All of them!

Hello Friends! If you follow me on Twitter, you know the story behind this best Canadian banks to invest in post which was supposed to be only 3 words All of them!

I initially wanted to make more of a silly post but as I value your time and thankful for your presence, will give some information so you hate me less!

So, What are the Best Canadian Banks to Buy in 2024?

I already answered! All of them. Absolutely, buy them all. And if you feel adventures like myself, buy the smaller ones like Equitable Bank (EQB), Manulife Financial (MFC), Sun Life Financial (SLF), or Brookfield Asset Management (BAM.A).

And, What are the Best Canadian Banks to Invest in 2024?

The best Canadian banks to invest in are the same as the best Canadian banks to buy, isn’t it too obvious?

- Bank of Montreal (BMO)

- Bank of Nova Scotia (BNS)

- Canadian Imperial Bank of Commerce (CM)

- National Bank of Canada (NA)

- Royal Bank of Canada (RY)

- Toronto-Dominion Bank (TD)

Ok! How to Buy the Best Canadian Banks in 2024?

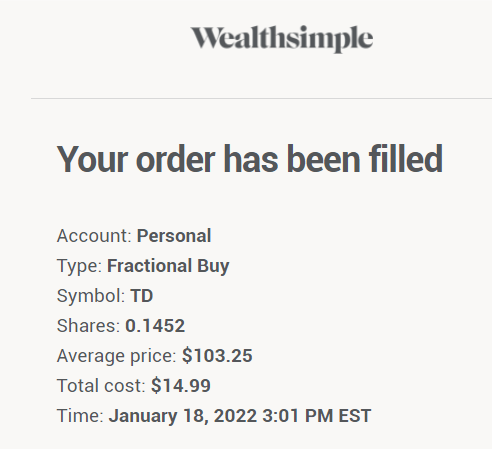

Simply use any brokerage account. Questrade or Wealthsimple are among the best and cheapest in Canada.

A great option is to buy fractional shares on Wealthsimple Trade. This means, investors can own these relatively expensive banks with as low as $1.

Related: What are CDRs and how they can help investors paying less in foreign exchange for US stocks?

Oh! Then, What are the Best Canadian Banks ETFs to Buy?

Not ready to buy all the best Canadian banks directly or don’t have time? Maybe you aren’t lucky enough to have a no-fee trading platform? Fair points (Kind of). But, don’t worry as you are in luck.

You can now buy all Canadian banks using one of below Canadian Banks ETFs.

- BMO Equal Weight Banks Index ETF (ZEB)

- CI First Asset CanBanc Income Class ETF (CIC)

- BMO Covered Call Canadian Banks ETF (ZWB)

- RBC Canadian Bank Yield Index ETF (RBNK)

- iShares S&P/TSX Capped Financials Index ETF (XFN)

- iShares Equal Weight Banc & Lifeco ETF (CEW)

- iShares Canadian Financial Monthly Income ETF (FIE)

Which Canadian Banks ETF Do I Recommend?

It depends. However, I recommend BMO Equal Weight Banks Index ETF (ZEB) because it is designed to track the performance of the Soloactive Equal Weight Canada Banks Index. This means equal exposure to all the 6 big Canadian banks.

ZEB comes with a 0.28% MER and currently has a 3.31% dividend yield.

Alternatively, investors can buy iShares Equal Weight Banc & Lifeco ETF (CEW) which provides exposure to the biggest Canadian banks plus insurance companies including IA Financial, Great West Lifeco, Sun Life Financial, and Manulife Financial.

CEW has a 0.61% MER and a 3.06% monthly dividend yield.

Do I Own Any Canadian Banks ETFs?

No, I don’t. The only ETF I own which contains all the big banks plus many other great dividend companies is VDY. You can read more about what ETFs I own in a series of 3 posts starting by this one.

Why Not Owning Any Canadian Banks ETFs?

Simply because I like saving the fees of ETFs and add more money in my pocket. In addition, I have more flexibility in buying the banks directly based on their performance.

Most importantly, I know exactly how much passive income I will receive from each of them which provides me with full control over these payments.

Honestly, with the possibility of buying fractional shares with as little as $1 CAD, there is no real reason to buy Canadian banks ETFs.

ETFs have their own advantages including saving time and headache. However, we are dealing with 6 big banks only. It is not an S&P 500 or NASDAQ. Buying 6 Canadian banks directly is the most efficient method to own a piece of this delicious cake. However, make sure you don’t pay hefty trading fees.

Final Words About the Best Canadian Banks in Canada to Buy

Just buy them please. Buy as much as you can! Banks will benefit from any financial situation. If (or when) interest rates go up, our beloved Canadian banks will benefit as well.

Canadian banks are the stocks you want to hold on for life despite any short term meltdown. Here is a Tweet by my friend Mark the founder of FIWOOT movement!

Thanks for stopping by! See you soon again.