As you might know, Wealthsimple has multiple products including Wealthsimple Cash, Wealthsimple Invest, Wealthsimple Trade, and Wealthsimple Crypto.

I have written a detailed Wealthsimple Cash Review to help investors like you get a free $10 which can be used to boost your invest or trade account. You can also open this account easily after having your Wealthsimple Invest account by using my referral link.

Use my Wealthsimple Cash Referral link and we each get $10 when you sign up. Thanks

Complete Review of Best Robo-Advisors in Canada 2021 can also be helpful to familiarize yourself and have a detailed comparison of other Canadian robo advisors.

In this post, I am going to do a detailed and complete Wealthsimple Invest review. You will understand what Wealthsimple Invest is, how it works, its different portfolios, how to start, and basically everything to get you start your amazing investment journey.

Wealthsimple newest update is its Fractional Shares offering on Wealthsimple trade. This means you can buy a slice of a share rather than buying a whole share. Don’t you have $2000 to buy 1 share of $SHOP? No problem at all. Just get $1 or $100 or you put the desired amount which will be filled by the end of the day.

What is Wealthsimple Invest?

Wealthsimple Invest is an automated passive investing product backed by Nobel Prize-winning research which is the most reliable and convenient way to grow your money over the long term.

Wealthsimple Invest is a robo advisor service as there are predefined algorithms to manage the investor’s funds by computers (aka Robots) rather than human advisors (Traditional Mutual Funds).

Wealthsimple Invest includes 9 low-cost Exchange Traded Funds (ETFs). The weight of these ETFs in each portfolio is defined by the investor’s risk score. These ETFs are listed in below table:

| ETF Name | Ticker | Description |

| Vanguard Total Stock Market | VTI | 3,800 companies mirroring the US equity market |

| iShares MSCI Min Vol Global | ACWV | Stocks in Europe, Australasia, and the Far East |

| iShares MSCI Min Vol Emerging | EEMV | 300+ emerging market equities |

| iShares Core MSCI EAFE USD | IEFA | Stocks in Europe, Australasia, and the Far East in |

| Shares Core S&P/TSX Capped | XIC | 95% of the Canadian equity market |

| Vanguard US Total Market ETF | VUS | US equity market with hedged currency exposure |

| BMO Long Federal Bond Index ETF | ZFL | Long term securities by Federal Canada |

| iShare Canada Short Term Corporate Bond | XSH | Short-term corporate debt |

This is a fantastic plan for those who don’t want to pick stocks or ETFs manually but looking to have everything automated to take that psychological aspect of investment away completely.

What Are Wealthsimple Invest’s Features?

Auto Deposits: You can set up automatic deposits from your bank account to be added to your investments account periodically. For example, a specific amount on your pay date to be moved to your invest account.

Dividend Reinvesting: If you are like me in love with dividends, you realize the power of compounding. Hence, any dividend will be auto invested in your portfolio easily and automatically.

Automatic rebalancing: When one ETF or Sector grows more rapidly than other ETFs or Sectors, the portfolio will be imbalanced. Wealthsimple Invest takes care of rebalancing the portfolio automatically.

Easy access: You can access and manage your portfolio from anywhere in the world (Use a VPN when outside Canada) using Wealthsimple website or Wealthsimple Invest mobile iOS or Android App.

Personalized Portfolio: Wealthsimple Invest offers SRI (Socially Responsible Investing) and Halal Investing portfolios in addition to the normal products covering all industries and sectors.

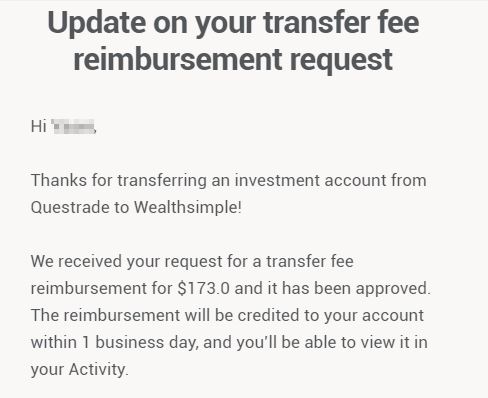

Transfer Fees Coverage: Wealthsimple doesn’t charge any transfer fees, but others do. However, when you transfer a minimum $5000 to Wealthsimple, all the fees are covered by Wealthsimple.

