Do you fancy credit cards’ points and would like to optimize your HSBC Rewards Points value and optimize your HSBC Points redemption? In this article, I am going to walk you through a complete review of HSBC Rewards Points while comparing all the methods in order to answer below questions:

- How do I spend my HSBC points?

- How to maximize HSBC Points?

- How much is 100,000 HSBC Points worth?

- What is HSBC Rewards Points value?

Is HSBC Rewards Points Program Worth Considering

Maximizing the return on our credit card rewards is a fantastic way to recover a small portion of our spending. HSBC Rewards is one of the most appealing and flexible programs in the Canadian credit card market.

In addition, HSBC is a popular worldwide bank which means many citizens of planet Earth including Canadians with an HSBC bank account have an HSBC credit card. However, needless to say, taking advantage of all the promotional bonuses that come with getting a new HSBC rewards credit card is the fastest method to collect HSBC Rewards points.

After a year of owning my first ever HSBC credit card, HSBC World Elite Mastercard, I accumulated enough points from bonuses and minimum spending requirements to redeem my points for a reasonable amount. This is similar to any investment return where I invested my time to apply and optimize the return.

As pointed on my article here, I like to apply for different credit cards to earn bonuses and points that I can redeem for rewards. On top of this, as I don’t like paying for credit cards yet want to have a card with a great insurance coverage including travel and rental car coverage, I always get a new card annually to take advantage of the waived first year fee.

Related: Best Travel Credit Cards in Canada

Related: Complete BMO Rewards Points Guide & How to Maximize BMO Points Dollar

Last year, I applied for HSBC Credit Card and earned 136,264 HSBC Rewards with 120,000 came from bonuses for applying and keeping the card for 180 days. As a resident of Quebec, I didn’t have to spend any amount to earn points. However, I had to pay the $149 annual fee.

It was time to redeem my HSBC Rewards points to cash or equivalent. Honestly, I prefer cashback versus points programs. But, HSBC Rewards program is one of the best in Canada due to its flexibility so no complaints.

In the following sections, I am going to cover HSBC Rewards Points value and which category to use in order to maximize the dollar value of your HSBC Points.

What Is the HSBC Rewards Points Value

Lots of people ask questions like, how much is 100,000 HSBC Points worth? To answer this and similar questions including “how do I spend my HSBC Points?”, we need to understand the different ways and the value of redeeming HSBC Rewards points to cash value.

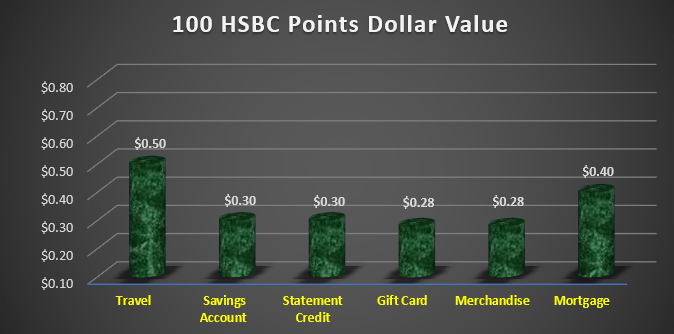

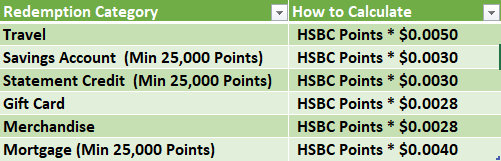

Here is a chart showing the average dollar value of 100 HSBC points in different categories.

HSBC Rewards points to cash value can be in average anywhere between $0.28 to $0.50 per 100 HSBC Points which is equal to 0.28 to 0.50 CPP (Cents Per Point).

How to Maximize HSBC Rewards Points Redemption

The best methods to optimize HSBC Points is to redeem them for travel credit. Next best option is to apply the points for a mortgage credit. And finally, the worst or least favorable method is to redeem HSBC Rewards for gift cards or merchants.

How to Calculate the HSBC Rewards Points Value in Cash

You need minimum 25,000 HSBC Points to redeem for $125 in Travel Rewards. To calculate the value of 100 HSBC Rewards Points to cash the math will be as simple as below:

$125 * 100 / 25,000 HSBC Points = $0.50 (1 HSBC Point = $0.005)

This means, redeeming for travel category gives a value of 0.5 CPP (Cent Per Point).

