I am really impressed by Wealthsimple innovations which is offering Canadians great solutions making money managements easier and more convenient.

Wealthsimple Cash is a Canadian Peer-to-Peer (P2P) Electronic Cash System allowing Canadians to transfer money to other Wealthsimple Cash clients for free in seconds. In addition, Wealthsimple Prepaid Mastercard is one of the best free travel cards in Canada.

In this post, I will go through a detailed and complete Wealthsimple Cash review along a step-by-step guide to get you going through this new financial solution.

Related: Detailed Wealthsimple Invest Review & Free Managed $10,000 Bonus

Wealthsimple Cash in its newest updated version is Wealthsimple’s new addition to other services by Wealthsimple such as Wealthsimple Invest, Wealthsimple Trade, and Wealthsimple Crypto.

Use my Wealthsimple Cash Referral link and we each get $1 when you sign up.

You will get the cash even if you have any of the other Wealthsimple accounts. Only requirement is to be a first timer to Wealthsimple Cash.

What Is Wealthsimple Cash

Wealthsimple Cash is a very simple, convenient, secure, and fast method of sending or receiving cash between Wealthsimple users. It is similar to Venmo in the US. “I’ll Venmo you” means, “I’ll pay my share later.” something similar to “Google it” which means “Look it up”.

I am really hoping Wealthsimple Cash becomes ubiquitous in Canada and we will use the phrase “I’ll Wealthsimple you”.

It can be a great alternative for e-Transfer payments for any transactions done via online platforms like Kijiji or Facebook Marketplace. It can also be used between family and friends to pay back their share for a service (Meal, Taxi) or send and receive money.

How To Start Using Wealthsimple Cash

- Use my Wealthsimple Cash referral and sign up for Wealthsimple Cash

- Download the app “Wealthsimple Cash” from Google Play or App Store

- Sign in the app, accepts the agreements, and provide your phone number for authentication

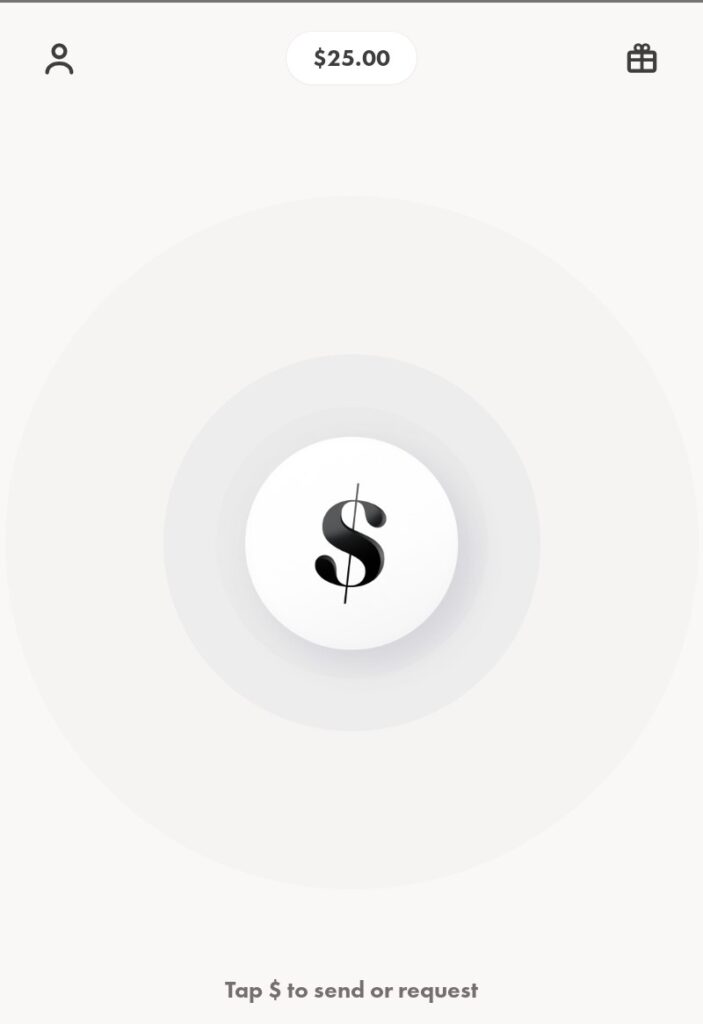

- Create your Wealthsimple $ign which will be used by others to connect and interchange money

