Ideology Behind Applying for So Many Cards

You read this right! I am a Credit Card Bonus addict. I applied for 4 new credit cards in 2 days (Friday and Saturday) and got 3 new credit cards approved in 2 days. My goal was to get value cards both from the Welcome bonus and the card feature.

The third card is a fantastic travel credit card.

The only soft rejection was from TD which you can read the details here.

If you’d like to know more about travel credit cards and special offers, please check out True Best Travel Credit Cards in Canada 2021.

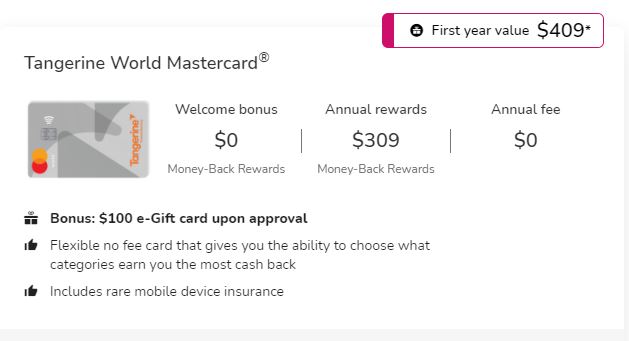

First New Credit Card: Tangerine World Mastercard

The first New Credit Card was a Tangerine World Mastercard. I saw the offer on a new to me site. The $100 Amazon Visa card offer is through this third party not Tangerine directly.

Does it matter who gives the free money? I don’t think so. I provided all the details and a step by step application process to claim your $100 Amazon Visa card on this post.

What am I gaining? $100 Amazon Visa Card and a 2% money back on 3 categories. I will use the Bill Payment category as I the best I have now is Rogers World Elite Mastercard offering 1.5%.

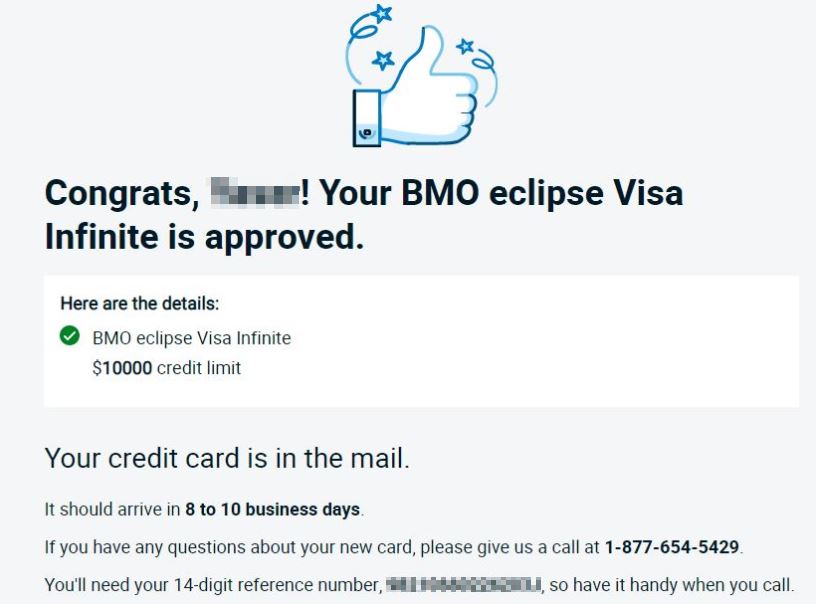

Second New Credit Card: BMO eclipse Visa Infinite

I should admit! I love the name “eclipse”. It is the most unique name for a credit card I have ever owned. Distinctive. This is my first ever BMO product. Can you believe it? Never had anything to do with BMO.

I was a bit worried after TD’s rejection but I was like, either suck it up and keep wonder when to apply for a new Credit Card again or just go ahead and screw your credit score by applying! Worst case, I just have to wait couple months for the Credit Score to come up closer to 800 range again.

But there goes BMO kindness and I got approved. Isn’t this fantastic? I also wanted to apply for their new Chequing account offer to get a sweet $300 cash.

Gen Y Moeny has a great product review of the new bank account offers on her great blog.

