Best Free Income Tax Software in Canada for 2022

As I mentioned in my first post About, I try to write about my personal experiences.

Hence, I waited till I test some of the Certified Income Tax Software and send my own income tax before writing my personalized review about Income Tax Software in Canada. I will update this review when I am done sending my this year’s tax as well.

Do you want to get paid for filing your income taxes? Keep reading to find out how!

Take a look at my recommendations link. It will help us if you use any of my links.

My Personal Tax Return Filing Since Arriving in Canada

Doing your own taxes sounds a challenging task if you have never done it. However, I do believe that everyone can do their own taxes easily, securely, efficiently, and freely from the comfort of their home.

I have been proudly doing our income taxes myself since arriving in Canada in 2010. The first 3 filings, 2010 – 2012, were paper returns.

I admit that it was a time consuming, annoying, and a bit frustrating experience. We are talking about paper and pen filing of the income tax application. However, it made me understand how all the lines and dozens of numbers including incomes, expenses, and deductions work together to generate the return result. It is one of those things you enjoy doing but never want to repeat!

Related: Canadian Financial Calculators & Income Tax Calculators

Note: If your Tax situation is complicated (Foreign investment or Business owner with multiple locations), it is always best to have a Tax specialist doing your taxes.

Steps for a Successful Income Tax Return

- Have a computer, tablet, or a smart phone

- Have internet connection to download the software or load the web site and to use NETFILE to send your income tax return in one click to CRA

- Gather all your documents including T4s, T4As, T5s, RRSP receipts, Child Care receipts, etc. Review your checklist for a successful Canadian Tax Return here and for QC residents like me check it out here (This was last updated in 2020).

- Having your CRA (and Revenue Quebec) login account information and Access Code is handy (Not Mandatory)

- Choose a certified by CRA (and by Revenue Quebec if applicable) Income Tax Return Software

Income Tax Filing Deadlines for the 2021 Tax Year

- April 30, 2022: Individuals tax return filing deadline for the 2021 tax year

- June 15, 2022: Self-employed individuals and cohabiting spouse or common law partner

- Mar 1, 2022: Deadline to contribute to an RRSP, a PRPP, or an SPP

- May 2, 2022: Deadline to pay your 2021 taxes

Methods to File Your Income Tax Return Online in Canada

- NETFILE is the online transmission service provided by CRA to do the income tax filing online. To take advantage of this method a usage of a certified software is mandatory. The benefit of NETFILE is that the filing goes to CRA directly securely in minutes.

- EFILE is what tax preparation firms use to send your filing to CRA. This is basically for those who do not want or cannot use NETFILE due to personal or complication reasons.

Important Notes to Consider For 2021 Tax Year (2022 Tax Changes)

- Any recipients of COVID-19 support payments including CRB, CRSB, or CECB will receive a T4A (RL-1 or RL-2 in Quebec)

- For those like me who worked from home, we can deduct the Home Office Expenses. There are two methods: SIMPLIFIED which uses a flat rate of $2 a day for up to $400 or DETAILED which requires a T2200 (TP64 in QC) provided by employer. I send an email to our Payroll department and they provided it fast. My line 12 (Expenses Claim) is $1,284.09 or 3.2 times the SIMPLIFIED method. I encourage you to take the time and use Form T777S to do the detailed method

- For the 2021 tax year, prior to filing your tax return electronically with NETFILE, you will be asked to enter an Access code. Your eight-character Access code is located on the right side of your Notice of Assessment for a previous tax year. Providing Access Code is not mandatory. If you do not enter your Access code, you will have to rely on other information for authentication purposes which is based on the software you are using. This code does not apply to you if you are filing your tax return for the first time.

- Home Buyers Plan (HBP) withdrawal from RRSP is increased from $25,000 to $35,000. This means a couple can use up to $70,000 of their RRSP toward their home.

- All other numbers are changed to reflect a bit of the inflation.

- EI: Maximum insurable earnings increased from 56,000 to 60,000.

- Pension: Maximum pensionable earnings increased from $61,600 to $64,900.

- Canada Child Benefit: Increased to $6,833 for children under 6 and $5,765 for children ages 6 to 17.

