In this article, I cover the 9 Best Roadside Assistance in Canada and why every car owner should have it in Canada. These will be divided in three sections. First section covers the only completely free plan. Second section covers those plans offered with a waivable fee-based credit card. Third and final section is for independently paid services.

Complete Best Roadside Assistance in Canada Comparison

| Plan | Cost | Tow KMs | Calls | Fuel | Winch |

| Canadian Tire Gold | Free – $99.95 | 200 Chosen | 5 | $5 Free | 1 Hour |

| Canadian Tire Silver | $69.95 | 10 Chosen | 3 | $0 Free | 20 Mins |

| BMO DAA Basic | Free – $69 -$120 | 10 Nearest | 4 | $0 Free | 1 Hour |

| TD Deluxe Auto | Free – $79 – $120 | 200 Nearest | 6 | $5 Free | 1 Hour |

| CAA Basic | $75 | 10 Chosen | 4 | $0 Free | None |

| CAA Plus | $119 | 200 Chosen | 4 | $15 Free | 1 Hour |

| Costco Standard+ | $63.99 | 100 Nearest | 4 | $5 Free | 20 Mins |

| Access Basic | $69.95 | 7.5 Nearest | 2 | $0 Free | Unknown |

| Access Advantage | $99.95 | 140 Nearest | 5 | $15 Free | Unknown |

Important Considerations Regarding the Table

- Only those plans cheaper than $120 annually are included in this table.

- All plans include the basic standards. Flat Tire, Battery Boost, Fuel Delivery, and Lock out.

- The Cost Column includes all options. With or without credit card or independent purchase.

- Access Advantage service calls are variable. 5 Calls including 2 tows for up to 140 Km or 1 tow for up to 280 Km. I also couldn’t find their Winching information.

- Pay attention to the towing policy. Only Canadian Tire and CAA allow choosing the service centre. Others will not tow to your dealership if it’s couple feet / meters farther than the nearest garage.

- Canadian Tire Silver towing increases to 25 Km if towed to Canadian Tire Auto Service centre.

The History Behind My Best Free Roadside Assistance

Roadside assistance is similar to any insurance. It protects you from a sudden failure and much appreciated when needed but feels such a waste of money otherwise.

Wouldn’t you be happy to have your insurance covered for free without you paying for it? Like many Travel Insurance, Car Rental Insurance, and many other benefits that come with many credit cards these days?

Related: How to Get 10 Cents per Litre Discount on Fuel & Other Free Snacks?

As always, I like to personalize my post so here goes the personal experience. I never had roadside assistance until 2018. During our trip in Scandinavia, while returning from Oslo, Norway to our Airbnb which was 40 minutes drive away, one of the tires blew off. It was after midnight and in the middle of the highway. The car didn’t come with a spare tire, so I had to call for help. Luckily, as there was no spare tire, all the expenses (Including $565 taxi fees to get to our Airbnb and then to the Europcar’s Airport office, the towing company, and the replacement car) were covered by the rental company.

This experience made me realize anything can happen to a car even if it is an almost brand new one. In addition, It proved a simple emergency can cost hundreds of dollars. Therefore, I ended up applying for a credit card just to get a free roadside assistance in Canada covering both Canada and the US.

Features to Consider Before Choosing a Roadside Assistance Plan

The most important question to answer is what kind of coverage you will mostly need? In Canada, we will barely run out of fuel as gas stations are almost everywhere. However, your car might get a flat tire. In addition, considering the cold Winter months, the chance of waking up to a dead battery is not uncommon.

In addition, the car might breakdown suddenly while on a road trip far from home. How far do you want your roadside plan to cover for the towing? Some plans only cover 5 KM of towing which means it is only good if you drive around main cities. If you drive outside cities and use any rural or highway road, 5 or even 20 Km will most likely not be a good coverage at all and you’ll end up paying a lot for the extra Kms.

Another consideration is to decide if you want to have a driver or vehicle plan. In a driver plan, any car the covered driver drives get the coverage. This is a good option if the person drives multiple cars.

In a car plan, the car is covered regardless of who the driver is. If your household has one car, best option is to cover the car using a vehicle plan.

The Only Free Roadside Assistance Plan in Canada (Canadian Tire Gold Plan)

Well, this might sound strange but unfortunately there is only one free method to get a free roadside assistance in Canada which is through Canadian Tire. Home Trust Preferred Visa used to include roadside assistance which is no longer the case.

