Tech ETF Versus Individual Stocks Holdings

I have been searching for the 5 Best Technology ETFs in Canada which mostly track US and CAD technology stocks. After all, I work in technology and have a passion for it so holding tech stocks should be part of my growth plan.

The disadvantage of technology ETFs is their MER which is fine considering the exposure and peace of mind holding in local CAD rather than USD. The other negative part of holding technology ETFs or Stocks is the fact that they barely pay any dividends, but the growth beats every dividend paying stock.

If there is MER, why am I going to hold an ETF? Two reasons basically. Firstly, I hate going through currency conversion which makes me pay extra fees nor I am a fan of some complicated buy and sell methods (Norbert Gambit) with a week or so waiting to get the funds in my desired currency.

The second reason is that history repeats itself. Blackberry is a lesson to remember. Hence, I prefer holding an ETF with more stocks exposure than holding handful number of companies. I will never know what company will be the next Amazon or Shopify so no point on even trying.

So there goes the story! Below I am going to list what I found as my 5 Best Technology ETFs in Canada.

Also, if you’d like to know how my story started and what my plans are, you can find my monthly financial reports here.

Related: Detailed analysis of XAW and VXC versus holding underlying funds directly on Best & Most Tax Efficient US & International ETFs Listed on TSX. XAW vs. VXC and beyond!

TEC – TD Global Technology Leaders Index ETF

TEC is a pure technology ETF developed by a German company called Solactive. Currently, TEC seeks to track the Solactive Global Technology Leaders Index (CA NTR), an index which tracks the performance of securities of global mid- and large-capitalization issuers that are related to technology.

In addition to technology, CA NTR also includes companies that belong to other subsectors but are engaged in technology-related themes such as Cyber-Security, the Internet of Things, E-Commerce, Robotics & Automation, Artificial Intelligence, Autonomous Vehicles, Cloud, and Big Data.

This ETF holds 296 international stocks and not surprisingly, the top 30 stocks weight more than 70% of the total ETFs holdings. Also, as seen below, Canadian tech giant Shopify’s weight is only 0.58%.

Open Text is very low on the list with only 0.06%.

| Holding Name | Holdings % |

| Apple Inc | 13.75 |

| Microsoft Corp | 11.25 |

| Amazon.com Inc | 6.8 |

| Tesla Motors Inc | 4.06 |

| Alphabet Inc – Common Cl A | 4.02 |

| Meta Platforms Inc – Common Cl A | 3.8 |

| Alphabet Inc – Common Cl C | 3.72 |

| NVIDIA Corp | 3.71 |

| Visa Inc – Common Cl A | 1.8 |

| Mastercard Inc – Common Cl A | 1.56 |

| ASML Holding NV – Common | 1.45 |

| Adobe Inc – Common | 1.23 |

| Cisco Systems Inc – Common | 1.15 |

| Netflix Inc – Common | 1.12 |

| Broadcom Inc – Common | 1.12 |

| Accenture PLC – Common Cl A | 1.09 |

| Intel Corporation | 1.09 |

| Salesforce.Com Inc – Common | 1.07 |

| PayPal Holdings Inc – Common | 1.02 |

| Qualcomm Inc – Common | 0.97 |

| Texas Instruments Inc – Common | 0.82 |

| Advanced Micro Devices Inc – Common | 0.77 |

| Intuit Inc – Common | 0.72 |

| Sap SE – Common | 0.69 |

| Sony Group Corp – Common | 0.67 |

| Oracle Corp – Common | 0.66 |

| Applied Materials Inc – Common | 0.64 |

| IBM | 0.59 |

| Shopify Inc – Common Cl A | 0.58 |

| ServiceNow Inc – Common | 0.52 |

| Total Percentage | 72.44 |

The current dividend yield is 0.50% which covers the MER and TER of 0.39%. ETF facts can be found here on TD’s official site.

One important note is that this ETF is not an actively managed one. However, it gets reviewed once a year and can be modified by removing or adding new stocks. For example, in 2021 when I wrote this first review, it had 248 technology companies. However, they added 48 companies to the ETF.