I transferred my TFSA & RRSP from Questrade to Wealthsimple recently. Questrade charges $150 plus tax for a full account withdrawal. Thankfully, Wealthsimple reimbursed the full amount for both accounts.

No Foreign Exchange Fees: You don’t pay any fees when the robots convert Canadian Dollar to US Dollar to invest in any USD ETF.

No Minimum Balance: There is no minimum balance requirement to open an account with Wealthsimple Invest.

Tax Loss Harvesting: Automatic for Black (Above +$100K) & Generation (+$500K) clients.

Excellent Customer Service: You can access customer support through live chat, phone, or email. They can accordingly escalate the matter to licensed portfolio managers for complex concerns.

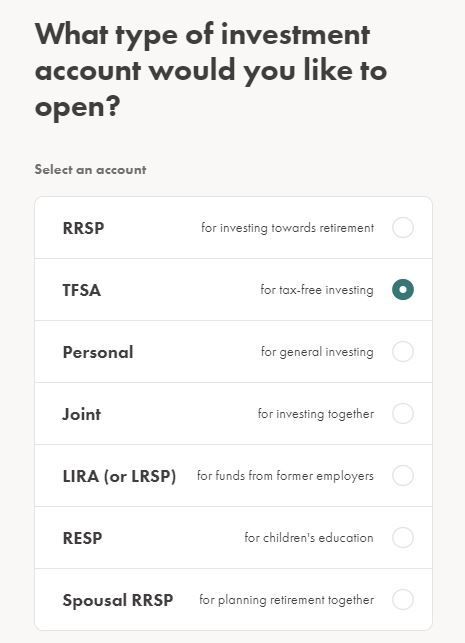

What Accounts Are Covered in Wealthsimple Invest?

Wealthsimple Invest provides almost all type of accounts as shown below.

What Are the 3 Wealthsimple Invest Plans?

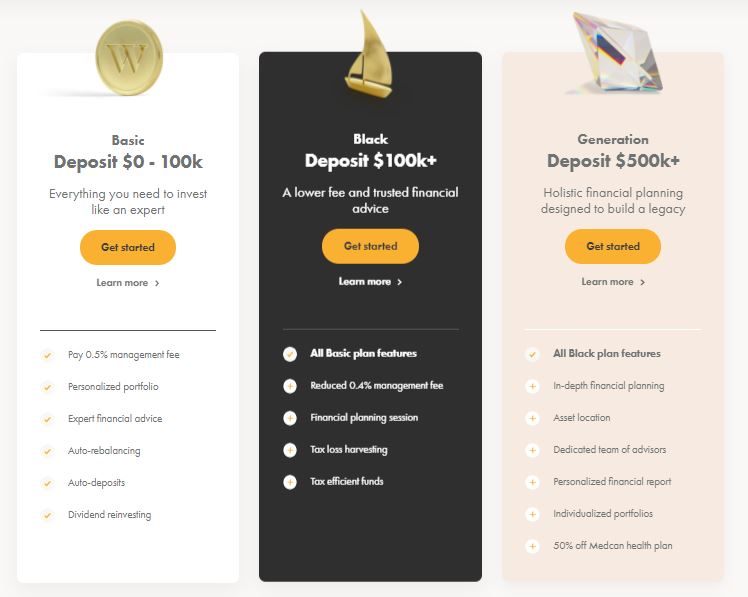

Wealthsimple Invest offers 3 tiers based on the portfolio size. Each tier has its own features on top of the ones from the lower tier. The most significant benefit is the reduction of management fee from 0.5% to 0.4%.

