It is 2023 so hopefully no big mistakes anymore but regardless, last year will always be remembered as one of the most horrific years in the Crypto history books.

2021 created many successful stories and Crypto billionaires (Read Sam Bankman-Fried SBF) while 2022 took these billionaires and the people who trusted them down with no mercy.

Crypto investors had to fight all kind of rugs, hacks, and lost keys, in addition to a highly conflicted industry players working to destroy their assets. Not only is this not tech utopia, this is mad max anarchy.

In this post, I am going to simplify what happened to Crypto market and how miserably I among many others did in 2022. This is not something I am proud of but I want to be honest with the community (including yourself) so they (and you) learn from my mistakes.

Note: You should be very proud of yourself if you haven’t lost any money in Crypto.

If you think the journey is worth the hassle as the hype is over and things are stabilizing, take a look at my Cryptocurrency page.

How To Lose Money In Cryptocurrency

There are many ways to lose money in cryptocurrency, including:

- Buying at the wrong time: If you buy when the price is at its highest, you may end up losing money if the price drops soon after.

- Selling too soon: If you sell your cryptocurrency as soon as you see the price going up, you may miss out on potential future price increases.

- Sending money to a scammer: There are many scams in the cryptocurrency space, such as fake ICOs and Ponzi schemes. Be sure to thoroughly research any investment opportunity before sending any money.

- Losing access to your wallet: If you lose access to your cryptocurrency wallet, you may lose access to your funds permanently. Be sure to keep a backup of your wallet recovery phrase in a safe place.

- Not keeping your software up to date: If you don’t keep your cryptocurrency software up to date, you may be vulnerable to security threats that could eventually result in the loss of your funds.

- Not understanding the technology: If you don’t fully understand how cryptocurrency works, you may make mistakes that result in the loss of your funds. It’s important to educate yourself before investing in cryptocurrency.

How To Not Lose Money In Crypto

Here are some tips to help you avoid losing money in cryptocurrency:

- Do your own research (DYOR): Don’t blindly trust anyone’s advice, including mine. Make sure you understand the risks and potential rewards of any investment before you make it.

- Diversify your portfolio: Don’t put all your eggs in one basket. Consider investing in a variety of different cryptocurrencies (Bitcoin and Ethereum) to spread out your risk.

- Use a secure wallet: Make sure you use a secure cryptocurrency wallet to store your funds. This will help protect your money from hackers and thieves.

- Keep your software up to date: As a general rule, always use the latest version of your cryptocurrency software, as updates often include important security fixes.

- Use two-factor authentication: Enable two-factor authentication on your wallet or exchange account to add an extra layer of security.

- Don’t invest more than you can afford to lose: Cryptocurrency is highly volatile, and you should only invest what you can afford to lose.

Is Crypto a Good Investment (Should I Invest In Crypto)

Cryptocurrency is a highly volatile and risky investment. Prices can fluctuate significantly, and a single piece of news can have a major impact on the value of a cryptocurrency. Additionally, the cryptocurrency market is largely unregulated, which means that it is potentially more susceptible to fraud and manipulation.

That being said, some people have made a lot of money by investing in cryptocurrency. However, it’s important to keep in mind that it is possible to lose all or most of your investment. Therefore, it’s important to do your own research and invest wisely.

If you do decide to invest in cryptocurrency, it’s important to have a long-term perspective and to be prepared for significant price fluctuations. It’s also a good idea to diversify your portfolio by investing in a variety of different cryptocurrencies, rather than just one.

