Not everyone is interested in obtaining a credit card and instead prefer using one of the best prepaid credit cards in Canada.

Do you prefer spending your own money instead of relying on credit or maybe you have concerns about high interest rates or have a poor credit history?

Related: Complete Neo Financial and Neo Card Review – Is It a Good Card?

Fortunately, there is a type of card that can offer similar benefits as a credit card without requiring a credit check or the risk of accumulating debt. This is known as a prepaid credit card.

By using a prepaid card, you can load your own money onto the card and avoid the risks of overspending and accumulating debt with interest. Additionally, some prepaid cards even offer rewards for purchases, similar to traditional credit cards.

Whether you prefer a prepaid Visa or a prepaid Mastercard, there are several great options available in Canada. Here are some of the best prepaid credit cards and their unique features.

Bonus: This article also includes a list of the worst prepaid credit cards in Canada. Please avoid most of the prepaid cards in this article at all costs.

What Are The Advantages of Prepaid Credit Cards

There are several advantages of using a prepaid credit card:

- No credit check required: Unlike traditional credit cards, prepaid credit cards don’t require a credit check. This means that even if you have a poor credit score or no credit history, you can still get a prepaid credit card.

- No interest charges: Since you’re loading your own money onto the card, you won’t be charged interest on your purchases. This can be a great way to stay within your budget and avoid accumulating debt.

- Control over spending: With a prepaid credit card, you can only spend the amount of money that you’ve loaded onto the card. This can help you stay within your budget and avoid overspending.

- Security: Prepaid credit cards can be a safer option than carrying cash, as they can be replaced if lost or stolen. Additionally, many prepaid credit cards come with fraud protection and zero liability policies.

- Reward programs: Some prepaid credit cards offer reward programs, which can allow you to earn cash back, points, or other rewards for your purchases.

- Convenience: Prepaid credit cards can be used wherever credit cards are accepted, making them a convenient option for online purchases, travel, and everyday spending.

What Are The Disadvantages of Prepaid Credit Cards

While there are several advantages to using a prepaid credit card, there are also some potential disadvantages to consider:

- Fees: Some prepaid credit cards come with fees, such as activation fees, monthly maintenance fees, transaction fees, ATM withdrawal fees, and inactivity fees. It’s important to read the fine print and understand the fees associated with a particular prepaid credit card before choosing one.

- Limited credit building opportunities: Since prepaid credit cards don’t involve borrowing money or paying interest, they don’t typically help build credit history or improve credit scores. If you’re looking to build credit, a secured credit card or a traditional credit card may be a better option.

- Limited acceptance: While many merchants accept prepaid credit cards, there may be some limitations. For example, some rental car companies or hotels may not accept prepaid credit cards for security reasons.

- Reload limitations: Depending on the prepaid credit card, there may be limits on how much money you can load onto the card or how frequently you can reload it. This could be inconvenient if you need to use the card frequently or for larger purchases.

- No grace period: Unlike traditional credit cards, prepaid credit cards don’t come with a grace period for paying off balances, as you’re not borrowing money. This means that if you don’t have enough money loaded onto the card to cover a purchase, you may be declined or charged a fee.

Let’s start reviewing all the prepaid credit cards in Canada.

Wealthsimple Cash Mastercard

The Wealthsimple Cash App enables users to claim their unique Dollar $ign, similar to the Cash App in the US, offers a free prepaid Mastercard that rewards users with 1% cash back on all purchases made with the card which can earn a nice 1.5% interest.

In addition to providing a free prepaid Mastercard with 1% cashback on all purchases, the Wealthsimple Cash Card and app also offer a variety of other benefits.

- Send money instantly to contacts

- No monthly or annual account fees

- Reload instantly via a direct bank transfer

- No foreign transaction fees (Save those nasty 2.5% FX fees internationally)

- No ATM withdrawal fees globally (WS doesn’t charge any fee)

- Free deposits or withdrawals

- Add Wealthsimple Mastercard to Apple or Google Pay

- Use the cashback to purchase stocks, cryptos, or earn 1.5% interest

My Verdict: Overall, Wealthsimple Mastercard is an excellent choice for those seeking cashback rewards. I also think it is one of the best cards for international purchases while traveling considering the no FX and ATM feature.

For more information, check out my detailed review of Wealthsimple Cash.

CIBC AC Conversion Visa Prepaid Card

Currently, the CIBC Air Canada Conversion Visa Prepaid Card is the sole prepaid card in the market that permits users to load and store 10 currencies on a single card while also offering 1% cash back on all spending.

