption value is $0.40 for the smallest amount and $0.445 for the highest amount for most cards. However, not all cards offer a a gift card with a value above $100.

If your BMO credit card return is the highest possible which is 5 BMO Points for grocery, gas, and dining by using BMO eclipse visa infinite card, you need to spend $1,250 to get 6,250 points enough to redeem a $25 Gift card or $44,900 in spending for a $1,000 gift card .

The highest possible dollar cashback value for gift cards redemption is 2.23%.

Some merchants like Nintendo have different redemption range but the cashback would be the almost in the same range. For example to buy a $20 Nintendo card you need 5,000 points.

How to receive free Xbox subscription? Another option is to swap your BMO points for Xbox Live Gold Subscription. 10,750 points or 16,250 points for 6 and 12 months subscription respectively.

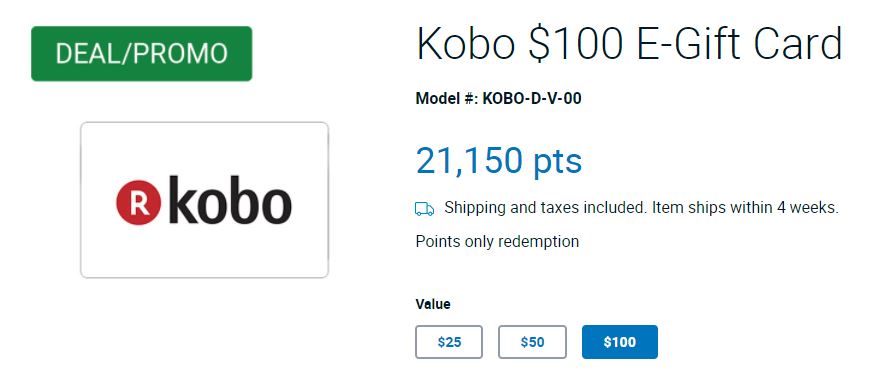

Occasionally, there are special offers or promos listed on BMO Rewards. At the time of writing, there is a BMO Rewards promo to get a $25, $50, or $100 Kobo gift card for 5,750, 10,800, or 21,150. This increases the cashback value based on the 5 BMOs per $1 assumption to 2.36%.

However, if your BMO card earns 2 BMO points (Grocery and gas in BMO World Elite Mastercard), the real return for gift cards redemption is less than 1%.

Gift Cards Redemption Conclusion: Redeeming BMO Rewards Points for Gift Cards or Prepaid Mastercard isn’t at your best interest.

How to Redeem BMO Rewards Points for Merchandise

The value for merchants is almost equal to redeeming points for gift cards. The number is $0.43 per 100 BMO Points.

Currently there are 1636 products listed on BMO Rewards merchandise section. The good thing is that all shipping and taxes are included but you need to cover a minimum 80% of the item’s value with BMO points.

The cheapest item is a Pet Pals Magic Gloves Grooming Gloves – Blue for 4000 points while Samsung The Terrace 55 in. 4K QLED IP55 Smart Outdoor TV for 912,500 BMO Points is the most expensive listed item.

This TV is listed on Amazon and Walmart for $4,998.00 or $5,508.50 with tax for QC residents.

To have enough points buying this TV, a card holder making 5 BMO points per $1 needs to spend $182,500 on their credit card. This translates to 3.01% cashback return on the card.

As I have a little below 35,000 BMO points mostly from credit card signup bonuses, I searched for items ranging between 30,000 and 35,000 BMO Points and randomly picked Ninja Air Fryer.

This item requires 35,000 BMO Points and listed for $151.98 on Amazon. For 5 BMO per $1, this will be a $7,000 spending which will make it a 2.28% cashback return.

Next, let’s pick an item on the promotion list which is AfterShokz Aeropex Bone Conduction Headphones – Black Diamond for 34,000 BMO Points. This item is listed for $169.95 on Amazon.

Based on our 5 BMO per $1 spending calculations, this will come up to 2.25% cashback return on the card. However, if we calculate based on the average 3 BMO per dollar, it will be a 1.15% return.