- TFSA: No Change staying at $6,000.

- Basic Personal Amount: $14,398 for those Canadians less than $155,625

- Tax Breaks for Seniors: 10% increase on OAS pension from July 2022

Free Income Tax Return Software in Canada

Spoiler Alert: My personal choice was StudioTax until 2020. However, I am going to use WealthSimple Tax for my 2021 tax year return again.

WealthSimple Tax (SimpleTax)

As mentioned, I filed my income tax using WealthSimple Tax this year. My experience was smooth. WealthSimple Tax is totally free and sends your filing directly to CRA via a secured encrypted communication to CRA.

Surprise: Wealthsimple Tax pays $10 in a Trade or Crypto account to anyone filing for the first time in 2021. Isn’t that just wildly amazing?

Bottom line here is that your information is saved in their cloud servers. I did not mind this as I trust WealthSimple which follows Canadian Regulations for Cyber Security. In addition, I already have an account with WealthSimple so the addition of my income to the information they already have is not a deal breaker for me.

If you get confused at any point, they have an Email support [email protected]. They are a local Canadian team but no guarantee you get a response immediately. You can find their well written article about their newly acquired product here.

WealthSimple can Autofill your returns from both CRA and Revenue Quebec. It will authenticate you using CRA or Revenue Quebec login and do the rest automatically. You can still enter whatever still not uploaded to CRA or Revenue Quebec manually.

Please note that you can’t use WealthSimple if you are deemed ineligible for NETFILE.

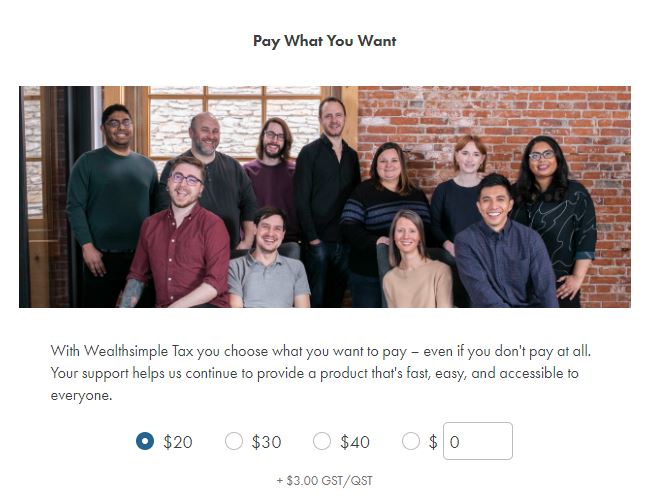

After filing your taxes, it asks for donations. I really loved the team photo. Check it out below. Love it. After submitting your tax, it will try to make you open an account with them. I think this was the whole point of WealthSimple buying SimpleTax. To know who they can make doing a new business with them.

StudioTax Free

StudioTax was my favorite till their introduction of the small $15 fee. I could not avoid mentioning it here as it is the best honestly! I always preferred to keep my data offline so loved that StudioTax is a software that can be installed locally on iPhone, iPad, Android, Windows, and Mac.

StudioTax has a feeling of being from the Windows XP era. It is powerful yet a very simple interface. Preparing the Income Tax with StudioTax is still free however you need a license for a small fee of $15 (Which is totally worth it) to print or file electronically using NETFILE. Exceptions to the fees or the residents of our beautiful Canadian Territories and anyone with an income below $20,000 CAD.

Personally, I believe StuidoTax is a great choice for anyone with complicated filing who can get confused by the online WealthSimple Tax. Or for those who prefer keeping their data locally (Versus the software provider’s data center servers).