Canadian Tire Triangle World Elite Mastercard truly makes life a whole lot easier without spending extra amount. Considering this is a free credit card, its roadside assistance service is the only free roadside assistance plan in Canada. I hope this won’t change anytime soon. Honestly, this free plan is much better than many paid roadside assistance plans in Canada.

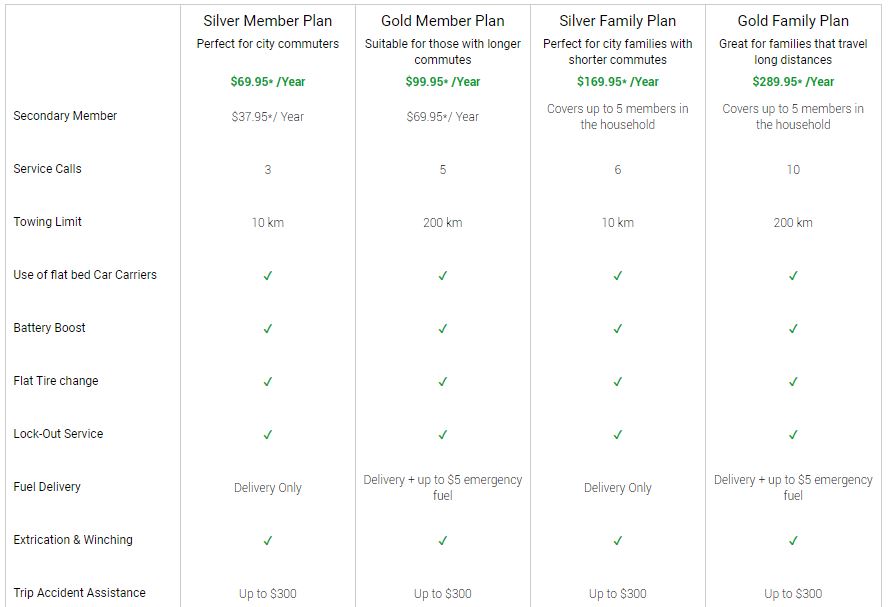

Triangle comes with your choice of Gold Vehicle or Member Plan (Valued at $99.95 yearly)

The only challenge is to have a minimum $80K personal annual income to be eligible for this card.

On top of the roadside assistance, the card offers some great returns including 3% grocery except Walmart and Costco and 5 cents discount on gas in Gas+ stations. It also includes up to 3 years free financing for purchases higher than $150. I took advantage of this in 2020 when I had to urgently buy new All Season tires while driving around Niagara Falls on a family road trip.

Features of Canadian Tire Gold Roadside Assistance Plans (5 Service Calls)

- Vehicle Plan: Service a registered car regardless of the driver (My option as we have 1 car)

- Driver Plan: Service a driver regardless of the car (Can be any car including rental cars)

- Roadside assistance covering both Canada and the US

- Coverage includes the standards like Fuel Delivery ($5 Free), Flat Tire Change, Battery Boost, Lock Out Service, Extrication & Winch

- Up to 5 tows to any chosen service centre plus unlimited tows to any Canadian Tire Auto Service Centre within 200 Km per service call

All Terms and Conditions can be found here.

Disadvantages of Canadian Tire Roadside Assistance

- There is no drive or passenger transportation. This means in case of a breakdown; the car occupants need to figure out how to find their own ride.

- Canadian Tire reduced the towing coverage back to 200 Km from its previous 250 Km.

My Experience with Canadian Tire Roadside Assistance

I had to call Canadian Tire Roadside Assistance three times so far. They helped me twice but declined to come in one occasion. Here are the details:

- In 2019, there was a huge snowstorm here in Quebec and I got stuck in the snow. The street wasn’t plowed and more than 3/4th of each wheel got buried in the snow. Canadian Tire agent said they can’t risk sending a car as it might get stuck too and I have to wait.

- During the same year, I woke up to a dead battery. This was my fault! I used an air compressor on the cigarette lighter for an extended period which drained the battery. I called Canadian Tire and they came in 25 minutes. A quick battery boost saved the day.

- In early 2020, we returned from a 3 week vacation to a dead battery in the airport’s parking lot. To my surprise, parking authorities wanted to charge for a battery boost, but they said they will open the gate for roadside assistance vehicle. I called Canadian Tire Roadside assistance and they gave me another battery boost 😊 Thank you!