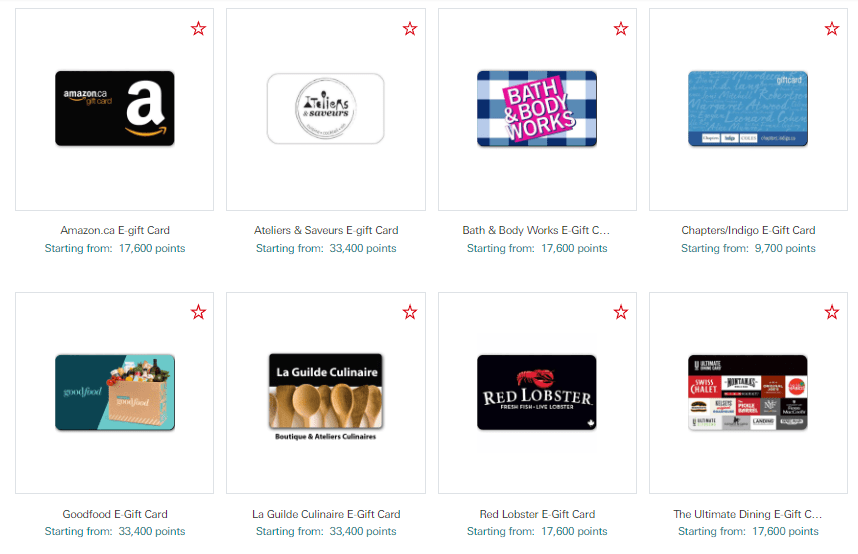

Another example is that you need 17,600 HSBC Points to buy a $50 Amazon gift card. Below is the related calculation:

$50 * 100 / 17,600 HSBC Points = $0.28 (1 HSBC Point = $0.0028)

The 100 in the middle is to do the calculations for 100 HSBC points to make the number more human readable. You can easily do the same calculation for 1 HSBC by removing the 100. Based on above, redeeming HSBC Points for gift cards provides a 0.28 CPP (Cent Per Point) value.

How to Redeem HSBC Rewards Points for Gift Cards

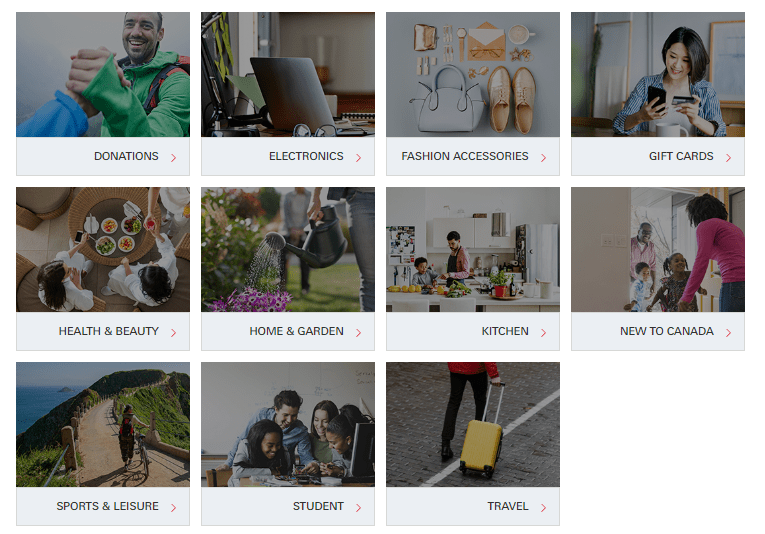

There are currently 59 products under gift cards section of HSBC Rewards.

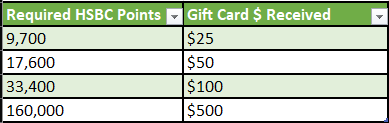

Except for Costco Membership and Accor Ovation Rewards Bed & Breakfast, you need 9,700 HSBC Points for $25, 17,600 for $50, 33,400 for $100, and 160,000 HSBC Points for a $500 gift card.