What am I gaining? Honestly, much better than expected! I just picked a quick promotion different than the initial one I aimed for in TD and instead of $200 with TD will get $400 with BMO.

I will get a 25,000 BMO Points after spending $3000 in the first 3 months plus 15,000 points on the first anniversary. In addition, the $120 annual fee is waived in the first year. As I will spend the $3000 on gas and grocery, there goes an extra 15,000 BMO Points.

The dollar value of a BMO Rewards point remains constant at $0.007, as you receive a $1.00 credit for every 140 points. This means I am gaining more (5 points per $1 spent on eligible dining, groceries, gas, and daily transit purchases) than my current 3% with my Canadian Tire World Elite Mastercard.

The 15,000 BMO Points is going to be $107.14 versus $90 in CT Points. The 40,000 points will be translated to $285.

- 5 points per $1 spent on eligible dining, groceries, gas, and daily transit purchases

- 1 point per $1 spent on all other eligible purchases.

- Add an authorized user to earn 10% more rewards on all your spending

- 7 types of included travel insurance and purchase protection

- A unique $50 annual lifestyle credit

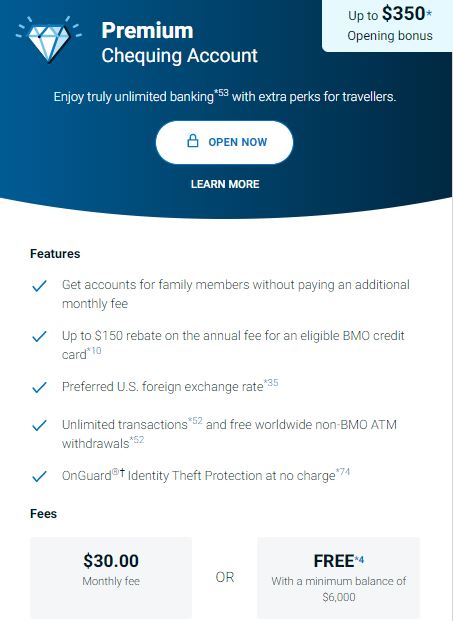

I Will Not Pay BMO eclipse Visa Infinite Annual Fee, Ever! How?

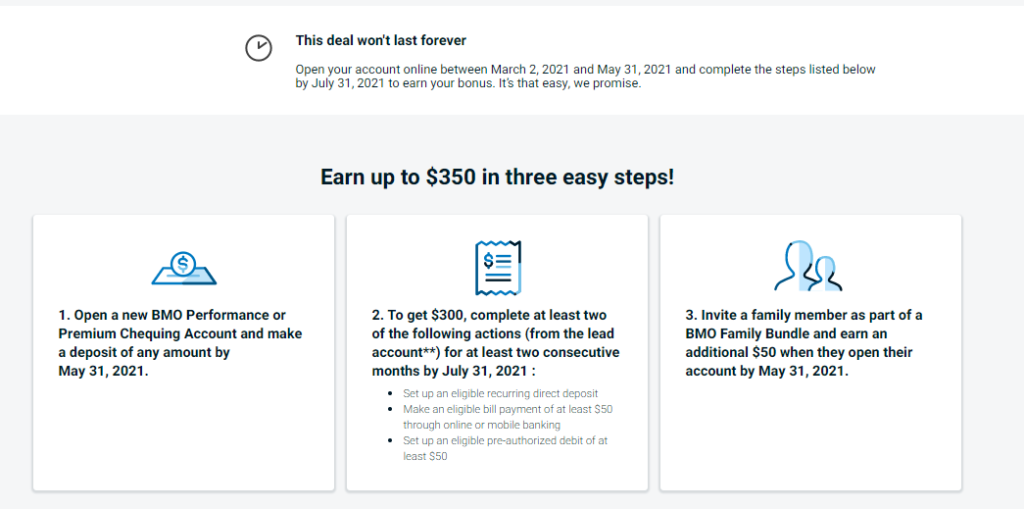

Easy! I am going to apply for BMO Premium Chequing Account, get another FREE $300 and all kind of benefits including free unlimited worldwide ATM (Good to have a backup for my STACK Card for foreign ATM withdrawals). Also, this Premium Chequing Account offers a $120 rebate on the Credit Card which makes it a FREE card with some amazing features. Technically, I am making money from BMO counting in the $50 credit.

