Have you ever wanted to get an automatic effortless guidance to get your savings up by using your leftover pocket change money?

How about a magical way to round up spending and get the spare change automatically invested on your behalf in diversified Exchange-Traded Funds (ETFs)?

If you answered yes, this article is for you. In this Moka review, I’ll provide you with a comprehensive review of the Moka app, which is one of Canada’s leading saving and investing solutions. You will learn how to save money fast and get that savings automatically invested.

What is Moka & a Brief History

Moka is a Montreal-based financial technology leader that aims to help Canadians including millennials, accelerate their saving and investing by using its user friendly mobile app to achieve their financial goals.

This service was founded in 2017 and got rebranded from Mylo to Moka before expanding to France to offer its automatic round up and investment tool to Europeans. Since then, the app has been downloaded by over 1 million users and earned thousands of 5-star reviews.

In addition, the company developed new products powered by AI and human expertise to accelerate debt repayment, provide financial coaching, and deliver valuable cashback rewards.

In May 2021, the company was acquired by fintech pioneer Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) which is one of Canada’s leading digital payments and financial technology companies.

How to Join Moka

Opening a new account is a very straightforward process.

- Visit Moka

- Create an account and answer some questions to build your investor profile

- Determine your financial goals and risk tolerance through the signup process

- Link your bank (or credit card) account to the app

- Congratulations! You are on your way to achieving your financial goals

Moka In a Nutshell

| Offered Products | Automated saving and investing, Cashback with partners | |

| Regulation | Owned by its publicly traded Canadian parent company MOGO | |

| Supported Accounts | Unregistered Savings, TFSA, RRSP accounts | |

| Minimum Deposit | None (No minimum balance to start investing) | |

| Fees | $3.99/month (Moka), $15/month (Moka 360) | |

| Offered Portfolios | Conservative, Conservative Moderate, Moderate, Moderate Aggressive, and Aggressive. All portfolios have an SRI option | |

| Withdrawal Fees | $25 for partial or $50 for full RRSP (HBP/LLP) withdrawal, otherwise all withdrawals are free | |

| Other Features | Portfolio rebalancing, Dividend reinvestment, SRI (Social Responsible Investing) | |

| Insurance | No CPIF insurance but same protection as any ETF fund | |

| Security | Major Canadian bank security infrastructures and policies | |

| Platforms | iPhone and Android apps | |

| Custodians | Fidelity Canada Clearing and and trustee is TMX Trust | |

| Customer Support | Email: [email protected], Chat: in-app messaging tool |

What Are Moka’s Pros

- Automatic round up and investment of spare change from every purchase

- Recurring and one-time deposits to boost investment accounts

- Automatic and easy investment of funds in ETFs from a predefined portfolio

- No minimum deposit to start saving and investing in ETFs

- Socially Responsible Investment (SRI) investment options

- Earn cashback with perks from Moka partners

- Access to a certified portfolio manager

- Charity donation option by using Round Up to Give

- Free withdrawals for non-registered and TFSA accounts

What Are Moka’s Cons

- High monthly fees from $3.99 to $15.00 plus tax

- Only supporting non-registered, TFSA, and RRSP savings accounts

- No phone support and in-app chat support starts with a bot

- Moka is neither an investment nor a robo-advisor solution

- Withdrawal fees for RRSP including HBP or LLP accounts

- Related: Complete Review of Best Robo-Advisors in Canada

- Related: Detailed Wealthsimple Invest Review & Free Managed $10,000 Bonus

What Does Moka Offer

Moka has become one of Canada’s most popular investing services due to its roundup feature, which automatically rounds up daily purchases and invests the spare change in personalized, diversified portfolios of Exchange Traded Funds (ETFs).

Its members including first-time investors, can easily invest through a TFSA, RRSP or non-registered account. There is no financial knowledge, minimum investment or lifestyle change required to use Moka, so anyone can start saving and investing by downloading the app and simply linking an existing debit or credit card.

This process of saving the spare change is referred to as micro investing which can pay off in the long term. Basically, it helps investors to save little by little to gain their financial freedom gradually in a slow but steady method.

