Would you love to own an investment property but don’t have the down payment? Or maybe you appreciate being a hands off landlord? If so, this addy review article is for you.

Owning real estate in Canada is becoming a mission impossible due to the sky rocketing cost of properties in this hot Canadian real estate market along the increasing interest rates.

addy’s mission is to break these barriers that prevent entering the Canadian housing market by providing Canadians an equal real estate investment opportunity via its crowdfunding platform which is accessible via a browser web or mobile app.

In this addy review, I am introducing you to one of the best solutions to own real estates in Canada through the real estate crowdfunding service offered by addy.

How Does addy Help Canadians Invest in Real Estate

addy is a real estate crowdfunding solution which provides Canadians with a great opportunity to own a fraction of a property with as little as $1 (plus an optional $50 annual fee).

Finally, a chance for everyone to get into real estate. That’s ownership without the life-altering sacrifices of ownership.

By addy

addy’s flexibility in property ownership simplifies the process of owning lucrative real estate properties in Canada. Investors don’t need to deal with complicated barriers when owning a slice of a property through addy.

What is addy

addy is a real estate crowdfunding platform which was founded in 2018 by Michael Stephenson and Stephen Jagger. The platform aims to giving all Canadians the opportunity to become partial owners of a diversified real estate portfolio in Canada

With addy, Canadians don’t need to deal with complicated matters including down payments, inspections, renovations, mortgages, and property managements.

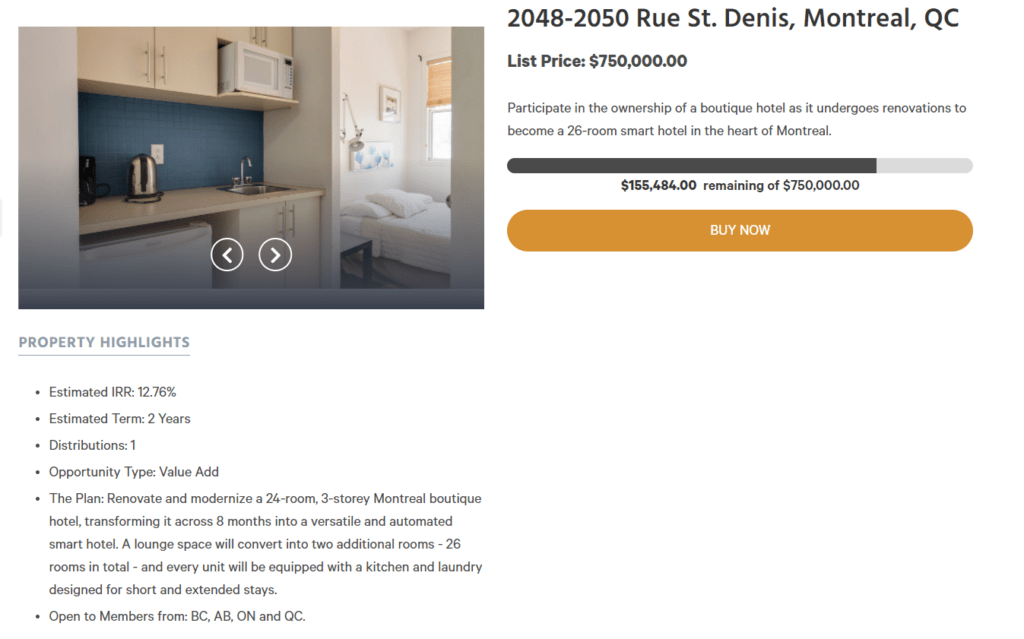

In this addy review, I’ll demonstrate how to choose a listed property including office parks, mixed-use buildings, apartment complexes, hotels, and multi-family buildings in Alberta, British Columbia, Ontario, or Quebec, fund your account, and buy a share of the real estate for up to $2,500 per property.

addy’s secret sauce is by optimizing each purchase process and utilizing technology to bring down the transaction costs! On top, with addy, every property will be fully funded, and every dollar a member puts towards a property will go to that property.

Note: addy does not invest in single-family homes or individual condos.

How Does addy Work

Here is the process on how addy works to provide Canadians with affordable options to own lucrative properties across Canada with shares of up to $2,500 per property.

- addy teams including acquisitions, investment committee, and addy’s experienced Board of Directors identify, study, and make a collective purchase decision.

- After the final acquisition decision, the property is divided in units worth $1 each. For instance, if a property is $2,000,000, there will be 2 million available units.

- Shares get listed on addy and every investor will have the opportunity to purchase 1 to 2500 units (free plan members can buy up to 1500 units) per property.