- You might be requested to upload official documents and bank statements for verification

- Unless approved immediately, wait 1 day and you should be able to start sending and receiving

- Once approved, refer your friends to receive $25 bonus (Promotional Offer)

- Link bank accounts and start sending and receiving cash easily

What Are The Current And Future Wealthsimple Features

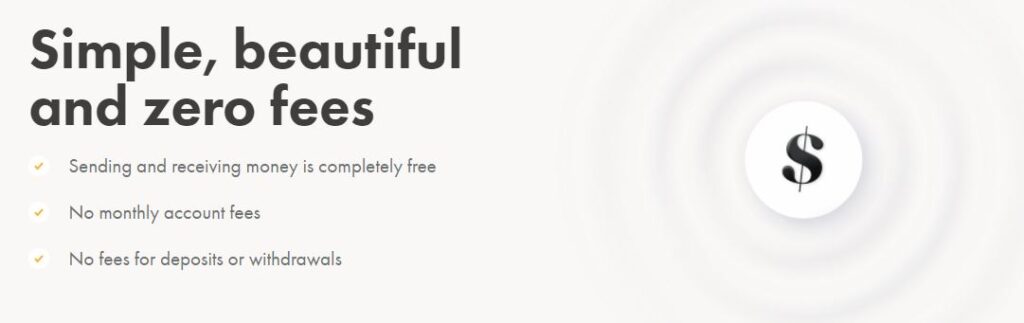

- Free No monthly account fee, No exchange fee on foreign transactions, No min balance fee

- Wealthsimple Cash account accessible via Wealthsimple Invest app offers 1% interest rate