As shown below, I will have to keep $6000 in my account to have the Chequing account fees waived.

I need to confirm with BMO that they don’t charge the additional 2.5% fee for foreign ATM transactions. Here is their fine print which sounds like they charge then refund the 2.5%.

52. Includes everyday banking transactions at a BMO branch, BMO ATM, BMO Telephone Banking, BMO Online Banking, BMO Mobile Banking, debit card purchases, cheques drawn on your account and Pre-Authorized Debits.

53. Some non-BMO ATMs may charge you a convenience fee. The convenience fee is not a BMO fee and is added to the total amount of your withdrawal. You are responsible for the convenience fee that may be applied to your transaction.

58. For purchases made through the Mastercard network, a hold may be put on your bank account in the amount of your purchase in Canadian dollars. The hold will be removed when the transaction is debited from your bank account. The exchange rate for converting foreign currency transactions to Canadian dollars is the rate charged to us by Mastercard International on the date the transaction is posted to your account, plus 2.5% for purchases and minus 2.5% for refunds. For foreign currency transactions other than U.S. dollars, the amount is first converted to U.S. dollars and then to Canadian dollars.

It is confusing, right? Oh well! Welcome to Financial Independency techniques!

The card’s first year fee is waived. Here are my timelines:

- March 6th, 2021: Credit Card Approved

- May 15th, 2021: Open BMO Premium Chequing Account and request Payroll to change banking account. Leave $6000 in the account to avoid the $30 in fees. Perform 2 online banking payments.

- June 2021: Receive the welcome 20,000 BMO Points

- Aug 31, 2021: Receive $300 which is a nice 5% return on investment.

- March 2022: Receive the additional 15000 BMO Points.

- June 2022: The Chequing Account must remain open until May 31, 2022. I will cancel the credit card and BMO chequing account.

There might be better chequing accounts offering better with more products rebates. TD Safe Box and Road Side Assistance as an example. We shall see by June 2022 (Have to keep the chequing account open till end of May 2022).

For reference, here is the insurance certificate for this card. Emergency Medical Coverage is for the first 15 days. This card doesn’t come with Trip Cancellation/Trip Interruption Insurance, Flight Delay and Baggage Insurance, Hotel Burglary Insurance. These limitations, make this card less attractive or reliable for traveling purposes.

Third New Credit Card: CIBC Aventura Visa Infinite

This is another fantastic card with some unique features. Honestly, I LOVE this card’s features.

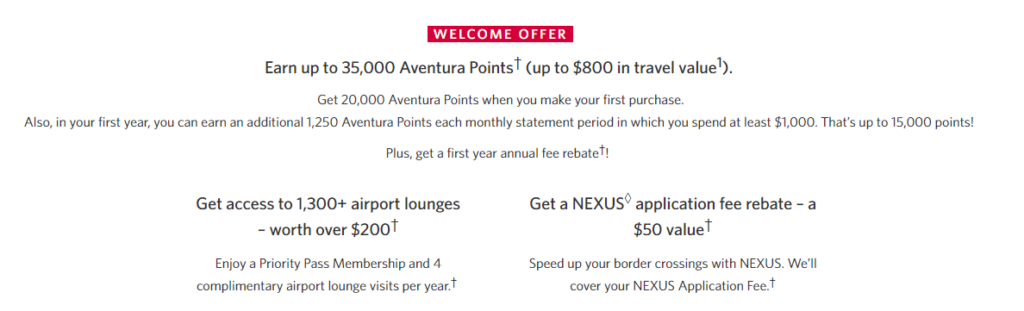

What am I gaining? $800 in travel value? Of course not. That just sounds too fancy! I don’t like their limited travel offers as they don’t have any partners (Totally different experience than Aeroplan).