If you can get the Triangle World Elite Mastercard, do yourself a favor and get it. However, If you don’t meet the minimum personal income requirement, you can choose to pay for their service or choose another provider from the list below.

Fee-Based Credit Cards Roadside Assistance Plans in Canada (BMO DAA & Deluxe TD)

I couldn’t classify this as free roadside assistance because the credit card is not free. However, there are some methods to make it free such as taking advantage of promotional offers waiving the first year fee or opening one of the expensive chequing account packages while maintaining a minimum balance to waive the chequing account fees. These packages usually cover one credit card fee annually.

BMO CashBack World Elite Mastercard (DAA Basic Coverage) – Free Options

BMO CashBack World Elite Mastercard comes with some good returns including 5% groceries, 4% transit, 3% gas, 2% recurring bills, and 1% all other purchases. However, it costs $120 per year.

There are maximum spending and other conditions with each category so please review the details. For instance, the grocery is only for supermarkets and not butchery or bakeries and it pays 5% only for up to $500 spent per month.

How to get the BMO CashBack World Elite Mastercard for free? Getting BMO’s Premium Chequing Account provides a full rebate for this credit card. However, premium chequing costs $30 per month which can be waived by maintaining a minimum monthly $6000 balance.

Regarding our roadside assistance topic, this card comes with a free membership in the Dominion Automobile Association (DAA) and the benefits of their Basic Coverage BMO Roadside Assistance Program which is worth $69 per year.

Features of BMO Basic Roadside Assistance Plan (4 Service Calls)

- Driver Plan: Service a driver regardless of the car (Including rental). There is no vehicle plan

- Roadside assistance covering both Canada and the US

- Coverage includes the standards like Fuel Delivery (Cost of fuel payable by the member), Flat Tire Change, Battery Boost, Lock Out Service, 1 Hour Extrication or Winch Service

- Up to 4 tows to any chosen service center within 10 Km per service call

TD Cash Back Visa Infinite Card (Deluxe TD Auto Club)

TD Cash Back Visa Infinite Card comes with 3% cash back dollars on grocery, gas, and recurring bills plus 1% on all other purchases. It has a $120 annual fee so isn’t classified as a free roadside assistance.

How to get the TD Cash Back Visa Infinite Card for Free? Getting TD All-Inclusive Banking Plan provides a full rebate for this credit card. However, All-Inclusive chequing costs $29.95 per month which can be waived by maintaining a minimum monthly $5000 balance.

This card comes with Deluxe TD Auto Club Membership which is valued at $79.00.

Features of Deluxe TD Auto Club Roadside Assistance Plan (6 Service Calls)

- Driver Plan: Service a driver regardless of the car (Including rental). There is no vehicle plan

- Roadside assistance covering both Canada and the US

- Coverage includes the standards like Fuel Delivery ($5 Free), Flat Tire Change, Battery Boost, Lock Out Service, 1 Hour Extrication or Winch Service

- Up to 6 tows to any chosen service center within 200 Km per service call

- Personal Transportation: Within 80 Km in case of breakdown or reimburse up to $25

- Traffic Accident or Stolen Vehicle Emergency Services: Accident Towing (Reimburse up to $200), Accommodation and Meals (Reimburse up to $200), Personal Necessities (Reimburse up to $50)

- Hazardous Weather Services: Up to $200 Emergency accommodation and meals and 200 Km towing service

- Return to Location of Repair in case of accident: Reimburse up to $200

These three credit cards are the only ones in Canada offering roadside assistance. We are going to cover other paid roadside assistance programs in Canada.

Paid Roadside Assistance Plans in Canada (CAA, Costco, Esso, DAA, Access)

CAA Roadside Assistance Plan (4 Service Calls)