HSBC offers a wide range of gift cards. The list contains Amazon, Best Buy, Avis, Canadian Tire, Chapters, Cineplex, Cora, Costco, Esso, Home Hardware, Hudson’s Bay, IGA, Shoppers Drug Mart, Petro-Canada, SAQ, Sport Check, Walmart, Wayfair, Ultramar, Uber, and more.

Here is the gift cards’ redemption table.

As shown above, the redemption value for 100 HSBC Points is $0.26 or 0.26 CPP for the smallest amount and $0.31 or 0.31 CPP for the highest amount for almost all cards.

If your HSBC credit card return is the highest possible which is 6 HSBC Points for travel purchases by using HSBC World Elite Mastercard, you need to spend $1,617 to get 9,700 points enough to redeem a $25 Gift card or $26,667 in spending for a $500 gift card .

The highest possible dollar cashback value for gift cards redemption is 1.87%.

How to receive a free Costco membership? Another option is to swap your HSBC points for Costco Membership. 20,700 or 40,000 points for Gold and Executive Memberships respectively.

This means, 40,000 for $120 or 0.3 CPP which is the best value for a gift card.

However, if your HSBC card earns 3 HSBC points, the real return for gift cards redemption is less than 1%.

Gift Cards Redemption Conclusion: Redeeming HSBC Rewards Points for Gift Cards isn’t at your best interest.

How to Redeem HSBC Rewards Points for Merchandise

The value for merchants is almost equal to redeeming points for gift cards. The number is $0.28 per 100 HSBC Points.

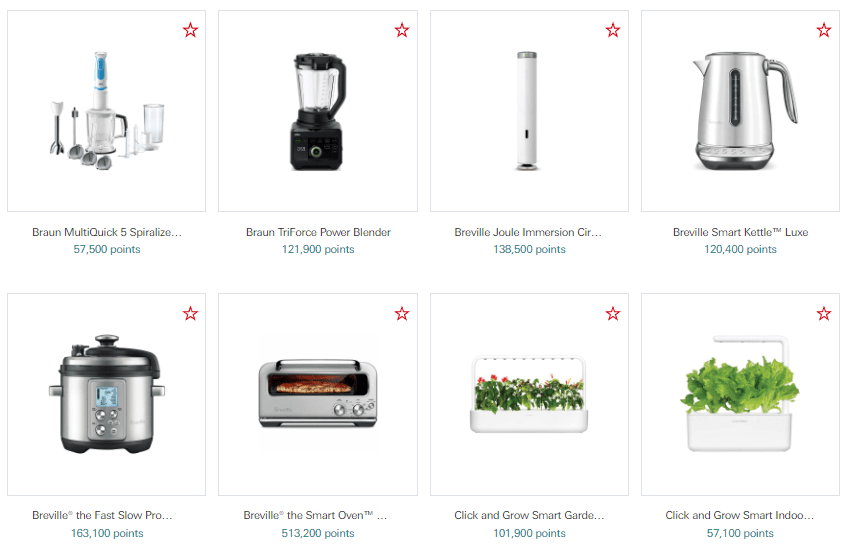

I am going to pick some random items and compare based on the listed price on Amazon or Walmart to get a sense of the CPP value.

From this list, I am going to pick Braun TriForce Power Blender which requires 121,900 HSBC Points. This item is listed for $299.99 on Amazon and a total of $344.91 after tax which means it has a 0.28 CPP.

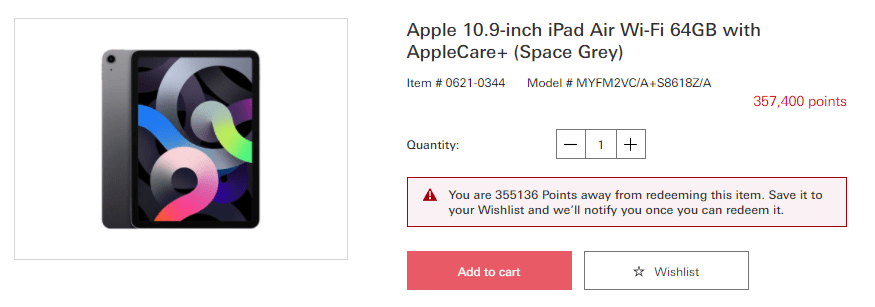

Here is another popular item to compare, an iPad Air Wi-Fi 64 GB with AppleCare+. This iPad comes to a total $986.49 after tax and shipping if purchased from Apple which again comes down to having a 0.28 CPP.