How Much Does Wealthsimple Robo Advisor Cost?

It is important to realize there are 2 types of fees. The account Management Fee and ETF MER Fee.

Account management fee is 0.5% for basic and 0.4% for black or generation plan holders annually. This means for a $10,000 investment in the basic tier, the investor pays $50 in fees annually.

Second fee is related to the ETFs MER fees which is charged by the ETF provider. Wealthsimple ETFs MER are 0.13% to 0.17%. However, this fee is higher for SRI or Halal portfolios ranging between 0.25% to 0.4%.

Based on these numbers, fees can be from 0.53% to 0.90% annually depends on the plan and portfolio.

How to Open a Wealthsimple Invest Account?

- Join Wealthsimple Invest and get your first $10,000 managed for free in the first year

- Provide basic information (Name, Address, SIN, Email, Date of Birth)

- Answer questions regarding previous investment experiences and risk tolerance

- Depends on your answers, you will get one of the 3 portfolio types

- Electronically sign one or more investment management agreements

- Connect your bank account securely authenticating your online banking. You can also complete this step manually by uploading a void cheque or bank statement.

- Suitability Call can happen depending on your risk level and requirements. You might get a call from one of Wealthsimple portfolio Manager and have a short friendly conversation.

- Congratulations! Your account should be activated within 5 business days.

- If you get stuck or need help, give Wealthsimple support team a call at 1-(855) 255-9038

- When your account is up, login to Wealthsimple Web or Invest App

- Scroll down and click “Open an Invest Account” and choose your account

- Next page you can create or choose a pre-defined goal and follow the steps

- Accept and sign the agreements and you are all set with your new account

Please note you can open as many types of accounts as you’d like but you can’t have more than one account of each type. This means, you can’t have 2 different TFSA or RRSP accounts.

What Are Wealthsimple Invest Portfolio Options (Risk Score)?

Wealthsimple offers three portfolio options including Conservative, Balanced, and Growth. This is chosen based on the answers you provided when creating your invest account on step 1 above.

A unique factor about Wealthsimple portfolio is that all of them hold Gold in the portfolio. I think it is just a matter of time before Wealthsimple starts offering portfolios with Cryptocurrency (Bitcoin and Ethereum ETFs) exposure.