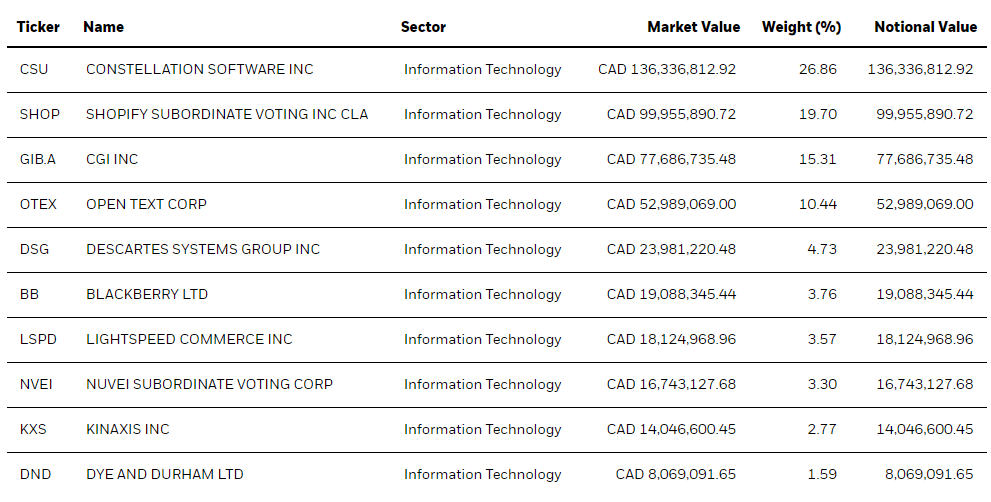

XIT only seeks Canadian Information Technology companies which means you won’t see any Apple, FB, Amazon, or Google in XIT. However, it comes with a very small unpredictable semi-annual distribution.

The ETF holds only 24 stocks and a small portion of cash in $CAD and $USD. After all, it is only for Canadian Capped IT stocks which aren’t that many. Hence, its 0.61% MER is really heavy considering the ETFs simple holdings.

Here are the top 10 Holdings. Interestingly but as expected, the top 4 counts for 72% of the ETF’s total weight.

I am not willing to pay 0.61% MER to hold this ETF and prefer to buy SHOP, CSU, OTEX, LSPD, KXS, and CLS individually.

QQC.F – Invesco NASDAQ 100 Index ETF – CAD Units (CAD-Hedged)

QQC.F seeks to replicate the performance of the NASDAQ – 100 Currency Hedged CAD Index. As the name says, this is not a pure technology ETF but rather after the best 100 (To be precise 103 currently) NASDAQ companies with a 0.89% distribution yield and an interesting 1.44% dividend yield. QQC.F’s MER is 0.22%.

The CAD hedged part can be tricky. It basically means no dollar gain or loss for CAD-USD fluctuations. If CAD rises against USD, this will be beneficial. However, if CAD loses value, it might eliminate the benefit of distributions and yield. Depends on the Oil price, CAD might keep rising (Or the opposite).