So What Happened To Crypto In 2022

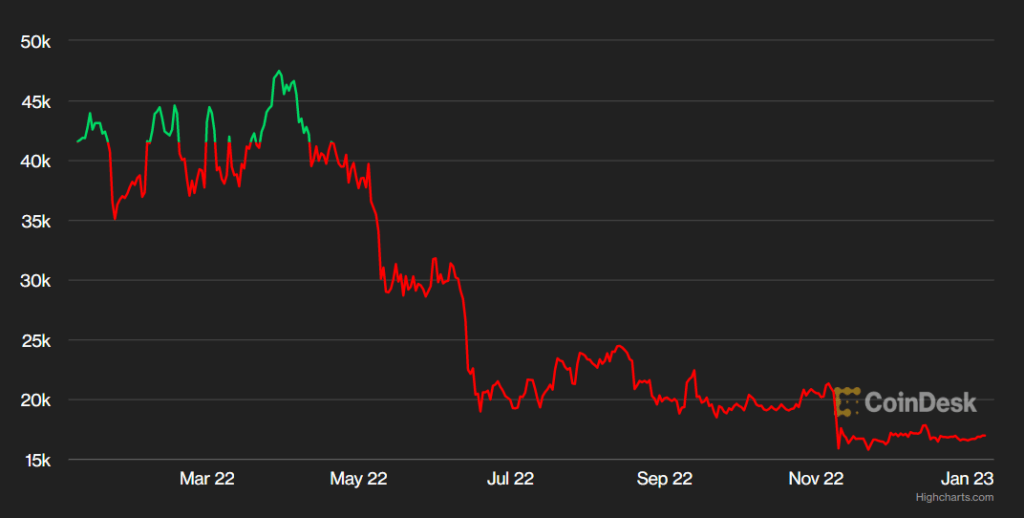

The graph above simplifies the whole 2022 drama in a picture. Bitcoin $BTC lost almost two third of its value and down from around $45K USD per Bitcoin to $16K by the end of 2022.

Considering BTC is the benchmark and the leader in the Crypto market, its movement leads the market direction. I wish other cryptocurrencies get their own mind independent from the crazy Bitcoin (Hey $ETH, I am looking at you).

The Crypto winter which is triggered by the whole financial market crisis (bear market) wasn’t the only issue in the Crypto market.

Basically, the hype of Cryptocurrencies and NFTs are diminished. Did you know that the most expensive Bored Ape (Bored Monkey) NFT Bored Ape #8817 which was sold for $3.4M is now on OpenSea for sale and valued at 4% (down 96%) of its last sale.

As you see, the whole Crypto and NFT hype is going into a full hibernation mode.

In addition to all the downtrend market, big centralized exchanges and projects started to fail one after another. Here are some of the names which led to investors losing billions of dollars.

Terraform Labs (TerraUSD UST and LUNA)

This was the initial trigger for the Crypto collapse which started the chain of events. The Singapore-based company created TerraUSD $UST, a stablecoin which was supposed to be pegged to $USD, along with an associated token called $LUNA.

By investing $UST in its associated platform, Anchor, investors were promised an amazing 20% yield. However, in May 2022, TerraUSD plummeted amid a massive sell-off of the tokens.

While Do Kwon, the South Korean co-founder of Terraform Labs, is still on the run, Terraform Labs introduced a new cryptocurrency, with Kwon calling it a “chance to rise up anew from the ashes.”

The new coin is available and is called LUNA while the old one is renamed to LUNC. Imagine a stablecoin which was valued at $1 USD is trading for $0.02015 as of today.

The collapse of UST and LUNA, set off a chain events that led to the painful collapse of crypto lenders Voyager Digital and Celsius Network, and hedge fund Three Arrows Capital, plunging the industry into further turmoil.

Celsius Network

Imagine a company which was once valued at $20B (That’s 20 Billion USD), offering great high yield, and leading the un-bank slogan to suddenly halt withdrawals and declare bankruptcy.

Celsius was one of the most trusted centralized exchanges in the industry with its leaders always providing updates and assuring investors everything is going perfectly fine.

Most world citizens were angry at regulators going after these places. However, we all now realize without regulations, the financial industry will turn into a big zoo.

Celsius first halted withdrawals in June 2022 before declaring bankruptcy and sending all its investors money down the drain.

Voyager Digital and Three Arrows Capital

Voyager Digital was another centralized exchange which offered high returns on its savings accounts. Voyager loaned Three Arrows Capital, $665M USD. Unfortunately, Three Arrows, headed by Su Zhu and Kyle Davies, used the loans and made risky bets including putting the majority of it in TerraUSD Anchor platform.

With the crash of UST and Anchor, Three Arrows collapsed and filed for bankruptcy in July.

It also defaulted on majority of its loans to Voyager which resulted in Voyager suspending customers’ withdrawals and filing for bankruptcy itself. Voyager had more than 100,000 creditors and listed assets and liabilities of between $1B and $10B.

At the same time FTX offered to bail out Voyager. This is getting more interesting.

BlockFi

This is another centralized cryptocurrency exchange which collapsed in Summer 2022. FTX was supposed to buy BlockFi for $400M but then it got in trouble itself which caused BlockFi to halt withdrawals in Nov 2022.

Similar to its other collapsed friends Celsius and Voyager, BlockFi was offering high returns to cryptocurrency investors.

FTX Collapse

I can’t wait for a Netflix or Amazon documentary of the biggest Crypto Ponzi, FTX.

FTX collapse caused a massive Cryptocurrency market shake in a totally different magnitude than all others mentioned above and below. This was an earthquake leading to typhoons.

The company was once valued at $32B while its owner Sam Bankman-Fried SBF was one of the biggest donors to the US Democratic lawmakers and regulators as he was pushing regulations that were supposed to benefit the industry and his business.

The shocking FTX collapse was triggered by a CoinDesk report about SBF’s trading firm, Alameda Research which led to Binance’s CEO selling about $530M of FTX coins $FTT.