When buying products from international online merchants, many credit cards entail transaction fees due to the currency conversions required. The AC Conversion Visa Prepaid Card, on the other hand, makes purchases on supported international online stores in any of the ten currencies more convenient and cost-effective.

Current Supported Currencies: CAD, USD, EUR, GBP, AUD, JPY, HKD, TRY, CHF and MXN

- Canadian dollars (CAD)

- U.S. dollars (USD)

- Euros (EUR)

- British pounds (GBP)

- Australian dollars (AUD)

- Mexican pesos (MXN)

- Turkish lira (TRY)

- Swiss francs (CHF)

- Hong Kong dollars (HKD)

- Japanese yen (JPY)

This means, card owners can simply load these 10 currencies at anytime from anywhere to earn 1% cashback on all their Canada and international purchases. Here is the list of CIBC Air Canada Conversion Visa Prepaid card benefits:

- Preload the supported currencies and save 2.5% foreign transaction fees

- No monthly fees

- 1% cashback on all transactions

- Free Canadian ATM withdrawals

- 1 free international ATM withdrawal monthly

- Earn $10 bonus for referring a friend who joins and loads the card

My Verdict: The CIBC AC Conversion Card is a viable solution for individuals who frequently travel abroad. It allows travelers to conveniently make payments worldwide using local currencies, while helping them manage the unpredictability of FX rates and save on fees.

Considering that this card is free, I recommend having the CIBC AC Conversion prepaid card as a backup card for international traveling.

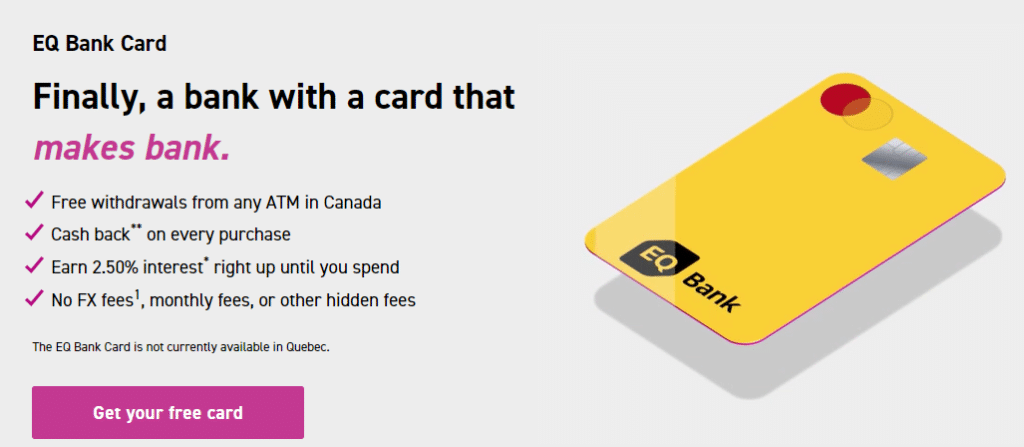

EQ Bank Prepaid Mastercard

EQ prepaid Mastercard is the newest prepaid card in Canada offered by EQ bank. This card doesn’t have any monthly or annual fee. It also comes with 0.5% cashback and pays 2.5% interest on the preloaded funds in the account.

In addition, there is no ATM withdrawal or foreign transaction fees. On top of this, EQ bank reimburses for all Canadian ATM withdrawal fees incurred by the ATM provider. The only downside of the card is that it is not available for Quebec residents.

Current Bonus: Sign up and earn a $20 referral bonus after making the qualifying deposit.

My Verdict: I highly recommend EQ prepaid Mastercard especially for international transactions. I can’t think of any Canadian provider offering a free card while waiving FX and ATM withdrawal fees.

Netcoins Prepaid Visa Card

Similar to Shakepay and Crypto.com cards, Netcoins prepaid visa card is a Crypto card which earns 1% on all transactions in Bitcoin which can be converted to Canadian Dollar and be withdrawn for free using Interac e-Transfer. Funding via e-Transfer is free to.

The card comes in both physical and virtual forms and can be added to Google, Apple, and Samsung Pay. The card has a 1.5% foreign transaction fees but offers free ATM withdrawals worldwide.

One limitation of the card is that it initially earns in $CAD then converts the amount on the 10th day of each month to Bitcoin so the earning in Bitcoin isn’t immediate.