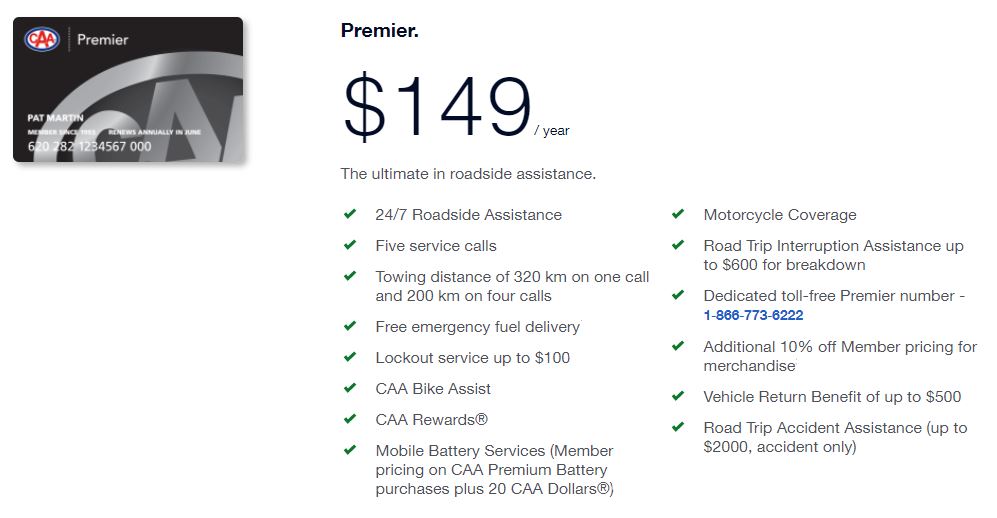

CAA Roadside Assistance comes with 3 packages. Basic, Plus, and Premier Membership. I think CAA is unique on its own ways as it is the only one offering bike coverage.

Basic Membership offers 4 service calls which includes all the basics except covered Winching. Towing of up to 10 Km per call is included. It costs $75 per year.

Plus Membership has the same 4 service calls limit but can tow up to 200 Km and costs $119 per year. It also offers free passport photos and road trip accident assistance up to $600. Of course it includes all the basics mentioned previously which each count as one service call.

Premier Membership features shown below.

One important fine print to mention is that Road Trip Accident Assistance and Road Trip Interruption Assistance are not insurance benefits but assistance services only. Assistance is applicable only to trips 200 km or more from the Member’s primary residence, which include at least one overnight stay.

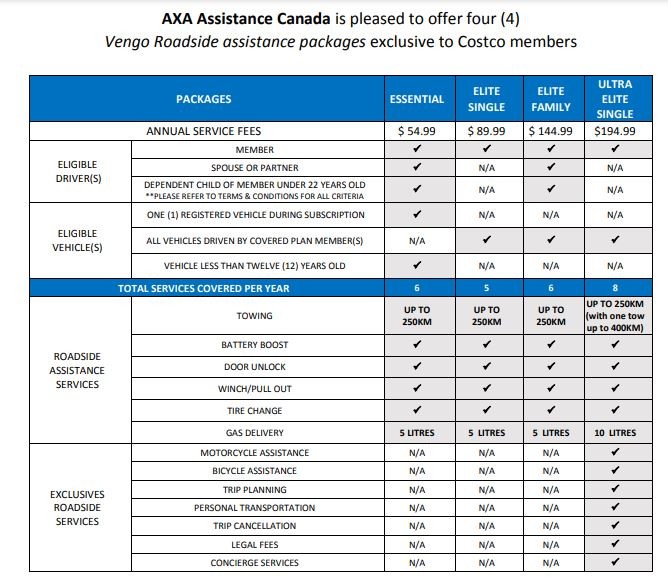

Costco Roadside Assistance Plan (4 Service Calls)

Costco Standard+ Roadside Assistance is only for its members ($50 membership fee per year) and costs an additional $63.99 per year. Costco covers both Canada and the US, but your car should be less than 12 years old. It also includes maximum 4 service calls per year. It includes the basics like Flat Tire Service, Jump Start, Gas Delivery, Lockout Service, and Winching.

What I don’t like about Costco Roadside is its limitation. They tow your car to the “closest” authorized repair shop within 100 Km. This means, you don’t have a choice on where the car can be taken to. The other limitation is the Winching which only covers 20 minutes. If they can’t take the car out, you will have to pay for towing yourself.

However, Costco offers another service called AXA Assistance Canada with 4 different packages. Details are shown below.

Esso Auto Club Roadside Assistance Plan

Esso Auto Club seems to be another Roadside Assistance which I have never heard of. After some Googling, I came up with this page showing there are Individual or family choices from 2 packages Basic and Deluxe. Clicking on the PDF links on the page doesn’t work. It seems you have to call 1-800-265-3776 to register. Basic plan costs $82.5 while deluxe is $107 per year. Basic plan offers all the basics but up to 20 Km for towing. I can’t find the other details including how many service calls or the towing limitation for their Deluxe plan.