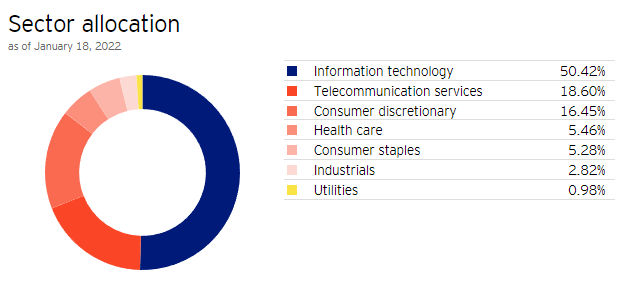

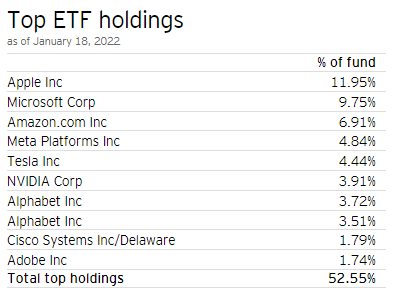

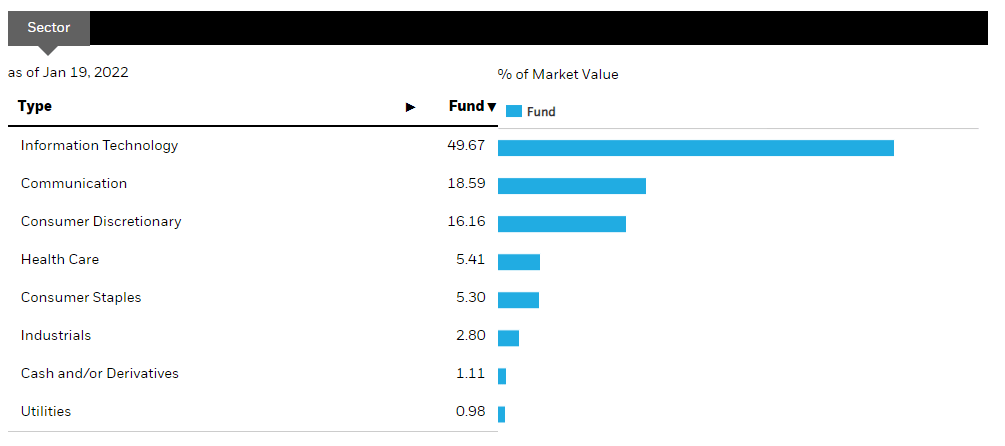

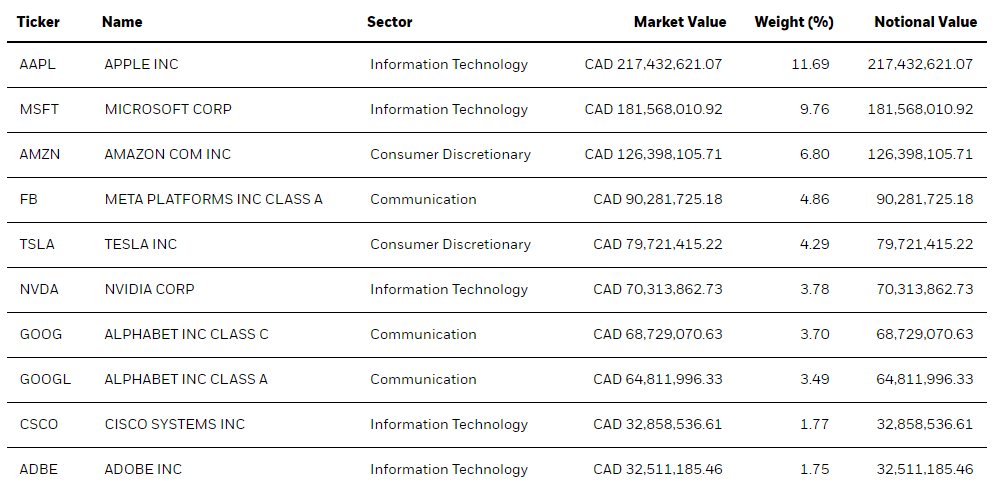

QQC.F‘s top 10 holdings are listed below which count for 51.21% of the total fund’s weight. Considering its 48.11% Information Technology and 19.80% Telecommunication Services holdings, it is fair to say this ETF can be counted as a mostly technology ETF.

XQQ exposures to 101 of the largest non-financial companies listed on The Nasdaq Stock Market based on market cap. XQQ’s MER is 0.39% with a 0.36% distribution yield.

As shown below, XQQ is almost identical to QQC.F in holding and sector allocation. Similar to QQC.F, with its large exposure to Information Technology and Telecommunication, can be considered a mostly technology ETF.

IYW is the US version of XIT with a huge exposure difference where it holds 159 US Stocks (Versus XIT’s 24 Canadian stocks). IYW is traded on NYSE and is in USD but I had to mention it here.