My Verdict: I am neutral about Netcoins card considering it has no ATM withdrawal fees and pays 1% cashback on all transactions. However, don’t forget there is a 1.5% foreign transaction fee which should be considered for international purchases or ATM withdrawals.

Related: You can read my complete Netcoins review here.

Shakepay Prepaid Visa Card

Shakepay Card is crypto virtual card which can be used with any Visa-accepting merchant where Apple and Google Pay are supported. Funding and withdrawing $CAD is free via Interac e-Transfer.

The card pays 2% cashback on the first $5,000 lifetime spending. After this amount, the reward is 1%. This cashback comes is paid in Bitcoin which can be exchanged to Canadian Dollar easily but with a 1-3% embedded fee.

There is also a 3% foreign transaction fee for any international purchases.

My Verdict: Considering how Bitcoin fluctuates and the limitation of this card (no physical card so no ATM withdrawals) plus the FX fees, I recommend Shakepay Card only to those who believe in the future of Cryptocurrency and Bitcoin.

Mogo Prepaid Visa Card

The Mogo prepaid credit card stands out as the most ecologically sustainable option available. Not only is it free to use, but it also offers various benefits that could appeal to those with an environmentally conscious mindset.

For instance, each transaction made with this card earns the user 50 Satoshis of Bitcoin. Additionally, the Mogo card plants one tree for every transaction, effectively offsetting around 500 pounds of CO2 emissions over a span of 25 years for each user.

Mogo has no monthly fees. However, it carries the following fees:

- Domestic ATM: $1.50

- International ATM: $3.00

- Adding money at a Canada Post office: $3.00

- Account inactivity fee after 365 days of not using the card: $1.99

- 2.5% foreign transaction fee

- Not available to Quebec residents

My Verdict: I don’t see a real benefit of using Mogo Prepaid debit card considering it charges fees for ATM and foreign transaction usages. It also encourages consumers to spend at least once a year to avoid the $1.99 monthly inactivity fee.

BMO Prepaid Mastercard

The BMO Prepaid Mastercard comes with an annual fee of $6.95. Users have the option to deposit funds between $100 and $10,000. BMO users can load the card directly by transferring from BMO chequing or savings account.

Non-BMO customers, can load the card by using the bill payment option. It’s worth noting that using the card for cash transactions incurs a fee of $5, and the regular 2.5% foreign transaction fee is also applied.

There is no incentive (cashback) for using the card. However, users can enjoy extended warranty and purchase protection for items purchased by the BMO prepaid Mastercard.

My Verdict: I understand that the annual $6.95 fee is negligible. However, considering there is no real benefit of having the card plus its 2.5% FX fee and monthly $5 inactivity fee, I don’t recommend BMO Prepaid Mastercard.

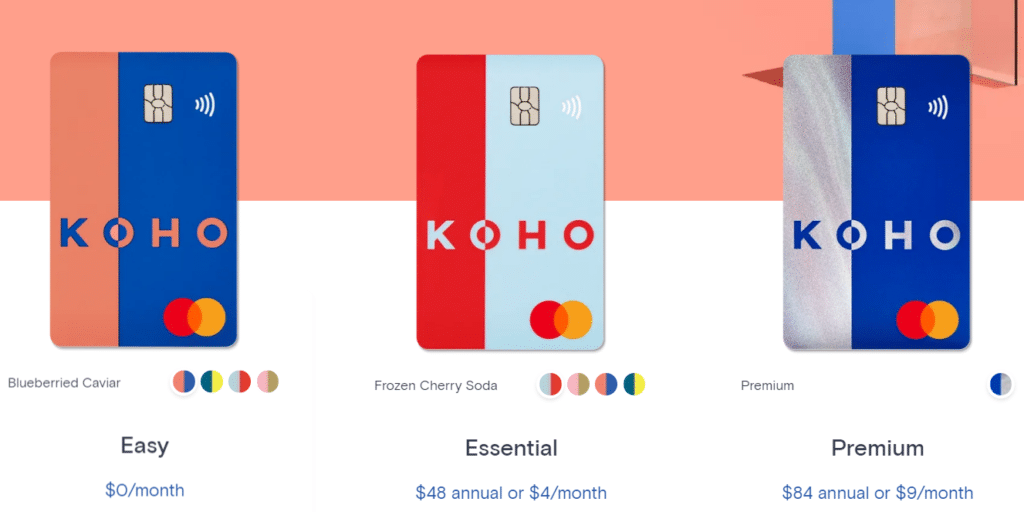

KOHO Mastercard Prepaid Card

KOHO offers a prepaid Mastercard that can be used for online and in-store purchases anywhere Mastercard is accepted. Additionally, the card comes with a smartphone app that provides budgeting tools, automated savings, and easy payment options through Apple Pay or Google Pay.