Next, let’s pick an item from the Sports & Leisure category. Because we love camping, I picked Coleman Dark Room Sundome 4-Person Conventional Tent which requires 69,500 points. This item comes to a total $171.93 after tax and shipping on Walmart.

Based on our little calculation, this comes to 0.25 CPP which is in line with the previous CPPs. I am now personally curios and going to do one more item to get a better view of HSBC Rewards value.

I picked BaByliss PRO Tourmaline and Ceramic Hairdryer from Health & Beauty category which requires 41,100 HSBC Points. This hairdryer is listed for $70 on Amazon and comes to a total $80.48 which brings the CPP all the way down to 0.19. Isn’t this awful?

Higher CPP or Lower CPP, which one is better? Higher CPP is always better. It means, you get more cents or dollars from each earned point. 0.20 CPP means 0.2 cents or $0.002 per point.

Based on our 6 HSBC per $1 spending calculations, in the best case scenario, this will come up to 1.69% cashback return on the card. However, if we calculate based on the average 3 HSBC Points Per Dollar, it will be a 0.85% return.

Merchants Redemption Conclusion: It seems redeeming HSBC Points for items on the merchandise list isn’t worth it. You get less value for your points in comparison with gift cards or redemption for travel spending.

How to Redeem HSBC Rewards Points for Travel Rewards

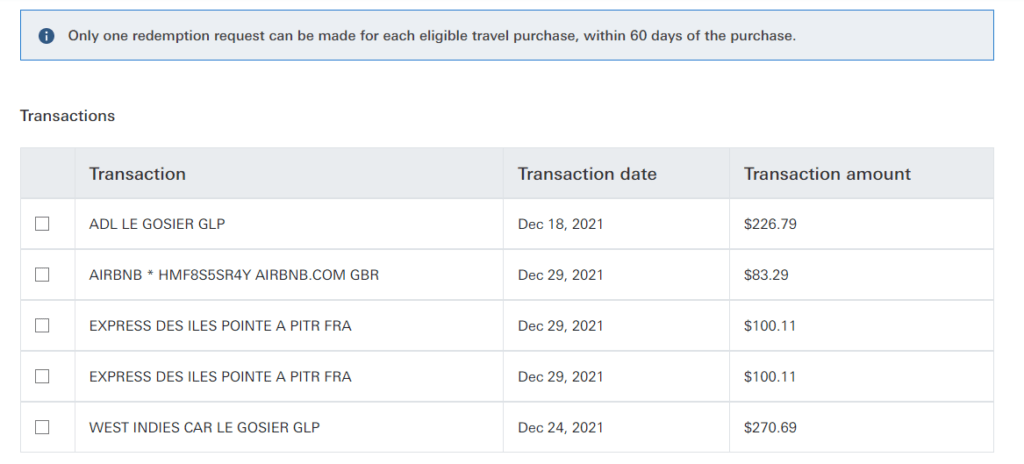

This is different than redeeming for the balance statement. Travel Rewards option can be used toward flights, vacation packages, hotel, Airbnb, car rental, cruise, rail ticket, or a tour.

HSBC Points can be redeemed for the above mentioned travel expenses. Travel credit value is $0.50 per 100 HSBC points or 0.5 CPP. This is different than booking travels using HSBC Points which I will discuss soon.