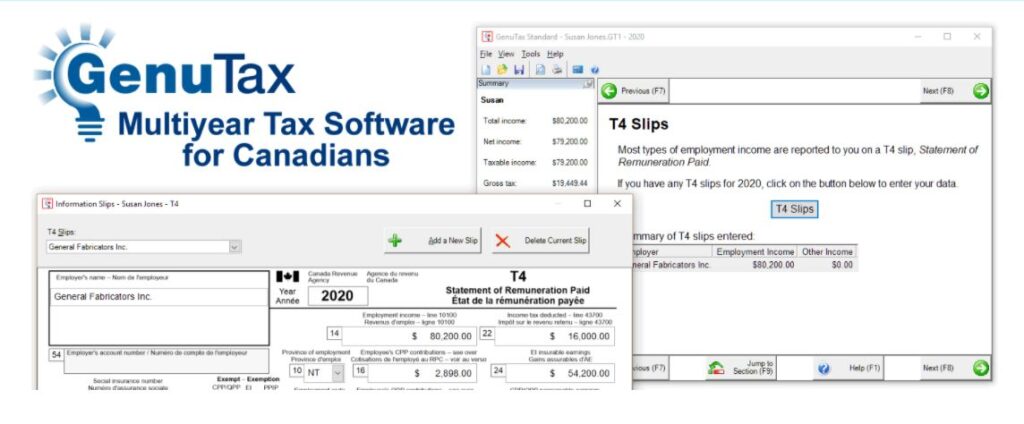

GenuTax Standard

GenuTax is only available for Windows operating system. There is a big RED flag for Quebec residents. GenuTax does not support the preparation of the Quebec provincial income tax return, which is to be sent to Revenue Québec.

They accept your generous donations, and it can also Auto fill the returns directly by connecting to CRA.

One great and unique feature of GenuTax is Express NOA. After filing your tax return using NETFILE, use Express NOA to view your Notice of Assessment for that tax return from CRA.

Another great feature is ReFILE. if you need to change a tax return you have already filed, use ReFILE to send your changed tax return directly to the Canada Revenue Agency (CRA) over the Internet.

Personally, I would have tried GenuTax instead of WealthSimple if they were authorized by Revenue Quebec.

H&R Block Online

H&R Block Online is the most known name in the Tax filing industry in Canada serving Canadians for more than 55 years. Their online filing is free. However, they have two other options. Assistance $19.99 and Protection $29.99 per return.

Like other software, it can Auto fill from both CRA and Revenue Quebec.

Personally, I have never used H&R and no intention on using them. They require you to sign up and create an account. I do not have an account with H&R and not willing to share my information with H&R. Also, they are less regulated than the bank industry so sharing personal information in their systems come with a bigger risk.

TurboTax Free

TurboTax Free is for Mobile devices covering both iOS (iPhone, iPad) and Android. The alternative is using its free Online version.

Feeling like a winner? Check out Barry’s detailed review of TurboTax for a chance of winning one of TurboTax Canada Giveaway prizes each worth up to $279.99.

ike others, it can Auto fill your information from CRA (No mention it can do the same from Revenue Quebec). It has an interesting feature. Maximum refund guarantee. They pay you $9.99 if you get a larger refund or smaller tax due by using any other tax method. I never understood why they would offer this on the free version!

You can also access your Notice of Assessment or REFILE ($5) for adjustments.

Personally, I have never used TurboTax before, but it is a very popular software.

TaxTron

TaxTron for Web is totally free and their 2021 tax software for Windows does not require a license for returns under $31,000 total income or full-time students. For a family or income higher than $31,000 a license for $24.99 is required. TaxTron has a big list of exclusions.

Personally, I feel their site, FAQ, and the whole design is a bit confusing and not straight forward. I am not sure if I want to try or even recommend it to anyone. Specially, knowing many other alternatives with a proven history of successful income tax returns are there for free (or cheaper).

Best Free Income Tax Software in Canada 2022 Summary

There are many great names and products out there. The most important thing is to use a Certified software by CRA (And Revenue Quebec if Quebec Income).

My opinion might not reflect yours but if you have concerns with your data being stored online use the offline StudioTax software ($15). You might also need StudioTax if your tax has some complications.

If your tax is not too complicated and you do not mind your information being stored in WealthSimple data centers which has over $3 billion in asset under management then use the free online WealthSimple. You can still download a PDF version of your income tax return. I downloaded our T1 and TP1 from WealthSimple for my records.

Bottom line, I much prefer having my data stored in WealthSimple which is a member of Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor’s Protection Fund (CIPF) which protects accounts up to $1,000,000 against insolvency than in a software company.

Have you been doing your Taxes yourself? If so, what is your favorite software and what are you going to use for this year?