| Portfolio | Stock | Bond | Gold | MER | Return |

| Conservative | 35% | 62.5% | 2.5% | 0.16% | 3.75% |

| Balanced | 50% | 46.2% | 3.8% | 0.16% | 4.98% |

| Growth | 80% | 17.5% | 2.5% | 0.13% | 8.54% |

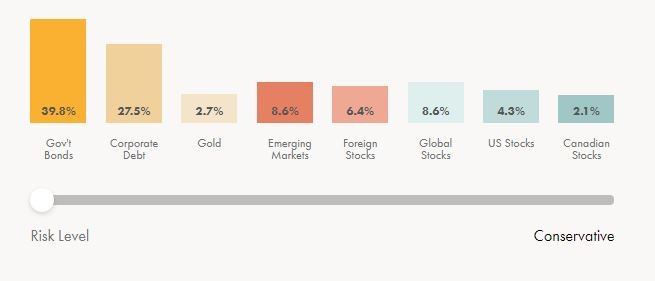

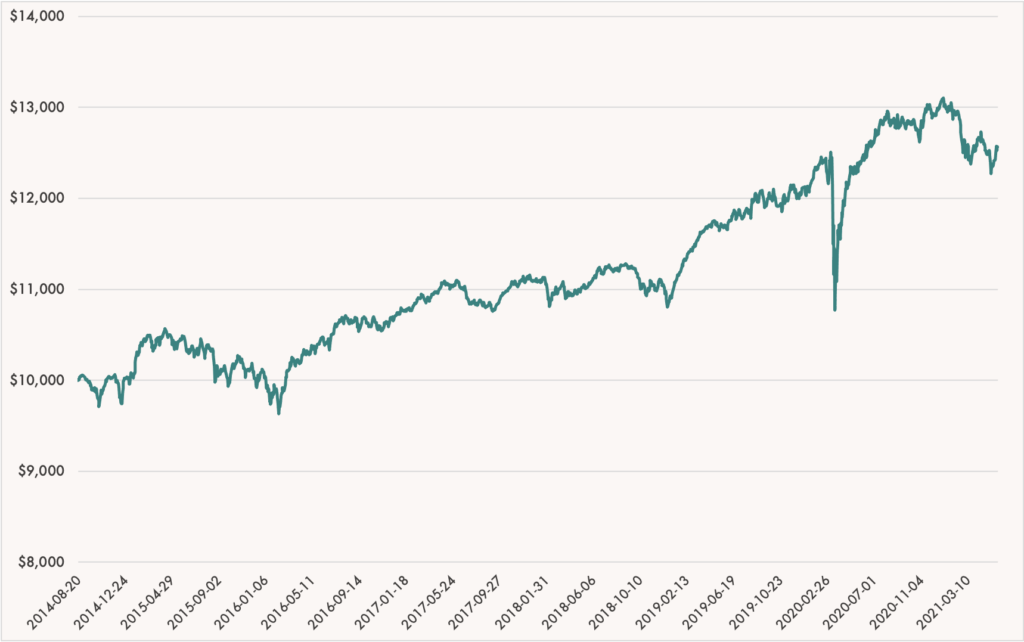

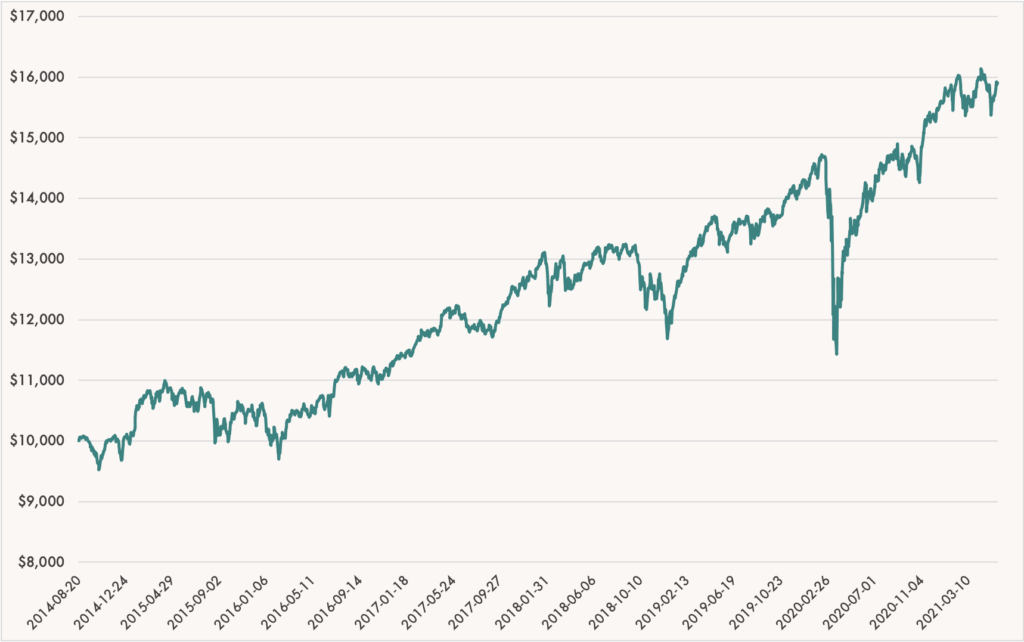

Conservative portfolios have around 30% equity allocation with the rest in bond investment. This is a great option for those who prefer stability and a modest return. This portfolio has grown by 25.65% (net of fees) since Wealthsimple’s launch on August 20, 2014, to May 31, 2021.