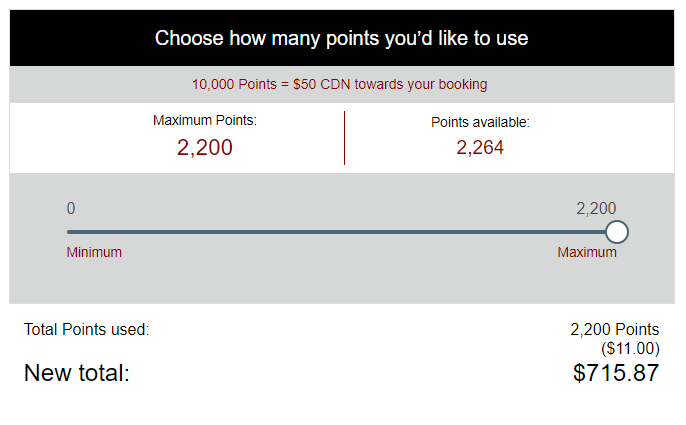

HSBC Rewards points can pay for travel purchases made in the last 60 days. The disadvantage is that a minimum of 25,000 points needs to be redeemed toward a $125 travel expense. After the initial 25,000, it needs to go in a 10,000 points incremental.

This means, you can’t redeem 30,000 for $150. It can only be done for 35,000 and so on.

This category can be considered as redeeming HSBC rewards for money or cash payouts. You are basically paying your statement by using the (kind of) freely earned points.

Travel Rewards Redemption Conclusion: Redeeming HSBC Points for a travel credit balance is equal to 1-3% cashback depends on your HSBC Credit Card reward earning points. However, this provides a higher CPP value than merchandise or gift cards.

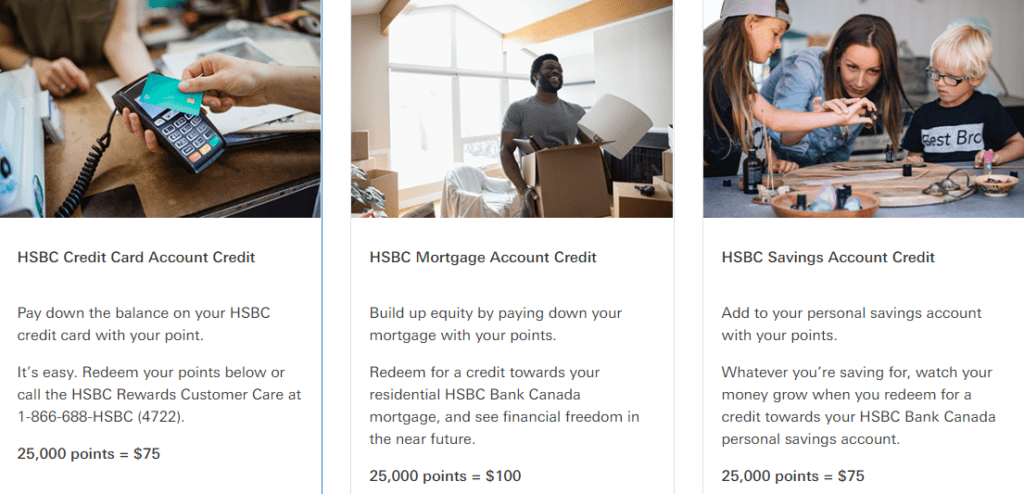

How to Redeem HSBC Rewards Points for Mortgage or Savings Account

Do you want to pay down your mortgage faster? Yes, free money toward your property!

This is an interesting category which shockingly doesn’t provide a great CPP value. Best option is to use 25,000 points towards $100 in HSBC Mortgage Account. This is a 0.4 CPP.

It’s worth noting that this redemption will not replace or reduce the scheduled mortgage payments. However, HSBC will waive any charges which may apply as a result of HSBC Mortgage account credit.

The other option is to invest $75 by redeeming 25,000 in an HSBC Personal Savings Account. The CPP is 0.3 which is similar to purchasing a gift card. I wonder why HSBC doesn’t make this more interesting to get more people open and invest their money in an HSBC Savings Account!

Mortgage or Savings Account Redemption Conclusion: Redeeming HSBC Points for a Mortgage balance is better than applying it towards a Savings account or purchasing items from merchants. However, travel credit remains the leader in this equation.

How to Redeem HSBC Rewards Points for Statement Credit

HSBC Rewards Points can be redeemed with a 0.3 CPP for credit card balance. Unfortunately, this can’t be done online and you’ll need to contact HSBC Rewards Customer Care for applying 25,000 HSBC Points per $75 of credit card statement balance.