One feature that sets KOHO’s prepaid Mastercard apart from other prepaid cards is the ability to earn cashback on purchases. Depending on the retailer, cardholders can earn up to 5% cash back on their purchases.

KOHO offers three different prepaid credit card accounts which are called Easy, Essential, and Premium account. KOHO offers different cashbacks in different categories on its plans.

A feature in KOHO cards is the ability to build a credit history. However, charging Canadians with no or bad credit an annual $84 or $120 fee isn’t fair.

KOHO Easy Features:

- 1% cash back on groceries, bills & services

- Earn 0.5% interest on your entire balance

- Credit Building for $10/month

KOHO Essential Features:

- 1% cash back on groceries, bills & services, eating & drinking

- 0.25% back on all other purchases

- Earn 1.5% interest on your entire balance

- Credit Building for $7/month

KOHO Premium Features:

- 2% cash back on groceries, transport, eating & drinking

- 0.5% cash back on all purchases

- Earn 2% interest on your entire balance

- Credit Building for $7/month

- No FX fees

- 1 free international withdrawal / month

My Verdict: KOHO could have been a great option if they didn’t have the extra $7 or $10 monthly fee for (re)building credit history. In addition, there is no need to pay $84 a month to earn 1% cashback when the free Wealthsimple Cash pays 1% on all purchases.

On top of all the fees, KOHO’s customer support and app glitches have caused nightmares to many users. I don’t recommend KOHO as there are better options as stated above.

We Financial Visa Prepaid Card

We Financial reloadable credit card was initially launched in 2015 by the North West Company Inc and gained popularity among the residents of remote Northern Canada areas.

The card’s direct deposit feature allowed for quicker access to electronic payments, such as payroll. The card has a monthly $4.95 maintenance fee. It also charges $3 ATM withdrawal fees plus the 2.5% foreign transaction fees for international ATM withdrawals.

My Verdict: Considering the many better alternatives, I don’t recommend this card.

Wise Prepaid Debit Card

Wise is not a prepaid credit card but it works similarly to other prepaid cards so I thought it’s worth mentioning here.

Wise card is a multicurrency debit card which can hold and convert 49 currencies. Card holders can also receive funds in 9 currencies but send funds to 77 countries.

There is a fee for sending money which starts from 0.41%. Receiving money in Receive AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY and USD (non-wire) is free but it costs $4.14 USD if the USD payment is a wire payment.

The card comes with its own limitation including no Canadian ATM withdrawals. In addition, it only allows 2 free international ATM withdrawal as long as the total withdrawals are under $350 CAD monthly before charging the 1.75% plus $1.5 fee.

My Verdict: Wise card can be a beneficial card for those who need to send and receive money in one of the supported currencies and countries. However, I don’t think it is a good card for international travels considering its high ATM fees.

In addition, this card charges a fee to exchange between currencies. It also doesn’t offer any cashback or perks. Hence, I don’t recommend Wise debit card.

H&R Block Advantage Prepaid Mastercard

The card’s selling point is that tax refund for H&R customers is received as soon as the tax return is processed. The card has a $2.99 monthly fees. It also has a $3.00 reload fees. Interac e-Transfer which is usually free costs $3.95 with this card. Domestic ATM usage is $2.95 while international ATM costs $3.95.

On top of all these fees, the card users are dinged with a very high 3.5% foreign transaction fee which is the highest I have ever seen.

My Verdict: Don’t bother with this card even if you are an H&R client. All of us can wait a couple days to receive our tax refunds on another card which doesn’t cost anything.

Vanilla Prepaid Mastercard

The only use of Vanilla Prepaid Mastercard is to be given as a gift. This card can’t be used to withdraw cash from an ATM. It also comes with the 2.5% foreign transaction fee.

There is also a $3.95 to $7.95 activation fees on this card.

My Verdict: This card is good if you’d like to burn some extra money. Otherwise, I recommend buying a simple Walmart or Amazon gift card which doesn’t carry an activation fee.