This translates to which makes a 7 years annualized return of 3.75%. The MER of the Conservative portfolio is 0.16% with a 0.40-0.50% management fee.

Here are the holdings in Wealthsimple Conservative Portfolio. As shown, it holds mostly long term debt securities issued or guaranteed by Government of Canada and Short-term corporate debt.

| ETF Name | ETF Ticker | ETF Weight |

| Vanguard Total Stock Market | VTI | 5% |

| iShares MSCI Min Vol Global ETF | ACWV | 10% |

| iShares MSCI Min Vol Emerging Market Fund | EEMV | 10% |

| iShares Core MSCI EAFE USD | IEFA | 7.5% |

| Shares Core S&P/TSX Capped Composite Index | XIC | 2.5% |

| Vanguard US Total Market ETF (CAD-Hedged) | VUS | 0% |

| BMO Long Federal Bond Index ETF | ZFL | 37% |

| iShares Core Canadian Short Term Corporate Bond Index ETF | XSH | 25.5% |

| SPDR Gold MiniShares Trust | GLDM | 2.5% |

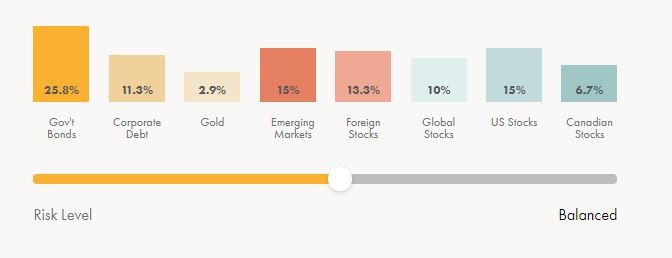

Balanced portfolios offer a low to medium risk while increasing the return over a conservative portfolio by having a 50% bonds and 50% equities in its holdings. The MER is 0.16%.

This portfolio has grown by 34.53% (net of fees) since Wealthsimple’s launch on August 20, 2014, to May 31, 2021, which makes its 7 years annualized return 4.98%.