How Does Moka Help In Saving and Investing

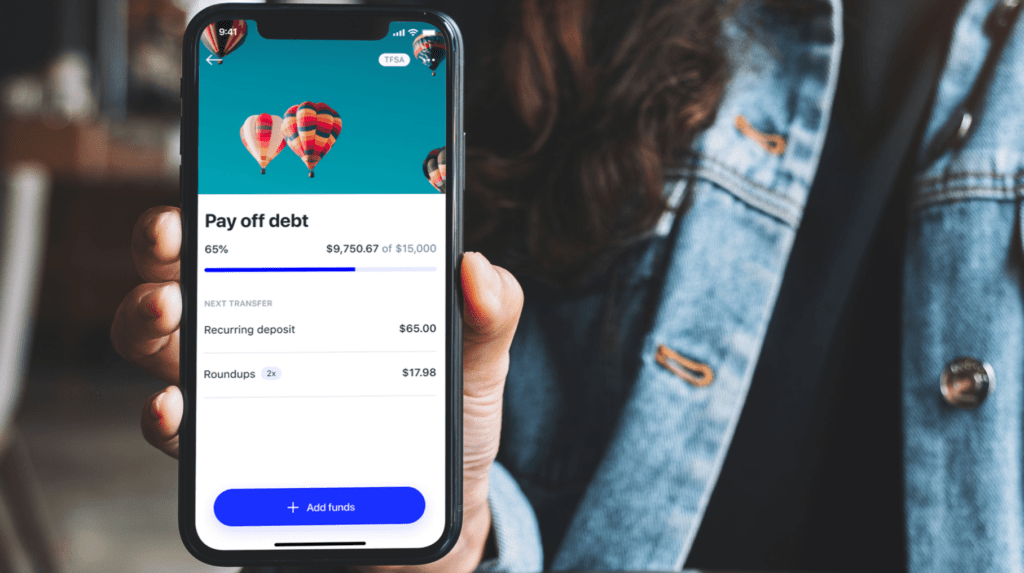

To simplify, let’s say a user buys a Sausage Biscuit for $3.29 using a card that is already linked to the Moka app. The app rounds up the purchase to $4.00 and puts the extra $0.71 in the Moka account.

This goes on throughout the whole week and every Monday, roundups from the previous week along with pre-set recurring deposits are withdrawn from the user’s linked bank account and invested into a Moka investment account on Moka’s users behalf all automatically without having to do anything.

These funds can also be withdrawn at anytime. However, pay attention to the registered accounts rules if this is a TFSA or RRSP account. There are some fees when withdrawing including HBP or LLP from an RRSP account.

To accelerate the saving and investing, on top of the mentioned roundup savings, investors can use one of below optional features to boost their financial growth:

Recurring Investments: By using this feature, users can deposit a weekly fixed amount on top of the standard roundups which are accumulated through their purchases.

Roundup Multiplier: With this feature, users can multiply their roundups by up to 8 times. For instance, if they want a 8x on their extra change, a 20 cents savings would become $2.00 ($0.20 x 10 = $2.00).

One-Time Boosts: This feature is for those who want to make lump-sum deposits in their accounts whenever they have extra money which expedites reaching their financial goals.

Moka Fees and Commissions

The fees to be familiar with are the monthly plan, ETF MER, NSF, Round Up to Give, and RRSP withdrawal fees.

- Monthly Fees: $3.99 or $15.00 plus tax

- ETF MER Fees: 0.06% to 0.38% for regular and 0.20% to 0.69% for SRI portfolios

- NSF Fees: Variable charged by the bank based on the linked account

- Round Up to Give: 2.0% charged by CanadaHelps

- RRSP Withdrawal Fees: $25.00 (+ tax) on partial or $50.00 (+ tax) fee on full withdrawals

Moka doesn’t have a deposit fee. There is also no withdrawal fee on non-registered or TFSA accounts. However, there is a fixed monthly fee regardless of the account size.