Statement Credit Redemption Conclusion: Redeeming HSBC Points for credit card statement balance is better is comparable to purchasing a $50 gift card. However, it is better to apply a travel credit than a whole statement credit if possible. The inconvenience of having to call to use this option is another reason to avoid it.

How to Redeem HSBC Rewards Points for Booking Travel

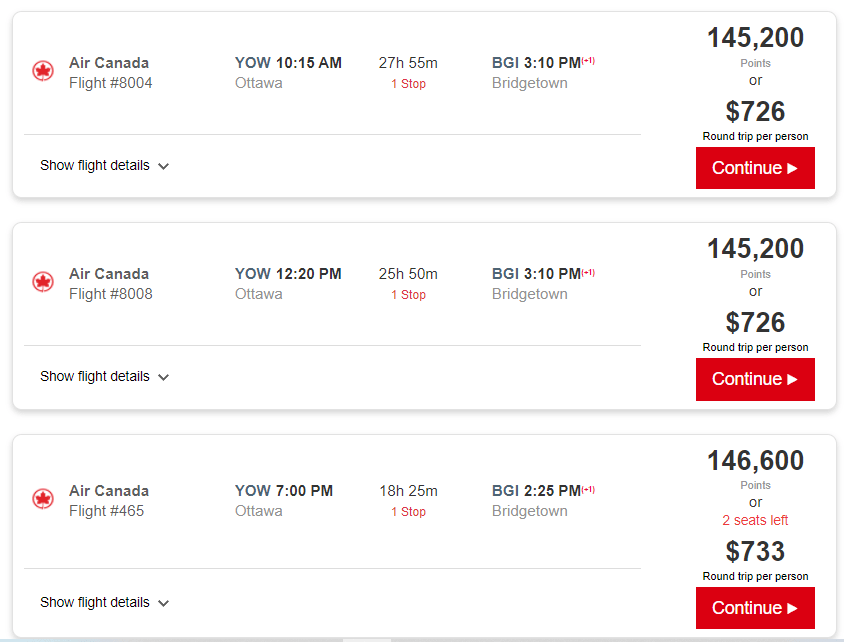

Redeeming HSBC Points for travel is as high (or good) as redeeming for investment. As shown below, I need 145,200 HSBC points in exchange of $726 for a booking a round trip flight from Ottawa to Barbados.

This translates to an amazing 0.5 CPP which is exactly what we get for redeeming HSBC points for Travel Credit.

- Points can be redeemed for flights, rental cars, and hotels

- Points can be used for any flight or seat as there is no blackout

- Points can be used for paying taxes and fees

- Points and credit card payments can be mixed. There is no minimum points requirements

- Bookings need to be done directly on HSBC Travel Partner

HSBC Travel uses Red Labels Vacations as its partner to process the travel bookings.

Travel Redemption Conclusion: Redeeming HSBC Points for travel gives the best value for money at a 3% return based on 6 HSBC per dollar. This gives the same value as redeeming points for Travel statements.

How Much is My HSBC Rewards Points Worth in Dollar Amount

Below is a simplified chart to calculate the dollar amount of your HSBC Rewards Points based on the available categories to redeem the points for.

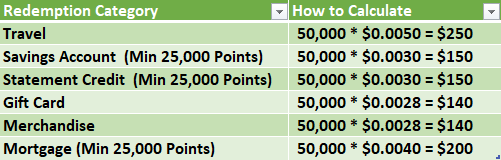

Here is an example to clarify the calculations even more.

John and Brenda have 50,000 HSBC Points. How to redeem 50,000 HSBC Points?

Based on our calculations below, 50,000 HSBC Points can be redeemed to purchase an item or a gift card worth up to $140, a statement credit of $150, deposit $150 into a personal HSBC Savings account, $200 for mortgage payment, or $250 in travel expenses.

It is worth reminding you that travel credit can be done in a 10,000 HSBC Points blocks after the first minimum 25,000. This means, only 45,000 can be redeemed as travel credit.

However, if booking directly from HSBC Travel, all the 50,000 HSBC Points can be used towards booking a flight, hotel, or a car rental.

Best Methods to Earn HSBC Rewards Points

Are you wondering about how to earn HSBC Rewards points? Simply start by taking advantage of promotional credit cards offers as it is the fastest method to accumulate HSBC Rewards Points.