Dominion Automobile Association Roadside Assistance Plan

DAA is another roadside assistance which isn’t offering online registration. You will need to call or send an email for more info. I should mention that their site still shows Copyright @ 2018 which is weird.

Please note this is the same service BMO uses which you can read about above.

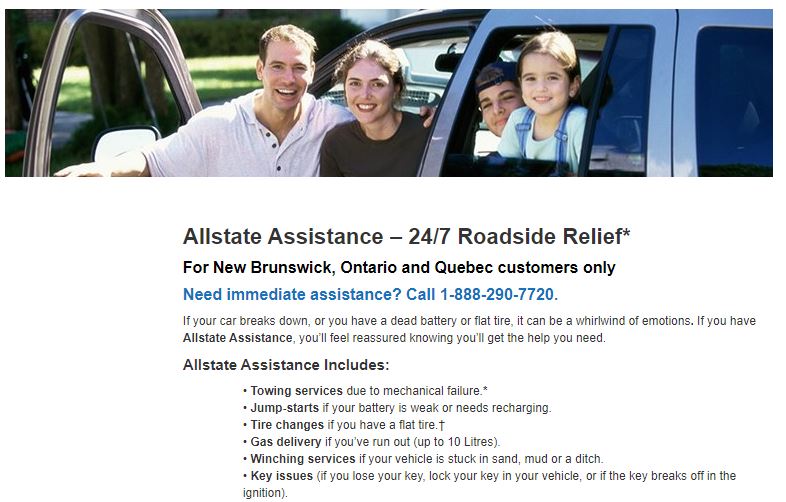

Allstate Roadside Assistance Plan (4 Service Calls NB, ON, QC)

Allstate Roadside Relief is only for New Brunswick, Ontario and Quebec customers’ insured vehicle(s) and applies to all insured on the applicable auto policy with the roadside assistance program. It’s also applicable everywhere in Canada and the United States (except Alaska and Hawaii) and includes all the basics for up to 4 service calls and a one-way 50 Km towing service.

Access Roadside Assistance Plans

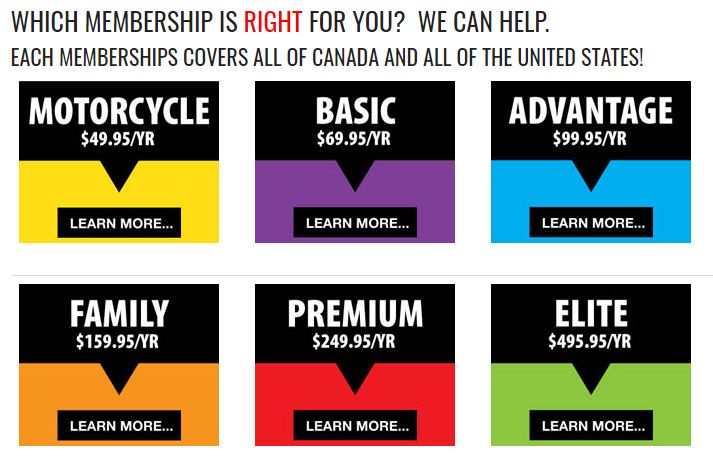

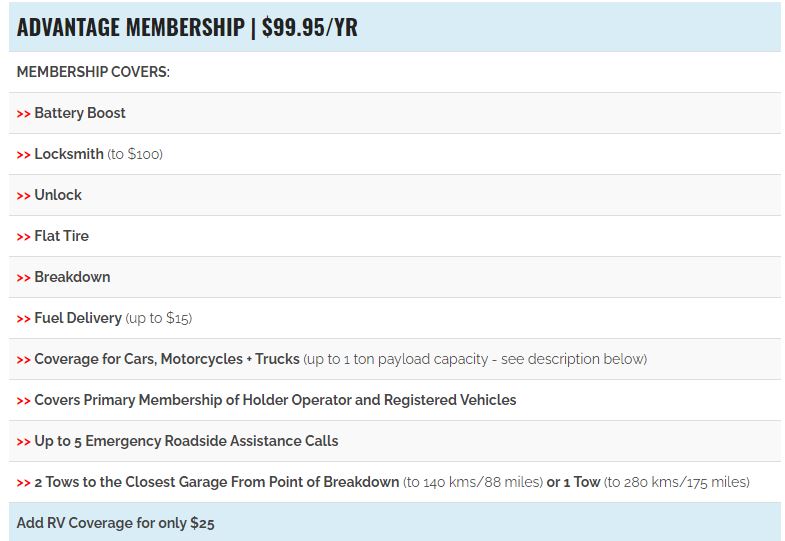

Access Roadside Assistance offers its service to both Canada and US residents. It has 6 different plans ranging from $49.95 to $495.95 per year.

