Do you fancy credit cards’ points and would like to optimize your MBNA Rewards Points value? In this article, I am going to walk you through a complete review of MBNA Rewards Points while comparing all the methods in order to answer the question: How do I spend my points?

Is MBNA Rewards Points Program Worth Considering

Maximizing the return on our credit card rewards is a fantastic way to recover a small portion of our spending. MBNA Rewards is a flexible programs in the Canadian credit card market.

In addition, MBNA Rewards Platinum Plus Mastercard is a free card which offers a reasonably good reward program. However, taking advantage of all the promotional bonuses that come with getting a new MBNA rewards credit card is the fastest method to collect MBNA Rewards point.

Did you know that you can get more than 5% rewards by using MBNA Points?

After a year of owning my first reward MBNA credit card, I accumulated enough points from bonuses and minimum spending requirements to redeem my points for a reasonable amount. This is similar to any investment return where I invested my time to apply and optimize the return.

As pointed on my article here, I like to apply for different credit cards to earn bonuses and points that I can redeem for rewards. On top of this, as I don’t like paying for credit cards yet want to have a card with a great insurance coverage including travel and rental car coverage, I always get a new card annually to take advantage of the waived first year fee.

Related: Best Travel Credit Cards in Canada

Last year, I applied for MBNA Credit Card and earned 15,000 MBNA Rewards since then. It is now time to redeem my MBNA Rewards points to cash or equivalent. Honestly, I prefer cashback versus points programs. But, MBNA Rewards program is a flexible program when it comes to redeeming the points especially when they are earned freely!

In the following sections, I am going to cover MBNA Rewards Points value and which category to use in order to maximize the dollar value of your MBNA Points.

What Is the MBNA Rewards Points Value

Lots of people ask questions like, how much is 40,000 MBNA Points worth? To answer this and similar questions including “how do I spend my MBNA Points?”, we need to understand the different ways and the value of redeeming MBNA Rewards points to cash value.

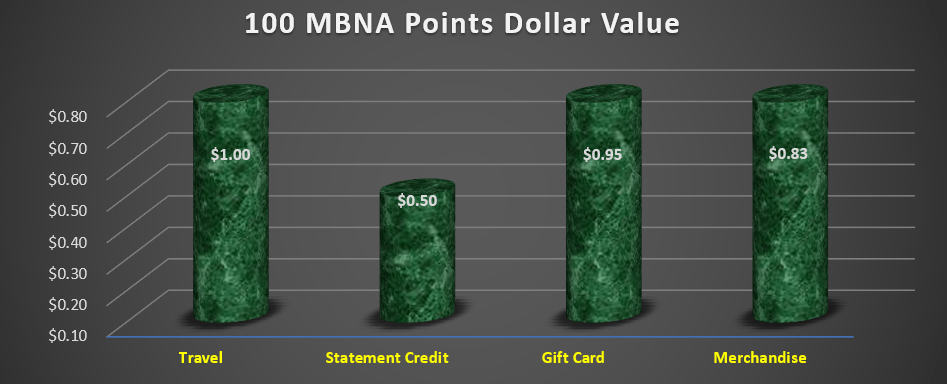

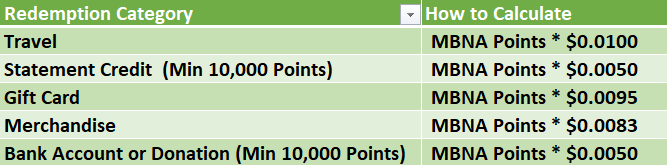

Here is a chart showing the average dollar value of 100 MBNA points in different categories.

As shown in the table, the MBNA Rewards points to cash value is equal to $0.50 per 100 MBNA Points. This can be interpreted as 0.5% cashback for 1 MBNA Points per $1.

Note: MBNA Points value is also $0.50 for depositing into the bank account or redeem for donations per 100 MBNA Reward Points.

How to Maximize MBNA Rewards Points Redemption

The best methods to optimize MBNA Points is to use them in to redeem them for travel which can be booked directly on MBNA Rewards portal. Next best option is to purchase a gift card or buy an item from the merchants.

Note: Some gift cards offer a better (higher than $1) value. For example, you can redeem 9,250 MBNA points for a $100 GAP Gift Card.

And finally, the worst or least favorable method is to redeem MBNA Rewards for statement credit which gets you half value in comparison with travel redemption.

