Purpose of Writing a New Tangerine Bank Review

Tangerine bank is one of the Canadian bank leaders offering many products including saving accounts, chequing accounts, credit cards, GICs, business accounts, investment funds, mortgage, HELOC, personal line of credit, TFSA, RSPs, and RIF accounts.

Tangerine’s chequing account is considered to be one of the best chequing accounts in Canada due to its features. I personally had a positive experience with Tangerine’s chat support which led to a $40 fee cancellation. I’d like to share this experience before providing my complete review of Tangerine’s products.

My Experience With Tangerine’s Customer Support

It all began when I put a plan to transfer our accounts out of Tangerine to EQ and eventually to Wealthsimple to be invested in the market.

Related: Best High Interest Savings Accounts Rates in Canada

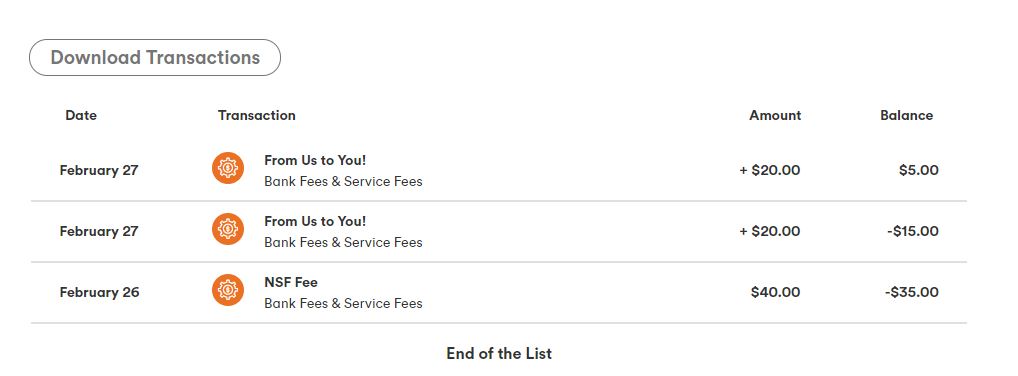

Tangerine’s special rate offer for our accounts got expired so I put a pull request via EQ bank to transfer from Tangerine to EQ. However, to my surprise, I got a notification email that the transfer request was declined due to insufficient fund and I got dinged with a $40 NSF fee.

I was mad at myself and wondered how it happened. After checking my EQ request, it appeared that I had the transfer to be done from my chequing account rather than the account with the fund, saving account.

Chequing account only had $5 so my balance became -$35 after the $40 NSF Fee.

I logged in my Tangerine account and started a chat session with Angela. She was understandable and offered a rebate of $20. I was (un)happy so thanked her and explained I realize she is doing her job. However, I expected better from Tangerine. I said this is the first time I needed Tangerine’s assistant which doesn’t seem to be going well.

She kept insisting that this is the best she can offer. At that point, I was really frustrated. Not at Tangerine but myself. It is only $40 but still a painful loss of earned money. So, I told Angela that because Tangerine with its multi billion assets does not want to help even though I have the money in a different account, I will move my funds and close my accounts.

I think that tone did the trick which made her to try her best and ultimately refunded the full amount exceptionally! And that is how everyone ended up happy 😊

Despite the many available online reviews, this experience led me to write about my personal interaction and how Tangerine has been serving me since 2011. I will be unbiased and only say what I truly feel about Tangerine.

ING Direct Canada Becomes Tangerine

In November 2012 Scotiabank completed the acquisition of ING Direct Canada from ING Groep NV, the Netherlands-based parent company of ING Direct Canada in a CAD$3.1 billion deal first announced in August 2012.

On November 5, 2013, ING Direct Canada revealed that its name would be changed to Tangerine in early 2014.

My Personal Historical Relationship With Tangerine

Tangerine was not my first Canadian bank. Ironically, I chose Tangerine which is owned by Scotiabank after closing my Scotiabank account in 2011. I became Tangerine’s client not just because I liked their fair fees.

My father had an ING Direct account with the main Netherlands branch for decades. This somehow made me feel connected to my past and my father which subsequently led to opening my ING Direct Canada account.