- Convenient as there is no Security Question like the e-Transfer ones

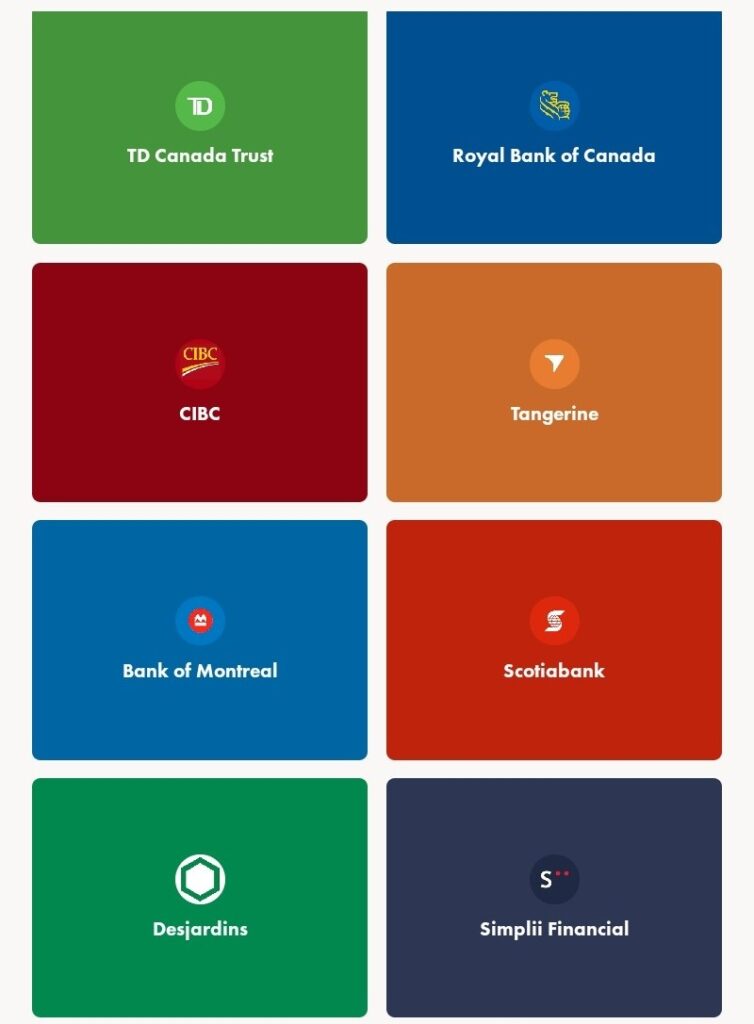

- Easy link to 8 Canadian Banks (TD, RBC, CIBC, Tangerine, BMO, BNS, Desjardins, Simplii)

- App availability for Android and iOS devices and Free sending and Receiving

- Bill Payments, Direct Deposits, Pre-Authorized Debit

- Cash Card, Digital Card, ATM Cash Withdrawals

Cash Card is currently not available. However, when it is ready, it can be used for ATM Cash Withdrawals in Canada and internationally. Wealthsimple won’t charge any ATM or Foreign Transaction fees. However, almost all ATMs charge a fee to use their network.

Related: Travel for free and learn more about awesome travel credit cards in Canada.

What Is The Wealthsimple Dollar Sign $ign

Wealthsimple is innovative so this is like any handle in other Apps. However, with Wealthsimple Dollar Sign $ign you can find and connect with others to send or receive money.

You choose your Wealthsimple Dollar Sign $ign when singing in the app for the first time. This is permanent and can’t be changed so put a bit of thought into it. This is your identification to everyone including potential buyers and sellers, family, friends, and colleagues in Wealthsimple Cash.

How To Add Or Remove A Bank Account To Wealthsimple Cash App (Fund Or Withdraw)