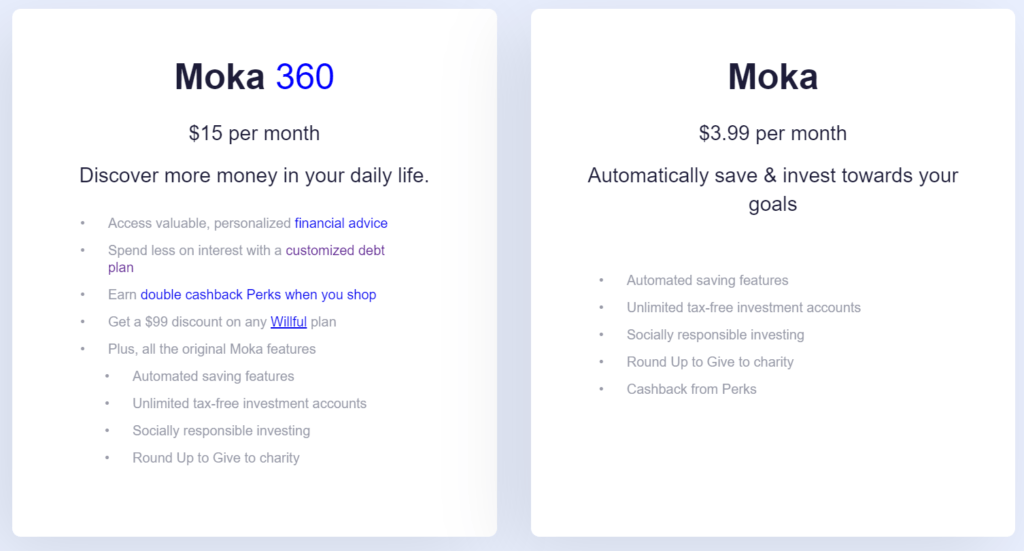

Currently, it offers two plans. The base plan costs $3.99 per month and the premium plan costs $15.00 monthly. Moka 360 offers a variety of extra features, including optimized debt repayment, personalized financial advice and double cashback.

does Moka cost” class=”wp-image-3483″ width=”806″ height=”433″/>

does Moka cost” class=”wp-image-3483″ width=”806″ height=”433″/>The monthly fee is the only fee charged by Moka. However, for those who invest inside ETFs, there is the ETFs MER (Management Expense Ratio) fee.

MER fees are not collected by Moka. They are charged regardless of where you invest in ETFs. The offered ETFs MER is between 0.06% and 0.38% for regular portfolios and between 0.20% and 0.69% for Socially Responsible Investing (SRI) portfolios.

Another fee that users should consider is the Non-Sufficient Fund (NSF) fee. Similar to MER fee, this fee isn’t charged by Moka but by the linked bank account. To help users mitigate the risk of this fee, the app implemented a technology called Low Balance Rule.

When it comes to withdrawing from an RRSP account, there are two things to consider. The withdrawal fee is $25 plus tax for a partial withdrawal or $50 for a full withdrawal. In addition, pay attention to the RRSP tax withholding rules.

On top of the mentioned fees, if users opt-in to use the Round Up to Give feature, CanadaHelps charges a 2.0% donation fee.

What Investment Portfolios Are Available From Moka

Each investment portfolio contains a combination of Exchange-Traded Funds (ETFs) to invest its users’ funds. These ETFs are a combination of stocks and bonds with thousands of underlying holdings.

Note: Moka deploys the Modern Portfolio Theory which prioritizes diversification over picking individual stocks or trying to beat the market.

Each portfolio has been built to reflect various risk versus reward profiles and aims to help investors achieve their financial goals by growing their deposits.

Moka uses the information collected during the sign-up process in combination with its users’ goal to provide them with an investment profile. These profiles use a mix of stocks, bonds, and savings funds to develop portfolios suited to its users’ personal goals.

Here are the 5 types of portfolios currently offered by Moka:

- Conservative: 100% savings

- Conservative – Moderate: 40% savings and 60% Bonds

- Moderate: 40% Stocks and 60% Bonds

- Moderate – Aggressive: 60% Stocks and 40% Bonds

- Aggressive: 80% Stocks and 20% Bonds

The app also offers a Socially Responsible Investing (SRI) portfolio, which aims to invest in companies that are building a greener and safer world for future generations.

What Are Moka Portfolios’ ETFs

Here is the list of currently used ETFs in these portfolios.

| Asset Class | Ticker | MER |

| High-Interest Savings ETF | PSA | 0.16% |

| Canadian Stocks | VCE | 0.05% |

| US Stocks | VSP | 0.09% |

| International Stocks | VI | 0.22% |

| Canadian Bonds | VAB | 0.09% |

| US Bonds | VBU | 0.22% |

| International Bonds | VBG | 0.38% |

What Are Moka 360 Features

The app has a more expensive premium plan called Moka 360. On top of the features offered in the cheaper plan, users have access to additional tools for $15 per month.