Why Switching to Smaller Players Like Tangerine

I believe nobody should pay for day-to-day banking especially nowadays when banking is part of everyone’s life. Hence, I am totally against any bank charging clients for chequing accounts.

There are some bank accounts which waive the fees for keeping a certain amount of money monthly. For instance, TD Every Day Chequing Account charges a high $10.95 monthly fee which can be waived when there is a minimum $3,000 in the account daily. If the balance goes below this amount, even for 1 day, they will charge the $10.95.

Some individuals do not mind keeping $3,000 in an account which gives a 0.000% interest yield. This can also be translated to not gaining (losing) a potential $45 annually (considering a 1.5% interest rate in a bank like EQ Bank). However, if this individual has a balance below $3,000 in only one day per year, their loss will be a increased to $55.95.

Now back to our Tangerine discussion, I encourage Canadians to switch to smaller players like Tangerine! Unless you need some special benefits, using a big bank is pointless. You can do online banking easily and do not need a human interaction or a face-to-face customer service which will eventually be a thing of the past.

EARN AN EXTRA $50 by using my Tangerine Referral Orange Key. 43640010S1. Remember to enter my Tangerine Referral code (Orange Key) 43640010S1 and deposit $250 during the first 60 days to get your $50 extra bonus.

Tangerine Bank’s Chequing Account Features Review

Feature 1 – A Visa Debit Card

Tangerine’s new cards are Visa Debits which is a new addition to Tangerine’s benefits which you can read more about here.

- I consider Tangerine’s Visa in addition to being a debit card a benefit because it is a feature you can use without headache. It acts like a prepaid visa card when making an online or in-app purchase.

- The card comes in 2 colors. I chose the silver which I regret because the silver is only on one side. My first ever card with a different color on each side.

- I do not use nor recommend using the Visa feature unless you are out of options. This card is a prepaid card and do not offer any cash back. Instead, use Tangerine Money-Back Credit Card or Tangerine World Mastercard.

Feature 2 – A Free Chequing Account

- Tangerine’s $0 daily chequing fee is considered a great benefit.

- This account includes an unlimited number of debit purchases, bill payments, and pre-authorized payments

- In addition, it includes an unlimited number of Interac e-Transfer transactions

Feature 3 – Free ABM Access

- Tangerine’s limited free ABM access to 3,500 Scotiabank ATMs in Canada and 44,000 ATMs worldwide through Scotiabank’s Global ATM Alliance is a great benefit.

- I used the free ATM withdrawal feature offered by Tangerine in many countries including Mexico and Europe.

- Tangerine charges a 2.5% foreign exchange fee when using an ATM internationally.

Note: In addition to carrying my Tangerine card when traveling, I also take my amazing BRIM Mastercard which offers many features including no foreign exchange fees, no ATM withdrawal fees, and free access to WiFi globally. Read my BRIM Financial review here.

Feature 4 – Overdraft Protection

- Tangerine’s Overdraft Protection is a fantastic benefit that protects customers when there is a withdrawal request with not enough funds to cover the amount in the account.