After taking advantage of the signup promotions which usually include a waived first year fee, point accumulation can only be done by spending money using one of HSBC Rewards credit cards.

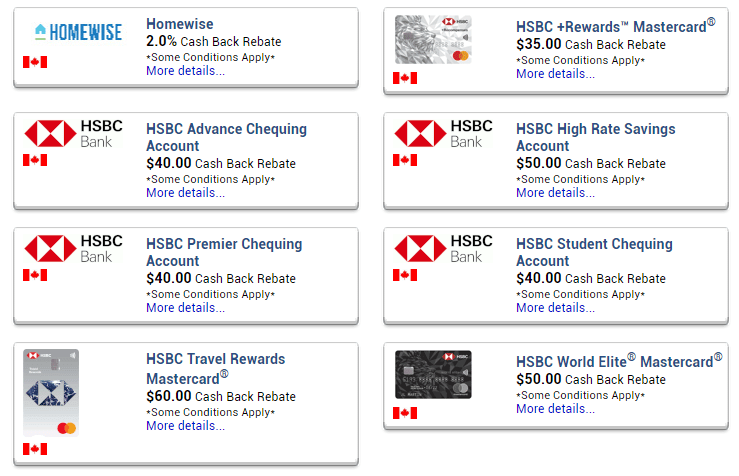

Use Rakuten to earn cashback when applying for HSBC Products. The offer is usually $60 but as shown below it is currently a promotional rate of $90.

What Is HSBC Travel Enhancement Credit

HSBC Travel Enhancement credit is a nice option for those who pay for seats, luggage or lounge. However, from my experience, you can basically redeem it towards any charge by an airline. I have used this personally for paying for one of my Pegasus flights.

Do HSBC Rewards Points Expire

HSBC Points will never get expired as long as the associated credit card is valid. This means, before cancelling a reward HSBC credit card, make sure to redeem all the points first.

Even though, HSBC Rewards points don’t expire, they can vanish completely if not redeemed before the card cancellation.

Can HSBC Rewards Points Be Transferred (Rewards for Miles)

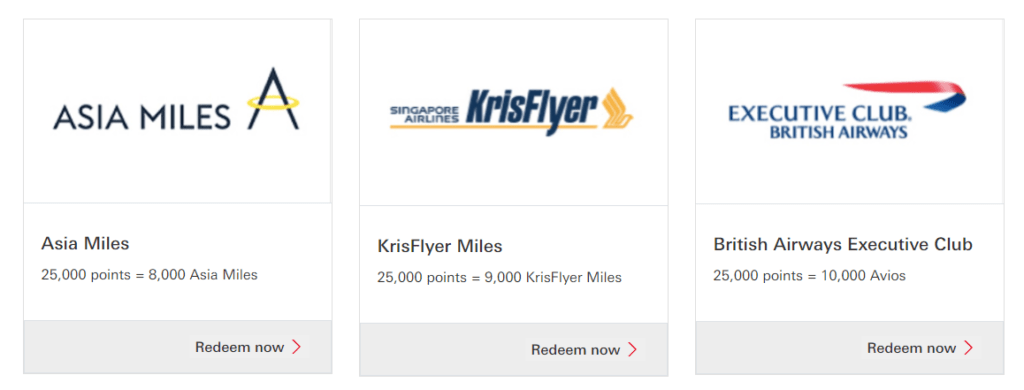

Absolutely! HSBC Rewards Points can be transferred from one program to another. However, there are many rules and restrictions.

In addition, HSBC Rewards is a unique loyalty program which allows you to transfer your points to other partner airlines’ rewards programs. The transfer partners and points conversion rates are as shown below:

- 25,000 HSBC Rewards points = 8,000 Asia Miles

- 25,000 HSBC Rewards points = 9,000 Singapore Krisflyer Miles

- 25,000 HSBC Rewards points = 10,000 British Airways Avios

There’s a minimum requirement of 25,000 points and then it goes up in 10,000 increments. If you’d like a detailed explanation of these transfers, I recommend reading the great post by my friend Ricky at Prince of Travel.

HSBC Rewards Credit Cards Comparison

There are four HSBC Rewards credit card with only one of them being a free card.