- Open Wealthsimple Cash app and sign-in

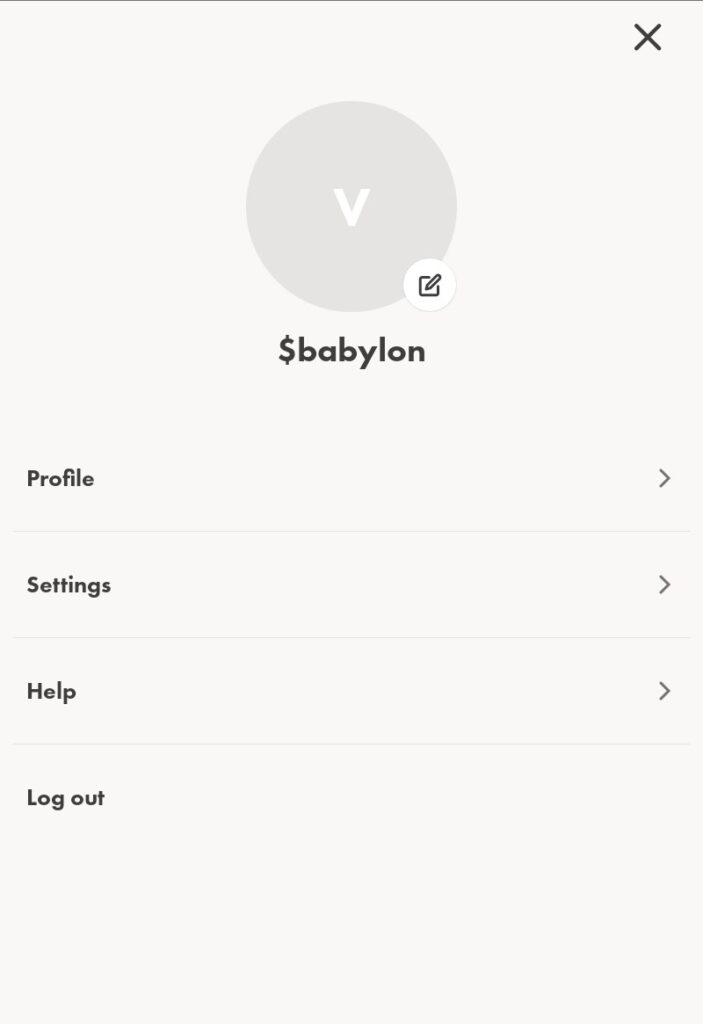

- Select the Profile icon in the top left-hand corner

- Choose the Profile menu item

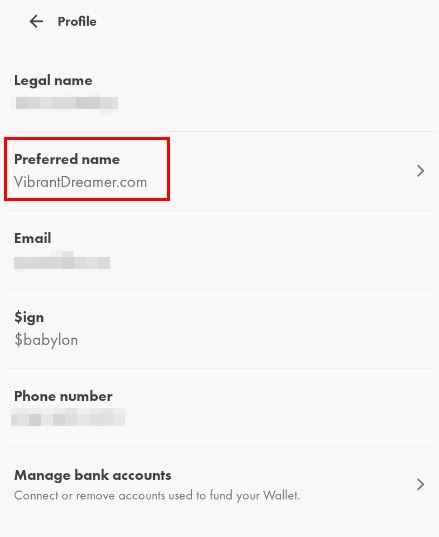

- Click Manage bank accounts

- To remove, click a Linked account and choose “Unlink this account”

- To add, click “Add a bank account“, choose your bank and sign-in to your other bank account, then choose the other bank’s account you’d like to link

How To Fund Wealthsimple Cash (Add Cash)