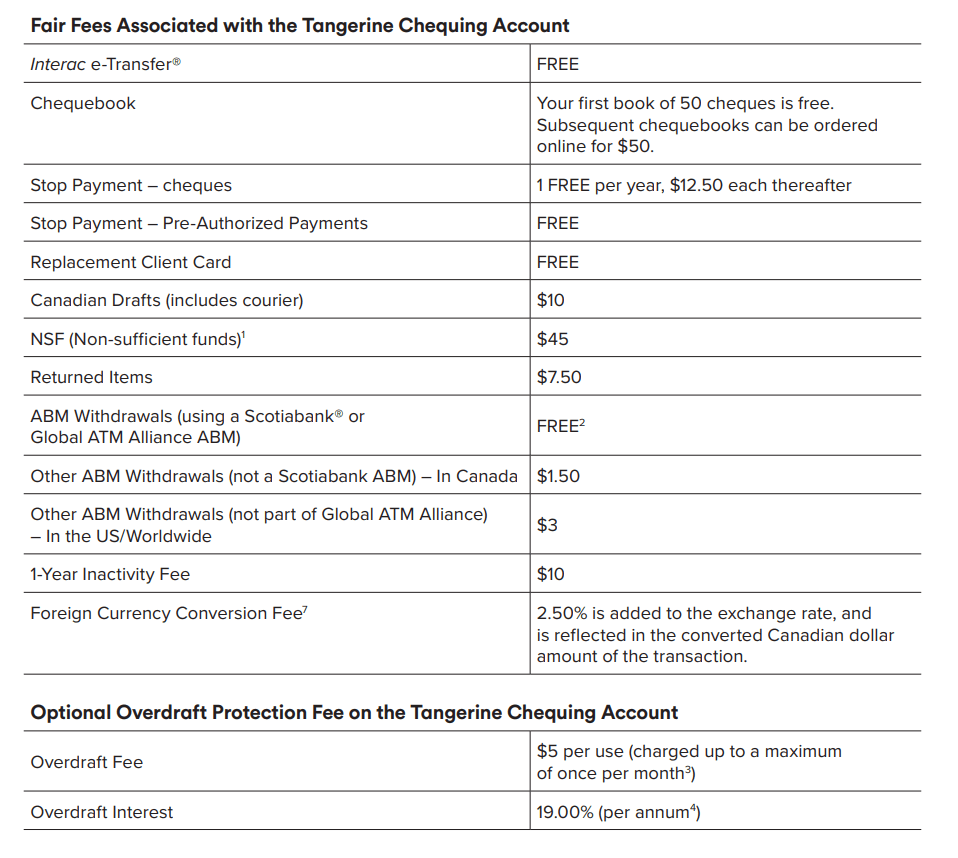

- Without this feature, there is a $40 Non-Sufficient Funds (NSF) fee.

- If your Account is short of funds, your Overdraft Protection will automatically kick in.

- It covers up to $5,000 so it couldn’t save me when I initiated my transfer to EQ bank.

Feature 5 – Track and Categorize Your Spending

Tangerine’s categorizing can be considered a conditional benefit which is useful if you only use Tangerine cards for majority of your expenses.

Tangerine’s Chequing Account Other Features

- Cheque-In: Deposit cheques instantly from your mobile device using the Cheque-In feature on your mobile app. I have used this feature personally successfully.

- Bank drafts: Order a bank draft online and have it delivered to your door or to your closest Tangerine Café. Canadian draft cost $10. This is higher price in comparison with others.

- Orange Alerts: Customize your preferences to receive important account alerts through text or email. This is one of the best features as it due to its customization.

- Mobile Wallet: Convenient ways to pay with your Tangerine client or credit cards.

- Cheque Book: First 50 cheques are free while additional books cost $50 each.

Tangerine Bank’s Savings Accounts

Tangerine offers five different savings accounts, including non-registered, TFSA, US Dollar, RRSP, and RRIF savings accounts. I personally do not recommend using Tangerine Savings accounts unless you get a special rate promotion.

Tangerine sends promotions to selective customers from time to time. For instance, my wife and I had a special rate offer which expired.

Note: Instead of investing in Tangerine’s savings accounts, explore options like EQ Bank or market investments using Wealthsimple or Questrade.

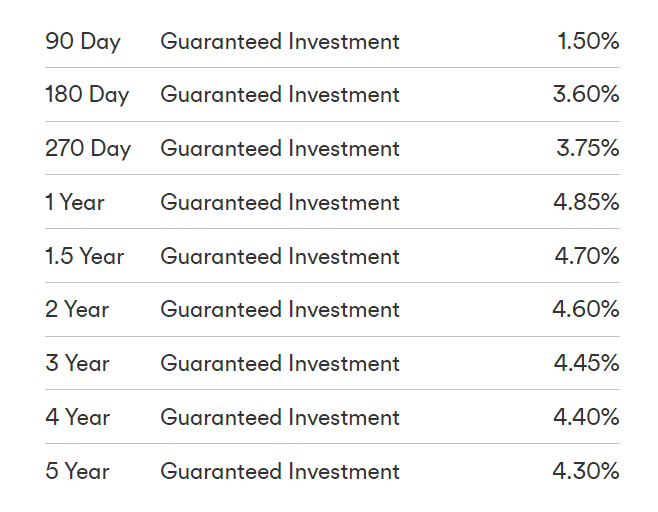

Tangerine Bank’s GICs

Tangerine offers GICs from 1.50% for 90 days up to 4.85% for 1 year. This can be an interesting product for anyone who doesn’t like to take a risk.