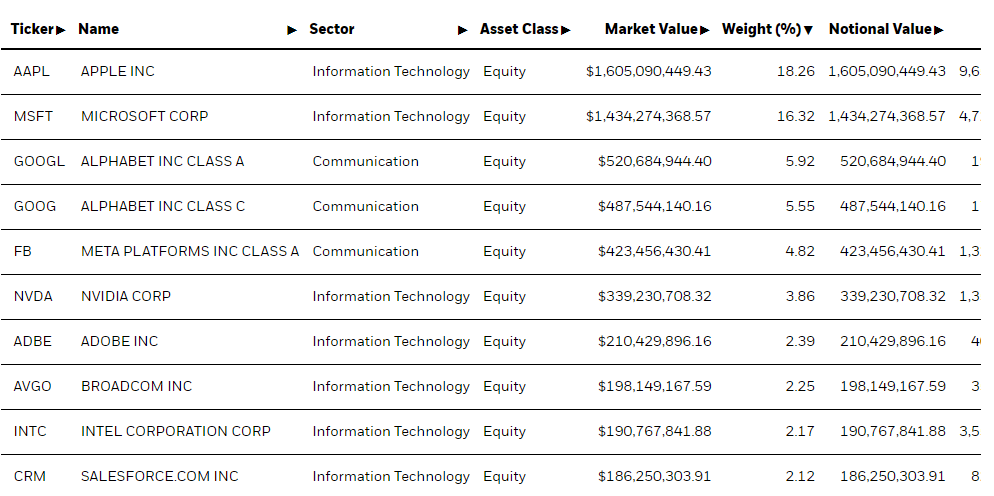

IYW has a 0.31% trailing yield and a 0.41% MER. The ETF’s top 10 holdings count for 63.66% of its total weight.

Owning a US listed ETF in $USD holding US stocks directly is the best way to avoid the 15% withholding tax in RRSP but it comes with the disadvantage of converting money from $CAD to $USD.

Growth and Performance Comparison of the 5 Best Tech ETFs

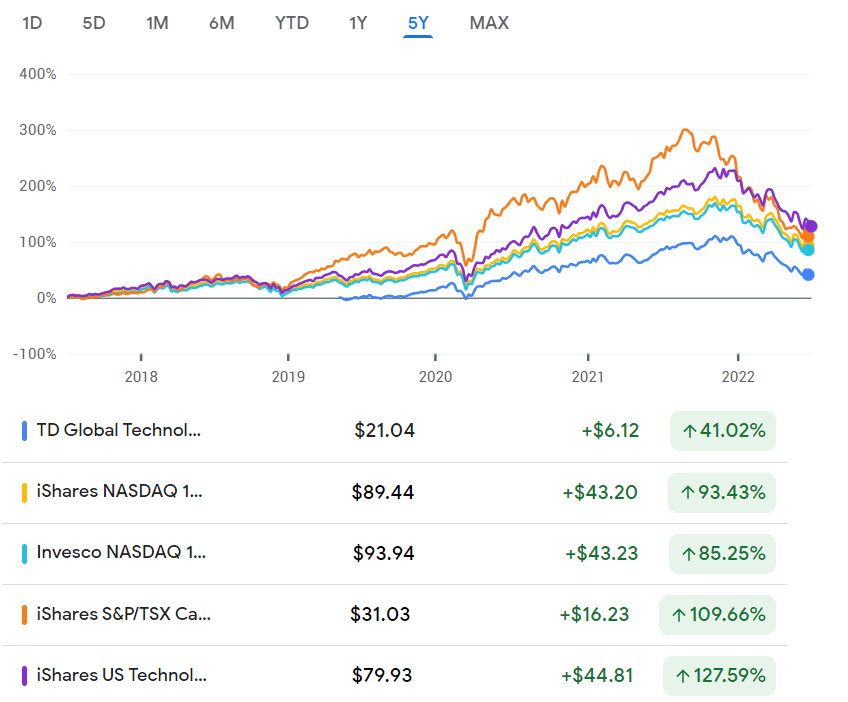

These are the best technology ETFs that I could find in the market. To understand them better, we need to compare their performance as well. The 5 year comparison isn’t fair as TEC started in 2019.

Very interestingly, IYW with 127.59% growth is leading the battle followed by our Canadian XIT with 109.66% growth rate in the past 5 years.