How to Calculate the MBNA Rewards Points Value in Cash

Let’s say you need 10,000 MBNA Points to redeem for $50 credit statement. To calculate the value of 100 MBNA Rewards Points to cash the math will be as simple as below:

$50 * 100 / 10,000 MBNA Points = $0.50 (1 MBNA Point = $0.005)

Another example is that you need 10,355 MBNA Points to buy a $100 Costco gift card. Below is the related calculation:

$100 * 100 / 10,355 MBNA Points = $0.97 (1 MBNA Point = $0.0097)

The 100 in the middle is to do the calculations for 100 MBNA points to make the number more human readable. You can easily do the same calculation for 1 MBNA by removing the 100.

How to Redeem MBNA Rewards Points for Gift Cards

There are 64 products under gift cards section of MBNA Rewards. This section is divided into 3 subcategories which are Restaurant & Entertainment, Retail, Travel & Petroleum .

For travel & petroleum section, there are only 2 providers which are Uber and Esso.

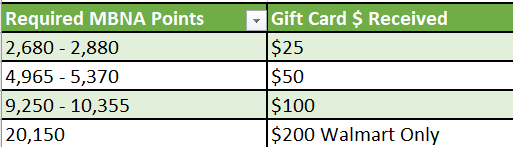

Lowest point redemption is the $25 Xbox E-Gift card for 2,680 MBNA points which is about $0.93 per 100 MBNA Points.

MBNA offers a wide range of gift cards. The list contains Apple, Amazon, American Eagle, Banana Republic, Bath & Body Works, Bass Pro Shops, eBay, Rakuten Kobo, Nintendo, Uber, Xbox, Cineplex, DoorDash, Esso, Gap, HBC Canada, Home Depot, Indigo, Old Navy, PlayStation, Walmart, Wayfair, and more.

Gift cards can be redeemed based on the following table:

As shown above, the redemption value is $0.87 – $0.93 for the smallest amount and $0.993 for the highest amount which is $200 in Walmart Gift Card. However, the $100 value is between $0.96 and $1.08.

If your MBNA credit card return is the highest possible which is 5 MBNA Points for restaurant, grocery, digital media, membership, and household utility by using MBNA World Elite Mastercard, you need to spend $536-$576 to get 2,680-2,880 points enough to redeem a $25 Gift card or $4,030 in spending for a $200 Walmart gift card.

The highest possible dollar cashback value for gift cards redemption is 5.40%.

However, if your MBNA card earns 2 MBNA points, the best real return for gift cards redemption is 2.16%.

Gift Cards Redemption Conclusion: Redeeming MBNA Points for Gift Cards can be a good alternative if you aren’t willing to redeem for the travel category.

How to Redeem MBNA Rewards Points for Merchandise

The value for merchants is lower than redeeming points for gift cards. The number is $0.83 per 100 MBNA Points.

There are many items listed on MBNA Rewards merchandise section. The good thing is that all shipping and taxes are included.

Let’s take the Hape Fire Station as an example to check the real MBNA Points value. This TV is listed on Amazon for $129.00 or $$149.46 with tax for QC residents. The MBNA Points value for this item is $1 per each 100 MBNA Points.

To have enough points buying this TV, a card holder making 5 MBNA points per $1 needs to spend $2,984 on their credit card. This translates to 5% cashback return on the card.

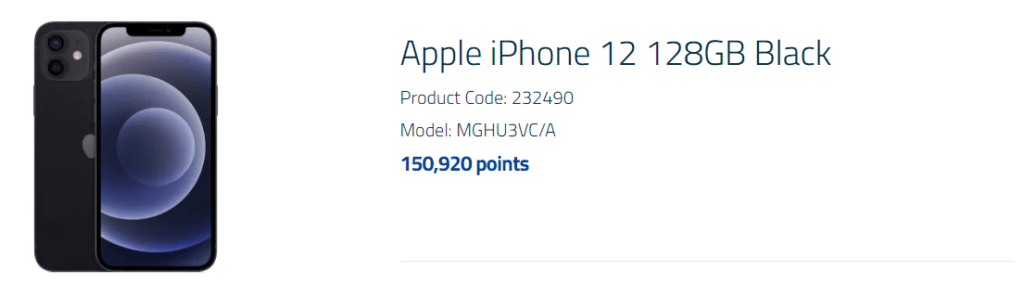

Let’s take another example and what’s better than an Apple phone? Apple iPhone 12 128GB Black requires 150,920 points. This device can be bought directly from Apple for $1,171.60 after tax.

For 5 MBNA per $1, this will be a $30,184 spending which will make it a 3.88% cashback return. However, if your MBNA card pays 2 MBNA per $1, this will be 1.55% cashback return. The MBNA Points value is $0.77 for each 100 MBNA points.