Tangerine Bank’s Investing

Tangerine offers three investment portfolio modes. Core Portfolios (Mutual Fund), Global ETF Portfolios, and Socially Responsible Global Portfolios.

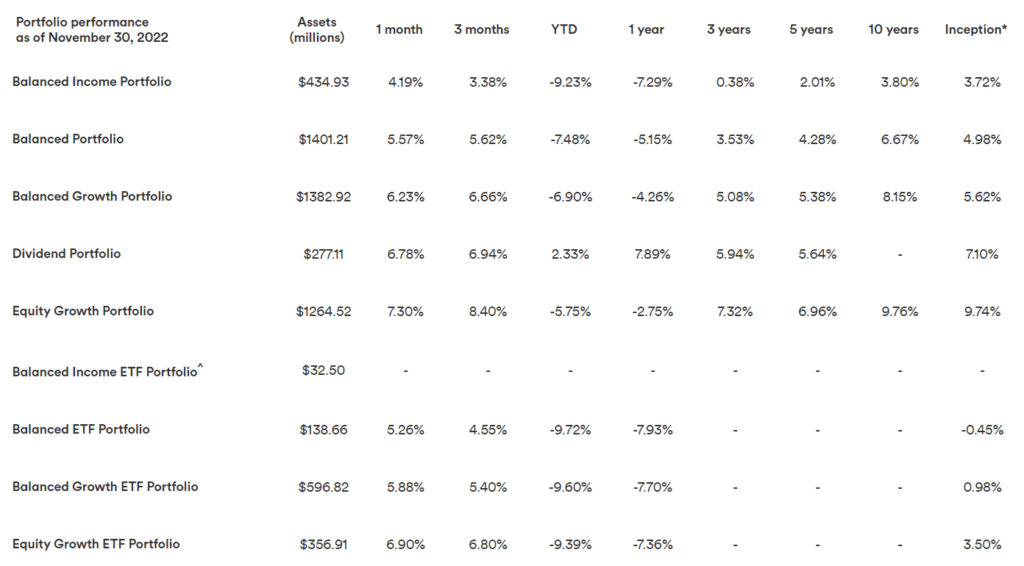

Tangerine Core (Mutual Fund) Portfolios

There are 5 different Portfolios. Balanced Income, Balanced, Balanced Growth, Dividend, Equity Growth. These portfolios come with a very high Management Expense Ratio (MER) fee of 1.06%. This means you end up paying $106 on every $10K per year in fees.

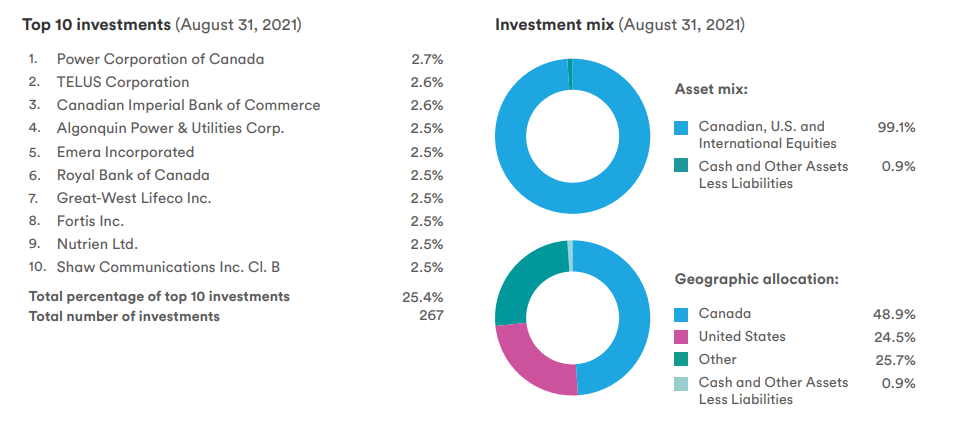

There are many cheaper ways to invest than using Tangerine’s expensive Mutual Funds. Let’s analyze the top holdings on Tangerines Dividend Portfolio. An investor who doesn’t mind spending some time online, can purchase these stocks directly without paying any extra fees. An alternative, is buying low-cost ETFs through Questrade or Wealthsimple.