These events led to a severe devaluation of FTT and sparked an investor run on FTX. Consequenctly, FTX halted withdrawals before filing for its own catasrophic bankrupcy.

Bankman-Fried faces fraud and conspiracy charges and was arrested in the Bahamas at the request of the US authorities. FTX which once wanted to save other troubled exchanges is being on fire itself and nobody has any hopes for its rescue.

Other Crypto Centralized Exchanges Failures In 2022

In addition to the big names mentioned above, other smaller Crypto exchanges halted withdrawals and declared bankruptcy in 2022. Let me know who I should add to the list.

Hodlnaut: This Singapore-based company halted withdrawals in August and filed for bankruptcy protection in Singapore.

Zipmex: This company filed for bankruptcy protection in July amid its $53M exposure to crypto lenders Babel Finance and Celsius.

Babel Finance: The lender abruptly suspended withdrawals on June citing unusual liquidity pressures similar to its competitors Celsius, Finblox and CoinFLEX.

Vauld: Vauld suspended withdrawals before filing for bankruptcy, and reportedly owed its customers a massive $363M USD.

Finblox: The company put a $1500 monthly withdrawals limit but seems to be still operational and promoting their business on Twitter! Who in their right mind adds money here?

CoinFLEX: This is another troubled exchange which is in a blurry state of reconstruction.

Atom Asset Exchange (AAX): A Hong Kong exchange which shut down after it deleted its social media accounts and froze withdrawals in November.

Midas: This platform which paid one of the highest interest rates in the market for years collapsed despite its founders assuring the investors on a daily basis. Disgusting.

The list seems to be endless so don’t hesitate to comment if you are aware of any other exchanges. My focus on this post is centralized exchanges only.

How Much Did I Lose In Crypto Craziness

My Cryptocurrency balance started with $2,450 in Celsius in June 2021. It kept growing to $82,274 by the end of April 2022 when everything started to go south from there.

Unfortunately, I trusted one of the biggest Ponzi scammers of the century Do Kwon, the co-founder and CEO of Terra with my money. After Crypto.com reduced its interest rates significantly, I felt lucky to have found Anchor protocol.

I only made money from this platform for about 2 months before it went boom and took my $40K CAD with it. In exchange, they gave their unlucky investors the new LUNA token which I now hold about 1,276 of them.

LUNA is traded as $1.77 CAD per token which means my $40K in $UST is now worth $2,258. And that’s how I lost about $38K CAD.

In addition, after deducting my revenue, I lost another $3,500 in Midas when they gave us their bankruptcy news and took our money after Christmas 2022.

Midas bankruptcy was a really disappointing event as the company’s CEO and CCO were very active on Discord and kept assuring all the investors along all the uncertainty that the company was doing great. After all, we trusted bunch of dishonest individuals.

Similar to LUNA, Midas took our money and gave us their worthless MIDAS token in return. I am now an unfortunate owner of 129 MIDAS tokens which are worth about $70.

Considering the current value of Bitcoin ($22,500) and Ethereum ($1700), my total loss at the time of writing is 1.8 $BTC (24 $ETH) which is around $41,000 Canadian Dollar.

Future Plans For My Cryptocurrency Portfolio

Unfortunately, I don’t have much of Crypto passive income anymore. It is time to wake up and realize that the get rich a little faster than others can work for a couple months but eventually kicks hard in the face.

I am back to focusing on building wealth through investing in value dividend growth stocks and companies. I am also planning to have my first real estate income purchase this year.

Regarding Cryptocurrency portfolio, I am only having a very small amount of Cryptocurrencies inside Crypto.com application and Crypto.com DeFi wallet.

Related: Complete Crypto.com App Review & Beginners Cryptocurrency Guide

This is a very small amount and I am willing to lose it. However, the main reason, I am keeping this is the associated Crypt.com credit card which I adore due to its unlimited lounge accesses.

Although, the company slashed almost all the good benefits, the lounge benefit is still there. As some of you might know, I am an addict (or avid) traveler and nowadays a lounge addict.

The small amount of CRO (Crypto.com token) I have generates a small passive income with a 10% interest rate paid daily in the DeFi wallet and weekly in the regular app.

On the other side, my LUNA holding is also paying around 6 LUNAs weekly. This might vanish overnight but the amount is too little in general that I am just risking it hopelessly.

To summarize, my Crypto portfolio went from $82K to currently around $10K. Maybe one day, my $CRO, $LUNA, or $ETH grow again and I can recover the loss.

I hope I didn’t bore (or disappoint) you with this blog post. Please be mindful to those who recklessly lose money in different ways. For me, no more distraction whatsoever.

Thank you for reading.