| ETF Name | ETF Ticker | ETF Weight |

| Vanguard Total Stock Market | VTI | 10% |

| iShares MSCI Min Vol Global ETF | ACWV | 10% |

| iShares MSCI Min Vol Emerging Market Fund | EEMV | 15% |

| iShares Core MSCI EAFE USD | IEFA | 10% |

| Shares Core S&P/TSX Capped Composite Index | XIC | 5% |

| Vanguard US Total Market ETF (CAD-Hedged) | VUS | 0% |

| BMO Long Federal Bond Index ETF | ZFL | 30.5% |

| iShares Core Canadian Short Term Corporate Bond Index ETF | XSH | 15.7% |

| SPDR Gold MiniShares Trust | GLDM | 3.8% |

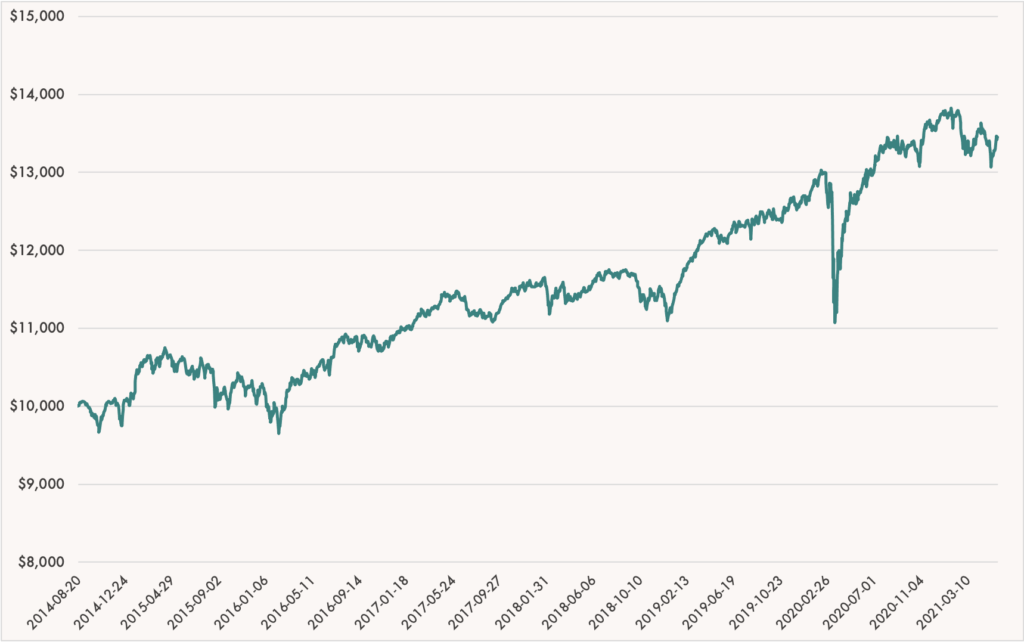

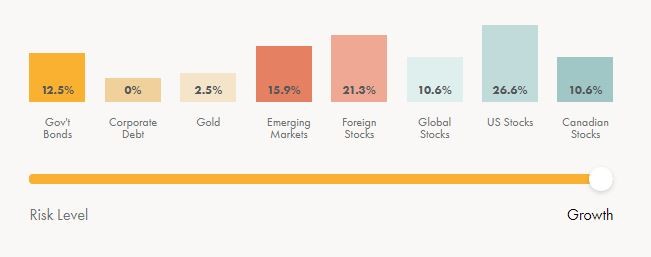

Growth portfolios are heavy on equities and designed to hold 75-90% in stocks. Investors choosing this model should have a long-term investments horizon and can easily ignore the market fluctuations including bear markets which can lead to a poor performance. The MER is 0.13%.

This portfolio has grown by 59.01% (net of fees) since Wealthsimple’s launch on August 20, 2014, to May 31, 2021, which makes its 7 years annualized return around 8.54%.

| ETF Name | ETF Ticker | ETF Weight |

| Vanguard Total Stock Market | VTI | 20% |

| iShares MSCI Min Vol Global ETF | ACWV | 10% |

| iShares MSCI Min Vol Emerging Market Fund | EEMV | 15% |

| iShares Core MSCI EAFE USD | IEFA | 20% |

| Shares Core S&P/TSX Capped Composite Index | XIC | 10% |

| Vanguard US Total Market ETF (CAD-Hedged) | VUS | 5% |

| BMO Long Federal Bond Index ETF | ZFL | 16.5% |

| iShares Core Canadian Short Term Corporate Bond Index ETF | XSH | 1% |

| SPDR Gold MiniShares Trust | GLDM | 2.5% |

How to Build Your SRI (Socially Responsible Investing) Portfolio?

Wealthsimple is a leader in SRI investments and offers 3 type of portfolios using 5 different ETFs listed below. The average MER of an SRI portfolio is 0.23%.

| Symbol | Description |

| WSRI | Canadian and American stocks that don’t violate social and environmental values |

| WSRD | European, Australian, and Asian stocks that don’t violate social and environmental values |

| ZFL | Long term debt securities or guaranteed by Government of Canada |

| ZMP | Debt securities issued by Canadian provinces |

| GLDM | Shares tracking the value of physical gold bars held in London vaults |

Here is the comparison table between the 3 different portfolios based on the risk level.