It is worth mentioning that addy itself invests in every deal on the exact same terms as its members. There are no free or preferential shares for anyone. All shares, including the ones owned by addy Real Estate Holdings, board members, founders and employees are common shares with pari-passu terms.

How to Start Investing in Real Estate With addy

- Open addy and click JOIN NOW

- Provide your personal information along a government ID

- Once your account is approved, link your bank account using Plaid or manually

- Fund your addy account

- Choose a membership and pay with your addy account balance

- Go under Properties For Sale, and choose a desired property, click BUY NOW

- Enter number of units, review the ownership percentage and the offering memorandum

- Agree to the offering memorandum and sign the contract

- Congratulations! You are now a Canadian real estate investor

Note 1: The estimated IRR (Internal Rate of Return) is shared and each property has a different payout. For some, the returns will be annual, quarterly, or paid out upon exit (sale of the property) which are all outlined in the Offering Memorandum.

Note 2: Your investment is locked in for the term outlined in the Offering Memorandum specific to each property and can’t be sold earlier than the agreed upon term.

Note 3: Withdrawal requests lower than $3,000 are processed and paid via ETF transfer to the linked bank account. Amounts above $3,000 need to be reviewed and approved manually.

How Much Does it Cost to Become an addy Member

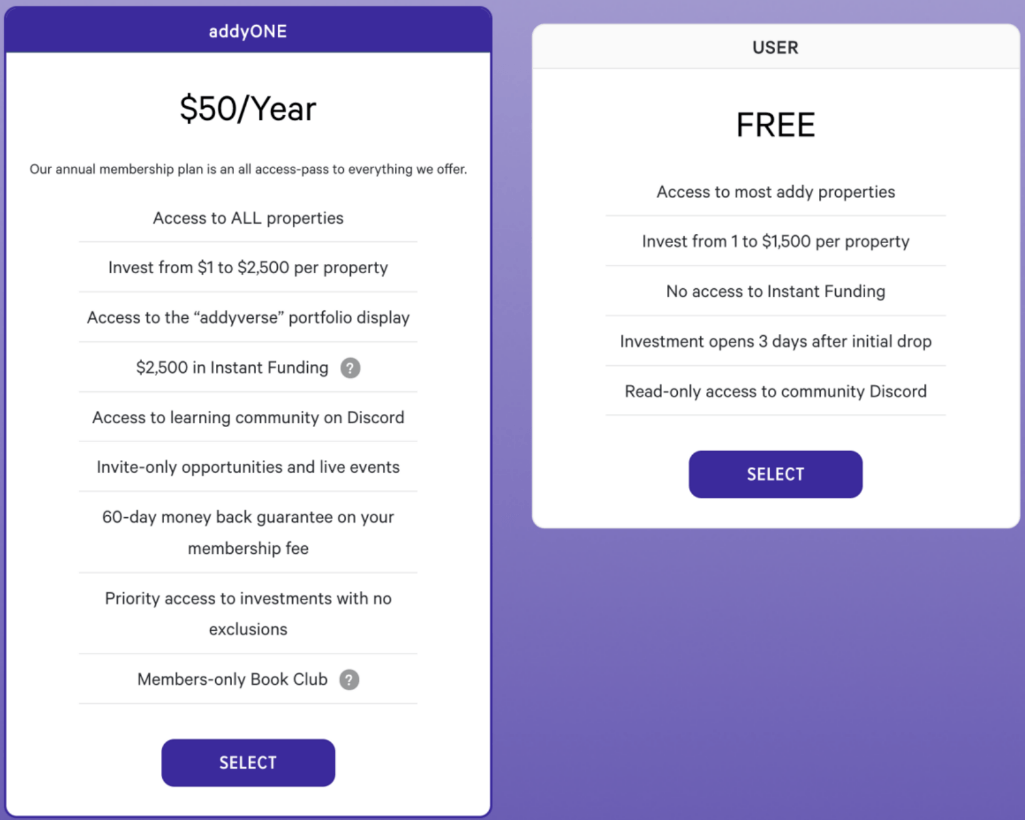

To purchase a fractional real estate through addy, investors do NOT require a paid addy membership anymore. addy is so amazing that made this even more affordable for all.

However, there are is an addyONE membership which gives more options and purchasing power including investing up to $2,500 per property (instead of $1,500) and an instant $2,500 funding.

Why is this instant funding important? Imagine an property drops in the market by addy and you’d like to purchase it. It will take up to 3 days to get your funds in addy which means the shares of that property might have been already sold out.

There are other differences between the two plans which includes a priority access to investment without the need to wait 3 days after the initial drop with the free plan.

In addition, addyONE Investors have the opportunity to access addy’s learning community on Discord along a unique Book Club. If this sounds exciting, what are you waiting for?