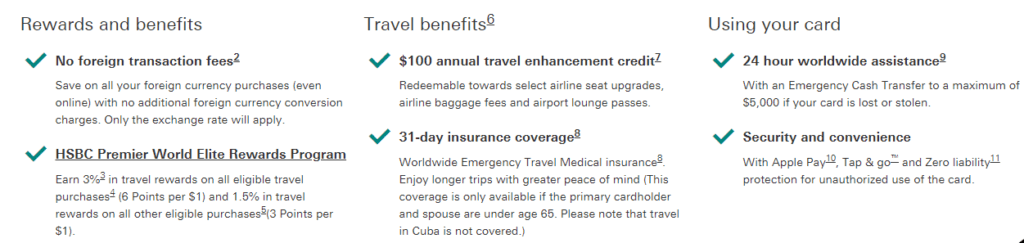

- HSBC Premier World Elite Mastercard

- HSBC World Elite Mastercard

- HSBC +Rewards Mastercard

- HSBC Travel Rewards Mastercard

I am going to simplify the comparison with a chart so you can decide on which card works the best for your needs. HSBC Premier and HSBC World Elite Mastercard are identical in fees and benefits. They differ on who can apply for them.

HSBC Premier also offers an extra $50 rebate on its fees to eligible users which technically makes it a free credit card. Both these cards come with a fantastic insurance package.

Use GCR or Rakuten to apply for HSBC Credit Cards in exchange of guaranteed cashback. Use my links to earn even more welcome bonuses. Here is what GCR currently pays.

The bonuses below have spending conditions. Please review the conditions before applying.

| Credit Card Name | Annual Fee | Current Bonus | Rewards | Benefits |

| HSBC World Elite Mastercard | $149 (Waived 1st year) | Up to 100,000 points | * 6 points for travel * 3 point on all others | $100 annual travel credit, No FX, Amazing insurance |

| HSBC +Rewards Mastercard | $25 (Waived 1st year) | 30,000 points | * 2 points for dining, entertainment * 1 point on all others | Lowest Interest Rate |

| HSBC Travel Rewards Mastercard | $0 | Up to 20,000 points | * 3 point for travel * 2 points gas & transportation * 1 point on all others | Interesting insurance for a free card |

Which HSBC Rewards Credit Cards to Apply For

HSBC +Rewards Mastercard isn’t worth its $25 annual fee. However, it is one of the best low interest credit cards in Canada. I don’t recommend having a balance on your credit card so don’t see a use for this credit card.

The free HSBC Travel Rewards Mastercard is a very interesting option and might worth getting due to its insurance including trip interruption coverage. However, keep in mind that this isn’t a medical emergency or trip cancellation coverage. In addition, this card charges 2.5% foreign exchange so using it in other currencies will cost you money.

I wouldn’t use this card as my main travel credit card due to its limitation including no rental car insurance.

There are many better cards including Brim Financial Mastercard which has a higher cashback while having no foreign exchange fees.

The winner is the credit card I already have, HSBC World Elite Mastercard. This card comes with some fantastic insurance (Unfortunately, useless in the past 2 years due to the Canadian government Level 3 travel advisory of Avoiding all non-essential travels).

In addition, this card pays back $100 of its $149 annual fees which makes. Considering it pays 3% cashback for travel expenses and no Foreign Exchange fees, I declare it as one of the best travel credit cards and the best HSBC credit card to apply for.

Final Conclusion on How to Maximize HSBC Points

HSBC Rewards Points is a very flexible program with wide range of selections to redeem your HSBC Points.

The best way to redeem the points are either for travel credit or booking a travel. Both are great choices. However, they each have their ups and downs. Travel credit can only be done for minimum 25,000 and in a 10,000 incremental points vs booking for travel has no min limit.

On the other hand, travel credit is a more flexible option and can be used for anything travel related including cruise, train, tours, and packages. However, travel booking is limited to rental cars, hotels (no Airbnb), and flights (no vacation packages or cruises). It also doesn’t provide all the available options to choose from.

There isn’t a wrong answer among these two travel redemption for HSBC Rewards Points options. You choose what works the best for you based on the circumstances.