Basic membership covers 2 towing up to 7.5 Km while the Advantage membership covers 2 tows up to 140 Km or 1 tow up to 280 Km per year and up to 5 emergency service calls. The disadvantage is that it doesn’t let you choose which service center and takes you to the nearest available one.

Other Roadside Assistance Plans (Dealership & Auto Insurance)

Many dealerships provide roadside assistance when selling a car. When buying a car, new or used, roadside assistance might be included in your package. However, pay attention to the coverage details.

Other option is the Auto Insurance coverage. For example, my auto insurance company, Intact Insurance, offers roadside assistance for extra fees. Their coverage is not optimal and includes 4 service calls with towing up to 50 Km plus all other standard features. Consult your Auto Insurance as you might find a better coverage and deal.

Which Plan to Choose If Eligible to Get the Credit Cards

If you have a personal $80K or $150K household income, Canadian Tire Triangle World Elite Mastercard should be your first option as it offers great service included for free in their free credit card.

However, if World Elite Mastercard’s minimum income eligibility can’t be met, I’d recommend TD Cash Back Visa Infinite Card (Deluxe TD Auto Club) ONLY if you can get the $120 annual fee waived.This is because of the reviews on top of TD’s towing policy to the nearest service centre versus the chosen one.

I will not even consider BMO CashBack World Elite Mastercard for its Basic roadside assistance. Its 10 Km towing limitation makes it a non-reliable option.

Which Plan to Choose if Can’t Get the Credit Cards

If you don’t meet the eligibility for any of the mentioned credit cards, I would recommend getting the famous CAA Plus Membership. It is not the cheapest, but it has good coverage and based on reviews very reliable.

Which Plans to Avoid Completely

This is a tricky question to answer which mostly depends on your driving requirements. However, I am going to assume similar to many Canadians, you like road trips which will take you far from a major town. Based on this assumption, I will not consider below plans at all due to their limited towing coverage:

- BMO’s Dominion Automobile Association (DAA) Basic Coverage

- CAA Basic Membership

- Canadian Tire Silver Plan

- Costco Standard+ Roadside Assistance

- Esso Auto Club Roadside Assistance

- Dominion Automobile Association Roadside Assistance

Final Thoughts and Conclusions

My theory is as always “Why pay more if you can get it legally cheaper or free”? I already talked about the winner Canadian Tire which is my choice and what I use. However, if I couldn’t get Canadian Tire Triangle or TD’s Cash Back Visa Infinite, I’d go with either Canadian Tire Gold or CAA Plus Membership.

What Roadside Assistance program do you use and how satisfied are you with your choice?

Wow, you are good at these detailed comparison/roundup posts!

We’ve been lucky to have always had some kind of free or included roadside coverage (and a handy father-in-law ready with jumper cables, ha ha).

If we didn’t already have the CT Mastercard, I would get one today—it is such a great card for so many reasons!

Thanks for sharing so much great info to help other Canadians. This is yet another post of yours that I plan to send people to!

Hi Chrissy,

Thanks for stopping by 🙂 I used to do all these comparisons just for myself in the past decade! I am just trying to help others by sharing what I believe in and do personally.

It is great to have an included free roadside coverage. I feel lucky and thankful to have CT Mastercard. Having a nice relative or friend is always a bonus. I am a very “not asking for help” kind of person. I always offer my help but I am terrible at asking.

You are very welcome and thank you for spreading the word. I am planning to update this post whenever there is a change I become aware of.

Take care & Stay Safe,

Mr. Dreamer

I carry a spare fully charged battery and booster cables in my car. So that takes care of the battery issue. As to mechanical breakdowns, my 1999 Ford Panther (109,000) kilometers has never suffered the indignity of requiring towing service. And I still am capable of changing a flat tire.