I will get 20,000 Aventura Points when I make my first purchase. I honestly, have no clue how much value I can get out of it but my estimation is around $200 plus a first year waived fee. My heart is hurt a I can’t take advantage of their free 4 times a year Longue.

Should I just try getting to a Longue in Ottawa airport (If open at all)?

The card comes with a $139 fee. Only the 4 lounge cost around $160 per year so it is a win situation in case of taking advantage of it. The points aren’t very encouraging. 1.5 points for gas, grocery, and drug stores. However, it has the standard great insurance necessary for any traveler.

The disadvantage is that I won’t be spending any dollar with this card so no extra 1,250 Aventura Points monthly up to 15000.

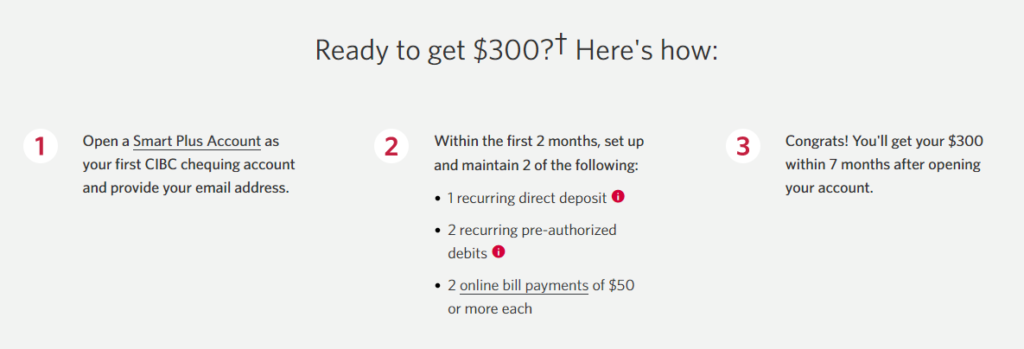

Will I keep this card? No, I won’t. I will close this account if I can’t maintain it for free. I can avoid paying the annual fee by getting CIBC Smart Plus Account.

Currently, there is a promotion similar to BMO’s where you can get a $300 in cash. To avoid the $29.95 after the first 3 months, I will need to maintain a $6000 balance. However, this offer is open till July 29, 2021. I might open the account on July 28th, and fulfill the requirement in Aug and Sept 2021 to get the $300 (After reviewing BMO’s requirement in more details).

For reference, here is the insurance certificate for this card. Emergency Medical Coverage is for the first 15 days and comes with full travel coverage. I just wished their 15 days was more as we sometimes travel for 3 weeks.

Conclusions and Future Plan Summary

Tangerine World Mastercard is a free card. No worries to keep it.

BMO eclipse Visa Infinite is a good card. However, there are better cheaper cards. Considering BMO Chequing account’s $300 offer, I will keep this card as long as I am not paying for it. In total, a 40,000 BMO Points and an additional $300 in cash for the Chequing account.

CIBC Aventura Visa Infinite is a relatively good travel credit card. However, it can’t be my main travel card due to its 2.5% foreign exchange fees and only 15 days out of province emergency travel insurance.

I am going to get the CIBC chequing account to take advantage of their $300 offer . This will be on top of the 20,000 points.

In total, I will get $600 cash, 60,000 BMO and CIBC points, $100 Amazon Gift Card. The total value will be around $1200 CAD. The disadvantage is not too complicated. I have to maintain $6000 in CIBC Smart Plus Chequing until Aug 1st, 2022 and another $6000 in BMO Premium Chequing until May 31, 2022. It is a 5% ROI ($600 for $6000).

Tell me about your cards and experiences. What are your thoughts about my plans? I appreciate any feedback in making a better and more informed decision.

You should look into the Scotiabank Momentum too! 10% cash back and there’s a $100 cash back with Great Canadian Rebates. I love credit card offers 🙂

PS thanks for the mention.

Thank you! I had the Scotia Momentum Visa Card couple years ago but I will apply for it in 3 months again when I am done spending the $3000 on the new BMO card to be eligible for the points.

In 2019, I took advantage of Scotiabank Gold where they gave back $300.

There are so many options out there but should be careful to leave enough time between applying / cancelling for eligibility.