Tangerine Global ETF Portfolios

Tangerine realized investors are not interested in paying high fees for mutual funds so invented their own ETFs. There are 4 types of Tangerine ETF Portfolios. Balanced Income ETF (70% Bonds, 30% Stocks), Balanced ETF (40% Bonds, 60% Stocks), Balanced Growth ETF (25% Bonds, 75% Stocks), and Equity Growth ETF (100% Stocks).

These ETFs come with a high 0.76% Management Expense Ratio (MER) fee. There is also a Trading Expense Ratio (TER) fee of around 0.30% which brings the total fees to a very high 1.06%. In addition, there might be a $125 transfer-out fee for a transfer to another financial institution.

All these ETFs hold different percentage of other ETFs and the details can be found here.

Similar to Tangerine’s mutual funds, Tangerine ETFs are expensive and should be avoided as there are many cheaper alternatives including buying low-cost ETFs through Questrade or Wealthsimple.

For those who enjoy a totally automatic and hands off investment, Questwealth is a great cheap alternative.

Tangerine Socially Responsible Global Portfolios

This is Tangerine’s newest addition to the investing family. Similar to Tangerine’s Global ETF portfolios, there are 4 types of Tangerine SRI Portfolios. Balanced Income SRI (70% Bonds, 30% Stocks), Balanced SRI (40% Bonds, 60% Stocks), Balanced Growth SRI (25% Bonds, 75% Stocks), and Equity Growth SRI (100% Stocks).

These ETFs come with high fees as well and my feedback is similar to what I mentioned previously about Tangerine’s mutual funds and ETFs. Please use an alternative cheap option as it will save you thousands of dollars in fees during your years of investments.

Tangerine Bank’s Credit Cards

Check out my complete Tangerine credit cards guide.

I personally own Tangerine World Mastercard which I really appreciate having. I think Tangerine did a great job in their credit cards and are offering nice credit cards for those of us who enjoy having some of our spending returned through credit card cashbacks.

Currently, Tangerine offers two credit cards which I’ll be talking about in this section.

Special Limited Bonus: Apply for a Tangerine Money-Back Credit Card or Tangerine World Mastercard by Jan 31 , 2023 and earn an extra 15% back (up to $150) when you spend up to $1,000 in everyday purchases within your first 2 months.

Tangerine Money-Back Mastercard

This free credit card offers a nice 2% unlimited cashback in 3 selected categories if the cashback goes into Tangerine Savings account.

All other non-selected categories will receive 0.5% cashback.

The categories are grocery, furniture, restaurants, hotels, gasoline, bills, drug store, home improvement, entertainment, and public transportation | parking. Tangerine Money-Back Mastercard has no annual fee with an annual 19.95% interest rate.

Tangerine World Mastercard

This credit card is another no fee card. Similar to Tangerine’s other card, it comes with 2% cashback on any selected 3 categories if cashback goes into Tangerine Savings account.

However, it comes with some features, like free Boingo Wi-Fi anywhere in the world, access to Mastercard airport lounges plus a travel reward program, and insurance (car rental and mobile device).

To be eligible for Tangerine’s World Mastercard, you need to have a gross household income of $100,000 or more or a total balance of $250,000 in Tangerine savings or investment accounts.

As mentioned earlier, I personally use Tangerine World Mastercard in my chosen three categories which are grocery, gasoline, and restaurants.

Apply for a Tangerine Money-Back Credit Card or Tangerine World Mastercard by January 31, 2023 and earn an extra 15% back* on up to $1,000 in everyday purchases made within your first 2 months.

Other Tangerine’s Services and Products

Line of credit to borrow money to pay off at your discretion, with a low variable interest rate and no annual fee. This can be a great alternative to emergency funds.