Earn Double Perks

The basic plan offers cashback opportunities through Perks which provides discounts and cashbacks from brands like Uber Eats, Apple Music, and Foot Locker. By using Moka 360, users double their cashbacks in comparison with the basic plan.

Discount on a Will Plan

With Moka 360, users can get a $99 discount on any Willful plan. Willful provides Canadians with a tool to create their own legally-valid will and ultimately save on legal expenses.

Willful currently has two main plans. Will is $99 while Notarial will costs $349. The main difference is that the cheaper Will plan requires a probate.

Note: Probate is the approval process that takes place in Canada that validates your will and confirms the appointment of your executor.

With the premium plan, users can cover the cost of the Will plan offered by Willful.

Personalized Financial Advice

This feature gives users access to a dedicated financial coach to help answering financial questions such as how much can a user afford for a mortgage. The coaches also offer budgeting tools and plans to help users meet their financial goals.

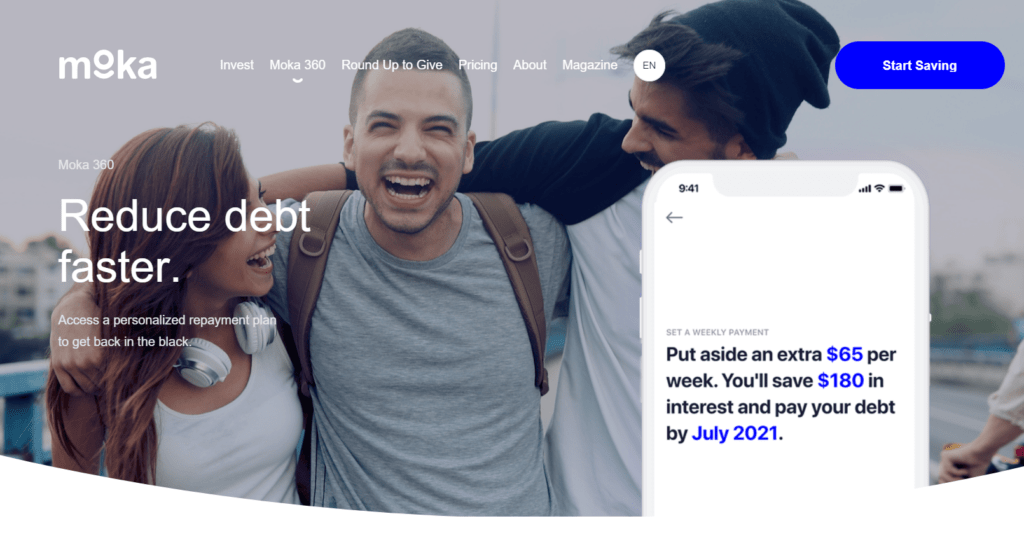

Customized Debt Planner

This feature helps users reduce their debt faster by accessing personal repayment plans. Below is a list of how Moka helps its users achieve this goal faster.

- Become debt free, faster: The AI looks at your personal financial situation and calculates the fastest way for you to pay down credit card debt

- Keep more of your money: Your personalized plan will also identify opportunities for you to save hundreds every year by paying less interest

- Save easily for repayment: Round up purchases and invest spare change or set up recurring weekly deposits to effortlessly save

- Take back control: Manage all your debt in one place, and track your progress with one simple, automated tool

Is Moka Best Suited For You

You are the best person to answer this question. However, you can find the app handy if you are a new investor who is looking for an automated, stress-free way to invest without having to make significant financial sacrifices in order to see financial growth.

What differentiates Moka from other apps is the ability to automatically invest your money on your behalf. Some users don’t have the will power or the time to do this task themselves. If you are one of those users, this app can help you grow faster financially.

Frequently Asked Questions (FAQs) About Moka

Is Moka’s Basic Plan Worth Its $3.99 Monthly Fee

The answer really depends on how much you actually save. The plan costs $3.99 monthly which is $47.88 annually. Now, let’s consider you save $50/month which is $600/year.

This means, the savings is costing you $47.88 / $600 = 7.98% in fees which is very high. But, if you managed to save $400 a month, your fees would be $47.88 / $4800 = 1% which is reasonable but still high when compared with robo-advisor solutions like Wealthsimple or Questrade.