How Do addy Investors Make Money

addy investors can make money on the addy platform in two ways:

- Liquidation Event: When the property is sold, the appreciation (if any) is paid back to investors in addition to their investment principal.

- Rental Income: When tenants pay rent, additional cash flow can be passed back to investors in the form of a distribution.

These details are outlined in the Offering Memorandum for each property which should be reviewed by investors prior to signing the contract.

Do Investors Receive Passive Income (Distributions) From addy

Some of addy real estate opportunities pay distributions which are calculated by subtracting recurring capital expenditures plus any mortgage payments and any other liabilities from the funds from operations.

addy calls the day distributions show up in addy investors’ wallet as Owner Day.

Distributions are similar to dividends but they are different. These are payments from the equity of the company, while dividends are payments from the profit of the company.

Dividends may or may not involve cash. In contrast, distributions always come in the form of cash payouts.

Utilize addy Referrals to Earn More

After joining addy, new investors can invite their family and friends to start their own Canadian real estate investment adventure.

When you friend joins addy and becomes a member using your referral link, you both will be eligible to receive $25 bonus each in your addy wallet. You friend needs to buy an addy membership for both of you to receive your bonus.

Note: I’ll also receive $25 if you join addy and buy a membership using my addy referral link. However, a nice $5 will be paid to me if you just join the free addy plan without paying.

What are addy Fees and Charges

The only fee is the membership fee if you choose to become a paid addyONE member. addy doesn’t charge any transaction fees, property acquisition fees, withdrawal fees, promotion fees, or lifts on the property.

In addition, addy handles all of the logistics with respect to the properties. Each property is unique and details are outlined in the Offering Memorandum specific to each property.

Regarding property management, The General Partner (GP) is addy’s property management partner where addy does deep due diligence on each GP.

No Fees Sounds Too Good To be True, How Does addy Make a Profit

Well, I was like you and that’s why I started doing my due diligence. However, there are absolutely no hidden fees when investing with addy.

addy makes profit through membership fees, capital gains or distributions via the units it holds. This can also work as an assurance knowing they are a true partners taking as much profit (and risk) as their investors (members).

Do Investors Pay Taxes on addy Investments or Distributions

All distributions are listed under addy account by going to the “Wallet” tab. Currently, all distributions are listed similarly. However, here are the main tax forms to deal with:

- Capital Gain or Loss is generally realized from the sale of the property, and reported on the T5008 form.

- Rental Income is generally the net income earned from property rental revenue, and is reported on a T5 form.

However, Property Transfer Taxes are accounted in the budget and paid by addy before paying distributions which means no need to worry about property transfer taxes.

Is addy Considered a REIT

No, addy isn’t a REIT. A REIT lets you invest in a basket of properties while addy gives you the opportunity to choose a specific property with a desired value and location.

Is addy Legal and What Is the Investor’s Liability

addy abides by the rules and regulations of the appropriate Securities Commission in each province and operates under National Instrument 45-106 Prospectus Exemptions – Section 2.9 Offering Memorandums.

There is no liability beyond the amount investors invest in each property. The exact details are available within the Offering Memorandum which lists the opportunities and risks.

In addition, there is no need for any beneficiary designation as addy shares are just like one’s car or furniture which are part of the estate.

How Do I Receive the Newly Listed addy Properties

addy sends an email to all subscribed users before a property is listed to provide them with enough time for funding their addy account.

In addition, you can follow addy’s Twitter and join addy’s Discord channel. For support, the addy support team can be reached via chat or email. I also think addy’s blog is a great source.

addy’s Competitors & Other Canadian Crowdfunding Providers

addy isn’t the only Canadian crowdfunding real estate company. However, I genuinely believe that addy is the most accessible and least expensive solution.

NexusCrowd is another Canadian crowdfunding solution but is only accessible to accredited investors. Another option is BuyProperly which requires a minimum $2,500 investment while charging a 2.5% annual management fee. It also has associated recurring and one-time fees.

Final addy Review Thoughts

Through this addy review, I tried to demonstrate the pros and cons of addy. addy is helping average Canadians the opportunity to join the real estate investment market without taking too much risk.

It also helps minimize the headache of dealing with realtors, inspectors, handymen, tenants, and lawyers.

Considering the amazing fact that addy removed the requirements of having a paid plan, I don’t see any disadvantage of using addy to invest in the Canadian real estate market.

If you join the paid membership by using my link, you can recoup the $50 by inviting your friends and have two friends buying a membership on addy portal.

I purchased my first investment in addy when it became available to Quebec residents. The concept of being an owner of a hotel or a residential complex is very appealing to me personally. Maybe it is appealing to you too?

I hope you enjoyed reading my complete addy review and ready to take advantage of this priceless opportunity to invest and grow together.