| Portfolio | WSRI | WSRD | Bonds & Gold |

| Conservative | 15% | 15% | 70% |

| Balanced | 30% | 30% | 40% |

| High Growth | 45% | 45% | 10% |

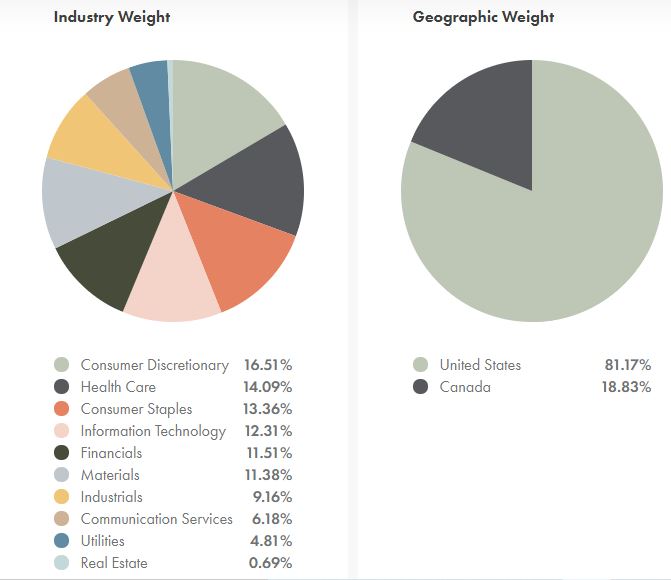

WSRI ETF is the North America Socially Responsible Index ETF with 81.17% weight in the US and 18.83% in Canadian companies.

The top 10 holdings are Vulcan Materials, Hydro One, Agnico Eagle Mines, DR Horton, NVR, Take-Two Interactive Software, LKQ, Coca-Cola, Mondelez International, and General Mill Inc.

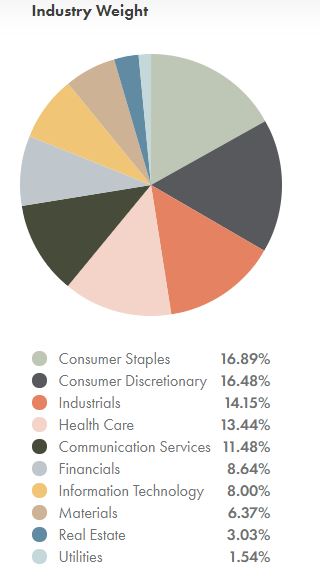

WSRD ETF is Developed Markets ex NA Socially Responsible Index ETF with more than half of its weight in Sweden 27.03% and Japan 23.07%.

Top 10 holdings are Sony, Pola Orbis Holdings, James Hardie Industries, Boliden AB, Ito En, Fuji Media, Sugi Holdings, Adidas AG, Investment AB Latour, and Industria de Diseno Textil SA.

What Is Halal Investing in Wealthsimple Invest?

This is a smart portfolio that complies with Islamic law. Based on Wealthsimple, this portfolio is screened by third-party committee of Sharia scholars which involves eliminating companies generating more than 5% of their profit from gambling, arms, tobacco, or any other restricted industries by Islamic laws.

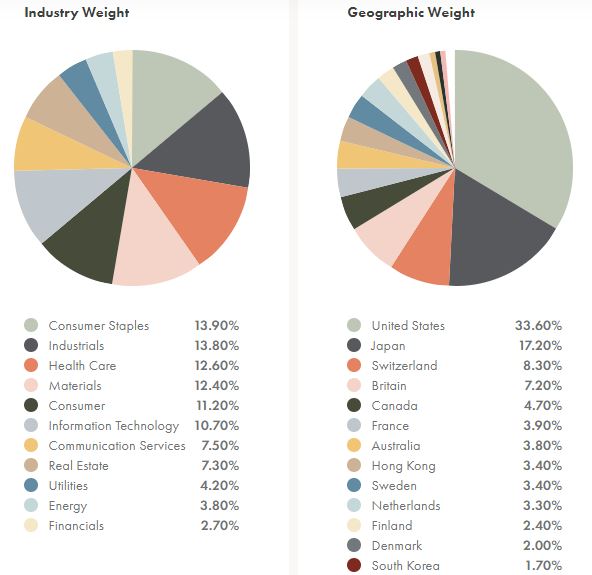

Similar to other options, there are 3 portfolios, Conservative, Balanced, and High Growth. Wealthsimple created the Canada’s first Shariah World Equity Index ETF WSHR. United Stated and Japan take half of WSHR’s weight. Next countries are Switzerland 8.30%, Britain 7.20%, and Canada 4.70%.