Titanium+ Prepaid Mastercard

This is yet another card which should technically be considered illegal due to its hidden fees. First, there is a $9.99 plus tax activation fee for both standard and bundle plans.

In addition, there is a $6.50 or $12.99 monthly fee for this card. Canadian ATM withdrawal costs $1.99. I really don’t want to keep talking about the fees associated with this card as I am sure you are wise enough to never consider this card.

My Verdict: I am trying to understand why this card exists or being used by anyone. The card doesn’t offer any reward and users end up paying so much in fees.

American Express Prepaid Cards

American Express has prepaid cards that can be purchased online and shipped to buyers directly in Canada. These cards are available in $25, $50, $100, $200, $500, and $1,000 denominations.

There is no monthly fee with an Amex prepaid card. However, there is a one-time activation fee to use the card. This fee varies based on the card value.

My Verdict: Similar to Vanilla prepaid card, I am not a fan of any preloaded credit card due to its activation fee. Hence, I don’t recommend it unless you can’t find any better method of using your Amex points other than buying an American Express prepaid card.

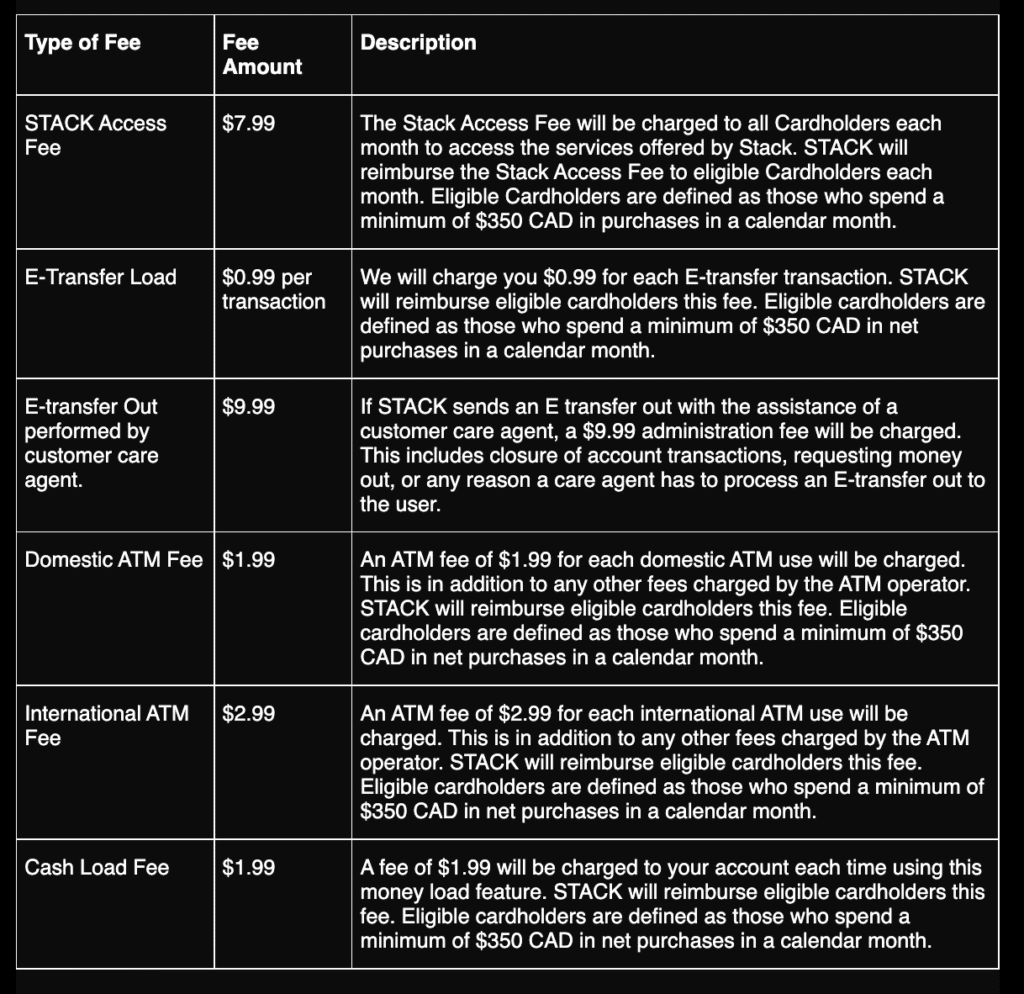

STACK Prepaid Mastercard

STACK prepaid Mastercard should be on the list of the worst prepaid credit cards in Canada. The card used to offer no foreign transaction fees plus free worldwide ATM withdrawals.