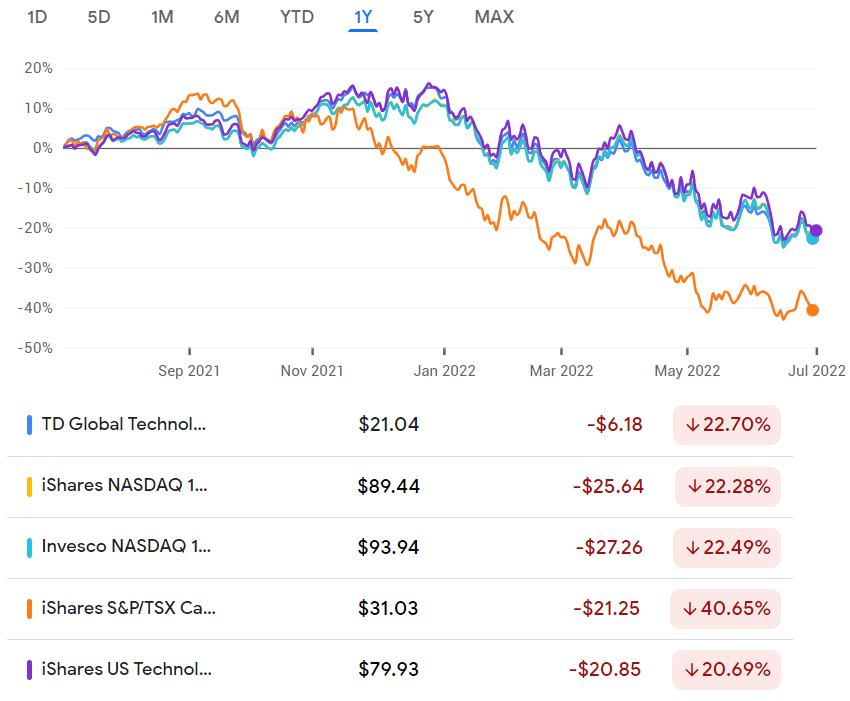

However, to make a better decision, I am going to study the 1 year performance chart as well.

As shown below, all the ETFs had an almost similar fall down except one. XIT which was the winner of growth in 2021 review, is now down -40.65% YoY.

IYW is the best loser when it comes to YoY performance with a -20.69% decline followed by XQQ , QQC.F, and TEC with their -22.5% YoY decline.

Which ETF to Keep, XQQ vs QQC.F Battle

From all the above, I eliminate QQC.F as its performance is lagging in comparison with XQQ despite having a lower MER and higher distribution yield. Hence, I declare XQQ as the winner of XQQ vs QQC.F battle.

I also remove IYW as it is in USD and doesn’t include companies like Tesla or Amazon.

I consider these companies as tech. Amazon’s AWS is a pure cloud service which is technology related similar to Tesla’s AI technology.

3 ETFs to compare. TEC vs. XIT vs. XQQ

I believe, XIT’s exposure isn’t worth its MER. Considering its heavy weight on only handful stocks, one can hold individual stocks and avoid paying the MER.

In addition, as expected companies like Shopify have been hammered badly during the bear market which weights negatively on XIT’s performance.

Therefore, I eliminate XIT from the equation and prefer to hold the underlying top stocks directly especially $SHOP.

With Wealthsimple Trade, we can also buy the top technology stocks with as little as $1. Wealthsimple’s fractional share technology is truly changing the trading game.

Wealthsimple Trade is Canada’s first $0 commission App.

Sign up using my referral code 8RR_5G to receive $10 to trade.

To get up to $250 or a free month in Questwealth, please use my Referral QPass 646713816388276. You will get below based on the account and your contributions.

Between XQQ and TEC, I did the top stocks comparison and they are becoming different ETFs considering their weight and holdings. For example, QQC.F holds 18.26% Apple while TEC’s Apple is 13.75%. Same for Microsoft. TEC is 11.25% versus QQC.F’s 16.32%.

Final Thoughts and Picking the Best Technology ETF in Canada

Technology stocks are a must to own for any growth seeker investment plan. For me, I will keep buying Canadian technology stocks individually.