| Portfolio | WSHR | Gold | Non-Interest Bearing Cash |

| Conservative | 40% | 15% | 45% |

| Balanced | 70% | 20% | 10% |

| High Growth | 90% | 10% | 0% |

It is very interesting that there is a very high weight of cash in the conservative portfolio. Even 10% in balanced is still a lot of cash for managing the risk level of these Halal portfolios.

Top 10 holdings are Nestle, Hong Kong & China Gas Co, CLP Holdings, Givaudan SA, Beiersdorf AG, Waste Connections, McDonald’s Holdings Co Japan, Wolters Kluwer NV, Singapore Telecommunications, and SGS SA. The complete holding list can be found here.

The list holds interesting companies like Nissan, Casio, Canon, Yamaha, Nintendo, Apple, CNR, Cisco, Constellation, eBay, Facebook, Fortinet, CGI, Google, Garmin, J&J, Coca Cola, Microsoft, Nestle, P&G, L’Oréal, Pinterest, Ferrari, Snap, Target, Twitter, Unilever, Visa, Walmart, and Exxon Mobile.

Are Investments in Wealthsimple Secure & Protected?

Yes! Any account in Wealthsimple is protected by CIPF. Honestly, this should be enough for 90% of the investors. For an individual investor, the limits on CIPF protection are as follows:

- $1 million for all general accounts combined (such as cash accounts, margin accounts and TFSAs), plus

- $1 million for all registered retirement accounts combined (such as RRSPs, RRIFs and LIFs), plus

- $1 million for all registered education savings plans (RESPs) combined where the client is the subscriber of the plan.

This means, you can have $3M distributed between these categories or even more for couples. Please find more information on CIPF Coverage Page.

Regarding security everything is encrypted and Wealthsimple uses two-factor authentication (2FA) on top of its state-of-art data encryption technology.

Any Disadvantage with Using Wealthsimple Robo?

The only disadvantage is the management fee which is higher than the rival competitor Questrade. Questrade charges 0.20-0.25% for Questwealth (Questrade Robo) portfolios.

Another known limitation is for Quebec residents who has an RESP. Wealthsimple doesn’t offer QESI (Québec Education Savings Incentive) in its accounts which is why my RESP is in Questrade.

Any Other Great Features to Mention?

Indeed! There are 2 more worth mentioning features in Wealthsimple platform which can help investing more and subsequently growing your portfolio faster.

Roundup: Enable this feature from the web or app, and after making a purchase, Wealthsimple round up the purchase to the nearest dollar and add the extra to Wealthsimple Invest automatically.

Roundups are transferred from the bank account you link to Wealthsimple. Even if you link multiple credit or debit cards, all of your roundups will still come from only the linked bank account.

Overflow: Automatically invest your extra cash. First set a bank balance for the cash you need and then Wealthsimple moves the extra cash to Wealthsimple Invest automatically once a month. You will also get notification before the deduction in case you have some plans and need to keep the cash.

Wealthsimple Invest Review Summary

Wealthsimple is the best choice for robo advisor seekers in Canada. Considering their amazing customer service, low ETF fees, efficient signup process, and a simple user-friendly platform, I highly recommend Wealthsimple Invest to new investors.

When your portfolio grows beyond $100K, it will make sense to move it to other platforms like Questrade as the fee will be half. This means, instead of paying $400 in Wealthsimple annually, you pay $200 in Questwealth.

I hope you find this review helpful. Please don’t forget to leave your comments or questions below.

2 thoughts on “Detailed Wealthsimple Invest Review & Free Managed $10,000 Bonus”