To conclude, the value of Moka depends on how much you think you will be able to save.

Is Moka 360 Plan Worth Its $15.00 Monthly Fee

Same answer. It depends on how much you are going to utilize the extra perks and features. Having an access to a financial coach for $15 a month is worth the cost if you are planning to use it.

However, I don’t think anyone needs to pay for a customized debt plan. Google search can help freely with finding methods to reduce your debt without accumulating more debt by a paid service. You can even use Canadian government’s official budgeting tool freely.

Double cashback offers limited perks but it might onboard more partners in the future. On the other side, the discount on the Will plan might be worth the consideration.

To make Moka 360 worth considering, a user needs to save more than $132.12 in comparison with the basic plan. The best person to answer the question of whether or not it’s worth considering, is you and your situation.

I personally don’t think it is a beneficial option for avid savers and investors but can be an extraordinary boost to those seeking to get out of debt and start investing with the help of a financial coach.

To conclude, the value of the plan depends on how much you think you will be able to save from utilizing its features.

Does Moka Have a Browser App

No. Moka only offers iOS and Android apps.

What Banks and Credit Cards Are Supported

The complete list of supported banks and credit cards can be found here. However, you can reach out to support if your card or bank isn’t listed to hopefully get it added to the list.

Can I Get Reimbursed For NSF Fee

No as the Non-Sufficient Fund fee is charged by your bank. However, in order to avoid such fees, the app has put in place certain tools to prevent a transfer if there is not enough money in your account to cover the transfer amount.

Is Moka Safe

Yes. Moka is owned by a publicly traded Canadian company which means there is an extra level of oversight into the company’s safety and security. Moka uses the same security and encryption measures that any major Canadian bank uses.

Can Investors Lose Money By Using Moka App

Yes. Investors can lose money in any investing strategy. This loss is a natural result of the market fluctuations. It’s for this reason that Moka assesses its users risk tolerance when signing up for the platform.

However, the app invests in a diversified portfolio to spread the investment’s risk. It also invests in ETFs covered by the Canadian Investor Protection Fund (CIPF).

Is There a Minimum Investment Required

No. Users can start investing in the app with as little as $1.

What Accounts Are Offered By Moka App

Moka offers three types of accounts: personal non-registered, RRSP, and TFSA. There is also no limit to how many accounts of each supported account type a user can open.

Does Moka Still Offer Moka 360 Guarantee

No! Moka 360 guarantee was discontinued a while back for Moka users.

Is There a Referral Or Promotional Code

Yes, after becoming a member, if you refer a friend who joins Moka with your referral link and meets the four conditions below, you’ll each earn $10, free.

- Use your referral link to download the application on their phone

- Connect their bank to their Moka account

- Pass the identity verification process

- Have at least one successful transfer of roundups or boosts

Referral bonuses are processed every Monday with the weekly transfer of roundups.

What Is Round Up to Give Feature

Round Up to Give is an easy method to support the Canadian charities that you value. Moka partnered with CanadaHelps to help donate spare change to more than 86,000 registered Canadian charities.

These donations aren’t invested by Moka but only held temporarily in your charity goal and sent out once per month to your selected charity. These funds can be withdrawn before the last Friday of every month which is when they are sent to the charity.

Where is Moka Available

Moka is available in every Canadian province and territory, and now they’re also available in France! Download the app on your mobile device today and start saving and investing!

How Can I Close My Moka Account

If you end up not seeing any benefit from using the app, you can freely withdraw your money at any time and close your account by contacting a support representative through the app or by emailing [email protected].

Note: To contact the support within the app, head to the Overview section, then scroll all the way down to find the Contact us! button.

Conclusions and My Moka Review Verdict

As demonstrated, Moka can be a very beneficial app to those who need help automating their saving and investing. It works best for those who are relatively new to investing or struggling financially and seeking affordable assistance to make a dramatic improvement financially.

However, if you are a person who has a solid financial plan and are already hands-on in savings and investing independently or through robo-advisors, Moka might not be too beneficial for you.

This brings us to the end of this comprehensive Moka review. I hope you found this review helpful and are planning to join the Moka family. If so, I would appreciate if you signed up using my Moka referral link.