Merchants Redemption Conclusion: It seems redeeming MBNA Points for items on the merchandise list can return different value. Ultimately, compare the item you are trying to purchase with buying an Amazon or Walmart gift card for the real valuation.

How to Redeem MBNA Rewards Points for Credit Statement Credit

Statement credit value is $0.50 per 100 MBNA points. MBNA Rewards points can be redeemed easily towards credit statement. The minimum redemption is 10,000 MBNA points for $50.

This category can be considered as redeeming MBNA rewards for money or cash payouts. You are basically paying your statement by using the (kind of) freely earned points.

Credit Balance Redemption Conclusion: Redeeming MBNA Points for a credit balance is equal to 0.25 – 2.5% cashback depends on your MBNA Credit Card reward earning points. This is the worst method to redeem your MBNA Points.

How to Redeem MBNA Rewards Points for Bank Account

Do you want to invest in your future using MBNA Rewards points? Yes, free money to be saved in a bank account!

This is an interesting category but unfortunately its value is as low as the credit statement category. MBNA Rewards points can be redeemed as a cash deposit into an MBNA account. However, a minimum of $50 (10,000 MBNA Points) must be redeemed.

Bank Account Redemption Conclusion: Redeeming MBNA Points in a bank account is as terrible as the credit statement redemption which gives 0.25 – 2.5% cashback depends on your MBNA Credit Card. Avoid using this option if possible.

How to Redeem MBNA Rewards Points for Travel

Redeeming MBNA Points for travel provides one of the best values in this program.

You can redeem 100 MBNA points for $1. There is no special points discounts similar and the required points you’ll see in travel category is based on the 100 points per each $1.

- Points can be redeemed for flights, cruises, rental cars, hotels, and vacation packages

- Points can be used for any flight or seat as there is no blackout

- Points can be used for paying taxes and fees

- Points and credit card payments can be mixed. There is no minimum points requirements

- MBNA Rewards offers a price match guarantee on vacation packages and airline bookings

- MBNA Rewards don’t have any point partner and bookings need to be done directly on MBNA Travel

Travel Redemption Conclusion: Redeeming MBNA Points for travel gives the best value for money at a 5% return based on 5 MBNA per dollar or 1% cashback for the free MBNA Rewards Mastercard which pays 1 MBNA per dollar.

However, I discourage travelers to use 3rd party sites to book for flights or hotels. I personally try to book directly with the airlines or hotels as much as possible nowadays to avoid the extra middle-man headache.

How Much is My MBNA Rewards Points Worth in Dollar Amount

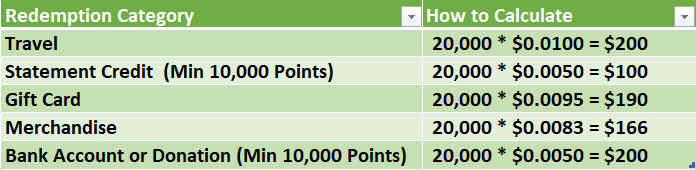

Below is a simplified chart to calculate the dollar amount of your MBNA Rewards Points based on the available categories to redeem the points for.

Here is an example to clarify the calculations even more.

John and Brenda have 20,000 MBNA Points. How to redeem 20,000 MBNA Points?

Based on our calculations below, 20,000 MBNA Points can be redeemed to purchase an item or a gift card worth $190, a statement credit of $100, deposit $200 into bank account, or $200 in travel expenses.

Best Methods to Earn MBNA Rewards Points

Are you wondering about how to earn MBNA Rewards points? Simply start by taking advantage of promotional credit cards offers as it is the fastest method to accumulate MBNA Rewards Points.

After taking advantage of the signup promotions which usually include a waived first year fee, point accumulation can only be done by spending money using one of MBNA Rewards credit cards.

Before providing a list of MBNA Rewards Credit Cards which pay MBNA Points, I will answer two important question.

Do MBNA Rewards Points Expire

MBNA Points will never get expired as long as the associated credit card is valid. This means, before cancelling a reward MBNA credit card, make sure to redeem all the points first.

Even though, MBNA Rewards points don’t expire, they can vanish completely if not redeemed before the card cancellation.

Can MBNA Rewards Points Be Transferred

Absolutely not! Unfortunately, there is no way to transfer MBNA Rewards Points to another credit card or even another partner program. MBNA Doesn’t have a partnership agreement for point transfer with any provider. Once gain, make sure to redeem your points before cancelling your card.

MBNA Rewards Credit Cards Comparison

There are only 2 MBNA credit cards which pay MBNA Points as rewards which are MBNA Rewards Platinum Plus Mastercard and MBNA Rewards World Elite Mastercard.