Merchants Redemption Conclusion: It seems redeeming BMO Points for items on the merchandise list isn’t worth it. You get less value for your points in comparison with all other categories except gift cards.

How to Redeem BMO Rewards Points for Money Statement Credit

Statement credit value is $0.50 per 100 BMO points. BMO Rewards points can pay for eligible purchases made in the last 30 days. This redemption can be as little as $1 using only 200 points! Based on 5 BMO Points per $1, this is a 2.5% cashback but only 1% for a 2 BMO Points per $1 credit card category.

This category can be considered as redeeming BMO rewards for money or cash payouts. You are basically paying your statement by using the (kind of) freely earned points.

Credit Balance Redemption Conclusion: Redeeming BMO Points for a credit balance is equal to 1-2.5% cashback depends on your BMO Credit Card reward earning points. However, this provides a higher value for the BMO points than purchasing an item from merchants or buying a gift card.

How to Redeem BMO Rewards Points for Money Investment Account

Do you want to invest in your future using BMO Rewards points? Yes, free money to be invested!

This is an interesting category with its value being the highest and in par with the travel category. BMO Rewards points can be redeemed as a cash deposit into a BMO investment account. However, a minimum of $100 (15,000 BMO Points) must be redeemed for each financial reward.

After the minimum contribution is made, each financial reward can only be redeemed in increments of $100 thereafter.

What BMO accounts are eligible for Invest with BMO Points

BMO Premium Rate Savings Account: This is a business account with a $0 monthly fees. However, as it is a business account, it requires to be registered by a business and therefore not accessible to majority.

BMO Smart Saver Account: This account comes with a tiny 0.05% interest rate and includes only 1 free transfer out monthly. The account has $0 monthly fees but any more than 1 withdrawal per month costs $5 per transaction.

BMO Investorline: This is the self investment account by BMO which is one of the most expensive trading platforms in Canada. I don’t recommend anyone using BMO Investorline and instead save the $9.95 per trade fee by opening an account with Wealthsimple Trade.

Referencing our previous assumptions of 5 BMO points per $1, this is a 3.33% return and for a 2 BMO points back plan, it is going to be 1.33% cashback.

Investment Account Redemption Conclusion: This category provides the highest return value and is as high as redeeming for the next category, travel. However, you probably end up having extra leftover points due to the 15,000 blocks of investments.

How to Redeem BMO Rewards Points for Travel

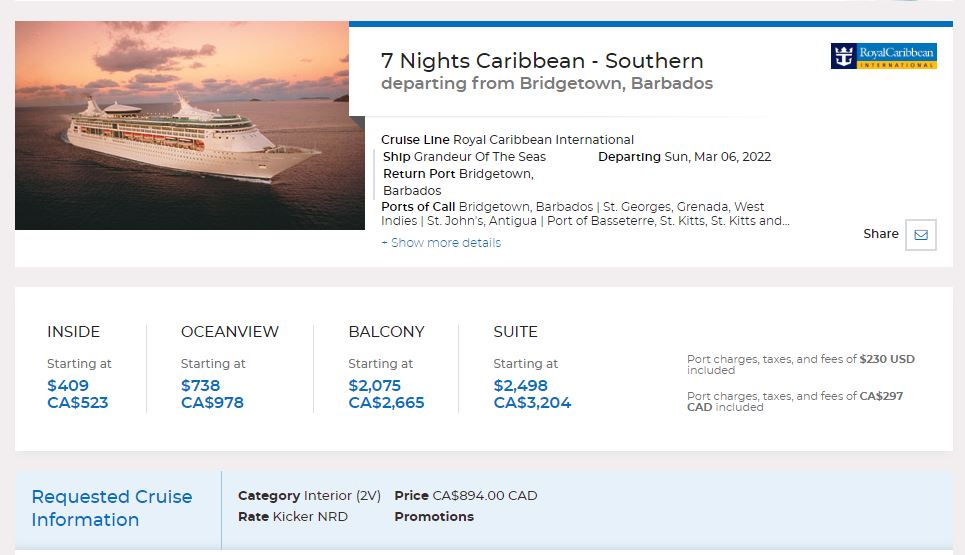

Redeeming BMO Points for travel is as high (or good) as redeeming for investment. My 34,821 BMO Points are worth $232.14 CAD which is higher than previous categories except investment.