These two were the main reason most savvy Canadians loved this card. However, STACK self destructed itself by removing its two best features.

In addition, as seen on the fee table below, STACK charges fees for pretty much everything which makes the card absolutely worthless unless you spend minimum $350 monthly on this card which doesn’t offer any incentive (cashback or points).

I hope by now I am being very clear that avoiding STACK is one of the best choices you can make at the moment. Just look at that $9.99 e-transfer to close out your account.

Cash Passport Canada Post Prepaid Cards

You would expect better than an iconic name such as Canada Post. I didn’t expect to find a card worse than STACK but here we have another winner to be added to the worst prepaid cards in Canada.

The card charges $15 for the acquisition of the card and $3 for any top ups. The card also comes with an inactivity fee of $2.80 per month if inactive for 12 months.

On top of these non-sense fees, there is a 1.5% transaction fees for domestic spending. ATM withdrawals varies but the cost is $3 in Canada. FX fee is 3.25% which is considered very high.

This card can be reloaded at any Canada Post office in cash or with a debit card in Canadian Dollars, US Dollars, Euros, British Pounds, Japanese Yen, Australian Dollars, or Mexican Peso.

My Verdict: Please stay as far as possible from this card.

What Is a Prepaid Credit Card

A prepaid credit card functions similarly to a debit card but with the added benefits of a credit card. While you cannot spend more than the available funds on a prepaid card, it does allow you to make purchases online, rent a car, or book a hotel room.

However, unlike a credit card, using a prepaid card does not help you build your credit history. Additionally, a prepaid card is not linked to your bank account, unlike a debit card.

Can Prepaid Cards Be Used Online

Most prepaid cards can be used for online purchases, but it’s essential to read the terms and conditions of the specific card you are purchasing. Some store-bought prepaid cards may not be valid for online purchases, and there may be instances where certain online merchants do not accept prepaid cards.

How Do I Activate a Prepaid Card

The activation process of a prepaid card may vary depending on the specific card you have chosen. Some cards can be purchased and activated with the first transaction, while others can be activated during the purchase process. It’s important to review the activation terms and conditions that come with your prepaid card when you purchase it.

What Are The Differences Between Secured Cards a Prepaid Cards

A secured card and a prepaid card are similar in that both require the user to deposit money upfront. However, there are some key differences between the two:

- Credit Building: A secured card is designed to help users build credit, while a prepaid card does not report to the credit bureaus and therefore does not affect credit scores.

- Credit Limit: With a secured card, the credit limit is typically equal to the amount of the security deposit, while a prepaid card has a spending limit that is predetermined by the amount of money deposited.

- Interest Charges: A secured card typically charges interest on outstanding balances, while a prepaid card does not.

- Fees: Both types of cards may have fees, but prepaid cards may have more fees associated with them, such as monthly maintenance fees, transaction fees, and ATM withdrawal fees.

In summary, a secured card is a type of credit card that requires a security deposit, and is designed to help users build credit. A prepaid card, on the other hand, is a debit card that requires a deposit, and is primarily used for convenience rather than credit-building purposes.

How Can I Check The Balance On a Prepaid Card

The method for checking your prepaid card balance may vary depending on the card. You may be able to check your balance online or through a linked app, such as with the Wealthsimple card.

Alternatively, when you make a purchase, the cashier can inform you of the remaining balance, or the balance can be displayed on your bill. The information on how to check your card balance will be provided when you receive your card.

Can You Recommend a Secured Card In Canada

Certainly. Neo Secured card is the best secured card in Canada which doesn’t have any fees and comes with a great range of benefits. Read the detailed review of Neo Financial here.

Best Prepaid Credit Cards In Canada Conclusion

Based on all the provided details, I highly recommend choosing a product which doesn’t cost any fees in either maintenance or activation fees.

It would be even more amazing if the card doesn’t charge ATM and foreign transaction fees. The only two cards that match these conditions are Wealthsimple Cash Mastercard and EQ Bank Mastercard.

A backup card can be the CIBC Air Canada Conversion Visa Prepaid Card which conditionally matches all the conditions if preloaded and used in one of the 10 supported currencies.

All other cards come with different fees which I won’t apply for myself and recommend you to avoid them as well. Those tiny fees will add up.

On the other hand, if your main goal is to build up a credit history, I truly recommend the amazing Neo Secured card.