MBNA Rewards Platinum Plus Mastercard

This card doesn’t have an annual fee which offers below insurance and coverage:

- Mobile Device Insurance: $1,000 coverage for eligible mobile devices in the event of loss, theft, accidental damage or mechanical breakdown.

- Purchase Assurance: Coverage on eligible items purchased with MBNA card in case of theft or damage within the first 90 days from the date of purchase.

- Extended Warranty Benefits: Doubles the written manufacturer’s warranties valid in Canada for up to one additional year on eligible new purchases made with MBNA card.

Here is what the card offers:

- 5,000 bonus points after your first purchase within the first 90 days of account opening and 5,000 bonus points if enrolled for e-statements within the first 90 days of account opening

- Earn 2 points for every $1 spent on eligible restaurant, grocery, digital media, membership, and household utility purchases until $10,000 is spent annually in the applicable category

- Earn points every day: get 1 point for every dollar spent on all other eligible purchase

- Each year, you will receive Birthday Bonus Points equal to 10% of the total number of points the account earned in the 12 months before the month of the primary cardholder’s birthday, to a maximum Birthday Bonus each year of 10,000 Points

MBNA Rewards World Elite Mastercard

This card has a $120 annual fee which offers below insurance and coverage:

- Travel Medical Insurance: Up to $2 million of coverage for the first 21 days of your trip. Available for an insured person under 65 years of age.

- Delayed and Lost Baggage Insurance: Up to $1,000 in coverage per insured person per trip toward the purchase of essentials such as clothes and toiletries if your baggage is delayed for over 4 hours or lost.

- Flight/Trip Delay Insurance: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Mobile Device Insurance: With Mobile Device Insurance, you’ve got up to $1,000 in coverage for eligible mobile devices in the event of loss, theft, accidental damage or mechanical breakdown.

- Price Protection Service: If you purchase an eligible item with your card and find the same product advertised in Canada at a lower price within 60 days of the purchase, the difference will be refunded subject to a maximum of $500 per item and a calendar year maximum of $1,000 per account.

Here is what the card offers:

- 15,000 bonus points after your first eligible purchase within the first 90 days of account opening and 5,000 bonus points once enrolled for e-statements within the first 90 days of account opening.

- Earn 5 points for every $1 spent on eligible restaurant, grocery, digital media, membership, and household utility purchases until $50,000 is spent annually in the applicable category. 1 point for every $1 on all other eligible purchases.

- Each year, you will receive Birthday Bonus Points‡ equal to 10% of the total number of Points the account earned in the 12 months before the month of the primary cardholder’s birthday, to a maximum Birthday Bonus each year of 15,000 Points.

Which MBNA Rewards Credit Cards to Apply For

I personally wouldn’t consider any of MBNA cards. There are many better cards including Brim Financial Mastercard which has a higher cashback while having no foreign exchange fees.

In addition, you can receive $50 for getting approved for a NEO Card which guarantees a 1% cashback on all purchases and an average 5% cashback.

Related: A Complete Neo Financial Credit Card Review

Other great alternatives are Tangerine Money-Back and Tangerine World Elite Mastercards.

Tangerine Money-Back Mastercard

This free credit card offers a nice 2% unlimited cashback in 3 selected categories. All other non-selected categories will receive 0.5% cashback.

The categories are grocery, furniture, restaurants, hotels, gasoline, bills, drug store, home improvement, entertainment, and public transportation | parking. Tangerine Money-Back Mastercard has no annual fee with an annual 19.95% interest rate.

Tangerine World Mastercard

This credit card is another no fee card. Similar to Tangerine’s other card, it comes with 2% cashback on any selected 3 categories.

However, it comes with some features, like free Boingo Wi-Fi anywhere in the world, access to Mastercard airport lounges plus a travel reward program, and insurance (car rental and mobile device).

To be eligible for Tangerine’s World Mastercard, you need to have a gross household income of $100,000 or more or a total balance of $250,000 in Tangerine savings or investment accounts.

I personally use Tangerine World Mastercard in my chosen three categories which are grocery, gasoline, and restaurants.

Final Conclusion of MBNA Rewards Points Program

MBNA Rewards Points is flexible program with wide range of selections to redeem your MBNA Points. I’d encourage you to take advantage of the promotional credit cards offers to stack more MBNA points.

The best way to redeem the points are either for traveling or gift cards. Both are great choices. However, always shop around and choose the best card based on your needs.

Finally, I don’t recommend paying for MBNA Rewards World Elite Mastercard even after considering the combined 20,000 MBNA points. This will be around $200 in a Walmart gift card but after deducting the $120 annual fee, your net profit is only $80.