For international stocks, they will be a small portion within an international ETF like VXC or XAW. I’d have loved to raise my stake in companies like SAP and Oracle, but I am bound to the limitations of owning an ETF holding international stock (And I don’t want to buy them in their own international currency).

Choosing between TEC and NASDAQ’s top 100, I prefer NASDAQ XQQ (CAD Hedged) ETF. The reason is because I get broader exposure by owning PepsiCo, Starbucks, Booking Holdings (My favorite Hotel booking service), Gilead, and even Trip.com with a 0.1749% weight to be a reminder of my travel addiction!

By holding XQQ, I avoid the tax complications (2 layers) that comes with holding TEC and its underlying German investment company with a 15% international exposure. I also increase my exposure to the great growth companies listed under XAW’s IVV or VXC’s VIU ETFs. I personally buy VIU weekly.

Related: Best & Most Tax Efficient US and International ETFs.

And finally, who doesn’t prefer a company’s ETF which gives back fairly. Hence, the winner of my best Technology ETF in Canada is XQQ (Or its Non-Hedged version QQQ).

IT IS YOUR TURN! WHAT ARE YOUR THOUGHTS? MAYBE I AM MISSING SOMETHING. DO LET ME KNOW!

Nice post, Mr. Dreamer! I’m not the biggest fan of currency conversion either. The holdings in these ETFs look excellent. I like iShares for ETFs even though I don’t hold any. I also like to look through ETFs and mutual funds to find equities to hold. Thanks for sharing!

Hello Graham & Thank you for stopping by!

I totally agree. I actually keep an eye on ETFs and their holdings to see what big banks value the most and take a risk on. I currently keep adding QQC.F but have XIT and TEC on my radar as they give me a better view on Canada and World’s technology companies.

Happy Investing 🙂

Excellent article ! 👌😃 I bought few months ago, XIT, I thought it was a good idea and after all, I totally agree with you, why pay 0,61% of MER!? So expensive ! Yesterday, I sold my XIT with 8% profit and decided to purchase 2 canadians tech stocks, $LSPD (51 shares) + $OTEX (66 shares), that’s it ! I think for the long run much better ! I see you bought some too, that’s very good !

Congratulations on your 8% profit. I also bought LSPD but sold it when it reached $79. Almost 14% profit. As there is no dividend, I am going to keep repeating this. Buying low, selling high. LSPD is reliable and recovers after sliding a bit down. OTEX is nice too. I now have about 8 TSX Tech stocks on my watchlist. I am even debating if I should buy $BB.

I bought some $SW when it tanked last week. I am already 4% up but not planning to sell. I might keep adding.

What do you think of ZINT ?

Great question. It looks to be similar to others but with a different weighting. The MER isn’t too high at 0.45%.

However, looking at its 1 year performance, you can clearly see that the more customized these ETFs get, the more complicated it becomes to bit the main index.

Awesome article! I was thinking about purchasing QQC (non-hedged version) as I feel it would best reflect the performance of its U.S. based QQQ. Knowing that it is relatively new and has low trading volume, do you still recommend buying this ETF if I plan on holding it for 30yrs and contribute to it on a weekly basis. Or will the low trading volume make it very difficult to sell all my accumulated shares 30yrs down the road? Would love to hear your thoughts. Thanks!

Hello Nathan,

Thanks for your kind words and question. I think both Invesco (QQC.F) and iShare (XQQ) are very reliable and trustworthy for a long period of time. However, QQC.F MER is 0.22% versus 0.39% for XQQ. In addition, as of June, $QQC.F’s distribution yield was 0.89% which wins over $XQQ’s 0.36%.

However, if we check the 5-year performance, we see that XQQ is winning by a good margin over QQC.F, 93.43% versus 85.25% as of today.

Ultimately, as you mentioned, the volume can be a factor too. I personally, swapped my QQC.F to XQQ (Thanks to Wealthsimple’s free trading avoided fees).

I understand the article will need a bit of update now to keep up with the changes.

Happy Investing

Nice article! Just wondering why HXQ.TO was not considered despite its low MER 0.28%. It holds the NASDAQ-100 stocks directly and there is no swap based anymore. It does not pay any dividend with full growth potential . Would love to hear your thoughts. Thanks!