Home Equity Line of Credit (HELOC) with a 3.10% loan payback interest rate.

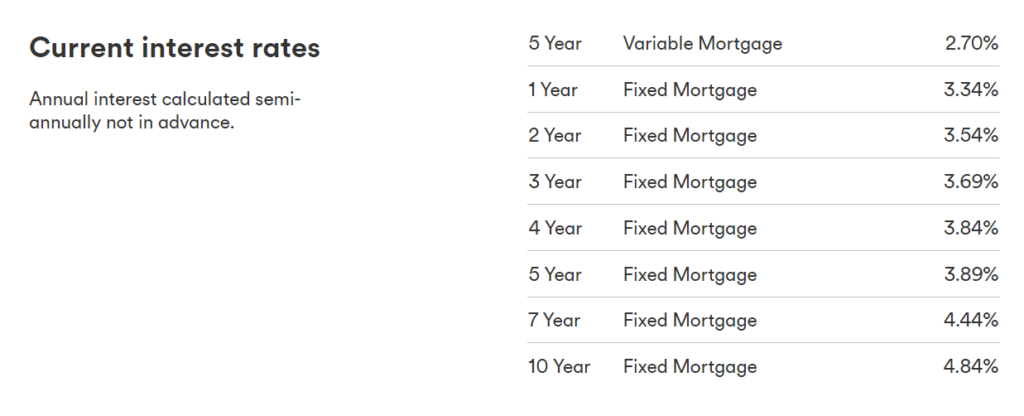

Mortgage which is currently 3.89% for a 5 year fixed term or 4.84% for 10 year fixed term. Tangerine offers a competitive mortgage rates in the Canadian market.

RSP Loan is another borrowing option offered by Tangerine. You can choose to repay the loan in 12 payments over 1 year or, if you prefer, wait 3 months, and repay the loan in full over the following 9 months. I don’t recommend using an RSP Loan to contribute to RSP accounts.

Please take all the fees into consideration when making a decision. For example, there is a $50 RSP, TFSA, or RIF transfer fee from Tangerine to other banks. A complete list of Tangerine fees can be found here.

Final Notes, Summary, and My Verdict

- I highly recommend Tangerine Chequing Account as it comes with great benefits including $0 monthly fees, unlimited Interac transfers, $50 free cheques, and free access to all Scotiabank ATMs.

- I do not recommend Tangerine Savings Account unless you are close to retirement or retired and do not want to take any risk. Even at that point, consider Tangerine’s Savings account only if you get a special offer higher than competitors like EQ Bank. In addition, count in the $50 transfer out fee for registered accounts.

- I do not recommend using any of Tangerine’s investment portfolios. This applies to Tangerine’s mutual funds, global ETFs, and SRI portfolios. Instead use Wealthsimple or Questrade for your investment. They provide self or robo investment options.

- I recommend signing up for one of Tangerine’s credit cards which are Tangerine World Mastercard and Tangerine Money-Back Mastercard. These are free cards with 2% cashback on 3 selected categories.

- Other Tangerine’s products like Personal LOC, HELOC, and mortgage are interesting options but it comes down to the rate offer you receive from Tangerine. I personally have a Tangerine’s Personal Ling of Credit as my emergency fund.

- Tangerine offers phone and chat support which I love. There is no direct interaction with employees in bank branches but there are limited cafes which are currently located in Toronto, Vancouver, Montreal, and Calgary.

With the world becoming digital more and more, I think everyone can and should adapt to the change. Tangerine is one of the best online banks in Canada. Nevertheless, if you need a traditional brick and mortar bank, Tangerine will not be your best option.

Is opening an account with Tangerine worth it? Absolutely. Getting all the mentioned features for FREE is a smart choice. If you decided to open a Tangerine account, EARN AN EXTRA $50 by using my Tangerine Referral Orange Key 43640010S1.

If you enjoyed reading this review, please help us grow together by using my Tangerine Referral code (Orange Key) 43640010S1 to get your $50 extra bonus.

I just want to know how much tangerine paid you for that review?

Hello Barbs. Thanks for reading. $0 sadly. But may I know why you thought this was a paid article? Did I say something that isn’t accurate? I am open to feedbacks.