This translates to 150 BMO points per $1 which is higher than 200 BMO points for the credit balance. Here are some facts about BMO Rewards travel category:

- Points can be redeemed for flights, cruises, rental cars, hotels, rail tickets, and vacation packages

- Points can be used for any flight or seat as there is no blackout

- Points can be used for paying taxes and fees

- Points and credit card payments can be mixed. There is no minimum points requirements

- BMO Rewards offers a price match guarantee on vacation packages and airline bookings

- BMO Rewards don’t have any point partner and bookings need to be done directly on BMO Travel

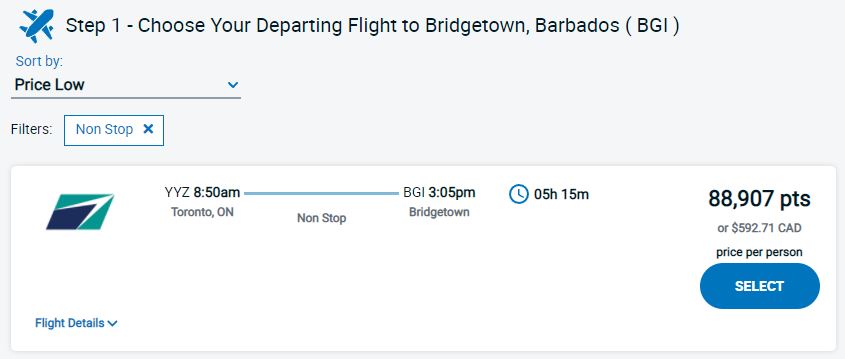

BMO Travel uses Priceline as its partner to process the travel bookings. I was trying to check flights from Toronto to Barbados, and it was very strange that it didn’t show any flight for Air Canada even though are are available flights with AC for the searched date and time.

88,907 BMO points for $592.71 CAD which translates to spending $17,781 based on the 5 BMO per dollar or a nice 3.33% cashback. Do you remember this number?

Travel Redemption Conclusion: Redeeming BMO Points for travel gives the best value for money at a 3.33% return based on 5 BMO per dollar or 0.67% cashback for the free BMO Rewards Mastercard which pays 1 BMO per dollar.

What I like about BMO Travel is its flexibility and price match. There is also no minimum points required towards bookings with points. However, the lack of listing a major airline like Air Canada was a big disappointment.

How Much is My BMO Rewards Points Worth in Dollar Amount

Below is a simplified chart to calculate the dollar amount of your BMO Rewards Points based on the available categories to redeem the points for.

Here is an example to clarify the calculations even more.

John and Brenda have 50,000 BMO Points. How to redeem 50,000 BMO Points?

Based on our calculations below, 50,000 BMO Points can be redeemed to purchase an item or a gift card worth up to $215, a statement credit of $250, deposit $300 into investment, or $335 in travel expenses.

Best Methods to Earn BMO Rewards Points

Are you wondering about how to earn BMO Rewards points? Simply start by taking advantage of promotional credit cards offers as it is the fastest method to accumulate BMO Rewards Points.

After taking advantage of the signup promotions which usually include a waived first year fee, point accumulation can only be done by spending money using one of BMO Rewards credit cards.

Before providing a list of BMO Rewards Credit Cards which pay BMO Points, I will answer two important question.

Do BMO Rewards Points Expire

BMO Points will never get expired as long as the associated credit card is valid. This means, before cancelling a reward BMO credit card, make sure to redeem all the points first.

Even though, BMO Rewards points don’t expire, they can vanish completely if not redeemed before the card cancellation.