- Open Wealthsimple Cash app and sign-in

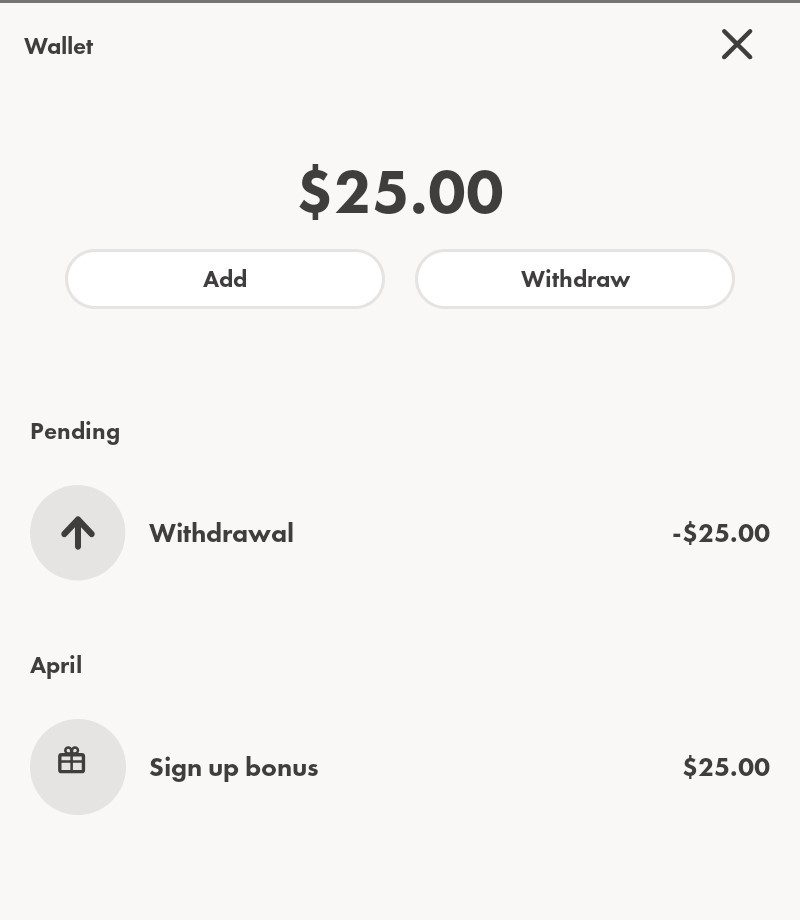

- Click on the Wallet balance at the top middle of the app

- Click Add to Add funds

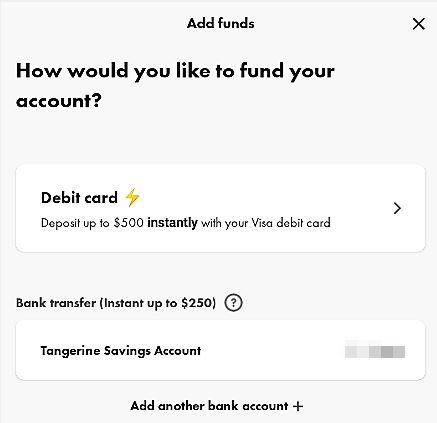

- Choose Debit Card (Only Mastercard Debit Card can be connected as of now) and enter your card info

- Alternatively, click on “Add another bank account” to link your bank account

- Depends on the transferred amount, it can take up to 5 business days to appear. However, using a Debit card deposit, you will have access to $500 instantly. Using a Bank transfer offers an instant access to $250 of your funds.

How To Withdraw Fund From Wealthsimple Cash (Cash Withdrawal)

- Open Wealthsimple Cash app and sing-in

- Click on the Wallet balance at the top middle of the app

- Click Withdraw to withdraw funds

- Enter the desired amount and continue

- Select where you would like it to be withdraw from or link a new bank account

What Is Quick Access Method For Wealthsimple Cash App

There are three options to sign-in the app.

- Biometric

- Passcode (Using a 4-digit numeric code)

- None (Login with email and password only)

These options can be accessed by following below steps:

- Open Wealthsimple Cash app and sign-in

- Select the Profile icon in the top left-hand corner

- Choose the Settings menu item

- Select Privacy and security

- Select Quick access method and choose a new quick access method

How To Change Your Wealthsimple Add Preferred Name

When other Wealthsimple Cash users find your account using the Dollar Sign $ign, your Preferred name will appear under that name. My Preferred name today is VibrantDreamer.com which I can update easily.

- Open Wealthsimple Cash app and sign-in

- Select the Profile icon in the top left-hand corner

- Choose the Profile menu item

- Click Preferred name and enter your new Preferred name

Is cash in Wealthsimple Cash Account Secure?

Yes, indeed. Wealthsimple Cash account is CIDC covered for up to $100K. You can read more about Wealthsimple accounts coverage here.

In addition, the app and Wealthsimple use 256-bit SSL encryption, scheduled backups, and a Multi-Factor Authentication (MFA) solution in addition to the username and password.

I can’t stress this enough. Always use Multi-Factor Authentication (MFA) which is activated on Wealthsimple Account for all their products.

What Are Disadvantages Of Using Wealthsimple Cash

Well, it is a simple cash account which doesn’t offer any rewards or cash back points. In addition, it can’t be used for any registered (TFSA, RRSP, RESP) account.

Are There Any Alternatives Or Competitors For Wealthsimple Prepaid Mastercard

Wealthsimple Prepaid Mastercard is a unique solution for Canadians especially when traveling. It offers free foreign currency transaction and free worldwide ATM withdrawal while giving back 1% in cashback for all credit purchases.

Final Thoughts And Recommendations

I personally signed-up and received a $25 bonus (this offer is expired now). I’d really like to see Wealthsimple as an alternative solution to Interac e-Transfers in Canada.

Use my Wealthsimple Cash Referral link and we each get $1 when you sign up.

In addition, it will be a great backup to my Brim Financial card when traveling internationally.

One thought on “Complete Wealthsimple Cash Review and a Detailed Guide”