Can BMO Rewards Points Be Transferred

Absolutely not! Unfortunately, there is no way to transfer BMO Rewards Points to another credit card or even another partner program. BMO Doesn’t have a partnership agreement for point transfer with any provider. Once gain, make sure to redeem your points before cancelling your card.

BMO Rewards Credit Cards Comparison

There are four BMO Rewards credit card with only one of them being a free card.

- BMO eclipse Visa Infinite Card

- BMO eclipse Visa Infinite Privilege Card

- BMO World Elite Mastercard

- BMO Rewards Mastercard

I am going to simplify the comparison with a chart so you can decide on which card works the best for your needs. All the cards except the free BMO Rewards Mastercard come with an amazing insurance package including travel and car insurance.

The bonuses below have spending conditions. Please review the conditions before applying.

| Credit Card Name | Annual Fee | Current Bonus | Rewards | Benefits |

| BMO eclipse Visa Infinite | $120 (Waived 1st year) | Up to 60,000 points | * 5 points for grocery, gas, dining, transit * 1 point on all others | $50 life style credit |

| BMO eclipse Visa Infinite Privilege | $499 | Up to 90,000 points | * 5 points for grocery, gas, dining, transit, travel, and drugstore * 1 point on all others | $200 life style credit |

| BMO World Elite Mastercard | $150 (Waived 1st year) | Up to 60,000 points | * 3 points travel, dining, entertainment * 2 points on all others | 4 free LoungeKey annually |

| BMO Rewards Mastercard | $0 | Up to 10,000 points | * 1 point on everything |

Which BMO Rewards Credit Cards to Apply For

I personally wouldn’t consider the most expensive and the free cards. My spending doesn’t justify paying $499 for a credit card even after getting a nice $200 back as a credit.

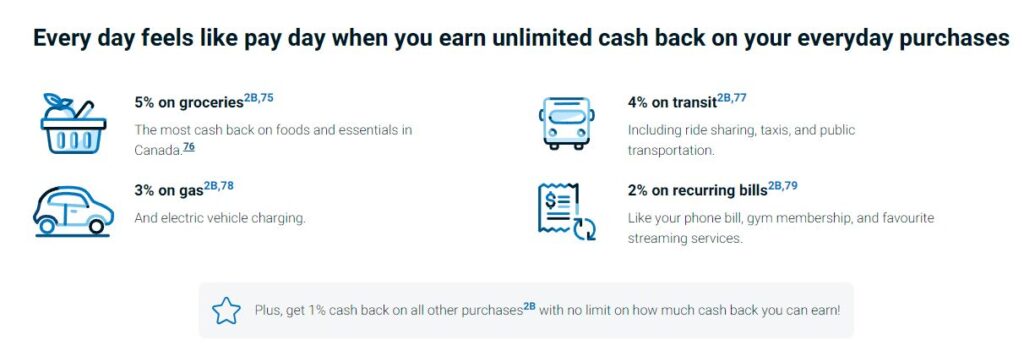

The free BMO Rewards Mastercard isn’t worth getting due to the low points it pays. There are many better cards including Brim Financial Mastercard which has a higher cashback while having no foreign exchange fees.

I already have the BMO eclipse Visa Infinite card which is a nice card to own as long as you don’t have to pay annual fees. The 5 points return is generous especially when redeemed for investment or travel which comes out to be a nice 3.3% cashback.

BMO World Elite Mastercard is another great travel card with some fantastic travel insurance. However, I don’t like paying $150 and getting only 3 points back which is really low for a fee based credit card.

If I had to choose one of the 4 as my BMO travel credit card, I’d choose my current card which is the BMO eclipse Visa Infinite card.

Final Conclusion of BMO Rewards Points Program

BMO Rewards Points is a very flexible program with wide range of selections to redeem your BMO Points. I’d encourage you to take advantage of the promotional credit cards offers to stack more BMO points.

The best way to redeem the points are either for traveling or investing. Both are great choices. However, always shop around and choose the best card based on your needs.